In this article we discuss position paper KG:024:2023:9. In this position paper the Knowledge Group on dividend withholding tax and other withholding taxes answers the question at which moment and over which amount Dutch dividend withholding tax is due if the share buy-back takes place against cash and a right to future payments of which the size is still uncertain.

The underlying case

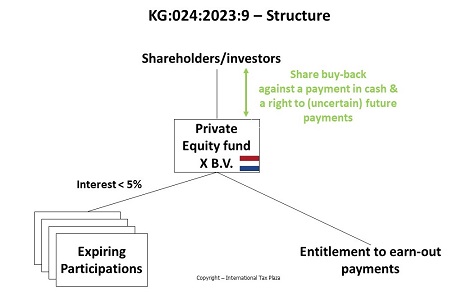

X B.V. is a private equity fund of which the intended term has expired. In addition to expiring participations, X B.V. is still entitled to some earn-out payments. It has been decided that X B.V. will buy back the shares from its investors. In exchange for their shares in X B.V., the investors will receive an amount in cash and in addition X B.V. will transfer its future net proceeds to the shareholders in proportion to the equity interest they previously owned. As a result the investors no longer retain a legal interest in X B.V., the investors do however retain an economic interest in X B.V.

(ITP: An expiring participation is an interest in a subsidiary which in the past exceeded 5% and to which the participation exemptions applied, but which interest now is below 5% as a result of which the interest does no longer meet the conditions of the participation exemption. In such situation however, the Dutch participation exemption still applies to such interest for a maximum of 3 years after the date on which the interest went below 5%.)

Question

At what time and over which amount is Dutch dividend withholding tax due if the share buy-back takes place against cash and a right to future payments of which the size is still uncertain?

Answer

If the share buy-back takes place against cash and a right to future payments of which the size is not yet certain, Dutch dividend withholding tax is due over the payment in cash if and insofar as the payment exceeds the average paid-up capital of the shares.

For as far as the consideration is made in the form of a right to future payments of which the amount is not yet certain, no proceeds have (yet) come at the disposal of the shareholder(s) at the time of agreeing on the right to future payments. Only when an unconditional right to payment exists, but no later than the moment on which the payments under the right to future payments are actually being made, the proceeds (of the share buy-back) are being made available. At that moment Dutch dividend withholding tax is due if and insofar as the distribution exceeds the remaining average paid-up capital of the shares.

From the consideration of the tax authorities

Article 3, Paragraph 1, under a of the Dutch dividend withholding tax (DDWT) Act arranges that in case of a share buy-back (if the buy-back doesn’t take place for temporary portfolio investment purposes), the amount paid in excess of the average paid-up capital of the relevant shares is taken into account as proceeds.

Article 7, Paragraph 1 of the DDWT Act prescribes that the tax is levied in the form of a deduction from the proceeds. Pursuant to the Paragraph 3, the withholding takes place at the that moment the proceeds have come at the disposal of the shareholder(s).

If the share buy-back takes place against cash and the granting of a right to future payments, both parts of the consideration/both considerations for the buy-back must be assessed separately. Pursuant to Article 3, Paragraph 1, under a of the DDWT Act for the part of the consideration that is paid in cash, it is clear that this is part of the proceeds if and insofar as the payment exceeds the average capital paid up on the shares.

The question arises as to how the right to future payments should be interpreted and when withholding should take place with respect to this part of the consideration?

Pursuant to Article 7, Paragraph 3 of the DDWT Act Dutch dividend withholding tax is to be withheld at the moment that the proceeds have come at the disposal of the shareholder(s).

For the question when the proceeds have come at the disposal of the shareholder(s), one has to take into account the rulings of the Dutch Supreme Court in the cases ECLI:NL:HR:1960:AY0560 and ECLI:NL:HR:2007:AZ2862. From these judgments it can be deduced that only if the shareholder(s) has/have an unconditional right to payment of the dividends, one can conclude that the dividends 'have come at the disposal' of the shareholder(s) and that therefore Dutch dividend withholding tax must be withheld (Parliamentary Papers II 2010/11, 32 426, no. 7, p. .41).

The foregoing means that if the amount of the future payments has not yet been established at the time of the buy-back, no proceeds have yet come at the disposal of the shareholders with respect to those future right(s). Only when there is an unconditional entitlement to payment, but no later than the moment on which the payments based on the rights to future payments are actually being made, the proceeds (of the buy-back) will have come at the disposal of the shareholders.

The full Dutch text of the position paper can be found here.

Other position papers of the Knowledge Group on dividend withholding tax and (other) withholding taxes of which we already made an English summary can be found here.

Copyright – internationaltaxplaza.info

Follow International Tax Plaza on Twitter (@IntTaxPlaza)