Over the last few years many suggestive reports have seen the light regarding aggressive IP planning. The main goal of most of these reports seems to be to feed the negative sentiment that the Netherlands is a tax haven for multinationals. These reports have been drafted by organizations as SOMO. They use terms like: “The Netherlands do not tax royalties”, “The Dutch APA and ATR practice allow multinationals to come to agreements with the Dutch tax authorities that are against the law” or “The Netherlands is a tax haven”, “Because of the Dutch APA and ATR practices other countries lose out on billions of (corporate) income taxes”.

In many of these reports it is suggested that the jurisdictions of which the sub-licensees are residents have lost out on huge amounts of taxes. The Netherlands is one of the jurisdictions that is often accused of being a tax haven that enables the (most US) IP-owners of robbing the jurisdictions of which the sub-licensees are residents out of the possibility to levy billions in taxes . (Obviously also Ireland and Luxembourg are jurisdictions that are regularly mentioned). What most of these reports furthermore have in common is that they love to throw around billions of royalties being paid by the sub-licensees. Furthermore they love to pretend that the structures lead to gigantic amounts of deductible costs in the jurisdictions of which the sub-licensees are residents and that these costs would not exist in a ‘straightforward’ structure.

Now I am not going to pretend that I have read all these reports, but what I miss in these reports is a comparison between the taxes that would have been paid by a multinational in a straightforward structure and the taxes that they pay when using an aggressive tax planning structure.

These reports have led to the OECD BEPS project. A project I think is very justifiable. However these reports also seem to have been the reason that the European Commission and the European Parliament have started a crusade against the Netherlands, Luxembourg and Ireland. And they have also led out to left-wing Dutch politicians like Paul Tang and Jesse Klaver yelling at every possibility that the Netherlands is a tax haven. For as far as I have seen over the last few years the EU crusade against the Netherlands has mostly been led by UK, German, French and Danish politicians. And honestly the latter surprises me.

What I will try to do in this article is to make a high-level comparison of the infamous double Irish Dutch sandwich with what in my opinion should be considered the straightforward structure. My comparison I limit to a structure in which only EU based ultimate sub-licensees and a UK sub-licensee are involved. For that I will try to explain where the structure leads to less corporate income taxes being paid and where they lead to lower withholding taxes to be withheld by the jurisdictions of which the sub-licensees are residents. I am the first to admit that with that the comparison is not complete since most likely also non-EU countries were impacted by these structures.

So what is the direct reason for me writing this article? Well in that I can be short. The direct reason was an interview with Paul Tang that was last week shown on Dutch TV. In the interview he stated that the advisors and lawyers that were working on the Zuidas from Amsterdam should start reschooling. The crusade the EU started against the Netherlands would put them out of work. And according to him that was good.

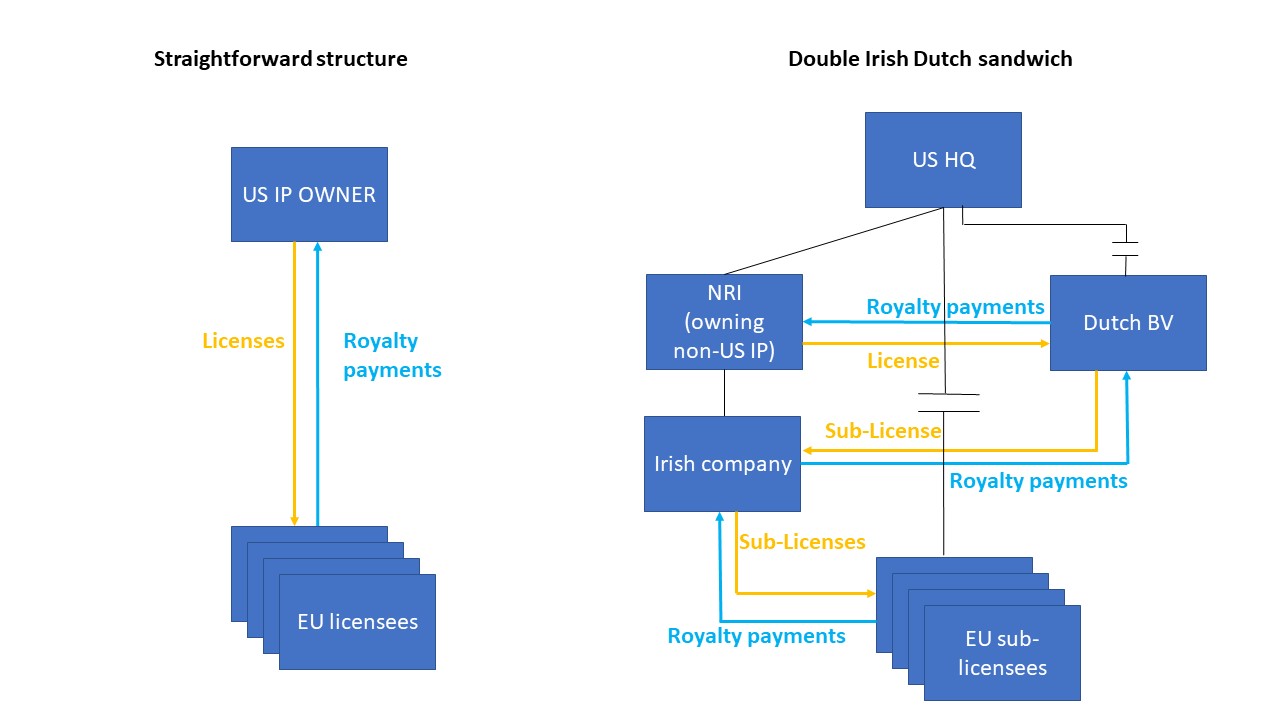

Straightforward structure

The structure I consider to be the straightforward structure is a structure in which a US entity develops an IP. The US entity licenses this IP to group entities. For these licenses the group entities have to pay royalties totaling to EUR 2 billion annually. In my comparison the total amount of EUR 2 billion is divided over the licensees in the different jurisdictions based on the number of people living in their respective jurisdiction.

Therefore the annual amount of royalties that the licensees will have to pay annually are be broken-down as follows:

|

Jurisdiction |

Percentage of the total royalties |

Amount |

|

Austria |

1,74% |

€ 34.708.831 |

|

Belgium |

2,22% |

€ 44.350.174 |

|

Bulgaria |

1,35% |

€ 26.995.758 |

|

Croatia |

0,77% |

€ 15.426.147 |

|

Cyprus |

0,23% |

€ 4.627.844 |

|

Czech Republic |

2,06% |

€ 41.264.944 |

|

Denmark |

1,12% |

€ 22.367.914 |

|

Estonia |

0,25% |

€ 5.013.498 |

|

Finland |

1,06% |

€ 21.210.953 |

|

France |

13,02% |

€ 260.316.236 |

|

Germany |

16,04% |

€ 320.863.864 |

|

Greece |

2,06% |

€ 41.264.944 |

|

Hungary |

1,87% |

€ 37.408.407 |

|

Ireland |

1,27% |

€ 25.453.143 |

|

Italy |

11,63% |

€ 232.549.171 |

|

Latvia |

0,37% |

€ 7.327.420 |

|

Lithuania |

0,54% |

€ 10.798.303 |

|

Luxembourg |

0,12% |

€ 2.313.922 |

|

Malta |

0,10% |

€ 1.928.268 |

|

Netherlands |

3,39% |

€ 67.875.048 |

|

Poland |

7,39% |

€ 147.705.361 |

|

Portugal |

1,99% |

€ 39.722.329 |

|

Romania |

3,72% |

€ 74.431.161 |

|

Slovakia |

1,04% |

€ 20.825.299 |

|

Slovenia |

0,40% |

€ 8.098.727 |

|

Spain |

9,16% |

€ 183.185.499 |

|

Sweden |

2,01% |

€ 40.107.983 |

|

UK |

13,09% |

€ 261.858.851 |

|

Total |

|

€ 2.000.000.000 |

Double Irish Dutch sandwich structure

In the Double Irish Dutch sandwich 3 additional entities are included in the structure. These are a Dutch BV, an Irish entity and an entity that was incorporated under Irish law that after incorporation became a resident of a sunny Caribbean island that levies no or only very little income taxes. The latter entity I call an non-resident Irish company (abbreviated to NRI).

In this structure the US entity and the NRI develop IP together. For this the US entity provides a part of the funding and scientists. The NRI provides the other part of the funding. When the IP is developed the US entity is owner of the IP-rights for-as-far as they relate to the US. The NRI owns the IP-rights for as-far-as they relate to the rest of the world (the non-US IP).

In this structure the NRI licenses the IP to the Dutch BV. The Dutch BV subsequently grants a sublicense to the Irish company, which in its turn grants sub-licenses to the EU and UK sublicensees.

In my calculation I take the position that the annual royalties the EU and UK sub-licensees have to pay do not significantly differ from the amounts they would have to pay in the straightforward structure. The reason here for is that the value of the IP does not change and that therefore the intra-group transfer prices these sub-licensees will not significantly change.

I assume that the Irish company will report a spread of approximately 5% of its incoming royalty fees as taxable income. Furthermore, I assume that he Dutch BV will report a spread of approximately 1% of the incoming license fees as taxable income. Consequently approximately 94% of the royalty fees paid by the EU and the UK sublicensees ends up with the NRI.

NB It should be noted that due to measures taken by the Irish government as of 2015 the double Irish Dutch sandwich structure can no longer be used for newly to be set-up structures. Existing structures could still benefit from the double Irish Dutch sandwich structure until 2020.

With respect to the Dutch BV it should be noted that the function of the BV mainly is to avoid withholding taxes to be withheld over royalties paid to the low-taxed/non-taxed NRI. Reason here for is that the Netherlands did not know a royalty withholding tax. However on January 1, 2021 anti-abuse legislation entered into force in The Netherlands (Wet bronbelasting 2021). As of January 1, 2021 the Netherlands will withhold 25% tax over outbound royalty payments that are made to related entities that are residents of low taxed jurisdictions or in case of abuse. (NB the same applies to interest payments)

The straightforward structure and the aggressive tax planning structure look as follows:

Impact on the local corporate income tax positions of the sub-licensees

As discussed above my assumption is that use of the double Irish Dutch sandwich do not impact the annual amount of royalties that each of the sub-licensees do have to pay. Therefore whether the straightforward structure was used or the double Irish Dutch sandwich structure is used this does not have an impact on the local corporate income tax positions of the sub-licensees. However, I admit this is debatable since this depends on how the transfer prices are determined. Does one start form calculating back from the value the licenses have for the sub-licensee and then calculating back to what will end-up at the level of the NRI. Or does one for example start with what the NRI should receive (the same as the US entity) and then by adding the spreads of the Irish and Dutch entities calculates the royalties that the (EU) sub-licensees will have to pay. If the latter method is used the annual royalties a sub-licensee will have to pay will be increased by a little over 6,3% or 126.528.442 EUR. Now taking into account an average corporate income tax rate of 25% this will lead to an annual total loss of corporate income taxes to be levied by all EU countries of in total approximately 31.632.111 EUR.

However, there are a few entities for which the CIT position changes for sure.

The first one obviously is the US entity. Their annual taxable income decreases by 2 billion EUR until. It should be noted however, that this leads to completely no taxes being paid in the US over this amount. Payment of US taxes was/is postponed until the funds are repatriated to the US.

The second entity for which the income changes is the new Irish company. The change can roughly be calculated as follows (For simplicity matters I do not take into account any administrative costs):

Additional royalty income: EUR 2.000.000.000

Minus: royalty costs: EUR 1.900.000.000

Taxable income: EUR 100.000.000

Irish CIT (12,5%) EUR 12.500.000

Thirdly there is the new Dutch BV. This change can roughly be calculated a follows (For simplicity matters I do not take into account any administrative costs):

Additional royalty income: EUR 1.900.000.000

Minus: royalty costs: EUR 1.881.000.000

Taxable income: EUR 19.000.000

Dutch CIT (25%) EUR 4.750.000

And last, but not least, we have the NRI. The NRI will generate EUR 1.881.000.000 of income, which will not be taxed at all, or perhaps the NRI will have to pay a minimum amount of taxes over the income it generated.

So roughly calculated the structure annually leads to a postponement of EUR 500 million of US taxes to be levied. Depending on the transfer prices used either the EU and UK jurisdictions do not lose out on any corporate income taxes to be levied at the level of the sub-licensees, or if we change the method of calculating the royalty fees they annually will lose out on approximately EUR 31,5 million of corporate taxes to be levied.

The Netherlands and Ireland will be in the position that they can levy more corporate income taxes than they could under the straightforward structure.

Conclusion

Based on the above my conclusion is that the double Irish Dutch sandwich does not lead to a significant decrease in the amount of corporate income taxes the European jurisdictions can levy at the level of the sub-licensees. If there is a significant difference in my view this might be an indication that the applied intra-group transfer prices were incorrect.

Withholding taxes

The second sort of taxes that come into play are the withholding taxes the jurisdictions of which the sub-licensees are residents can withhold over the outbound royalty payments these sub-licensees pay.

The reason why a Dutch BV is interposed is that until January 1, 2021 the Netherlands did not withhold taxes over outbound royalty payments. Since The Netherlands has a large treaty network under which withholding taxes are limited and the fact that the EU Interest and Royalty Directive (Council Directive 2003/49/EC of 3 June 2003) prohibits to withhold taxes over inter-EU royalty payments.

Consequently if the double Irish Dutch sandwich was used the jurisdictions of which the sub-licensees were residents were not allowed to withhold taxes over the outbound royalty payments to the Netherlands.

It should be noted that in the straightforward structure also a Dutch BV could be interposed between the US entity and the sub-licensees. This that would lead to the same effect on the withholding taxes as it does in the double Irish Dutch sandwich structure. However, in the calculation shown below I keep the straightforward structure really straightforward, so without interposing a Dutch conduit BV to lower the withholding taxes.

Furthermore for the calculation I assume that the IP developed in my example qualifies as scientific work as meant in Article 12 of the OECD Model Treaty.

First I calculate the amount of withholding taxes a jurisdiction is would be allowed to withhold under the straightforward structure. This amount is calculated by taking lower of the rate the jurisdiction would be allowed to withhold under the DTA the respective jurisdiction has concluded with the US and the domestic rate of withholding of the respective jurisdiction. As a disclaimer it should be noted that I did not reviewed all the DTAs, but that I used a database with treaty rates that is available on Deloitte’s website. There where there is no DTA in place, or where the DTA allows the source State to withhold taxes over outbound royalty payments I used the Deloitte database for domestic rates to see what the domestic rate applies to outbound royalty payments.

|

Jurisdiction |

Outbound royalty payment |

Applicable WHT rate |

WHT losed out by the jurisdiction |

|

Austria |

€ 34.708.831 |

0% |

€ - |

|

Belgium |

€ 44.350.174 |

0% |

€ - |

|

Bulgaria |

€ 26.995.758 |

5% |

€ 1.349.787,89 |

|

Croatia |

€ 15.426.147 |

15% |

€ 2.313.922,10 |

|

Cyprus |

€ 4.627.844 |

0% |

€ - |

|

Czech Republic |

€ 41.264.944 |

0% |

€ - |

|

Denmark |

€ 22.367.914 |

0% |

€ - |

|

Estonia |

€ 5.013.498 |

10% |

€ 501.349,79 |

|

Finland |

€ 21.210.953 |

0% |

€ - |

|

France |

€ 260.316.236 |

0% |

€ - |

|

Germany |

€ 320.863.864 |

0% |

€ - |

|

Greece |

€ 41.264.944 |

0% |

€ - |

|

Hungary |

€ 37.408.407 |

0% |

€ - |

|

Ireland |

€ 25.453.143 |

0% |

€ - |

|

Italy |

€ 232.549.171 |

5% |

€ 11.627.458,54 |

|

Latvia |

€ 7.327.420 |

0% |

€ - |

|

Lithuania |

€ 10.798.303 |

10% |

€ 1.079.830,31 |

|

Luxembourg |

€ 2.313.922 |

0% |

€ - |

|

Malta |

€ 1.928.268 |

0% |

€ - |

|

Netherlands |

€ 67.875.048 |

0% |

€ - |

|

Poland |

€ 147.705.361 |

5% |

€ 7.385.268,03 |

|

Portugal |

€ 39.722.329 |

10% |

€ 3.972.232,93 |

|

Romania |

€ 74.431.161 |

10% |

€ 7.443.116,08 |

|

Slovakia |

€ 20.825.299 |

0% |

€ - |

|

Slovenia |

€ 8.098.727 |

5% |

€ 404.936,37 |

|

Spain |

€ 183.185.499 |

0% |

€ - |

|

Sweden |

€ 40.107.983 |

0% |

€ - |

|

UK |

€ 261.858.851 |

0% |

€ - |

|

Total |

|

|

€ 36.077.902,04 |

Based on the table above in total the EU-countries would be allowed to withhold EUR 36.077.902 more taxes over the outbound royalty payments if these would have been made directly to the US. This amount is 1,8% of the total royalty payments made by EU and UK sub-licensees.

Conclusion

The high-level comparison between the straightforward structure and the infamous double Irish Dutch sandwich leads to the following conclusions:

· The use of the double Irish Dutch sandwich leads to a significant postponement in having to pay US taxes by US multinationals;

· The use of a double Irish Dutch sandwich in principle should not lead to more deductible costs at the level and therewith lower income taxes being due by the sub-licensees in their jurisdiction of residence;

· The interposing of a Dutch BV leads to the EU-jurisdiction losing out on withholding taxes that amount to 1,8% of the total amount of outbound royalty payments made by the EU and UK sub-licensees (obviously based on the allocation of costs as used in the case above, a change in allocation in costs leads to a higher or lower percentage);

· Unlike it often is suggested the Netherlands levies corporate income tax over royalty income (revenue minus costs) realized by a Dutch BV against the normal Dutch corporate income tax rate of 25%;

· The loophole to use a double Irish Dutch sandwich has been closed by the Irish government; and

· Because of anti-abuse legislation introduced in the Netherlands as of January 1, 2021 the Netherlands will withhold 25% withholding tax over outbound royalty (and interest) payments made to related entities that are resident in a low-taxing jurisdiction (lower than 9% (corporate) income tax rate) or in a jurisdiction that is included in the EU list of non-cooperative jurisdictions.

Copyright – internationaltaxplaza.info

Follow International Tax Plaza on Twitter (@IntTaxPlaza)