The U.S. Committee on Ways and Means launched an attack on Pillar 2, more specifically on the introduction of the UTPR by third countries. On May 25, 2023 the Ways and Means Committee Chairman Jason Smith, along with every Committee Republican, introduced H.R. 3665, the Defending American Jobs and Investment Act. In a press release issued by the Committee it is stated that the purpose of the bill is to prevent President Biden’s global tax surrender from killing American jobs, surrendering sovereignty over our tax code, and handing a competitive advantage to the Chinese Communist Party. The bill creates a reciprocal tax applicable to any foreign country that imposes unfair taxes on U.S. businesses and workers under the Organization for Economic Co-operation and Development (OECD)’s global tax deal.

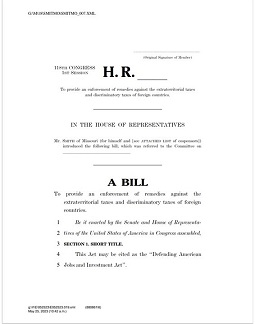

In the Bill itself it is stated that the Bill aims to provide an enforcement of remedies against the extraterritorial taxes and discriminatory taxes of foreign countries.

Background on the Defending American Jobs and Investment Act

H.R. 3665, co-sponsored by every Republican Member of the Ways and Means Committee, protects American jobs and economic growth with reciprocal taxes applicable to any foreign country that decides to target Americans with unfair taxes under the OECD’s global minimum tax:

- Requires the U.S. Treasury Department to identify extraterritorial taxes and discriminatory taxes enacted by foreign countries that attack U.S. businesses, such as the UTPR surtax.

- After the unfair foreign taxes have been identified, the tax rates on U.S. income of wealthy investors and corporations in those foreign countries will increase by 5 percentage points each year for four years, after which the tax rates remain elevated by 20 percentage points while the unfair taxes are in effect.

- The reciprocal tax ceases to apply after a foreign country repeals its extraterritorial and discriminatory taxes.

- The reciprocal tax will remain dormant as long as countries avoid any unfair taxes on U.S. businesses and workers. Several countries have already made the wise decision to exclude the UTPR surtax from their implementation of the OECD global minimum tax.

The full text of the Bill can be found here.

Copyright – internationaltaxplaza.info

Follow International Tax Plaza on Twitter (@IntTaxPlaza)