Introductory remarks

If under step 1 you have established that for a certain fiscal year the EU Directive (or the OECD Model Rules) applies to the group, this means that one or more top-up tax information returns will have to be filed. The filing obligations are laid down in Article 42 of the proposed Directive.

Chapter VIII contains administrative provisions, including filing obligations.

The Directive obliges a constituent entity of an MNE group located in a Member State to file a top-up tax information return, unless the return is filed by the MNE group in another jurisdiction, with which the Member State has an exchange of information agreement.

The required return may be filed either by the constituent entity or by another designated local entity located in the Member State on its behalf.

If the constituent entity is relieved from filing the return it must nevertheless notify its tax administration of the identity and location of the constituent entity filing the return for the MNE group.

The returns must be filed within 15 months after the end of the fiscal year to which they relate to.

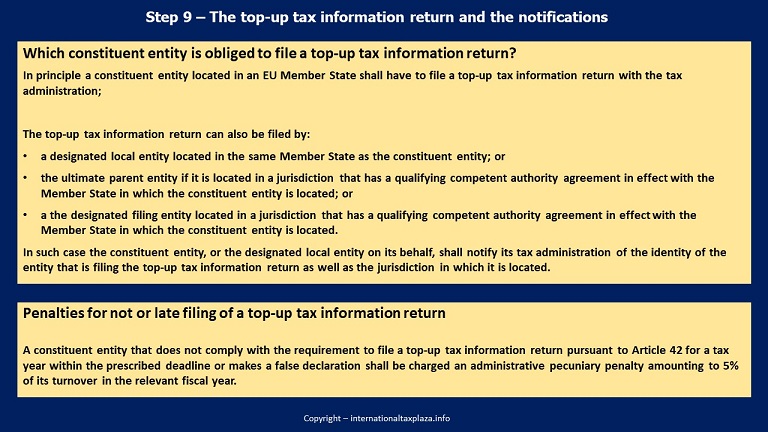

Which constituent entity is obliged to file a top-up tax information return?

In principle a constituent entity located in an EU Member State shall have to file a top-up tax information return with the tax administration of the Member State of which it is a resident. However, such return may also be filed by a designated local entity on behalf of the constituent entity.

By way of derogation of the aforementioned a constituent entity shall not be required to file a top-up tax information return with its tax administration if such a return has been filed, in accordance with the requirements set out in Article 42, Paragraph 5 (See below for more information), by:

(a) the ultimate parent entity located in a jurisdiction that has a qualifying competent authority agreement in effect with the Member State in which the constituent entity is located; or

(b) the designated filing entity located in a jurisdiction that has a qualifying competent authority agreement in effect with the Member State in which the constituent entity is located.

In such case the constituent entity, or the designated local entity on its behalf, shall notify its tax administration of the identity of the entity that is filing the top-up tax information return as well as the jurisdiction in which it is located.

Information to be included in the top-up tax information return

Article 42, Paragraph 5 of the proposed Directive arranges that the top-up tax information return shall include the following information with respect to the MNE group:

(a) identification of the constituent entities, including their tax identification numbers, if any, the jurisdiction in which they are located and their status under the rules of this Directive;

(b) information on the overall corporate structure of the MNE group, including the controlling interests in the constituent entities held by other constituent entities;

(c) the information that is necessary in order to compute:

(i) the effective tax rate for each jurisdiction and the top-up tax of each constituent entity;

(ii) the top-up tax of a member of a joint-venture group;

(iii) the allocation of top-up tax under the income inclusion rule and the UTPR top-up tax amount to each jurisdiction; and

(d) a record of the elections made in accordance with the relevant provisions of this Directive.

By way of derogation of the aforementioned, where a constituent entity is located in a Member State with an ultimate parent entity located in a third country jurisdiction that applies rules which have been assessed as equivalent to the rules of this Directive pursuant to Article 51 (“Assessment of equivalence”), the constituent entity or the designated local entity shall file a top-up tax information return containing the following information:

(a) all information that is necessary for the application of Article 7 (“Partially-owned parent entity in the Union”), including:

(i) identification of all the constituent entities in which a partially-owned parent entity located in a Member State holds, directly or indirectly, an ownership interest at any time during the fiscal year and the structure of such ownership interests;

(ii) all information that is necessary to compute the effective tax rate of the jurisdictions in which a partially-owned parent entity located in a Member State holds constituent entities identified under (i) and the top-up tax due; and

(iii) all information that is relevant for that purpose in accordance with Articles 8, 9 or 10 of the proposed Directive (See Step 8);

(b) all information that is necessary for the application of Article 12 of the proposed Directive (See Step 8), including:

(i) identification of all the constituent entities located in the ultimate parent entity jurisdiction and the structure of such ownership interests;

(ii) all information that is necessary in order to compute the effective tax rate of the ultimate parent entity’s jurisdiction and of the top-up tax due; and

(iii) all information necessary for the allocation of such top-up tax based on the UTPR allocation formula set out in Article 13 of the proposed Directive (See Step 8).

Filing deadline

The top-up tax information return and any relevant notifications shall be filed with the tax administration of the Member State in which the constituent entity is located no later than 15 months after the last day of the fiscal year.

Notwithstanding the aforementioned, the top-up tax information return and the notifications shall be filed with the tax administration of the Member States no later than 18 months after the last day of the fiscal year that is the transitional year.

Penalties for not or late filing of a top-up tax information return

A constituent entity that does not comply with the requirement to file a top-up tax information return pursuant to Article 42 for a tax year within the prescribed deadline or makes a false declaration shall be charged an administrative pecuniary penalty amounting to 5% of its turnover in the relevant fiscal year. This penalty shall only apply after the constituent entity has not provided the top-up tax information return pursuant to Article 42 of the proposed Directive, following any reminder issued, within a period of 6 months.

Format in which a top-up tax information return has to be filed

Unfortunately the proposed Directive does not mention anything regarding the format in which the top-up tax information return and the notifications have to be filed. However, it seems logical that like the county-by-country reports the top-up tax information return will have to be filed in an XML format.

Copyright – internationaltaxplaza.info

Follow International Tax Plaza on Twitter