The Global Anti-Base Erosion (GloBE) Rules provide for a co-ordinated system of taxation intended to ensure large multinational enterprise (MNE) groups pay a minimum level of tax on the income arising in each of the jurisdictions where they operate. It does so by imposing a top-up tax on profits arising in a jurisdiction whenever the effective tax rate, determined on a jurisdictional basis, is below the minimum rate.

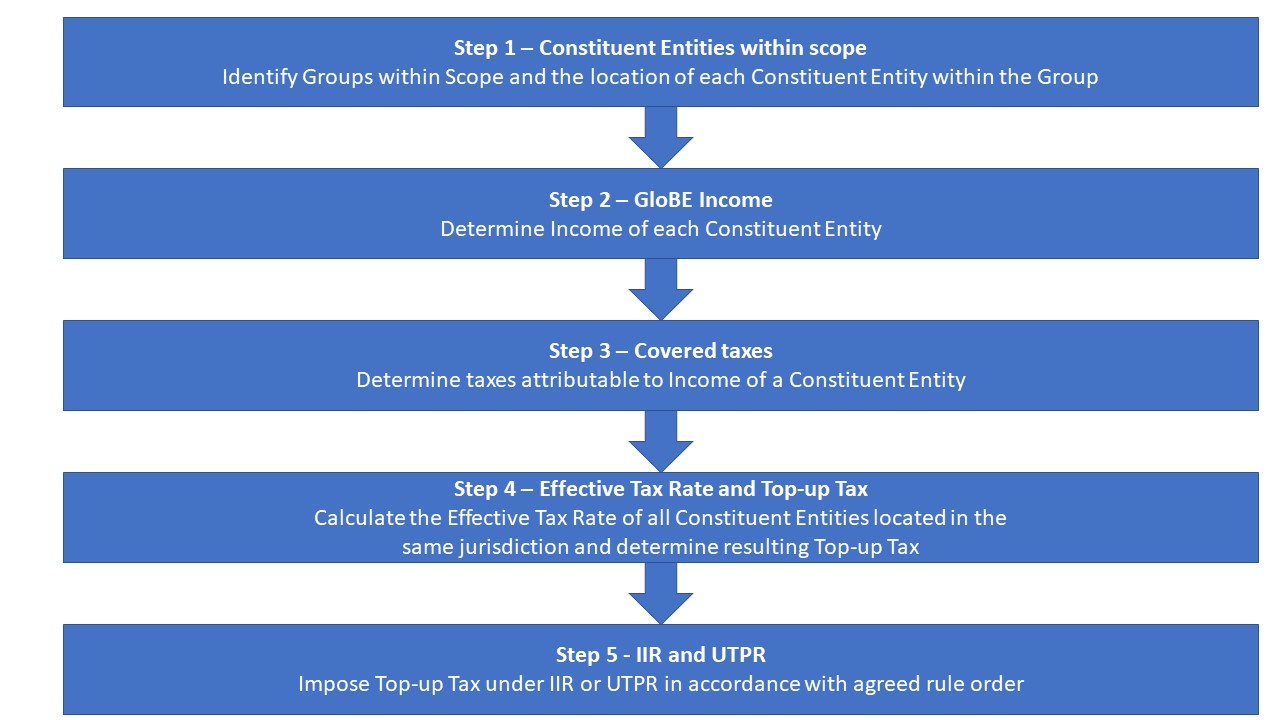

Based on the GloBE tax rules under Pillar 5 there are Steps a multinational enterprise needs to go through in determining its top-up tax liability:

• In Step 1 an MNE Group determines whether it is within the scope of the GloBE rules and identifies the constituent entities within the Group and their location.

• Step 2 and Step 3 determine the effective tax rate of each constituent entity.

• In the event an MNE is subject to an effective tax rate below 15% in any jurisdiction, Step 4 sets

• out the mechanism for calculating the top-up tax in respect of that low tax jurisdiction.

• This top-up tax is then imposed on a group entity under an income inclusion rule (or “IIR”) or Undertaxed Payments Rule (or “UTPR”) under Step 5.

The document in which the GloBE models rules are laid down is divided in the following ten chapters:

• Chapter 1 defines the scope of the GloBE Rules;

• Chapter 2 determines the constituent entities in the group that are liable for any top-up tax and the portion of any top-up tax charged to any such entity;

• Chapters 3 and 4 set out the components of the effective tax rate calculation under the GloBE Rules. Chapter 3 determines the income (or loss) for the period for each constituent entity in the MNE Group and Chapter 4 then identifies the taxes attributable to such income;

• Chapter 5 aggregates the income and taxes of all constituent entities located in the same jurisdiction to determine the effective tax rate for that jurisdiction. If the effective tax rate is below the minimum rate, the difference results in a top-up tax percentage which is applied to the jurisdictional income to determine the total amount of top-up tax. The top-up tax is pro-rated amongst the constituent entities located in that jurisdiction and then charged to the constituent entities liable for any top-up tax in accordance with Chapter 2. Chapter 5 also includes an elective substance-based income exclusion that may reduce the amount of profits subject to any top-up tax;

• Chapter 6 contains rules relating to acquisitions, disposals and joint ventures;

• Chapter 7 deals with the application of the GloBE Rules to certain tax neutrality and other distribution regimes;

• Chapter 8 covers administrative aspects of the GloBE Rules including information filing requirements as well as the application of any safe-harbours;

• Chapter 9 sets out certain transitional rules;

• Chapter 10 sets out defined terms used in the GloBE Rules.

The full text of the The Global Anti-Base Erosion (or “GloBE”) Model Rules under Pillar Two you can find here.

Copyright – internationaltaxplaza.info