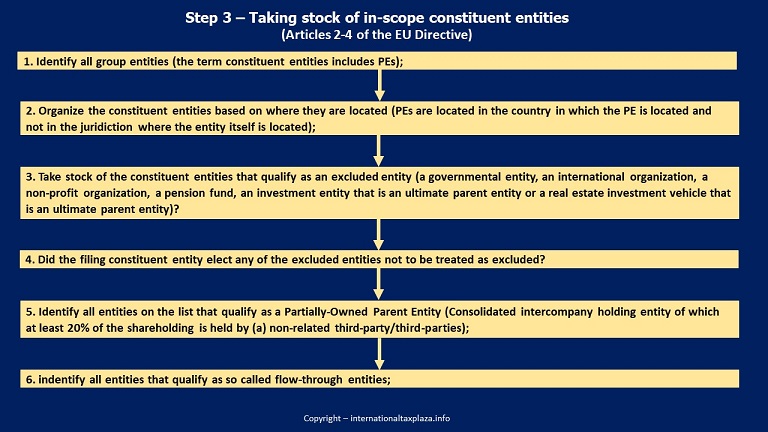

Once you have established that the EU Directive (or the OECD Model Rules) applies to the group for a fiscal year, it is wise to take stock of all constituent entities of the group. Me, personally I would immediately organize these constituent entities per jurisdiction in which they are located, because this will come in handy later in the process.

It should be noted that were it is stated ‘constituent entity’ that this term doesn’t only refer to an (actual) entity but also to Permanent Establishments (PE) that are part of an MNE group or a large-scale domestic group. In this respect it should furthermore be noted that the term PE as used in the Directive is wider than how we tax specialists normally use this term.

Furthermore, it is important to note that based on Article 2, Paragraph 3, sub a of the proposed EU-Directive the following categories of entities are considered to constitute ‘excluded entities’, unless the filing constituent entity elects not to treat such entities as excluded in accordance with Article 43, Paragraph 1 of the Directive. The election is made for a five-year period:

· a governmental entity;

· an international organization;

· a non-profit organization;

· a pension fund;

· an investment entity that is an ultimate parent entity;

· and a real estate investment vehicle that is an ultimate parent entity.

Article 2, Paragraph 3, subs b & c of the Directive subsequently provides conditions under which entities (partly) owned by entities falling in the abovementioned categories also qualify as excluded entities (unless the filing constituent entity elects not to treat such entities as excluded).

Since at this moment we are busy with the group structure this might also be a good moment to note the ownerships percentages in each constituent entity.

Furthermore it might also be the time to identify which entities qualify as so-called flow-through entities.

I would also immediately take stock of the entities that were involved in mergers and demergers during the underlying fiscal year.

Time to start the real work

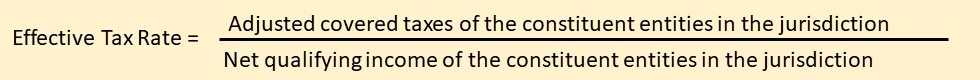

After we have taken stock of all constituent entities and organized them per jurisdiction it is time to start with the real work and that is starting the preparations to calculate the ETR per jurisdiction for the fiscal year. This ETR is calculated in accordance with the following formula:

In this article we have split this process over the following 3 steps:

· Calculating the qualifying income or loss of the constituent entities in a jurisdiction (Step 4);

· Computation of the adjusted covered taxes of the constituent entities (Step 5); and

· Calculating the ETR of the constituent entities located in a jurisdiction (Step 6).

Copyright – internationaltaxplaza.info

Follow International Tax Plaza on Twitter