On the internet site of the European Commission the Commission staff working document versions of the Mind the Gap Reports of the 27 EU Member States have become available. The documents provide an interesting insight into the challenges and opportunities that exist in each of the EU-jurisdictions for tax compliance and tax expenditure.

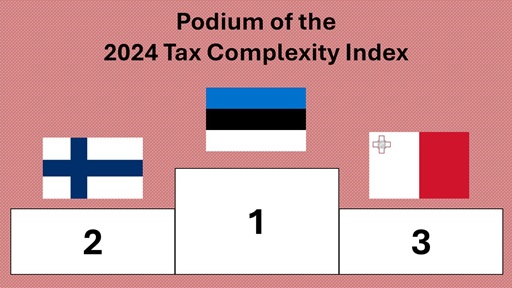

The documents also provide an overview of how the respective EU Member States rank in a so called Tax Complexity Index. The overall ranking is based on how each respective Member State scores regarding the complexity of its Tax Framework and how it scores regarding the complexity of its Tax Code. These 2 rankings result in an overall ranking.

What subjects are discussed in the country reports?

In the reports amongst others the following subjects are discussed:

- Snapshot of Tax System: Tax Revenues and their Sources;

- Monitoring of Compliance Gaps;

- Overview;

- Monitoring VAT Compliance Gap;

- Corporate and Personal Income Tax Compliance Gaps, and Measures of the Shadow Economy;

- Other compliance gaps;

- Monitoring of Policy Gaps;

- Tax Expenditures;

- VAT Policy Gap;

- Effectiveness of Tax Collection and Recovery Systems;

- VAT Collection;

- Recovery of Taxes;

- Use of Directive on Administrative Cooperation (DAC) instruments and data;

- Digitalisation and Compliance;

- Digital Transformation Strategy, Skills and Culture;

- Front-end digitalisation;

- Pre-filling;

- E-filing;

- Provision of Other Online Services;

- Back-end digitalisation;

- Use of Artificial Intelligence by the Tax Administration;

- Compliance Risk Management;

- Compliance Risk Management Strategy;

- Audit Types;

- Staff Dedicated to Audit, Investigation and Other Verification Functions;

- Additional Revenue from Audits as Share of Total Revenue; and

- Tax complexity.

High-level summaries

Via the links below you can find a high-level summary of each EU member State. In these summaries we provide you with a link to the working document of the respective Member State as available on the website of the European Commission:

- Austria;

- Belgium;

- Bulgaria;

- Croatia;

- Cyprus;

- Czech Republic;

- Denmark;

- Estonia;

- Finland;

- France;

- Germany;

- Greece;

- Hungary;

- Ireland;

- Italy;

- Latvia;

- Lithuania;

- Luxembourg;

- Malta;

- Netherlands;

- Poland;

- Portugal;

- Romania;

- Slovakia;

- Slovenia;

- Spain; and

- Sweden.

Copyright – internationaltaxplaza.info

Follow International Tax Plaza on Twitter (@IntTaxPlaza)