On August 6, 2021, on the website of the Dutch courts an interesting opinion of the Dutch Advocate General to the Dutch Supreme Court was published. Although nowadays we have the eurozone it will still regularly happen that taxpayers purchase assets for which the purchase price is denominated in another currency then the Euro. And often a purchase agreement will be entered into with respect to assets which will be delivered on a later date. In his very interesting opinion, the Advocate General sets out which facts influence how the question raised in the title is to be answered for Dutch corporate income tax purposes.

Simplified facts

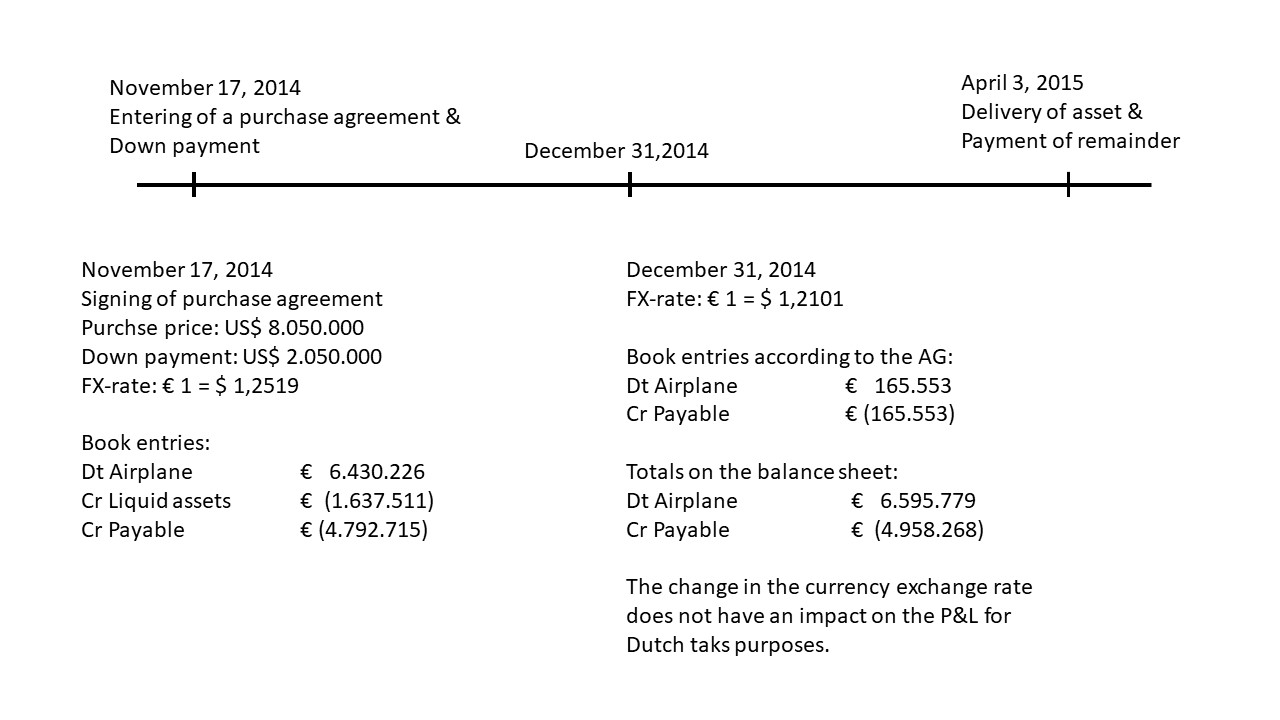

On November 17, 2014, the taxpayer entered into a purchase agreement regarding the purchase of an airplane. The agreed purchase price amounts to USD 8,050,000. On that same date the taxpayer made a down payment amounting to USD 2.050.000. The remaining USD 6,000,000 has to be paid on the date that the airplane is to be delivered (in this case on April 3, 2015). The taxpayer uses the Euro as functional currency for Dutch corporate income tax purposes. (NB please note that when certain conditions are met a Dutch taxpayer can opt to use a different currency as functional currency for Dutch corporate income tax purposes). On November 17, 2014, the EUR/USD exchange rate was: EUR 1 = USD 1.2519. On December 31, 2014, the EUR/USD exchange rate had changed to: EUR 1 = USD 1.2101

Book entries November 17, 2014

On November 2017 the taxpayer included the still to be delivered airplane in its books for EUR 6,430,226 (USD 8,050,000 / 1.2519). Furthermore, it included a payment obligation in its balance that amounted to EUR 4,792,715 (USD 6,000,000 / 1.2519).

So, at the moment of entering the purchase agreement the taxpayer made the following book entries:

Dt Airplane still to be delivered (USD 8,050,000) EUR 6,430,226

Cr Liquid assets (Down payment USD 2 Mio) EUR (1,637,511)

Cr Payable (Remainder of purchase price (USD 6 Mio) EUR (4,792,715)

All the abovementioned entries were entries to balance sheet items.

Since the EUR/USD has changed the taxpayer deducted an amount of EUR 165,553 as currency exchange loss. The amount of EUR 165,553 relates to change in value of the payable of USD 6,000,000 that the taxpayer included on its balance on November 17, 2014 (the remainder of the purchase price that still had to be paid).

So, at the moment of entering the purchase agreement the taxpayer made the following entries in its tax books:

Dt P&L 2014 Income/Loss for the year (FX loss) EUR 165,553

Cr Payable (Remainder of purchase price (USD 6 Mio) EUR (165,553)

After these entries the balance sheet for tax purposes of the taxpayer looked as follows:

Dt Airplane still to be delivered (USD 8,050,000) EUR 6,430,226

Cr Liquid assets (Down payment USD 2 Mio) EUR (1,637,511)

Cr Payable (Remainder of purchase price (USD 6 Mio) EUR (4,958,268)

Dt Income/Loss for the year EUR 165,553

From the analysis of the Advocate General

According to the Advocate General, the underlying case is not so much about hedge accounting or coherent valuation, as it is about the question how the cost price of an asset is to be determined. According to the Advocate General, the main question is what should be included in the cost price and thus in the depreciation basis of the aircraft. The abstract answer is: all that the entrepreneur has sacrificed for the acquiring and using a business asset. Capitalization can already be done at the moment ordering, i.e. when entering into obligations, but depreciation is only possible after delivery and commissioning of the asset, for the following two reasons:

(i) only as of that moment the business asset functions as a business asset and only then does it (thus) wear out through use in the business process; and

(ii) only as of that moment it is established over what the taxpayer must depreciate (the full cost price).

According to the Advocate General, this argues in favor of determining the cost price of a business asset upon delivery, unless:

- the cost price has previously been established by (full) payment before delivery,

- by purchasing and holding the contract currency required for the (residual) purchase price, or

- by hedging (currency) risks on the (residual) purchase price (the hedging costs are then to be included in the cost price).

If payment is only made after delivery, the link between the right to delivery (which disappears at the moment of delivery) and the payment obligation is broken, in particular given that the cost price must be depreciated from the moment of delivery, so that as of the moment of delivery an independent currency result is incurred to the 'creditors' item from that moment of delivery.

Therefor the Advocate General is of the opinion that in the underlying case the link between the right to delivery and the payment obligation was not yet broken on December 31, 2014, and therefore the taxpayer is not allowed to take an immediately deductible exchange loss into account.

Therefor according to the opinion of the Advocate General the taxpayer would have to make the following entries in its books for tax purposes:

Dt Airplane still to be delivered EUR 165,553

Cr Payable (Remainder of purchase price (USD 6 Mio) EUR (165,553)

After these entries the balance sheet for tax purposes of the taxpayer looked as follows:

Dt Airplane still to be delivered EUR 6,595,779

Cr Liquid assets (Down payment USD 2 Mio) EUR (1,637,511)

Cr Payable (Remainder of purchase price (USD 6 Mio) EUR (4,958,268)

Next to giving his opinion on the underlying case, the Advocate General also gives his view on a few what if questions, including a.o.:

(i) What if the taxpayer had immediately paid the full purchase price?

(ii) What if the taxpayer had hedged the currency exchange risk?

What if the taxpayer had immediately paid the full purchase price?

In the case that when entering into obligations to acquire a business asset in a non-euro currency a taxpayer immediately pays the full purchase price in advance, whether or not at a discount, then according to the Advocate General the cost price is fixed in euros at that date. And, in the opinion of the Advocate General, the normal valuation rule for business assets: cost price or lower market value or lower business value then apples. However, depreciation can only start after delivery of the business asset. If between the moment of payment and the delivery of the asset, the dollar and with it the value of the right of delivery rises, then according to the Advocate General taking that unrealized profit into account for Dutch corporate income tax purposes is probably in violation of the prudence principle of the good merchant principle. If the dollar falls, then according to the Advocate General a depreciation to the lower market value is allowed.

What if the taxpayer had hedged the currency exchange risk?

The taxpayer also raised the question what would have been legal if the taxpayer had (fully) hedged the currency risk on its remaining payment obligation at the time it ordered the business asset by (i) entering into a forward exchange transaction to that effect or (ii) buying the remaining dollar amount and to hold a dollar account until the date of delivery delivery. In the opinion of the Advocate General, the answer to that question is obvious: in both cases the cost price - at least in terms of currency risk - is fixed at the time of buying the required dollars or entering into the hedge contract (the exchange or hedging costs are part of the cost of the aircraft). In both cases the correlation between the currency movement of the right to delivery and the currency movement of the remaining payment obligation is in that case 100% because of the existing correlation between the hedge and the payment obligation. On December 31, 2014, both are therefore on the balance sheet at the values of the down payment/hedge date and they remain there until the moment of delivery/payment.

Copyright – internationaltaxplaza.info