This is our second article of our series of articles regarding the proposal for a Council Directive laying down rules against tax avoidance practices as published by the European Commission on January 28, 2016. This article will focus on the provisions with respect to exit taxation as laid down in the proposed Directive.

On January 28, 2016 the European Commission published its so-called Anti Tax Avoidance Package. One of the items of this Anti Tax Avoidance Package is the proposal for a Council Directive laying down rules against tax avoidance practices that according to the European Commission directly affect the functioning of the internal market.

The proposed Directive sets out six key anti tax avoidance measures, which all Member States should apply. These are:

· Interest limitation rule

· Exit taxation

· Switch-over clause

· General anti-abuse rule

· Controlled foreign company legislation

· Hybrid mismatches

First of all it should be noted that the proposed Directive arranges that the anti tax avoidance measures laid down in the Directive are minimal measures. In this respect Article 3 of the proposed Directive arranges that the Directive shall not preclude the application of domestic or agreement-based provisions aimed at safeguarding a higher level of protection for domestic corporate tax bases.

Exit taxation

The provisions regarding an exit taxation are laid down in Article 5 of the proposed Directive. Based on Article 5, Paragraph 7 the provisions with respect to an exit taxation as laid down in the proposed Directive shall not apply to asset transfers of a temporary nature where the assets are intended to revert to the Member State of the transferor.

Article 5, Paragraph 1 of the proposed Directive arranges that a taxpayer shall be subjected to a so-called exit tax in the following circumstances:

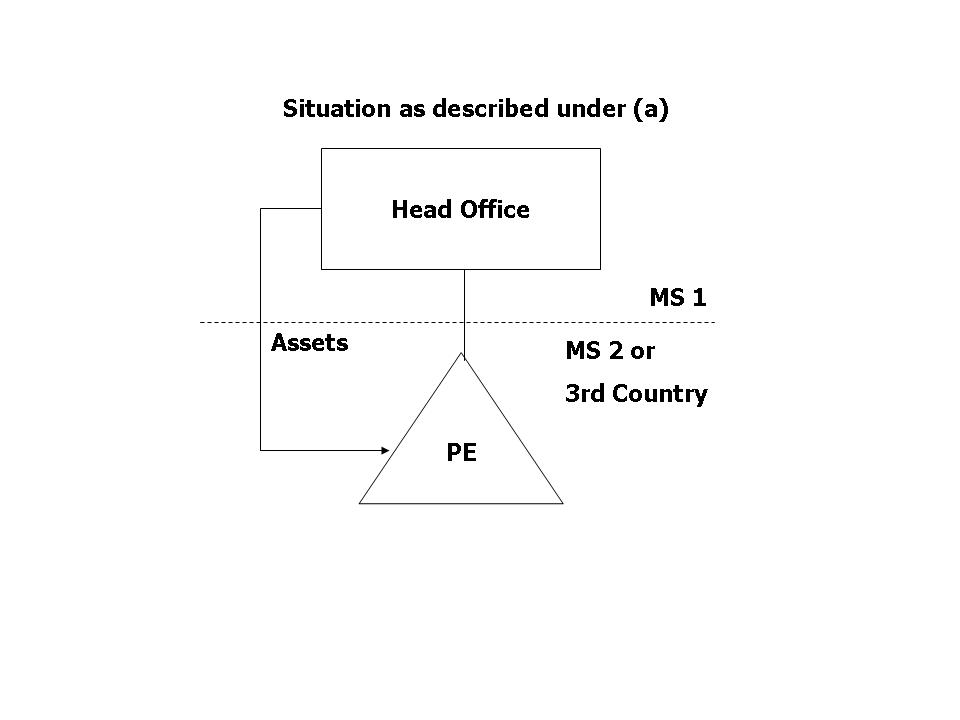

(a) a taxpayer transfers assets from its head office to its permanent establishment in another Member State or in a third country;

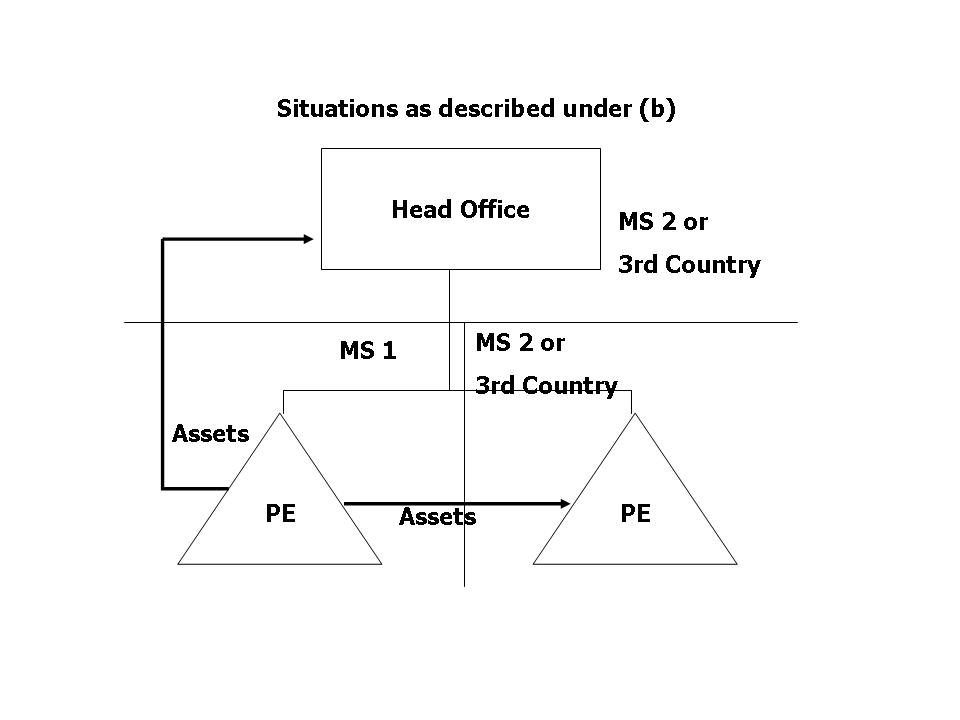

(b) a taxpayer transfers assets from its permanent establishment in a Member State to its head office or another permanent establishment in another Member State or in a third country;

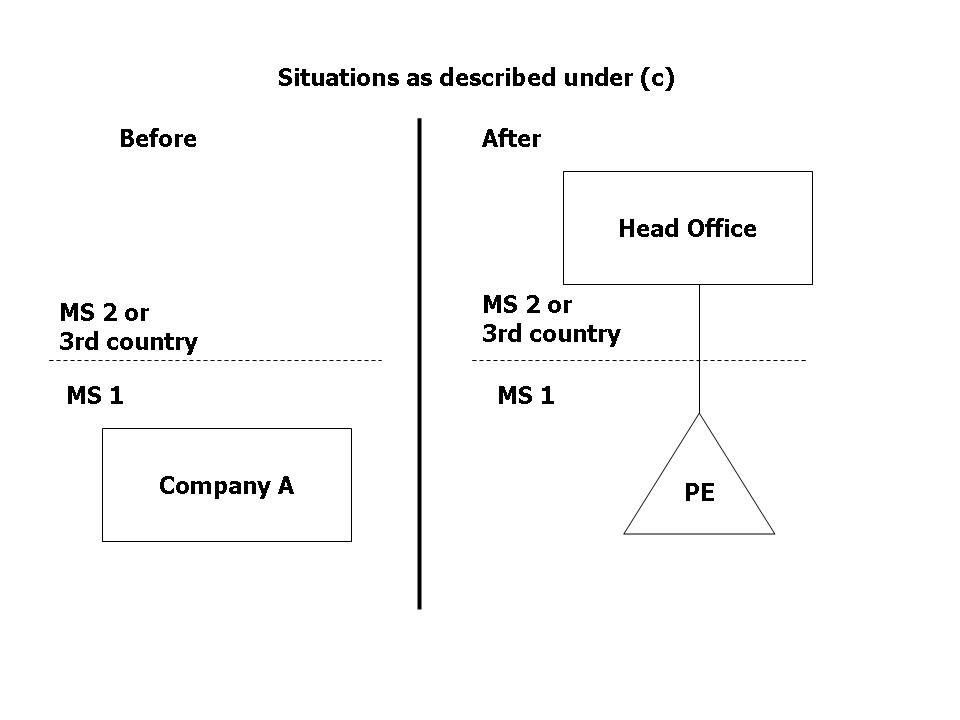

(c) a taxpayer transfers its tax residence to another Member State or to a third country, except for those assets which remain effectively connected with a permanent establishment in the first Member State;

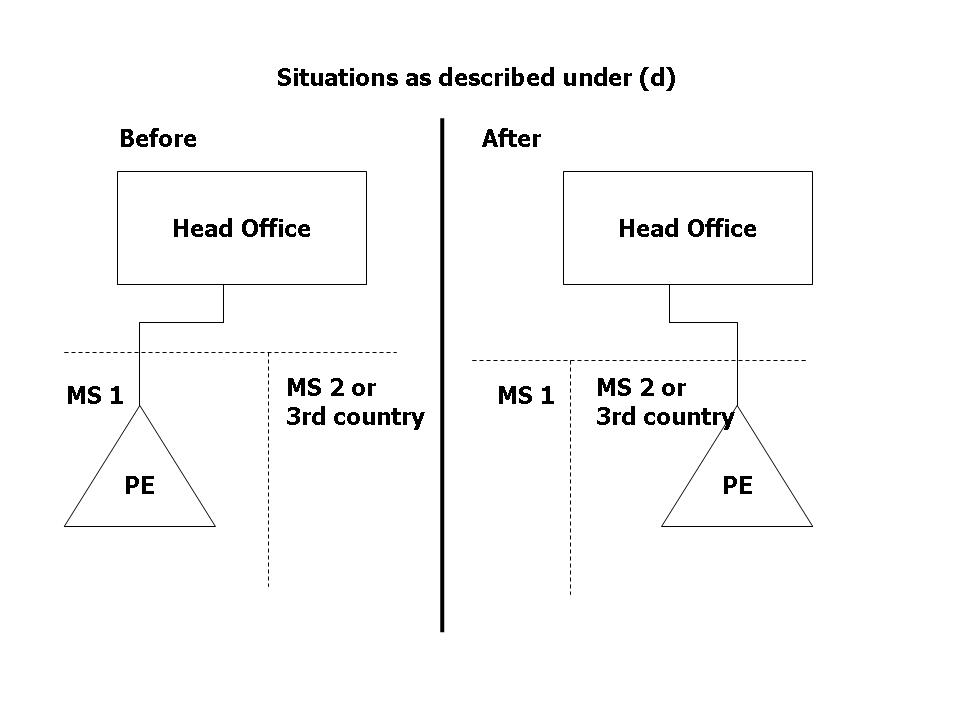

(d) a taxpayer transfers its permanent establishment out of a Member State.

The exit tax shall be calculated over the market value of the transferred assets (at the time of exit) -/- the value for tax purposes of the transferred assets (at the time of exit).

- Market value is the amount for which an asset can be exchanged or mutual obligations can be settled between willing unrelated buyers and sellers in a direct transaction.

- transfer of assets means an operation whereby the right to tax the transferred assets passes to another Member State or third country, whilst the assets remain under the beneficial ownership of the same taxpayer, excluding transfers of assets of a temporary nature as long as the assets are intended to revert to the Member State of the transferor;

- transfer of tax residence means an operation whereby a taxpayer ceases to be resident for tax purposes in a Member State, whilst acquiring tax residence in another Member State or third country;

- transfer of permanent establishment means an operation whereby a taxpayer ceases to have taxable presence in a Member State whilst acquiring such presence in another Member State or third country without becoming resident for tax purposes in that Member State or third country.

Article 5, Paragraph 2 of the proposed Directive provides the taxpayer with the possibility to defer the payment of an exit tax, by paying it in installments over at least 5 years, in any of the following circumstances:

(a) a taxpayer transfers assets from its head office to its permanent establishment in another Member State or in a third country that is party to the European Economic Area Agreement (EEA Agreement);

(b) a taxpayer transfers assets from its permanent establishment in a Member State to its head office or another permanent establishment in another Member State or a third country that is party to the EEA Agreement;

(c) a taxpayer transfers its tax residence to another Member State or to a third country that is party to the EEA Agreement;

(d) a taxpayer transfers its permanent establishment to another Member State or a third country that is party to the EEA Agreement.

Article 5, Paragraph 4 arranges that the deferral of payment in accordance with paragraph 2 shall be immediately discontinued and the tax debt becomes recoverable in the following cases:

(a) the transferred assets are disposed of;

(b) the transferred assets are subsequently transferred to a third country;

(c) the taxpayer's tax residence or its permanent establishment is subsequently transferred to a third country;

(d) the taxpayer goes bankrupt or is wound up.

In this respect it should be noted that the provisions arrange that in case a taxpayer transfers its tax residence to another Member State or to a third country, except for certain assets which remain effectively connected with a permanent establishment in the first Member State any subsequent transfer to a third country of these assets out of the permanent establishment which is situated in the first Member State and which the assets are effectively connected with shall be deemed to be a disposal at market value.

Article 5, Paragraph 5 of the proposed Directive contains a provision that avoids double taxation will take place when an exit tax has been levied. In this respect Article 5, Paragraph 5 arranges that where the transfer of assets, tax residence or permanent establishment is to another Member State, that Member State shall accept the market value established by the Member State of the taxpayer or of the permanent establishment as the starting value of the assets for tax purposes.

Alain Thielemans

Our earlier article in this series which discusses the interest limitation rule can be found here.

Copyright – internationaltaxplaza.info

Are you looking for a motivated new colleague? Then place your job ad on International Tax Plaza!

and

Stay informed: Subscribe to International Tax Plaza’s Newsletter! It’s completely FREE OF CHARGE!