On December 22, 2021, the European Commission released a proposal for a Council Directive laying down rules to prevent the misuse of shell entities for tax purposes and amending Directive 2011/16/EU. In this article we make a high-level analysis of the regulations as laid down in this Directive and we inserted slides that we hope are useful for the understanding of our readers.

First thing that one should notice is that unlike many other anti-abuse measures that have been introduced by the OECD and the EU over the last several years, the-anti abuse measures laid down in the underlying proposal do not only apply to large multinational enterprises but to all taxpayers that make use of shell entities.

What is the purpose of the proposed Directive?

The purpose of the proposed Directive is to establish transparency standards around the use of shell entities, so that their abuse can more easily be detected by tax authorities. For achieving this transparency, entities that meet certain conditions (“So-called reporting undertakings”) will be required to declare in their annual tax return whether or not they meet certain “minimum substance indicators”. This information has to be accompanied by supporting documentary evidence.

If an entity fails at least one of the “substance indicators”, it will be presumed to be a ‘shell'. However, entities that do not meet all substance indicators will still have the opportunity to rebut the presumption of being a shell.

If a company is deemed a shell company, the anti-abuse measures laid down in the Directive will have to be applied.

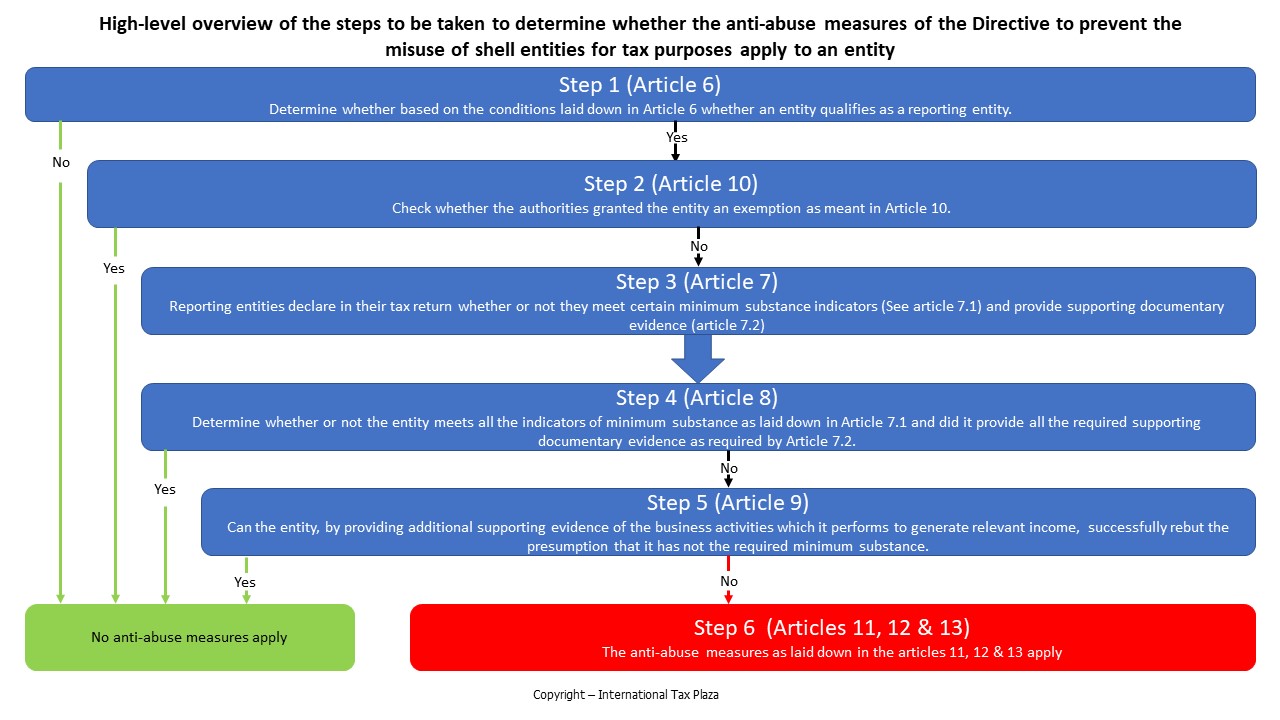

The schedule below shows the 6 steps of the Directive.

Step 1 – Determining whether an entity qualifies as a reporting undertaking

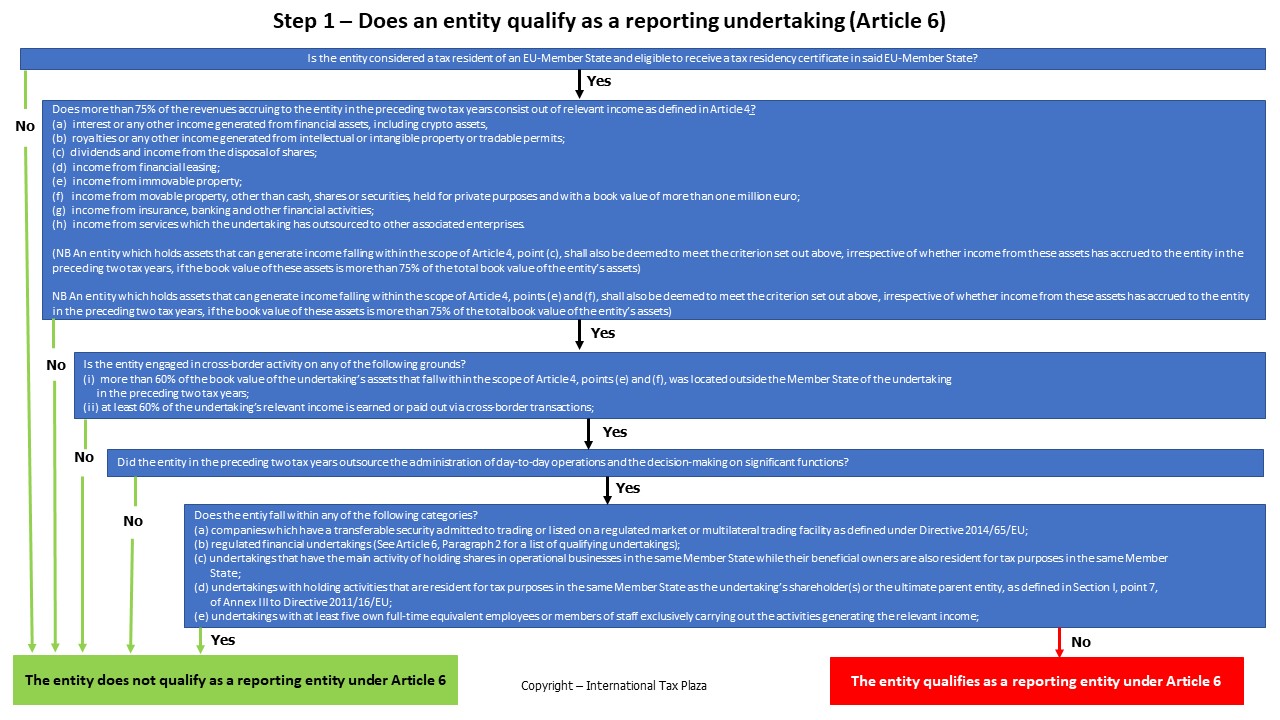

The schedule below contains a so-called decision tree that we hope can be useful when you have to determine whether based on the provisions of Article 6 of the proposed Directive an entity qualifies as a reporting undertaking.

Some additional remarks

As follows from the decision tree undertakings with at least five own full-time equivalent employees or members of staff exclusively carrying out the activities generating the relevant income do not qualify as a reporting undertaking. For groups with a large presence in a Member State in which also the undertaking is present it will therefore be relatively easy to achieve that the 5 full-time FTE criterion is met.

It should be noted however, that these 5 full-time FTE’s exclusively have to carry out the activities generating the relevant income to be exempt from the reporting requirements as laid down in Article 7. Therefore if these 5 FTE’s that are on the payroll of the undertaking spend a significant part of their time on activities for another group entity the undertaking in principle does not meet the 5 full-time FTE criterion.

Furthermore Article 6, Paragraph 2 contains an exhaustive list of what undertakings are considered to be “regulated financial undertakings” that are exempt from the reporting requirements as laid down in Article 7.

Step 2 – Is the entity entitled to the exemption of Article 10?

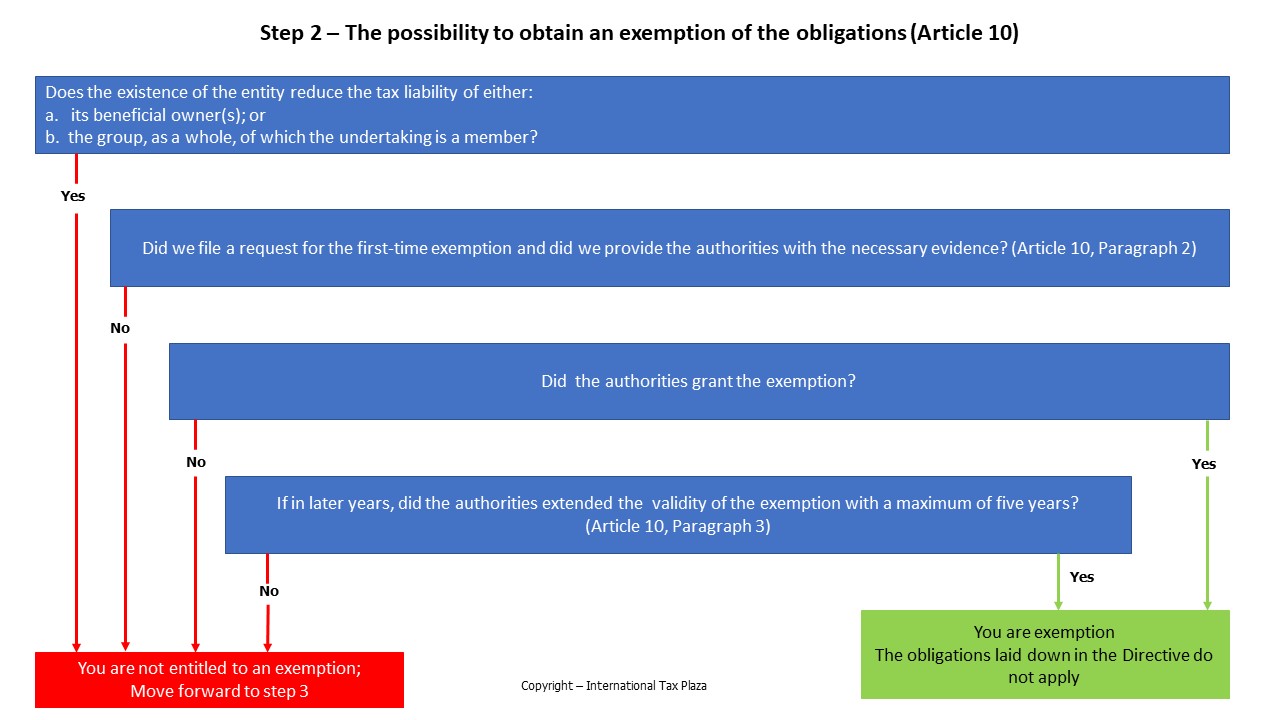

Once a taxpayer has come to the conclusion that based on Article 6 an entity qualifies as a reporting undertaking, in principle the obligations laid down in the Directive apply to said entity.

However, based on Article 10, Paragraph 1 of the Directive, Member States shall take the appropriate measures to allow an entity that qualifies as a reporting undertaking to request an exemption from its obligations under this Directive if the existence of the entity does not reduce the tax liability:

a. of its beneficial owner(s); or

b. of the group, as a whole, of which the undertaking is a member.

First a one-year period exemption

Article 10, Paragraph 2 arranges that a Member State may grant that exemption for one tax year if the entity provides sufficient and objective evidence that its interposition does not lead to a tax benefit for its beneficial owner(s) or the group as a whole, as the case may be. That evidence shall include information about the structure of the group and its activities. That evidence shall allow to compare the amount of overall tax due by the beneficial owner(s) or the group as a whole, as the case may be, having regard to the interposition of the entity, with the amount that would be due under the same circumstances in the absence of the entity.

A potential extension for 5 years

Article 10, Paragraph 3 arranges that after the end of the tax year for which an exemption was granted in accordance with paragraph 2, a Member State may extend the validity of the exemption for five years on the condition that the factual and legal circumstances of the entity, including of the beneficial owner(s) and the group, as the case may be, remain unchanged in the relevant period.

Step 3 – Declarations to be made and documentary evidence

If in step 1 we came to the conclusion that the entity qualifies as a reporting entity and subsequently in step 2 came to the conclusion that the entity is not entitled to an exemption of the obligations as laid down in the Directive we come to step 3 and that fulfilling the reporting obligations that are laid down in Article 7 of the Directive.

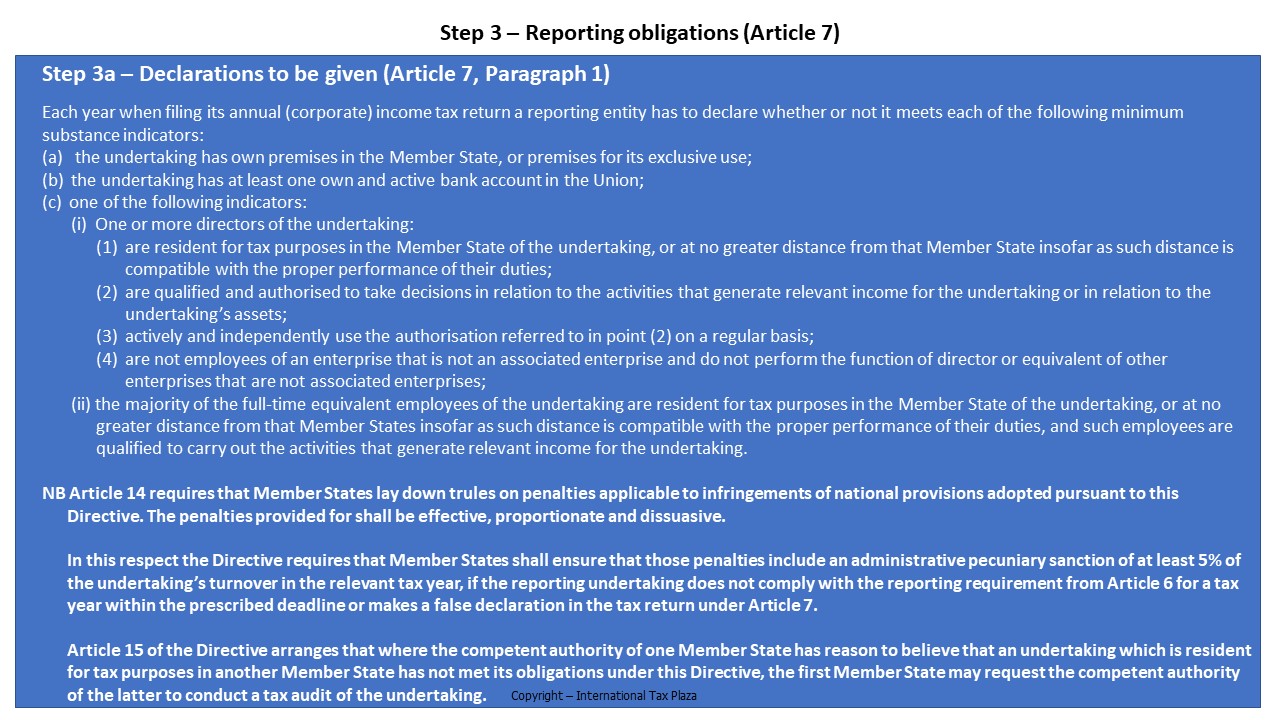

Declarations to be given

Based on Article 7, Paragraph 1, each year when filing its annual tax return a reporting entity has to declare whether or not it meets each of the following minimum substance indicators:

(a) the undertaking has own premises in the Member State, or premises for its exclusive use;

(b) the undertaking has at least one own and active bank account in the Union;

(c) one of the following indicators:

(i) One or more directors of the undertaking:

(1) are resident for tax purposes in the Member State of the undertaking, or at no greater distance from that Member State insofar as such distance is compatible with the proper performance of their duties;

(2) are qualified and authorised to take decisions in relation to the activities that generate relevant income for the undertaking or in relation to the undertaking’s assets;

(3) actively and independently use the authorisation referred to in point (2) on a regular basis;

(4) are not employees of an enterprise that is not an associated enterprise and do not perform the function of director or equivalent of other enterprises that are not associated enterprises;

(ii) the majority of the full-time equivalent employees of the undertaking are resident for tax purposes in the Member State of the undertaking, or at no greater distance from that Member States insofar as such distance is compatible with the proper performance of their duties, and such employees are qualified to carry out the activities that generate relevant income for the undertaking.

Conclusion: For a group that has a significant presence in a Member State, it seems that the above mentioned minimum substance requirements can be quite easily met by a reporting undertaking, since they can use directors/employees of an associated enterprise to meet the minimum substance requirements. (The definition of associated enterprises can be found in Article 5 of the Directive). Furthermore it shouldn’t be a big problem for a group that already has a significant presence in an EU Member State to arrange that the reporting undertaking will have its own premises, or premises for its exclusive use, in that Member State.

With respect to these declarations we wonder how this will be organized. The simplest way obviously would be if the annual tax returns would contain simple “yes” and “no” that a taxpayer/reporting entity has to tick.

Penalties

In this respect it is perhaps also the right moment to note that Article 14 requires that Member States lay down the rules on penalties applicable to infringements of national provisions adopted pursuant to this Directive, and that Member States shall take all measures necessary to ensure that they are implemented.

The Directive requires that the penalties provided for shall be effective, proportionate and dissuasive. In this respect the Directive requires that Member States shall ensure that those penalties include an administrative pecuniary sanction of at least 5% of the undertaking’s turnover in the relevant tax year, if the undertaking that is required to report pursuant to Article 6 does not comply with such requirement for a tax year within the prescribed deadline or makes a false declaration in the tax return under Article 7.

Request for tax audits

Article 15 of the Directive arranges that where the competent authority of one Member State has reason to believe that an undertaking which is resident for tax purposes in another Member State has not met its obligations under this Directive, the first Member State may request the competent authority of the latter to conduct a tax audit of the undertaking.

The competent authority of the requested Member State shall initiate it within one month from the date of receipt of the request and conduct the tax audit, in accordance with the rules governing tax audits in the requested Member State.

The competent authority which conducted the tax audit shall provide feedback on the outcome of such audit to the competent authority of the requesting Member State as soon as possible, and no later than one month after the outcome of the tax audit is known.

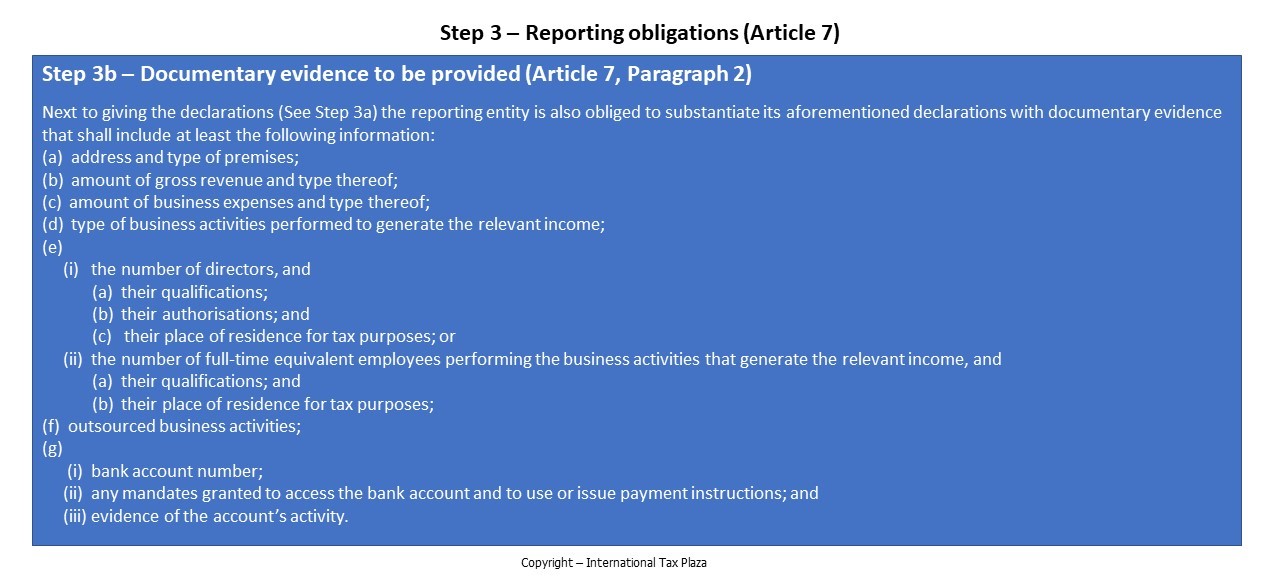

Documentary evidence to be provided

The reporting entity is obliged to substantiate its aforementioned declarations with documentary evidence that shall include at least the following information:

(a) address and type of premises;

(b) amount of gross revenue and type thereof;

(c) amount of business expenses and type thereof;

(d) type of business activities performed to generate the relevant income;

(e)

(i) the number of directors, and

(a) their qualifications;

(b) their authorisations; and

(c) their place of residence for tax purposes; or

(ii) the number of full-time equivalent employees performing the business activities that generate the relevant income, and

(a) their qualifications; and

(b) their place of residence for tax purposes;

(f) outsourced business activities;

(g)

(i) bank account number;

(ii) any mandates granted to access the bank account and to use or issue payment instructions; and

(iii) evidence of the account’s activity.

NB Be aware that both the declarations and the documentary evidence have to be given/provided on an annual basis.

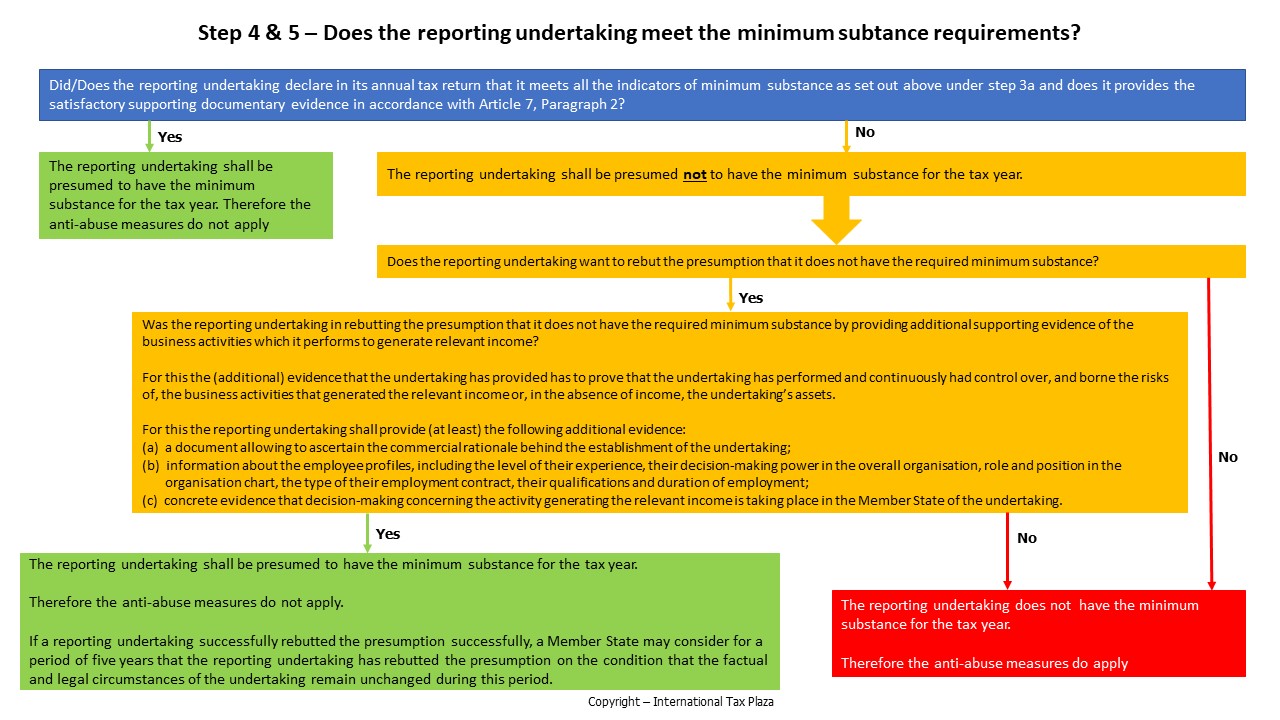

Step 4 – Does the reporting undertaking have minimum substance?

With all declarations and substantiating documentary evidence being filed the tax authorities have to come to a conclusion whether or not the reporting undertaking meets all the indicators of minimum substance. If in its annual tax return the reporting undertaking declares that it meets all the indicators of minimum substance as set out above and it provides the satisfactory supporting documentary evidence in accordance with Article 7, Paragraph 2 then it shall be presumed to have the minimum substance for the tax year. Consequently, the anti-abuse measures laid down in the Directive do not apply to the reporting undertaking for that tax year.

An undertaking that declares not to meet one or more of the indicators set out in Article 7, Paragraph 1 or that does not provide satisfactory supporting documentary evidence in accordance with Article 7, Paragraph 2 shall be presumed not to have minimum substance for the tax year. So does this mean that the anti-abuse measures apply to the reporting undertaking for the tax year? No, in that case we move forward to step 5.

Step 5 – Can the reporting undertaking rebut the presumption of not having the minimum substance?

Article 9 of the Directive provides the reporting undertaking with the possibility to rebut the presumption that it does not have the required minimum substance. For this the reporting undertaking will have to provide additional supporting evidence of the business activities which it performs to generate relevant income.

For this the reporting undertaking shall provide the following additional evidence:

(a) a document allowing to ascertain the commercial rationale behind the establishment of the undertaking;

(b) information about the employee profiles, including the level of their experience, their decision-making power in the overall organisation, role and position in the organisation chart, the type of their employment contract, their qualifications and duration of employment;

(c) concrete evidence that decision-making concerning the activity generating the relevant income is taking place in the Member State of the undertaking.

A Member State shall treat an undertaking as having rebutted the presumption if the (additional) evidence that the undertaking has provided proves that the undertaking has performed and continuously had control over, and borne the risks of, the business activities that generated the relevant income or, in the absence of income, the undertaking’s assets.

After the end of the tax year for which the reporting undertaking rebutted the presumption successfully, a Member State may consider for a period of five years that the reporting

undertaking has rebutted the presumption on the condition that the factual and legal circumstances of the undertaking remain unchanged during this period.

Step 6 – The anti-abuse measures laid down in the Directive

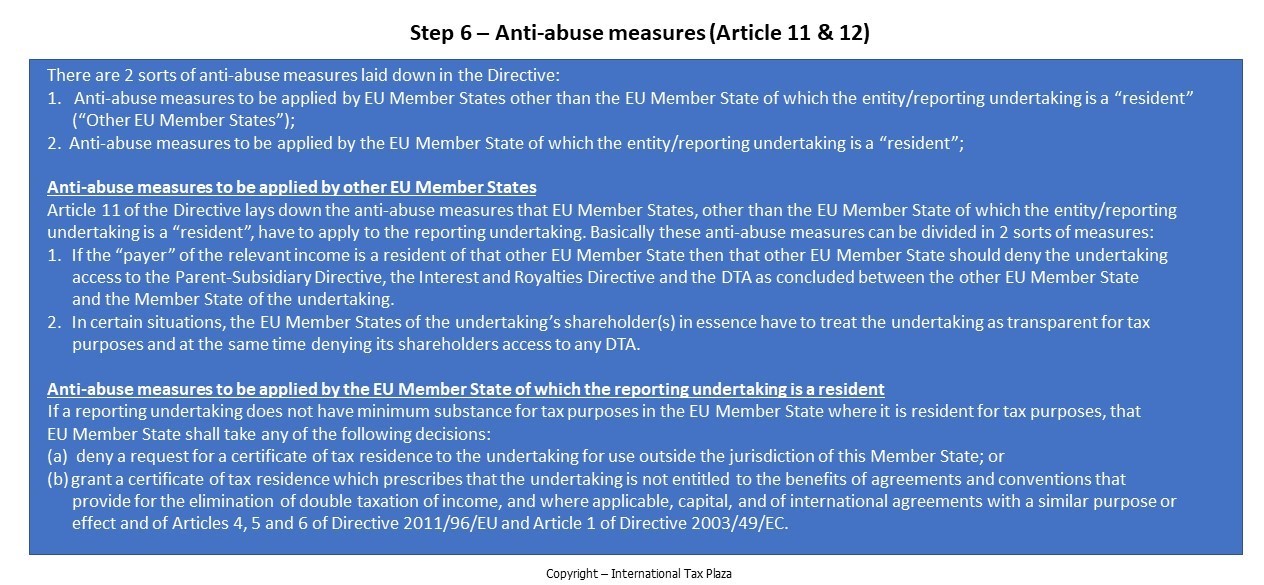

The anti-abuse measures that apply to reporting undertakings that do not meet the substance requirements are laid down in the Articles 11 and 12 of the Directive.

The anti-abuse measures laid down in the Directive are divided in:

1. Anti-abuse measures to be applied by EU Member States other than the EU Member State of which the entity/reporting undertaking is a “resident”;

2. Anti-abuse measures to be applied by the EU Member State of which the entity/reporting undertaking is a “resident”;

Anti-abuse measures to be applied by other EU Member States

Article 11 of the Directive lays down the anti-abuse measures that EU Member States, other than the EU Member State of which the entity/reporting undertaking is a “resident”, have to apply to the reporting undertaking. Basically these anti-abuse measures can be divided in 2 sorts of measures:

1. If the “payer” of the relevant income is a resident of that other EU Member State then that other EU Member State should deny the undertaking access to the Parent-Subsidiary Directive, the Interest and Royalties Directive and the DTA as concluded between the other EU Member State and the Member State of the undertaking.

2. In certain situations, the EU Member States of the undertaking’s shareholder(s) in essence have to treat the undertaking as transparent for tax purposes and at the same time denying its shareholders access to any DTA.

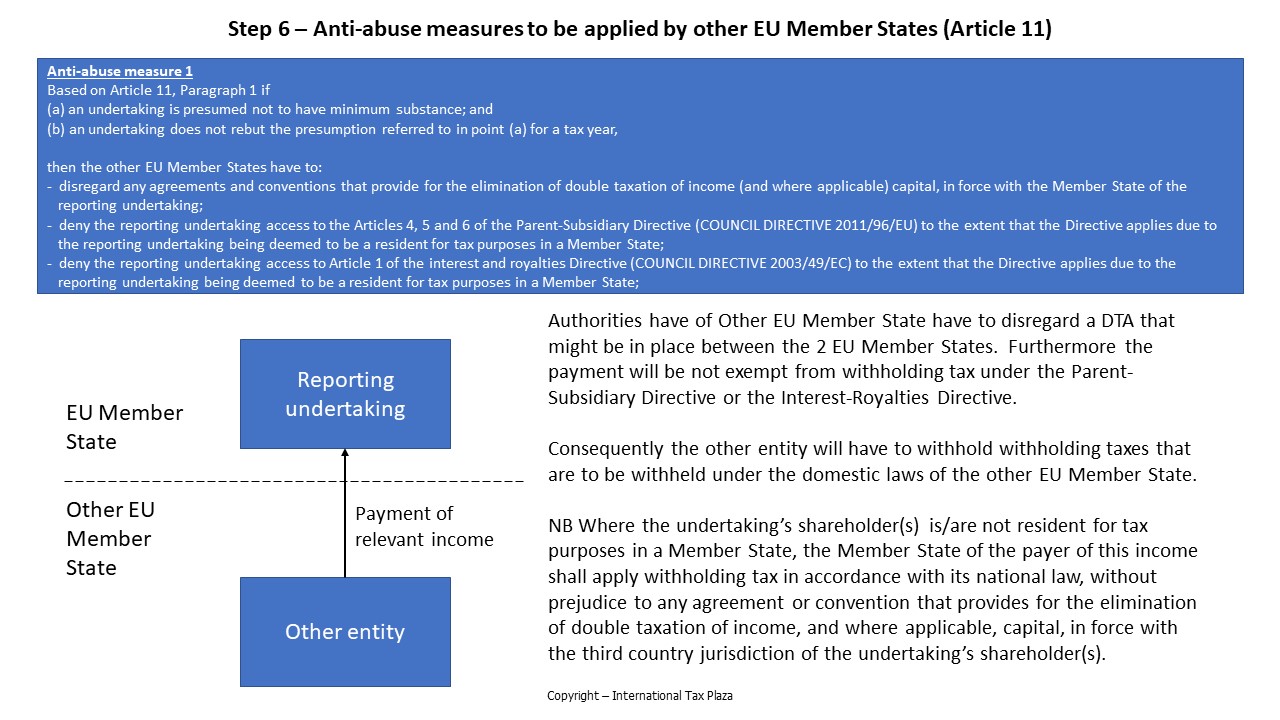

Anti-abuse measure 1

Based on Paragraph 1 if

(a) an undertaking is presumed not to have minimum substance; and

(b) an undertaking does not rebut the presumption referred to in point (a) for a tax year,

then the other EU Member States have to:

- disregard any agreements and conventions that provide for the elimination of double taxation of income (and where applicable) capital, in force with the Member State of the reporting undertaking;

- deny the reporting undertaking access to the Articles 4, 5 and 6 of the Parent-Subsidiary Directive (COUNCIL DIRECTIVE 2011/96/EU) to the extent that the Directive applies due to the reporting undertaking being deemed to be a resident for tax purposes in a Member State;

- deny the reporting undertaking access to Article 1 of the interest and royalties Directive (COUNCIL DIRECTIVE 2003/49/EC) to the extent that the Directive applies due to the reporting undertaking being deemed to be a resident for tax purposes in a Member State;

Where the undertaking’s shareholder(s) is not resident for tax purposes in a Member State, the Member State of the payer of this income shall apply withholding tax in accordance with its national law, without prejudice to any agreement or convention that provides for the elimination of double taxation of income, and where applicable, capital, in force with the third country jurisdiction of the undertaking’s shareholder(s).

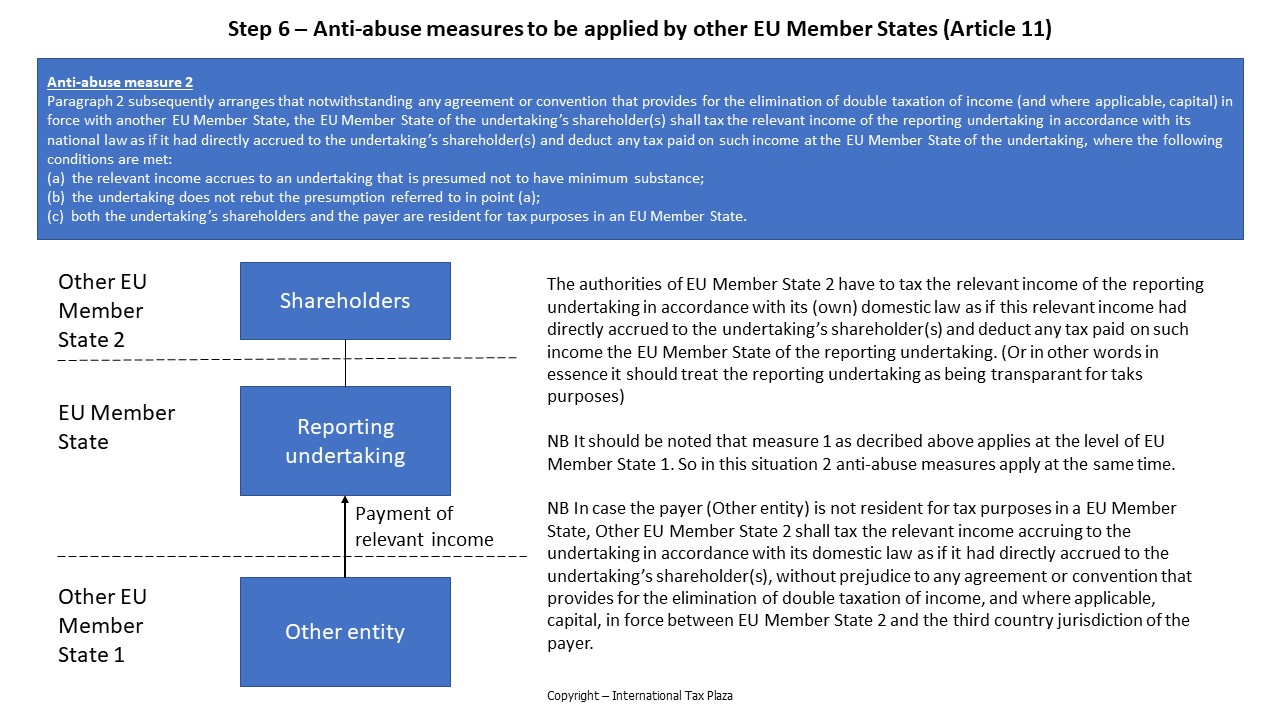

Anti-abuse measure 2

Paragraph 2 subsequently arranges that notwithstanding any agreement or convention that provides for the elimination of double taxation of income (and where applicable, capital) in force with another EU Member State, the EU Member State of the undertaking’s shareholder(s) shall tax the relevant income of the reporting undertaking in accordance with its national law as if it had directly accrued to the undertaking’s shareholder(s) and deduct any tax paid on such income at the EU Member State of the undertaking, where the following conditions are met:

(a) the relevant income accrues to an undertaking that is presumed not to have minimum substance;

(b) the undertaking does not rebut the presumption referred to in point (a);

(c) both the undertaking’s shareholders and the payer are resident for tax purposes in an EU Member State.

In other words, the EU Member States of the undertaking’s shareholder(s) in essence will treat the undertaking as transparent for tax purposes.

The Directive furthermore arranges that where the payer is not resident for tax purposes in a Member State, the Member State of the undertaking’s shareholder(s) shall tax the relevant income accruing to the undertaking in accordance with its national law as if it had directly accrued to the undertaking’s shareholder(s), without prejudice to any agreement or convention that provides for the elimination of double taxation of income, and where applicable, capital, in force between the Member State of the undertaking’s shareholders and the third country jurisdiction of the payer.

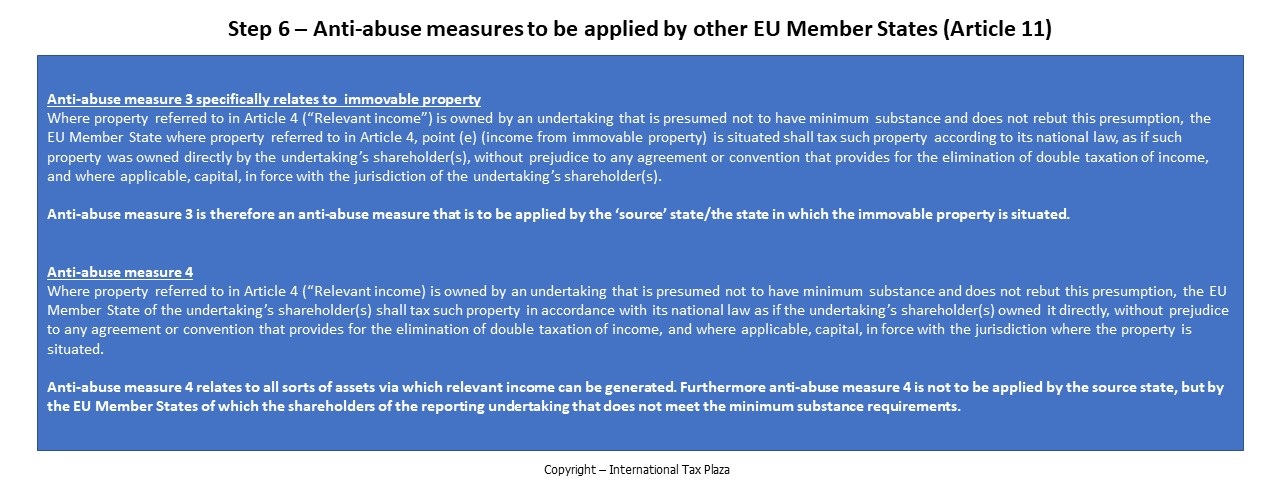

Anti-abuse measure 3 & 4

Where property referred to in Article 4 ("Relevant income") is owned by an undertaking that is presumed not to have minimum substance and does not rebut this presumption:

(a) the EU Member State where property referred to in Article 4, point (e) (income from immovable property) is situated shall tax such property according to its national law, as if such property was owned directly by the undertaking’s shareholder(s), without prejudice to any agreement or convention that provides for the elimination of double taxation of income, and where applicable, capital, in force with the jurisdiction of the undertaking’s shareholder(s);

(b) the EU Member State of the undertaking’s shareholder(s) shall tax such property in accordance with its national law as if the undertaking’s shareholder(s) owned it directly, without prejudice to any agreement or convention that provides for the elimination of double taxation of income, and where applicable, capital, in force with the jurisdiction where the property is situated.

Anti-abuse measures to be applied by the EU Member State of the undertaking

If a reporting undertaking does not have minimum substance for tax purposes in the EU Member State where it is resident for tax purposes, that EU Member State shall take any of the following decisions:

(a) deny a request for a certificate of tax residence to the undertaking for use outside the jurisdiction of this Member State; or

(b) grant a certificate of tax residence which prescribes that the undertaking is not entitled to the benefits of agreements and conventions that provide for the elimination of double taxation of income, and where applicable, capital, and of international agreements with a similar purpose or effect and of Articles 4, 5 and 6 of Directive 2011/96/EU and Article 1 of Directive 2003/49/EC.

Exchange of information

Article 13 of the Directive contains provision regarding the mandatory automatic exchange of information on undertakings required to report on indicators of minimum substance.

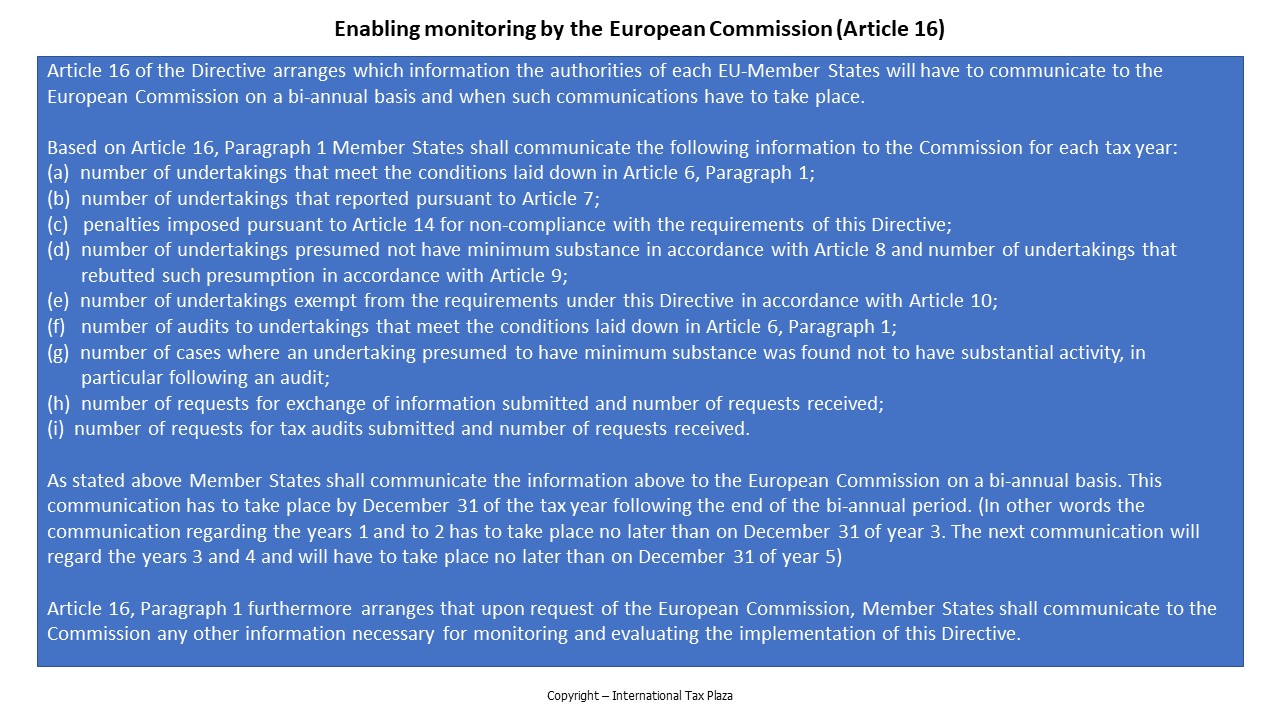

Monitoring by the European Commission

Article 16 of the Directive arranges which information the authorities of each EU-Member States will bi-annually have to communicate to the European Commission.

Transposition

It’s the goal of the European Commission that Member States shall adopt and publish, by June 30, 2023 at the latest, the laws, regulations and administrative provisions necessary to comply with this Directive and that they shall apply those provisions from January 1, 2024.

Some initial takeaways and a concern

Initial takeaways

The Directive seems to provide groups with large presence in a Member State in which it also has an entity that generates relevant income with an easy way to make sure this latter entity is exempt from the reporting obligations as laid down in Article 7. The group can arrange this by making sure that there are 5 full-time equivalent employees or members of staff exclusively carrying out the activities generating the relevant income employed by (on the payroll) of the entity that would otherwise qualify as a reporting undertaking.

But even if a group with large presence in/or very close to a Member State in which it has a reporting undertaking, such a group might be in an good position to meet the substance requirements. Since for meeting the minimum substance requirements it is allowed that the Board of Directors of the reporting undertaking is formed by employees/directors from associated entities. Furthermore if the group already has a significant presence in the Member State of which the reporting undertaking is a "resident", it is most likely that the group has acces to business premises in that EU Member State. In such situation it shouldn’t be a big problem for the group to arrange that the reporting undertaking will have its own premises, or premises for its exclusive use, in the Member State of which the reporting undertaking is a "resident".

When considering certain transactions or payments to be made from, or to, an entity, shareholders will have to carefully consider the timing of transaction/payment to make sure that no anti-abuse measures apply to such transaction/payment because either at the moment of the transaction/payment the entity/entities involved does/do not qualify as a reporting undertaking or does/do meet the minimum substance requirements.

A concern

One of my concerns is how the Directive is supposed to practically work. What I mean is the following. A reporting undertaking is required to annually meet its reporting requirements. Based on the declarations given and the supporting documentary evidence provided it is then ‘decided’ whether or not the reporting entity meets the minimum substance requirements. If not, the EU Member State will have to apply the anti-abuse measures.

What I am a bit struggling with is how the European Commission envisions the one (the reporting) time wise to work out with the other (the applying of the anti-abuse measures). What I mean is in theory the possibility exists that in year 1 an entity does not qualify as a reporting undertaking. In year 2 it qualifies as a reporting undertaking and does not meet the minimum substance requirements. Whereas in year 3 it still qualifies as a reporting undertaking, but in that year it meets the minimum substance requirements.

So what I would expect is that the anti-abuse measures would have to be applied in year 2, whereas no anti-abuse measures are to be applied in year 1 and year 3.

By just taking the Dutch system for filing corporate income tax returns as an example, the tax return for year 2, and therewith the declarations and supporting evidence, will most likely only be filed in year 3 or even the beginning of year 4? So if in year 2 the reporting undertaking receives for example a dividend, royalty or interest payment, how will the EU Member State of the payer be able to apply the applicable anti-abuse measure to such payment?

Click here to be forwarded to the text of a Proposal for a COUNCIL DIRECTIVE laying down rules to prevent the misuse of shell entities for tax purposes and amending Directive 2011/16/EU.

Copyright – internationaltaxplaza.info