Introductory remarks

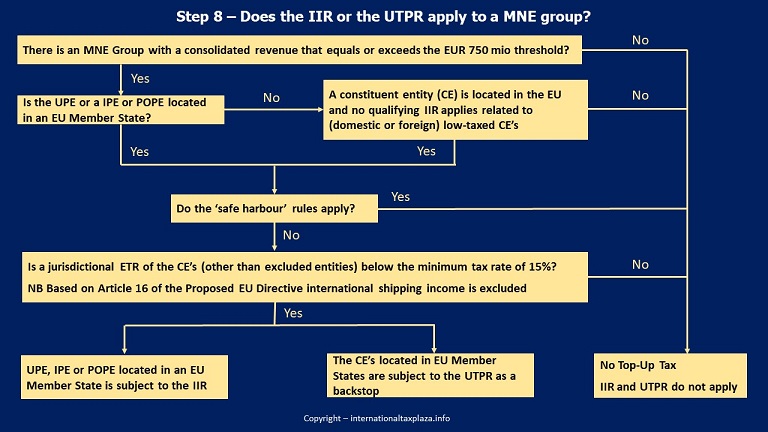

In cases where the Effective Tax Rate (ETR) of a (MNE) group for a fiscal year falls below the minimum tax rate in a given jurisdiction, the top-up tax (as computed under Step 7) should be allocated to the entities in the (MNE) group that are liable to pay the tax in accordance with the application of the Income Inclusion Rule (IIR) and the Under Taxed Payment Rule (UTPR).

Article 49 of the proposed Directive arranges that in cases where the ETR of a large-scale domestic group falls below the minimum tax rate, the Ultimate Parent Entity (UPE) at the top of the large-scale domestic group should apply the IIR in respect of its low-taxed constituent entities.

Chapter II sets out the rules for the application of the IIR and the UTPR by Member States.

The Income Inclusion Rule (IIR)

Under the rules of the proposed Directive, the IIR applies in the following situations:

(1) UPE in the EU

If the UPE is located in the EU, it will be subject to the top-up tax in respect of its low-taxed constituent entities in the same and other EU Member States as well as in third country jurisdictions.

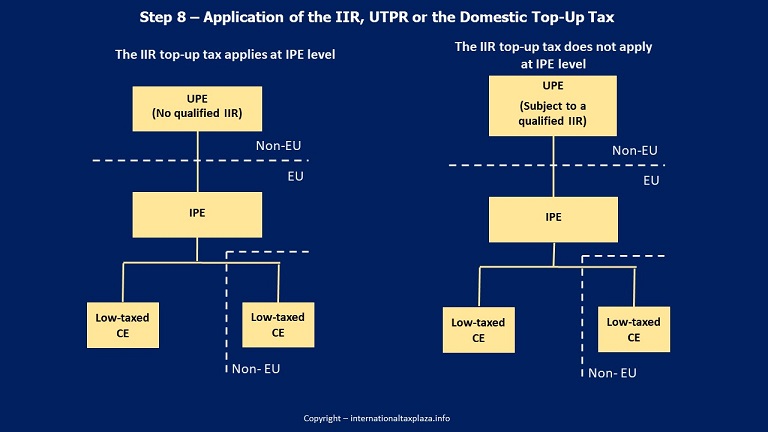

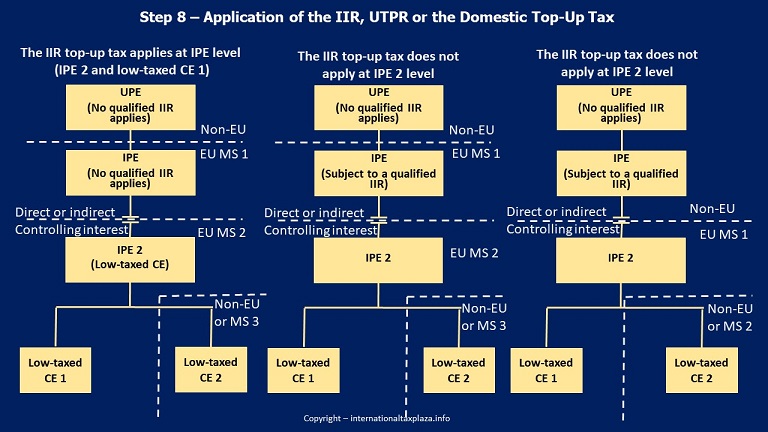

(2) IPE/POPE in the EU with UPE outside the EU;

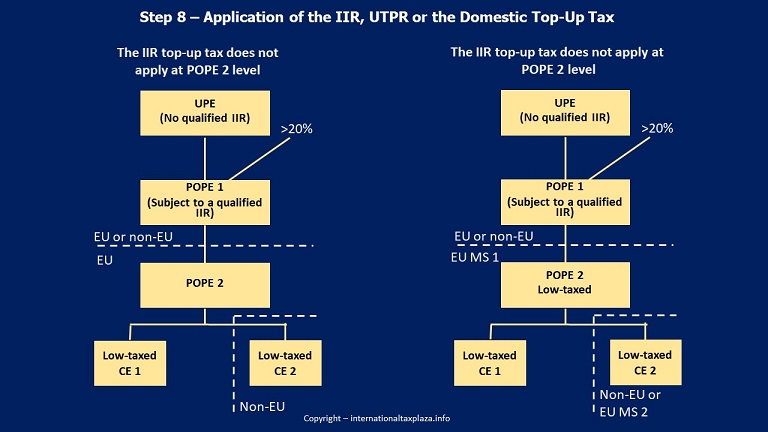

If there is no UPE in the EU, the low-taxed constituent entities of the MNE group in the EU would effectively be taken into account by the third-country UPE of the Group if it applies the IIR. However, if there is at least one (Partially-Owned Parent Entity) POPE or one (Intermediate Parent Entity) IPE (if the jurisdiction where the UPE is located does not apply an IIR) in the EU, then the IPE/POPE will be subject to the top-up tax in respect of their low-taxed directly or indirectly owned constituent entities in the EU and third country jurisdictions.

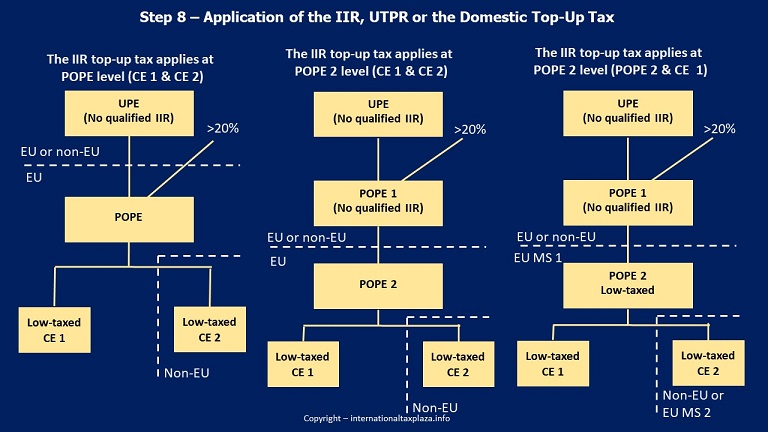

(3) POPE in the EU with UPE in the EU

Although a UPE located in the EU is normally charged the top-up tax in respect of its low-taxed constituent entities (see 1 above), there is also a possibility that the primary taxing right lies with the Member State of a POPE. In these cases, one has to follow a ‘bottom-up’ method in identifying the POPE that is liable to tax. One will have to start from the lowest-tier wholly-owned constituent entities and move up to the first POPE, which will be liable to top-up tax under the IIR in respect of its low-taxed constituent entities. The other POPEs up to the UPE will also be subject to the IIR but with a right to receive a credit for top-up tax due by another POPE lower in the chain.

The proposed Directive determines how much of a constituent entity’s top-up tax a Parent Entity is entitled to collect through the IIR. This allocable share is, in general, based on the proportion of the parent entity’s interest in the income of the low-taxed constituent entity.

Furthermore, in the case of large-scale domestic groups, the ultimate parent entity located in a Member State is subject to the IIR top-up tax in respect of its low-taxed constituent entities.

Domestic Top-Up Tax

In order to preserve sovereignty of Member States, the Directive provides that a Member State can opt to apply the top-up tax domestically to constituent entities located in its territory (Domestic Top-up Tax). This election allows that the top-up tax is charged and collected in a jurisdiction in which low-level of taxation occurred, instead of collecting all the additional tax at the level of the UPE. When this election is exercised, the parent entity applying the IIR will be obliged to give credit for the qualified domestic top-up tax when calculating the top-up tax in respect of the relevant jurisdiction.

The Undertaxed Payments Rule (UTPR)

The Directive provides that in circumstances where the UPE is located outside the EU in a jurisdiction that does not apply a qualifying IIR, all its constituent entities in jurisdictions with an appropriate UTPR framework will be subject to the UTPR. In this circumstance, constituent entities of such an MNE group that are located in a Member State will be apportioned, and will have to pay in their Member State, a share of the top-up tax linked to the low-taxed subsidiaries of the MNE group.

The Directive provides that the UTPR will also apply to situations where the jurisdiction of the UPE operates a qualifying IIR but the UPE, together with its subsidiaries located in that same jurisdiction, are low-taxed. The top-up tax corresponding to the low-taxed UPE and its domestic subsidiaries will be charged through the UTPR to all the eligible entities across the MNE Group, including to entities that are located in a Member State. This should only happen when the UPE is located outside the EU because an EU-located UPE either applies the IIR principles to itself and to its domestic subsidiaries or acknowledges that top-up was locally charged via the Domestic Top-up tax. Therefore, there should be no top-up tax allocated under the UTPR when the UPE is located in the EU.

In line with the OECD Model Rules, the calculation and allocation of the UTPR top-up tax in the Directive is based on two factors: number of employees and carrying value of tangible assets.

Exclusion from the IIR and UTPR of MNE groups in the initial phase of their international activity

The top-up tax due by an ultimate parent entity located in a Member State in accordance with Article 5, Paragraph 2 of the proposed Directive shall be reduced to zero in the first five fiscal years of the initial phase of the international activity of the MNE group notwithstanding the requirements laid down in Chapter V of the Directive. The period of five fiscal years referred shall start from the beginning of the fiscal year in which the MNE group falls within the scope of this Directive for the first time. For MNE groups that are within the scope of this Directive when it enters into force, the five-year period shall start on January 1, 2023. The ultimate parent entity shall inform the tax administration of the Member State in which it is located of the start of the initial phase of its international activity.

Where the ultimate parent entity of an MNE group is located in a third country jurisdiction, the top-up tax due by a constituent entity located in a Member State in accordance with Article 13, Paragraph 2 of the Directive shall be reduced to zero in the first five fiscal years of the initial phase of the international activity of that MNE group notwithstanding the requirements laid down in Chapter V of the Directive. The period of five fiscal years shall start from the beginning of the fiscal year in which the MNE group falls within the scope of this Directive for the first time. For MNE groups that are within the scope of this Directive when it enters into force, the five-year period shall start on January 1, 2024. The ultimate parent entity shall inform the tax administration of the Member State in which it is located of the start of the initial phase of its international activity.

Article 50 of the proposed Directive arranges that the top-up tax due by an ultimate parent entity of a large-scale domestic group shall be reduced to zero in the first five fiscal years, starting from the first day of the fiscal year in which the large-scale domestic group falls within the scope of this Directive for the first time. For large-scale domestic groups that are in scope of this Directive when it enters into force, the five-year period abovementioned shall start on January 1, 2023.

Income Inclusion Rule (IIR)

Article 5 – Ultimate parent entity in the EU

Article 5 of the proposed Directive arranges:

5.1 an ultimate parent entity located in an EU Member State is subject to the top-up tax (the "IIR top-up tax”) in respect of its low-taxed constituent entities located either in another EU Member State or in a third country jurisdiction for the fiscal year.

5.2 that where an UPE located in an EU Member State is a low-taxed constituent entity, it is subject to the IIR top-up tax together with its low-taxed constituent entities located in the same EU Member State for the fiscal year.

Article 6 – Intermediate parent entity in the EU

Article 6, arranges the following with respect to intermediate parent entities that are located in an EU Member State:

6.1 an intermediate parent entity located in an EU Member State and held by an ultimate parent entity that is located in a third country (“non-EU”) jurisdiction is subject to the IIR top-up tax in respect of its low-taxed constituent entities located in another Member State or a third country jurisdiction for the fiscal year; and

6.2 where an intermediate parent entity located in an EU Member State and held by an ultimate parent entity that is located in a third country jurisdiction is a low-taxed constituent entity, it is subject to the IIR top-up tax together with its low-taxed constituent entities located in the same Member State for the fiscal year.

Unless:

· the ultimate parent entity of a group is subject to a qualified income inclusion rule for the fiscal year in the jurisdiction where it is located; or

· another intermediate parent entity located in a Member State, or a third country jurisdiction where it is subject to a qualified income inclusion rule for the fiscal year owns, directly or indirectly, a controlling interest in the intermediate parent entity

Article 7 – Partially-owned parent entity in the EU

Article 7 of the proposed Directive arranges that unless the ownership interests of the partially-owned parent entity are wholly held, directly or indirectly, by another partially-owned parent entity that is located either in a Member State or in a third-country jurisdiction and is subject to a qualified income inclusion rule for the fiscal year:

7.1 a partially-owned parent entity located in a Member State is subject to the IIR top-up tax in respect of its low-taxed constituent entities for the fiscal year; and

7.2 a partially-owned parent entity located in a Member State is a low-taxed constituent entity, it is subject to the IIR top-up tax together with its low-taxed constituent entities located in the same Member State for the fiscal year

Article 8 - Allocation of the top-up tax under the income inclusion rule

A parent entity’s allocable share in the top-up tax with respect to a low-taxed constituent entity shall be the proportion of the parent entity’s interest in the income of the low-taxed constituent entity.

The IIR top-up tax due by a parent entity in respect of a low-taxed constituent entity shall be equal to the top-up tax of the low-taxed constituent entity, as computed in accordance with Step 7c, multiplied by the parent entity’s allocable share in such top-up tax for the fiscal year.

In addition to the amount that is allocated to a parent entity this way, the IIR top-up tax due by a parent entity pursuant to points 5.2, 6.2 and 7.2 mentioned above shall include the full amount of top-up tax computed for that parent entity in accordance with Step 7.

Article 9 - Income inclusion rule offset mechanism

Where an intermediate parent entity located in a Member State holds an ownership interest in a low-taxed constituent entity through another intermediate parent entity located in a Member State or in a third country jurisdiction where it is subject to a qualified income inclusion rule for the fiscal year, the top-up tax due pursuant to point 6.1 mentioned above shall be reduced by an amount equal to the portion of the intermediate parent entity’s allocable share in the top-up tax due by the other intermediate parent entity

Where a parent entity located in a Member State holds an ownership interest in a low-taxed constituent entity through a partially-owned parent entity located in a Member State or in a third country jurisdiction where it is subject to a qualified income inclusion rule for the fiscal year, the top-up tax due pursuant to points 5.1, 6.1 or 7.1 mentioned above shall be reduced by an amount equal to the portion of the parent entity’s allocable share in the top-up tax due by the partially-owned parent entity.

Joint ventures

A parent entity that holds a direct or indirect ownership interest in a joint venture or a joint venture affiliate (together referred to as a joint venture group) shall apply the income inclusion rule with respect to its allocable share of the top-up tax of each member of the joint venture group in accordance with Articles 5 to 9 of the proposed EU Directive.

Multi-parented MNE group

The parent entities of the multi-parented MNE group located in a Member State, including each ultimate parent entity, shall apply the income inclusion rule in accordance with Articles 5 to 9 with respect to their allocable share of the top-up tax of the low-taxed constituent entities.

Qualified domestic top-up tax

Article 10 of the proposed Directive provides EU Member States with the possibility to elect to apply a qualified domestic top-up tax. If a Member State elects to apply such a qualified domestic top-up tax and constituent entities of a MNE Group are located in that Member States, any low-taxed constituent entities of the MNE Group in that Member State shall be subject to that domestic top-up tax for the fiscal year.

Where a parent entity of an MNE Group is located in an EU Member State, and its directly or indirectly held low-taxed constituent entities located in another Member State or in a third country jurisdiction are subject to a qualified domestic top-up tax for the fiscal year in that jurisdiction, the amount of any top-up tax computed in accordance with Step 7 due by the parent entity pursuant to Articles 5, 6 and 7 (See above) shall be reduced, up to zero, by the amount of top-up tax due by those constituent entities.

Where the amount of qualified domestic top-up tax taken into consideration in the computation of the jurisdictional top-up tax in accordance with Article 26 of the proposed Directive (See Step 7) for a fiscal year has not been fully paid within the three following fiscal years, the amount of domestic top-up tax that was not paid shall be added to the jurisdictional top-up tax computed in Step 7b.

UTPR

Application of a UTPR across the MNE group

The Undertaxed Payments Rule (UTPR) only comes into play when:

a. the ultimate parent entity (UPE) of a MNE group is located in a third country/non-EU jurisdiction that does not apply a Qualified Income Inclusion Rule; or

b. the ultimate parent entity of an MNE group is located in a low-tax jurisdiction

UPE located in a third country jurisdiction that does not apply a Qualified IIR

As mentioned above the Undertaxed Payments Rule (UTPR) comes into play when the ultimate parent entity (UPE) of a MNE group is located in a third country (non-EU) jurisdiction that does not apply a Qualified Income Inclusion Rule. In such situation EU Member States shall ensure that the constituent entities located in the EU are subject, in the Member State in which they are located, to a top-up tax for the fiscal year (a ‘UTPR top-up tax’) for the amount allocated to that EU Member State in accordance with Article 13 of the proposed EU Directive.

It should be noted that constituent entities that are investment entities and pension funds shall not be subject to the UTPR top-up tax. (Remark AJT: The text of Article 11 of the proposed Directive seems to indicate that this exclusion does not apply to so-called pension services entities)

UPE located in a low-tax jurisdiction

As stated above the UTPR also comes into play when the ultimate parent entity of an MNE group is located in a low-tax jurisdiction. It should be noted that this low-tax jurisdiction can be an EU Member State or a third country (non-EU) jurisdiction. In such situation EU Member States shall ensure that the constituent entities of the MNE Group located in an EU Member State are subject to the UTPR top-up tax for the fiscal year and for the amount allocated to that Member State in accordance with Article 13 of the proposed Directive in respect of the low-taxed constituent entities that are located in the jurisdiction of the ultimate parent entity, irrespective of whether that jurisdiction applies a Qualified Income Inclusion Rule.

Again the proposed Directive arranges that constituent entities that are investment entities and pension funds shall not be subject to the UTPR top-up tax.

Computation and allocation of the UTPR top-up tax amount

The provisions that arrange how the amount of Undertaxed Payments Rule top-up tax is to be computed and to be allocated are laid down in Article 13 of the proposed EU Directive.

The total UTPR top-up tax for a fiscal year shall be the sum of the top-up tax of all the low-taxed constituent entities of the MNE group for that fiscal year, as determined in accordance with Article 26 of the proposed Directive (See Step 7), subject to the adjustments set out in paragraphs 3 (Step 7b) and 4 (Remark1 made under Step 7b) of said Article.

Paragraph 3 arranges that the UTPR top-up tax of a low-taxed constituent entity meant in the previous paragraph shall be equal to zero however where, for the fiscal year, such low-taxed constituent entity is wholly held directly by the ultimate parent entity, or indirectly through one or more parent entities, which are located either:

(a) in a Member State; or

(b) in a third country jurisdiction where it is required to apply a Qualified Income Inclusion Rule in respect of its low-taxed constituent entity for the fiscal year.

Subsequently Paragraph 4 arranges that where paragraph 3 above does not apply, the UTPR top-up tax of a low-taxed constituent entity shall be reduced by the amount of top-up tax allocated to a parent entity located in a third country jurisdiction which is required to apply a Qualified Income Inclusion Rule in respect of the constituent entity.

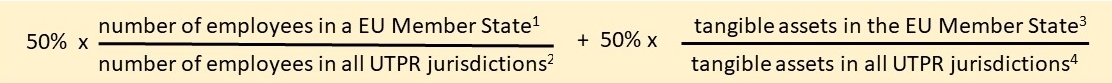

Paragraph 5 arranges that a Member State’s UTPR percentage shall be computed, for each fiscal year and for each MNE group, according to the following formula:

1 the number of employees in the Member State is the total number of employees of all the constituent entities of the MNE group located in that Member State. The number of employees shall be the number of employees on a full-time equivalent basis of all constituent entities located in the relevant jurisdiction, including independent contractors provided that they participate in the ordinary operating activities of the constituent entity.

2 the number of employees in all jurisdictions with a qualified UTPR is the total number of employees of all the constituent entities of the MNE group located in a jurisdiction that has a qualified UTPR in force for the fiscal year.

3 the total value of tangible assets in the Member State is the sum of the net book value of tangible assets of all the constituent entities of the MNE group located in that Member State. The tangible assets shall include the tangible assets of all constituent entities located in the relevant jurisdiction but shall not include cash or cash equivalent, intangible or financial assets.

4 the total value of tangible assets in all jurisdictions with a qualified UTPR is the sum of the net book value of tangible assets of all the constituent entities of the MNE group located in a jurisdiction that has a qualified UTPR in force for the fiscal year.

With respect to permanent establishments it should be noted that a permanent establishment shall be allocated the employees whose payroll costs are included, and tangible assets that are included, in its separate financial accounts pursuant to Article 17, Paragraph 1 adjusted in accordance with Article 17, Paragraph 2.

Furthermore it should be noted that the number of employees and the net book value of tangible assets held by an investment entity shall be excluded from the elements of the formula.

The number of employees and the net book value of tangible assets of a flow-through entity shall be excluded from the elements of the formula, unless they are allocated to a permanent establishment or, in the absence of a permanent establishment, to the constituent entities that are located in the jurisdiction where the flow-through entity was created.

By way of derogation from Paragraph 5, an EU Member State’s UTPR percentage for an MNE group shall be deemed to be zero for a fiscal year where that Member State has not collected from the relevant constituent entities the UTPR top-up tax amount which it was allocated in a prior fiscal year.

The number of employees and the net book value of tangible assets of the constituent entities of an MNE group which is located in a Member State with a UTPR percentage of zero for a fiscal year shall be excluded from the elements of the formula for allocating the total UTPR top-up tax to the MNE group for that fiscal year.

Joint ventures

The top-up tax due by the joint venture group shall be reduced by each parent entity’s allocable share of the top-up tax of each member of the joint venture group that is brought into charge under Article 34, paragraph 2 and 3. Any remaining amount of top-up tax shall be added to the total UTPR top-up tax amount pursuant to Article 13.

Multi-parented MNE groups

The constituent entities of the multi-parented MNE group that are located in a Member State shall apply the UTPR in accordance with Articles 11, 12 and 13, taking into account the top-up tax of each low-taxed constituent entity that is a member of the multi-parented MNE group.

Copyright – internationaltaxplaza.info

Follow International Tax Plaza on Twitter