In recent years the international call to narrow the wealth gap between the (super-) rich and the poor has become louder. In addition, the pleas for taxing the (super-) rich have also become louder. On July 11, 2023 the European Commission for example decided to register a European Citizens' Initiative (ECI) entitled ‘Taxing great wealth to finance the ecological and social transition'. (See our article from July 12, 2023) The obvious question that arises is what would be the best way to tax the high-net-worth individuals?

On the basis of the somewhat extreme VanMoof case, we want to show that it is necessary very carefully consider how a tax for the (super-) rich tax should be designed, because there can be quite a few snags.

The VanMoof case

In 2009 VanMoof was founded by the Carlier brothers. Their hip minimalist bicycle quickly became a success and both nationally and internationally, the company managed to acquire a good market share. Nevertheless, the company never really became profitable. Through various financing rounds, the company was able to continue to grow and incurred losses were covered.

The last financing round took place in 2021. In that financing round VanMoof managed to raise 128 million US dollars. Based on these proceeds, Quote (a Dutch magazine that yearly publishes a list of the 500 wealthiest Dutch people) estimated the joint wealth of the brothers to amount to a staggering 140 million euros (70 million euros per brother). Also in 2022, Quote estimated the brothers' wealth to amount to 140 million euros.

On July 17, 2023 three Dutch VanMoof entities were declared bankrupt by the District Court of Amsterdam. In its article of July 18, 2023 Quote assumes that after these bankruptcies the founding fathers of VanMoof no longer have any significant assets.

For discussion purposes, in this article we’ll assume that the numbers mentioned by Quote are correct. For the years 2021 and 2022 the brothers were members of the group of the super-rich. And as of mid-July 2023 they are back with the ‘normal’ people.

In this article we will discuss what consequences each of the following three methods of taxing high-net-worth individuals would have had for the Carlier brothers:

- The taxing of income stemming from assets (e.g. dividends, rent, interest, etc.) and realized capital gains;

- Taking the annual change in wealth into account as a tax base; and

- Taking the wealth into account as a tax base (a wealth tax).

In our example calculations below we do as if the brothers are actually 1 person to make the calculations more simple.

Method 1 – The taxing of income stemming from assets and realized capital gains

Under this method, high net worth individuals are taxed if they actually receive income from assets (such as receiving interest or dividends), or if they actually realize capital gains. The latter may include, for example, the capital gains realized on the sale of shares, bonds, commodities, real estate or if they realize currency exchange results. The increase in fair market value of an asset that has not yet been realized therefore not included in the tax base.

However, where capital gains are being realized, capital losses might also occur. When considering introducing such a system legislators have to take int consideration how such capital losses should be treated for tax purposes. It seems logical that capital losses can be set off against capital gains that are realized within the same tax year. But what to do if the total for a tax year is a capital loss? Can such a capital loss be off set against the taxable capital gains from other years? And if so, can the loss only be carried forward or can it also be carried forward?

Obviously the legislator will also have to determine against which rate the income has to be taxed.

Assuming that the VanMoof group did not distribute any dividends during its existence and if the brothers never transferred/sold any of the shares it owned in VanMoof, the answers to aforementioned questions have no impact on the tax position of the brothers. Although the 2021 financing round led to the brother getting a net worth on paper that amounted to 140 million euro, this is exactly what it was: a net worth on paper. Since the brothers did not sell any of their shares they did not realize any capital gains in 2021 nor 2022. In 2023 the net worth of the brothers decreased/returned to nil. However, since the brother never had to take a realized capital gai into account for tax purposes the decrease in value does not lead to a deductible capital loss for tax purposes.

Method 2 – Taking the annual change in wealth into account as tax base

In this second method the annual change in the fair market value of a taxpayer’s assets minus the fair market value of its liabilities is taxed. Therewith not only realized capital gains and capital losses are included in the taxpayer’s tax base, but also the unrealized ones.

As under method 1 above where taxpayers can have unrealized capital gains, they can also have unrealized capital losses and therefore a legislator that wants to introduce this method of taxation again has to consider how the unrealized capital losses will be treated. Can they be offset against the taxable gains of other tax years? And if so, can they be carried back? Carried forward? Or both carried back and carried forward?

The legislator will also have to determine against which rate the capital gains are going to be taxed.

For our VanMoof example we use a system in which capital losses can be carried back to the previous 2 tax years and can indefinitely be carried forward. Furthermore, we arbitrary assume that the capital gains are taxed against a 15% rate. It might be an arbitrary rate, but we didn’t pick it completely at random. We chose it since this rate is in line with the minimum rate that applies to Pillar 2 of the 2 Pillar solution that the OECD has developed for multinationals.

Finally, to be able to make calculations we assume that as per January 1, 2021 value of the combined assets of the brothers amounted to EUR 40 million.

Pre-2021

As stated above as per January 1, 2021 the value of the combined assets of the brothers amounted to EUR 40 million. That is EUR 40 million after taxes paid over the capital gains that took place before 1-1-2021. In the years before 2021, the brothers would therefore have already paid a total of € 7,058,823 in tax. ((€40,000,000 x 100/85) -/- €40,000,000 = €7,058,823)

2021

According to Quote as per 12-31-2021 the value of the combined assets of the brothers amounted to EUR 140 million. For the year 2021, the brothers would therefore owe tax over an unrealized capital gain of EUR 100 million (140 million euros -/- 40 million euros). The tax due for the year 2021 would therefore amount to EUR 15 million. (€100,000,000 x 15% = €15,000,000).

As per 12-31-2021 the total amount of capital gains taxes paid by the brothers would have amounted to € 22.058.823 (€ 7,058,823 + € 15,000,000).

2022

Before we can start with the calculation 2022 we have to calculate the value of the combined assets as per 1-1-2022. The value of these assets as per the end of 2021 amounted to EUR 140 million. However, since over 2021 an amount of EUR 15 million of capital gains tax had to be paid the value of the combined assets as per 1-1-2022 amounts to EUR 125 million. Therefor the value of the combined assets as per 1-1-2022 amount to EUR 125 million (140 million -/- 15 million).

Since the magazine Quote assumed that the value of the combined assets of the brothers did not change during the year 2022 we will do the same. Therefore, the value of the combined assets as per 12-31-2022 still amounts to EUR 125 million.

2023

As per 1-1-2023 the value of the combined assets amounts to EUR 125 million. After the bankruptcy of July 2023 the value of the combined assets amounts to nil. Consequently, unless something changes during the last months of the year the capital loss for the year 2023 would amount EUR 125 million (EUR 0 -/- EUR 125 million).

This loss can be carried back to the years 2021 and 2022. For as far as the capital loss from 2023 exceeds the taxable capital gains from the tax years 2021 and 2022 the remainder can be carried forward to 2024 and later years.

In our example, therefore, only a capital loss of EUR 100 million can be set off against the taxable capital gain from 2021. The brothers would therefore receive a refund of the EUR 15 million of capital gains tax that was paid for 2021. In addition, an amount of EUR 25 million of capital losses remain that could be offset against taxable capital gains from the years 2024 and onwards.

2024

As for 2022, for 2024 the value of the combined assets as per the beginning of the year has to be adjusted for the EUR 15 million that will be refunded because of the tax loss for the year 2023. Otherwise this EUR 15 million might be taken into account as a taxable capital gain in 2024.

What would it mean for the brothers?

For the positions of the brothers it would make a big difference how they would have financed the tax payment owed. Would they have sold shares in VanMoof to pay the tax? Or would they have taken out loans from one or more banks to finance these payments?

If they would have sold shares in VanMoof this first would mean that they actually would have realized part of the capital gains. It would secondly mean that their interest in VanMoof would have diluted. And thirdly it would mean that soon the brothers could expect an amount of EUR 15 million to be remitted to their bank account.

However, if the brothers would have wanted to avoid that their interest VanMoof would dilute and had been able to obtain loans from the banks it would mean that the brothers would be left with a loan payable of just over EUR 7 million. This/these loan(s) was/were obtained to pay the taxes that would have been due over the capital gains from the years 2020 and earlier.

Method 3 – A wealth tax

Under this method it are not the taxable gains that are being taxed, whether realized or unrealized, but is the fair market value of the assets minus the fair market value of his liabilities (Hereafter: the wealth) that form the tax base.

In our opinion the first question that arises is which wealth should form the tax base. Three options come to our mind:

- the wealth of the first day of the tax year (in the Netherlands that would be January 1);

- the wealth of the last day of the tax year (in the Netherlands that would be December 31); or

- the average of the wealth on both of the aforementioned days.

Furthermore, one can discuss whether the entire wealth should be taxed, or whether a threshold, a discount percentage or a combination of the both should be applied. If a threshold is applied, the taxpayer will only be taxed on that part of his wealth that exceeds the threshold. If a discount percentage is applied, the tax is calculated on the remaining percentage of the taxpayer's wealth. For example, if the discount percentage is 10%, the tax due is calculated over 90% of the taxpayer's wealth. In the case of a combination of the two, tax is only calculated over a percentage of the wealth by which that wealth exceeds the threshold.

Lastly, the legislator will have to determine which tax rate applies.

First let us start by immediately admitting that all our choices are arbitrary again. In this example we assume that the tax base is formed by the wealth as per the first day of each tax year (in this case January 1). Furthermore, assume that a threshold of EUR 10 million applies and that the applying wealth tax rate is 1,5%. This would result in the following amounts of tax being due over the years 2021, 2022 and 2023.

2021

The wealth as per January 1, 2021 amount to EUR 40 million. The tax base therefore amounts to EUR 30 million. Consequently the wealth tax due over the year 2021 amounts to EUR 450,000.

2022

The wealth as per January 1, 2022 has to be adjusted for the wealth tax that was due over 2021. Therefore the wealth as per January 1, 2022 amounts to EUR 139,55 million (EUR 140 million -/- EUR 450.000). The tax base therefore amounts to EUR 129,55 million. Consequently the wealth tax due over the year 2022 amounts to EUR 1,943,250.

2023

The wealth as per January 1, 2023 has to be adjusted again for the wealth tax that was due over 2022. Therefore the wealth as per January 1, 2023 amounts to EUR 137,606,750 million (EUR 139,550,000 million -/- EUR 1,943,250). The tax base therefore amounts to EUR 127,606,750 million. Consequently, the wealth tax due over the year 2023 amounts to EUR 1,914,101.

Total amount of wealth taxes due over 2021, 2022 and 2023

The total amount of wealth taxes due over the tax years 2021, 2022 and 2023 amounts to EUR 4,307,351. (EUR 450,000 + EUR 1,943,250 + EUR 1,914,101)

If the wealth of the last day of the tax year is used as a tax base the brothers would in total have to pay EUR 3,870,750. (EUR 1,950,000 + EUR 1,920,750 + EUR 0) of wealth taxes for the years 2021, 2022 and 2023.

If the average wealth for the year is used as a tax base the brothers would in total have to pay EUR 3,992,105 (EUR 1,200,000 + EUR 1,921,009 + EUR 871,096) of wealth taxes for the years 2021, 2022 and 2023.

Remarks ITP

Above, we have discussed 3 possible systems of taxation for high-net-worth individuals on the basis of a numerical example. As stated, the VanMoof case might be an extreme one, the joining of the club of high-net-worth individuals is shortly thereafter followed by being back to square one. But perhaps exactly that is precisely why the VanMoof case is an ideal case to highlight a few points.

The importance of a good determination of the initial value of the assets upon introduction

For all 3 methods, the fair market value of the assets minus the liabilities of a taxpayer will have to be determined on the date on which the tax takes effect. With the first 2 methods described above, the taxpayers will benefit if the initial value of the assets is set as high as possible. As a result of which, later capital gains would be lower. For proper compartmentalization, it is therefore important that the value of the assets is determined as precisely as possible on the date on which a new tax would come into effect.

In method 3 (a wealth tax) the taxpayer would benefit if the initial value of the assets is set as low as possible since this would result in the taxpayer having to pay less tax in the first tax year.

In case of the super-rich it will be relatively easy to value the majority of their assets, because most of the time these assets consist out of shares that are listed on a stock exchange. For another group of high-net-worth individuals it will be more difficult to value all their assets. In this respect one could for example think of people who participate in an unlisted family business. Or entrepreneurs who have started a successful company that is growing strongly but that has not yet had to raise external financing and that has not yet been listed on the stock exchange. After all, determining the value of such interests is more complicated than simply netting the assets and liabilities that are on the company's balance sheet. In such situations, each year there can be lots of discussion regarding the valuation of these interests.

Methods 1 & 2

Methods 1 and 2 described above are income taxes that either tax realized income stemming from assets and capital gains/capital losses realized/incurred in a tax year (under method 1) or additionally also unrealized capital gains/capital losses (under method 1).

Indefinite deferral of taxation

Under method 1 the brothers did not pay any taxes, nor were any taxes returned to them. And in the VanMoof case this seems fair since moneywise in 2023 the brothers are back where they started in 2009. The case however also shows the weakness of this method for taxing the high-net-worth individuals. They can arrange that they get the funds they need for their private needs while postponing the realization of the capital gains over a vast majority of their assets. Certainly in countries that, like the Netherlands, have share transfer schemes and/or business succession schemes, the realization of such capital gains and therewith the taxation thereof can be deferred almost indefinitely.

Therefore, the method under which only realized capital gains are taxed does not seem to be the preferred answer to the call to tax high-net-worth individuals.

Method 2

Under method 2 the annual change in value of the fair market value minus the liabilities is taxed. Therefore, both realized and unrealized capital gains are being taxed. Unrealized capital gains and losses only exist on paper. Therefore, the valuation of assets and liabilities plays a big role in this method of taxation. Consequently, the taxpayer and the tax authorities can regularly disagree on the valuation of the assets and liabilities.

Another issue is that unrealized capital gains can disappear just as quick as they have arisen. This means that it is very well possible that an unrealized capital gain in a certain year is followed by an unrealized capital loss in another year. In the VanMoof case an unrealized capital gain of EUR 100 million arose in 2021 which was then followed by a realized capital loss of EUR 140 million in 2023.

It seems logical that if authorities decide to implement a tax that taxes unrealized capital gains that then also the possibility is created that capital losses (both realized and unrealized) can be set off against capital gains from another year. Because if this possibility is not created the risks exists that the same capital gains are taxed multiple times.

However, one of our main with this method is that the risk exists that it turns out to be a system in which significant amounts of money are needlessly gong round in circles. In our VanMoof case this would already happen with small numbers. In 2021 the brothers would have to pay EUR 15 million of taxes under this method. Whereas 2 years later they would receive a repayment of EUR 15 million taxes.

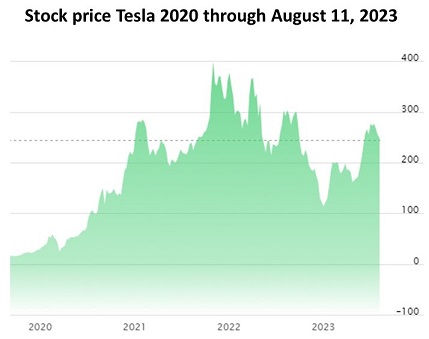

Now one could think that the VanMoof case is extreme, but is it? So, let’s have a look at Elon Musk’s wealth. In November 2021 Forbes estimated his wealth to amount to a staggering USD 320 billion. Then according to sources Musk’s wealth supposedly de decreased with USD 182 billion dollar to only USD 138 billion in January 2023. If Musk would be able to offset this capital loss against previous capital gains this means that Musk would get a repayment of approximately USD 27.3 billion. Then on July 31, 2023 the wealth of Elon Musk was estimated to approximately USD 240 billion. So, in the first seven months of 2023 Musk’s unrealized capital gains amounted to approximately USD 102 billion. Consequently, Elon Musk would then owe approximately USD 15.3 billion over these unrealized capital gains.

Another concern that might arise when unrealized gains are taxed is that taxpayers have to pay taxes even when the income did not lead to a cashflow. Consequently, the taxpayer will have to find funds to pay the taxes that he or she has to pay. In our VanMoof example this situation arose with the financing round that took place in 2021. In certain situations this might even lead to entrepreneurs choosing for a slower growth or a slower development of innovative products since the entrepreneur does not want his interest to dilute any further.

We hope that the aforementioned shows that governments have to carefully consider how such a tax should designed to avoid adverse consequences.

A wealth tax

A first remark that can be made with respect to this method is that under this system a taxpayer owes tax over his wealth and not over his income or capital gains, which means that even in tax years in which the wealth of a taxpayer decreases significantly he will owe this tax. In our example above, the brothers' wealth even falls to zero in 2023, and still they might owe tax for that year.

On the other hand, in a tax year in which a taxpayer’s wealth increases significantly, the taxpayer will only have to pay a very limited amount of tax. In our example, the assets of the brothers increased by EUR 100 million in 2021, yet the taxpayers only have to pay between EUR 450,000 and EUR 1,950,000 of wealth tax in that year.

Again, the amount of tax that is due is not necessarily caused by sources that include a cashflow. So also under this method it is possible that a taxpayer will have to arrange funding to pay the taxes due. However, this time the amounts of tax due are relatively small.

Another point to be taken into consideration is that once again every year a valuation of the assets must be made about which taxpayers and the tax inspector again may differ in opinion.

In addition, the buttons in the taxpayers’ heads might have to be switched. In many countries taxpayers are used to systems in which income is taxed and expenses are deductible.

Final conclusion

In our view if countries are considering introducing a tax specifically focusing on high-net-worth individuals in order to narrow the wealth gap between the rich and the poor. Based on the analysis we have made above, we feel that a wealth tax seems to be the easiest system to implement with the least potential adverse consequences.

Copyright – internationaltaxplaza.info

Follow International Tax Plaza on Twitter (@IntTaxPlaza)