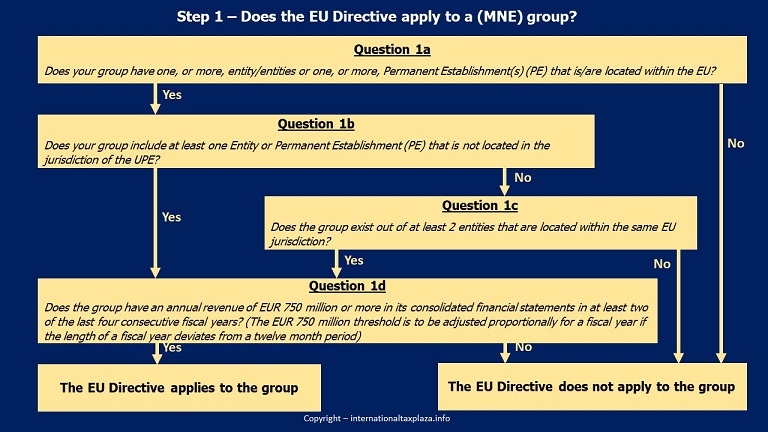

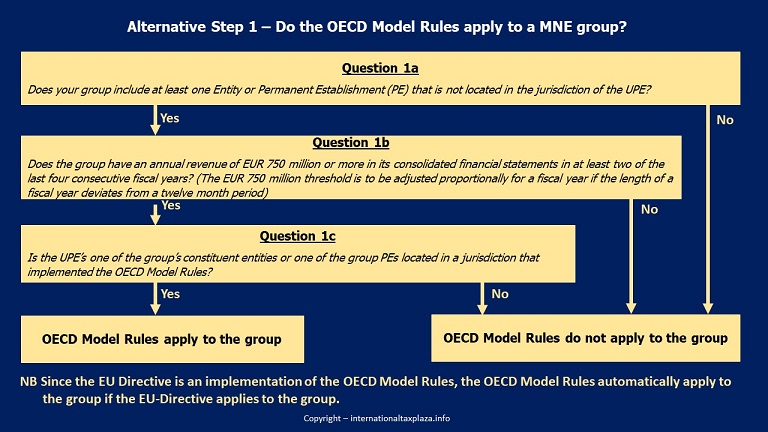

All the questions included in the schemes below have to be answered for each fiscal year!

It should be noted that groups that are both active in and outside of the EU might fall within the scope of both the OECD Model Rules and the EU Directive. Therefore we have prepared 2 question schemes.

This first scheme can be used to answer the question whether the EU Directive applies to a MNE group/large-scale domestic group.

The second scheme can be used to answer the question whether the OECD Model Rules apply to a MNE group.

Mergers/demergers and the EUR 750 million treshold

With respect to group mergers Article 31, Paragraph 2 arranges that where two or more groups merged to form a single group in any of the last four consecutive fiscal years, the consolidated revenue threshold of the MNE group as referred to in Article 2, Paragraph 1 of the EU Directive shall be deemed to be met for that year if the sum of the revenue included in each of their consolidated financial statements for that fiscal year is EUR 750 million or more.

Article 31, Paragraph 3 of the Directive subsequently arranges that where an entity that is not a member of a group (the “target”) merges with an entity or a group (the “acquirer”) in the fiscal year, and neither the target nor the acquirer has consolidated financial statements in any of the last four consecutive fiscal years, the consolidated revenue threshold of the MNE group shall be deemed to be met for that year if the sum of the revenue included in each of their financial statements or consolidated financial statements for that year is EUR 750 million or more.

Article 31, Paragraph 4 of the Directive arranges that where a single MNE group demerges into two or more groups (each a “demerged group”), the consolidated revenue threshold shall be deemed to be met by each demerged group if it reports:

(a) an annual revenue of EUR 750 million or more in the first fiscal year after the demerger; and

(b) an annual revenue of EUR 750 million or more in at least two of the second to fourth consecutive fiscal years after the demerger.

Constituent entities joining and leaving a MNE group

Article 32 of the proposed EU Directive contains provisions regarding the consequences of constituent entities joining or leaving an MNE group.

Question that immediately arises in this respect is whether the provisions laid down in Article 32 only apply to situations in which constituent entities join or leave a MNE group or whether they also apply to situations in which constituent entities join or leave a pure domestic group? For the OECD Model Rules it is clear that they only apply when constituent entities join or leave a MNE group since the OECD Model Rules the answer is straight forward: Since the OECD Model Rules only apply to MNE groups it is clear that also the merger/demerger provisions only apply to MNE groups.

The proposed EU Directive however, will apply to both MNE groups as well as in domestic situations. Since in Article 3 “Defnitions” of the EU Directive separate definitions for the terms group, MNE group and large-scale domestic group are given, the use of the term MNE group in Article 32 of the Directive might imply that the article only applies to MNE group. However, when considering that the Directive also applies to pure domestic situations in my view it seems more logical that Article 32 of the Directive should be interpreted in such way that it applies to both MNE groups and large-scale domestic groups.

Based on Article 32, Paragraph 1 of the EU Directive where an entity (the “target”) becomes or ceases to be a constituent entity of an MNE group as a result of a transfer of a direct or indirect ownership interests in the target during a fiscal year (the “acquisition year”), the target entity shall be treated as a member of the MNE group for the purpose of this Directive provided that a portion of its assets, liabilities, income, expenses and cash flows is included on a line-by-line basis in the consolidated financial statements of the Ultimate Parent Entity in the acquisition year.

Article 32, Paragraph 1 of the EU Directive furthermore arranges that the effective tax rate and top-up tax of the target entity shall be computed in accordance with paragraphs 2 to 8.

Based on Article 32, Paragraph 2 of the Directive, in the acquisition year, the financial accounting net income or loss and adjusted covered taxes of the target shall be included in the consolidated financial statements of the ultimate parent entity.

Article 32, Paragraph 3 subsequently arranges that in the acquisition year, and in each succeeding fiscal year, the qualifying income or loss and adjusted covered taxes of the target shall be based on the historical carrying value of its assets and liabilities.

Multi-parented MNE groups

Article 35 of the EU Directive contains a special set of rules that apply to multi-parented MNE groups.

Article 35, Paragraph 2 of the Directive arranges that where constituent entities form part of a multi-parented MNE group, the entities and constituent entities of each group shall be treated as members of one multi-parented MNE group. An entity, other than an excluded entity (See Step 3), shall be treated as a constituent entity if it is consolidated on a line by line basis by the multi-parented MNE group or if its controlling interests are held by entities in the multi-parented MNE group.

Based on Article 35, Paragraph 3 of the Directive, the consolidated financial statements of the multi-parented MNE group shall be the combined consolidated financial statements referred to in the definitions of a stapled structure or a dual-listed arrangement in Article 35, Paragraph 1, prepared under an acceptable financial accounting standard, which is deemed to be the accounting standard of the ultimate parent entity.

Article 35, Paragraph 4 of the Directive arranges that he ultimate parent entities of the separate groups that compose the multi-parented MNE group shall be the ultimate parent entities of the multi-parented MNE group. When applying this Directive in respect of a multi-parented MNE group, any references to an ultimate parent entity shall apply, as required, as if they are references to multiple parent entities.

Copyright – internationaltaxplaza.info

Follow International Tax Plaza on Twitter