On August 9, 2021 in an article that was only available in the Dutch language we discussed the opinion of Advocate General (AG) Wattel regarding the underlying case. In its judgment of June 16, 2023 the Dutch Supreme Court, ECLI:NL:HR:2023:922, has confirmed the opinion of the AG. In the underlying case the Dutch Supreme Court has ruled that it is contrary to sound business principles (goed koopmansgebruik) to charge an unrealized currency exchange loss incurred on the obligation to pay a remainder of the purchase price of a business asset to the P&L on balance sheet date. Instead this result must be added to the cost price of the business asset and then depreciated over the useful life of the asset.

Facts

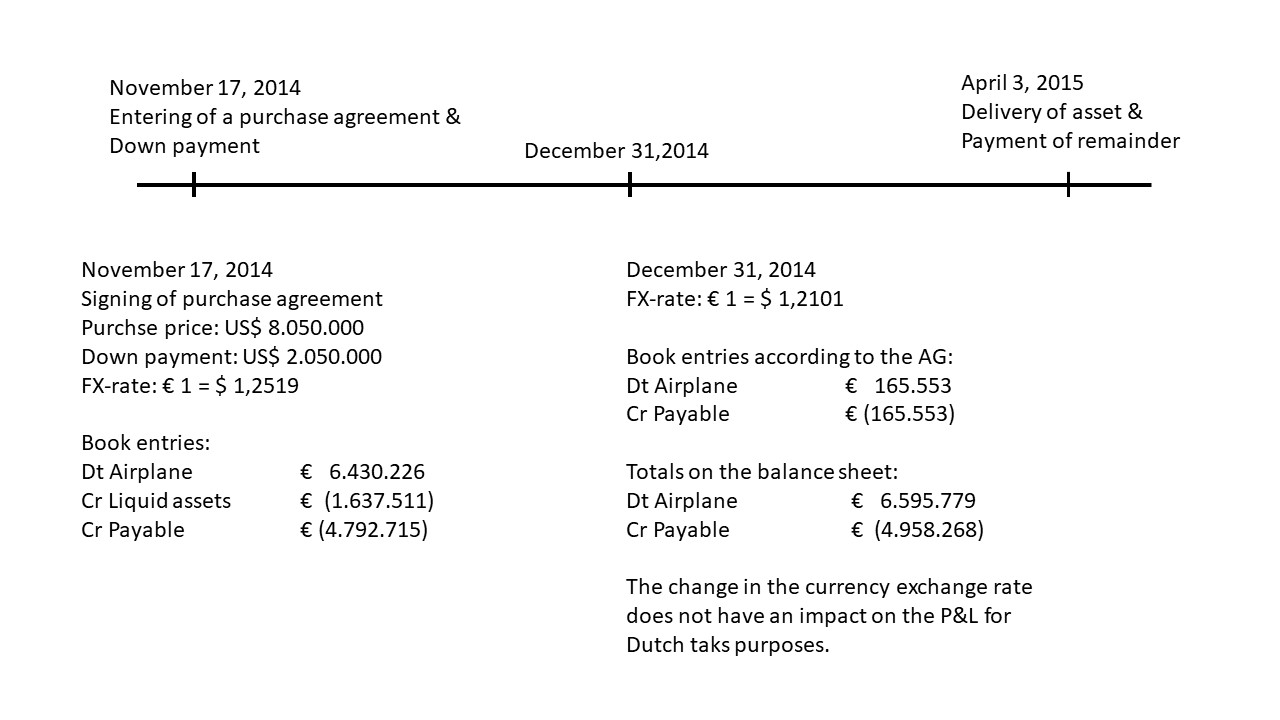

2.1 The taxpayer is the parent company of a fiscal unity for Dutch corporate income tax purposes. On November 17, 2014 a subsidiary that is part of the fiscal unity of the taxpayer (hereinafter: the subsidiary) purchased an aircraft (hereinafter: the aircraft) for a purchase price denominated in US dollars. The purchase price amounted to $8,050,000. In 2014 the subsidiary made a down payment amounting to $ 2,050,000. The remaining amount of the purchase price, $ 6,000,000, at the delivery of the aircraft. The delivery of the aircraft took place in 2015 and the subsidiary paid the remaining amount of the purchase price April 3, 2015.

2.2 The taxpayer’s taxable profit is determined/calculated in euros.

2.3 Between the date of purchase (November 17, 2014) and the balance sheet date (December 31, 2014), the USD-EUR exchange rate increased. Therewith increasing the remaining – future – payment obligation with 165.553 euros at the balance sheet date. The taxpayer included that payment obligation as a liability on its balance sheet and included the aforementioned increase in its 2014 Dutch corporate income tax return as a currency exchange loss for the year. When raising the 2014 the Dutch corporate income tax assessment the Dutch tax authorities did not accept the deduction of the currency exchange loss.

2.4 The Court of Appeal of the Hague has ruled that it is contrary to sound business principles, in particular the reality principle, to charge an unrealized currency exchange loss incurred on the obligation to pay the remainder of the purchase price to the 2014 profit.

From the considerations of the Dutch Supreme Court

3.1 The complaint of the taxpayer is directed against the judgment of the Court of Appeal as referred to in 2.4 above.

3.2 When assessing the complaint, the Dutch Supreme Court will take the following into account.

3.3.1 Sound business principles entail that at the latest at the time of delivery of the business asset the purchase price of that business asset, which forms part of its acquisition costs, is capitalized on a taxpayer’s balance sheet for tax purposes.

3.3.2 Capitalization of the acquisition costs of a business asset must take place in the currency in which the taxpayer calculates its taxable amount, i.e. in euros or - in the cases referred to in Article 7, Paragraph 5 of the Dutch corporate income tax Act - in another currency chosen by the taxpayer (a so-called functional currency). In a case such as the underlying in which (i) a purchase price in a currency other than the one in which the taxpayer calculates its taxable amount (hereinafter: foreign currency) has been agreed for a business asset, (ii) this purchase price is paid in whole or in part at a later date, for example upon delivery, and (iii) the exchange rate of that foreign currency against the euro, or another functional currency, changes after the conclusion of the purchase agreement, this may result in a change in the purchase price expressed in euros or in a other functional currency. Whether, and if so, to what extent such exchange rate changes will ultimately affect the purchase price will become clear at the time that the purchase price is definitively determined.

3.3.3 As a rule, the purchase price to be activated must be determined according to the situation at the time of delivery or – insofar as payment takes place earlier – at the time of that payment. This means that in a case as referred to in 3.3.2 above, the full purchase price expressed in euros, or in another functional currency will, generally be only definitively established at the time of delivery or - if applicable - at the earlier time of payment. In the event – which does not arise in the underlying case – that the purchase price has not yet been paid or has not been paid in full at the time of delivery, changes in the exchange rate of the foreign currency in which the purchase price has been agreed after the moment of delivery will therefore not lead to a change in the purchase price to be activated.

3.3.4 According to Article 3.30 of the Dutch Individual Income Tax Act, as being part of the acquisition costs of a business asset, in principle the purchase price must be allocated to the years in which the asset is used in the taxpayer's business by means of depreciation. In relation therewith, it is not permitted that changes to the purchase price occurring before its delivery as a result of the exchange rate changes as referred to above in 3.3.2 are included as income or expenses in the (tax) profit of the year in which those changes occur.

3.4 Parties are not disputing that after delivery the aircraft as purchased by and delivered to the subsidiary constitutes a business asset. The taxpayer has included the obligation to pay the remainder of the purchase price of the aircraft on its balance sheet for tax purposes. This liability, expressed in euros, has increased as a result of the increase in value of the US-dollar against the euro in the underlying year (2014). What has been considered above in 3.3 means that the taxpayer is not allowed to deduct this increase of its payment obligation from its taxable profit for the year, but that in return for tax purposes it must capitalize an equal amount.

3.5 In view of what has been considered under 3.4 above, the Court of Appeal has rightly ruled that in this case it is contrary to sound business principles to deduct a currency exchange loss in 2014 with respect to the obligation to pay the remainder of the purchase price of the aircraft. The complaint is based on a different view and therefore fails.

Judgment

The Dutch Supreme Court ruled the appeal in cassation as unfounded.

Remarks ITP

Where the judgment of the Supreme Court is very short and straight to the point, the opinion of the Advocate General more extensive. In his conclusion, the Advocate General also briefly discusses the 3 other scenarios. Although these remarks made by the Advocate General were not further discussed in the judgment of the Supreme Court we will discuss them below.

What if the taxpayer had paid the purchase price in full and at once?

If a taxpayer when entering into obligations to acquire a business asset in a non-euro currency immediately pays the full purchase price in advance, whether or not at a discount, then the cost price is fixed at that time in euros and, in the Advocate General’s opinion, the normal asset valuation rule - cost or lower market value or lower value - applies. Obviously one can only start only depreciating the business asset after delivery. If the dollar value increases and with it the value of the right to delivery, then taking that unrealized profit into account is probably contrary to the principle of prudence of the good merchant. If the dollar decreases in value, according to the Advocate General the right to delivery can be depreciated to that lower market value.

What if the taxpayer had hedged the currency exchange risk?

The taxpayer raises the questions what would have been the legal situation if at the moment of placing its order the taxpayer had (fully) hedged the currency exchange risk on its remaining payment obligation by (i) entering into a currency forward transaction to that effect or (ii) purchasing the remaining dollar amount and keep it in a dollar account until delivery.

According to the Advocate General, the answer to that question is obvious: in both cases the cost price - at least for as far as it regards currency risks - is fixed at the moment of buying the required dollars or entering into the hedge contract (the exchange or hedging costs are part of the cost of the aircraft) and in both cases the correlation between the currency movement of the right to delivery and the currency movement of the remaining payment obligation is 100% because the correlation between the hedge and the payment obligation is 100%, so very well within the 80 to 125% margin of cocoa bean judgment of the Dutch Supreme Court BNB 2009/271. On the 2014 balance sheet date, both values are therefore included at the values of the down payment/hedging date and remain there until the moment of delivery/payment.

What if it doesn’t regard business assets that are to be capitalized and depreciated, but stock?

The annotations show that the practice is concerned about the impracticability of the balance sheet valuation of stock purchased in a foreign currency that has not yet been paid for nor has been delivered on the balance sheet date. The question is whether it is advisable to elaborate about that without facts, without a case, without a dispute, without arguments from both parties and without insights from the judges on the facts. Even an - as always - instructive Opinion of an Advocate General cannot fill those gaps.

According to the Advocate General dogmatically, there is little more to say in the abstract than that the valuation stock ordered in unhedged foreign currency depends on the nature of the business and of the stock, the frequency of pre-purchasing, the feasibility and usefulness/uselessness of tracking exchange rates. and the degree of actual or contracted hedging of the currency risk on stocks. However, because stocks are less important from a fiscal temporal point of view than business assets are (at most 1 balance sheet date, whereas for business assets the consequences of cost price determination continue to have an impact for the full period over which the business asset is being depreciated/useful life of the asset, and possibly even much longer due to HIR (Re-investment Reserve) possibilities, it seems to the Advocate General that practically with unhedged foreign currency ordered stock, the principle of simplicity plays a much greater role than with unhedged foreign currency ordered business assets. This therefore seems to imply that sound business principles allows stocks ordered in an unhedged foreign currency and the therewith corresponding payment obligation are to be valued against the exchange rate at the time of ordering and that a currency result realized upon payment is included in the profit and loss account. According to the Advocate General, no currency exchange gain or loss is to be recognized on a balance sheet date that lays between the order date and the delivery/payment. The Advocate General states that the practice would probably be grateful if the Dutch Supreme Court – superfluously in the underlying case – would declare such a course of action to be acceptable for the sound business principles.

Unfortunately the Dutch Surpreme Court did not discuss this matter in its judgment of June 16, 2023.

Copyright – internationaltaxplaza.info

Follow International Tax Plaza on Twitter (@IntTaxPlaza)