On October 6, 2023 the Dutch Government sent its appreciation of this proposal to the Dutch parliament. In its appreciation the Dutch Government states that supports the goals the European Commission wants to achieve with the aim to strengthening the internal market and the competitive position of the EU as a whole. A harmonized corporate income tax system within the EU can lead to a reduction of administrative burdens for companies that are active in multiple EU Member State. It furthermore could also reduce the risk of double taxation resulting from disputes between Member States about the tax base. A harmonized corporate income taxsystem also means that companies have more certainty about the rules they must apply within the EU, which according to the Dutch Government increases the attractiveness of (further) doing business in the EU.

The Dutch Government potentially sees the proposed harmonized tax base, which is based on (commercial) accounting standards, as a good step towards achieving the aforementioned aims and a step in simplifying tax legislation. The proposal builds on the Pillar 2 directive, which is based on a similar basis.

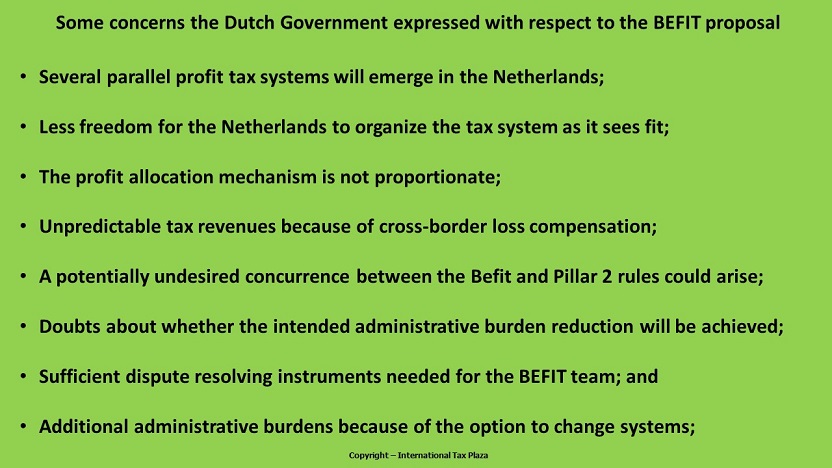

However, the Dutch Government isn’t solely positive about the proposal, in its letter to the parliament it also expresses some concerns with respect to the BEFIT proposal. Below we will highlight some of the concerns the Dutch Government expressed in his letter.

Several parallel profit tax systems will emerge in the Netherlands

The adjustments made to the annual result from the accepted accounting standard do differ from the adjustments made under the Pillar 2 guideline. The more the differences in this respect between the proposal and the Pillar 2 Directive can be reduced, the more the proposal will contribute to reducing administrative burdens and simplifying tax legislation for both companies and tax authorities. In the government's estimation, a truly harmonized system in which the differences in the basis of Member States and with the Pillar 2 directive are kept to a minimum would be most successful in this regard. In the letter it is stated that the Dutch government will draw attention to this during the negotiations.

On the other hand, the proposed method for determining the tax base means an overhaul of the current Dutch tax system, which has its own tax base determination that is laid down in the Dutch corporate income tax Act, as a result of which several parallel profit tax systems will emerge. These regard the profit determination for Dutch individual income tax purposes, for Dutch corporate income tax purposes, for the levying of the additional tax as a result of the Pillar 2 Directive and for the levying as a result of the current proposal for a BEFIT directive. This is a large accumulation of legislation, which makes the introduction of BEFIT at this moment very challenging.

The Dutch Government therefore prefers to have both the tax authorities and the practice first gain experience with the Pillar 2 system and to see whether these experiences can be used in setting up a harmonized basis.

Less freedom for the Netherlands to organize the tax system as it sees fit

Inherent in a harmonized basis is that the possibilities for the Netherlands to organize the tax system for some of the companies that are active in the Netherlands as it sees fit are limited. Given the requirement of unanimity in decision-making in the Council, it may also become more difficult to respond to future developments with changes to the tax base.

The profit allocation mechanism is not proportionate

In its current form, the Dutch government does not consider the proposed method of attributing profits to EU Member States to be proportionate. The government would have liked the proposal to have been limited to a truly harmonized tax base.

Unpredictable tax revenues because of cross-border loss compensation

A disadvantage is that the possibility to offset losses across borders and the way in which the transitional allocation method works can lead to an unpredictable tax base in the Netherlands which also depends on losses abroad. Consequently the consequences of the aggregation and proposed profit allocation for Dutch tax revenues are difficult to estimate. The Dutch Government states that it will draw attention to this during the negotiations.

A potentially undesired concurrence between the Befit and Pillar 2 rules could arise

Furthermore, as a result of the situation as described above, an undesirable concurrence could arise between the application of the rules following from Pillar 2 and the rules from the BEFIT Directive. Based on the Pillar 2 rules, additional tax may be charged based on the commercial results of that financial year. Because the profit to be allocated under BEFIT is based on results from the previous 3 years, it is conceivable that an undesirable difference will arise. For example, when a loss has been realized in the previous three years while a commercial profit is realized in the current year. This could mean that under BEFIT a loss is realized in the current financial year, despite the fact that for commercial purposes a profit is realized. Therefore no (BEFIT) tax is due. However, under the Pillar 2 rules additional taxes will be charged in the current year. This becomes extra complex due to the possibility of offsetting losses against profits that are realized in other Member States. According to the Dutch Government further study is needed to analyze how this potentially undesirable concurrence can be prevented.

Doubts about whether the intended administrative burden reduction will be achieved

Because cross-border loss settlement is possible through aggregation and because the BEFIT tax base must be allocated to Member States, the Dutch government is concerned about whether the intended administrative burden reduction will be achieved. In the current Dutch corporate income tax system, a taxpayer files an annual corporate income tax return. In the proposal, BEFIT entities first make a preliminary calculation of the tax base. After this, a BEFIT base is drawn up and allocated to the entities, this is done in a BEFIT information return which is examined by a BEFIT team from the tax authorities. After said profit allocation, Member States may draw up their own rules that apply to this tax base. The Dutch government states that during the negotiations it will indicate that it doubts whether the proposed reduction of the administrative burden outweighs the fact that Member States will still have the option to continue to apply their own rules.

The Dutch Government is positive about the possibility the directive offers Member States to maintain a set of instruments to make one's own policy choices (such as specific interest deduction limitations, a fiscal unity or an innovation box) or to anticipate national developments. At the same time, an unlimited possibility for Member States to apply their own rules appears to be counterproductive to the reduction of administrative burdens and the intended simplification and harmonization.

Sufficient dispute resolving instruments needed for the BEFIT team

The government considers it important that the BEFIT team is provided with sufficient instruments to resolve any disputes between tax authorities regarding the tax base. Such a mechanism is important because it allows the EU to offer more certainty to businesses as a result of which it becomes a more attractive trading bloc to invest in.

Additional administrative burdens because of the option to change systems

The BEFIT proposal offers companies with a turnover of less than € 750 million the opportunity to opt for the BEFIT system. If so, the company will be bound to use the system for a 5-year period. After these 5 years the company can choose to continue using the BEFIT system for another 5-year period or to return to the local tax system. The choice to change systems means that companies switch from valuation on commercial book values to a valuation on tax book values, and vice versa. The Dutch Government emphasizes that this leads to additional administrative burdens for both businesses and tax authorities. To limit this burden, the Dutch Government prefers to extend the period. In the letter its stated that during the negotiations the Dutch Government will raise this point.

From the proposal for a BEFIT Directive it follows that it must be possible to adjust a tax assessment without a time limit being applicable if a tax authority or court in another Member State makes a ruling that (indirectly) also affects the Dutch tax base. This can happen when the provisional base calculation is changed in such a way that it significantly affects the profit allocation. As a result, the profit allocation to the Netherlands can change in such a way that the Dutch tax assessment must be adjusted. The Dutch government considers it important to note that in practice this provision should not result in a Dutch tax assessment of a member of a BEFIT group not being irrevocably determined.

The full text of the appreciation as sent by the Dutch Government to the Dutch Parliament can be found here. (Only available in the Dutch language)

Copyright – internationaltaxplaza.info

Follow International Tax Plaza on Twitter (@IntTaxPlaza)