On March 17, 2023 on the website of the Dutch courts a very interesting opinion of the Dutch Advocate General was published. An opinion that, if the Dutch Supreme Court follows the Advocate General's opinion, could have consequences for taxpayers that are internationally active and that have loans payable and loans receivable outstanding that are denominated in the same foreign currency/currencies. In the underlying case the taxpayer and the Dutch tax authorities are amongst other disputing whether a de facto highly effective hedge is already sufficient for a taxpayer being obliged to use a coherent valuation of/hedge accounting for US-dollar payables and receivables for tax purposes. Or is next to the highly effective hedge a hedging objective or a business-economic link between the receivables and payables required for a taxpayer being obliged to use a coherent valuation of/hedge accounting for such payables and receivables?

In the underlying case at year-end 2012 and 2013, the taxpayer had payables and receivables outstanding that were denominated in US-dollars. Furthermore, the taxpayer had entered into forward currency (USD) exchange contracts.

For tax purposes the taxpayer recognizes currency exchange gains only when they are actually realized. Currency exchange losses however are taken into account as soon as the Euro-value of a receivable decreases or if the Euro-value of a liability increases. Earlier the Court of Appeal ruled that the dollar debts and forward currency exchange contracts have to be valued coherently. The Court of Appeal furthermore ruled that the US-dollar debts and the US-dollar receivables do not have to be valued coherently.

According to the Court of Appeal a highly effective currency hedge (actual correlation) in itself is not sufficient for a obligation to use a coherent valuation. According to the Court of Appeal, for an obligation to use a coherent valuation to come into existence it is also required that a business-political link, such as a hedging purpose or a business-economical link between the receivable and the payable exists.

The Secretary of State argues that the principle of reality implies that, in the case of an actual 100% correlation, debts and receivables that are denominated in the same (foreign) currency must be valued coherently. With all litigious payables and receivables being denominated in USD, the Secretary of State is of the opinion that the currency hedge is highly effective and therefore these payables and receivables should be valued coherently.

The Advocate General is of the opinion that the reality of a highly effective currency exchange hedge is that no exchange rate risk is run as long as and insofar as that hedge exists. To that extent the reality principle therefore requires that a coherent valuation is applied with respect to such payables and receivables, regardless of whether or not the taxpayer intended to hedge and regardless of whether or not a business-economic link exists between the payable(s) and the receivable(s) that is/are denominated in the same currency. According to the Advocate General, the aforementioned is in line with established case law regarding the use of a coherent valuation/hedge accounting for tax purposes.

It should be noted that according to the Advocate General that the fact that a taxpayer is obliged to use the coherent valuation method, does not mean that the taxpayer is not be allowed to (partly) amortize a loan receivable. Therefore if a highly effective currency exchange risk exists the taxpayer can still (partly) amortize a loan receivable, if based on the facts and circumstances it cannot be expected that the debtor will be able to fully repay the debt.

Remarks ITP

For Dutch (corporate) income tax purposes the basic principle is that all assets and liabilities are valued separately. Consequently the principles of sound business practice apply to each asset or liability separately. Until now however we were under the impression that one was only required to deviate from the aforementioned basic principle of separate valuation and to apply a coherent valuation of/hedge accounting to certain assets and liabilities for tax purposes if:

- the taxpayer intended to hedge the risks on one or more of its assets or liabilities with one of its other assets or liabilities (in that case the valuation of the asset/liability should be done together with the corresponding hedging asset or liability);

- a direct business-economic link exist between certain assets and liabilities (eg a loan payable denominated in a certain foreign currency was obtained with the sole purpose to fund a loan not receivable that is nominated in the same foreign currency).

Although the Advocate General states that his opinion is in line with established case law, we feel that he is stretching the rules as laid down in established case law by applying them to a situation in which the taxpayer did not intend to hedge the risks incurred with either (a) loan(s) payable or (a) loan(s) receivable nor did a direct business economic link exist between the loans payable and the loans receivable. We however do not feel that the opinion of the Advocate General does not lead to an unreasonable outcome.

An example

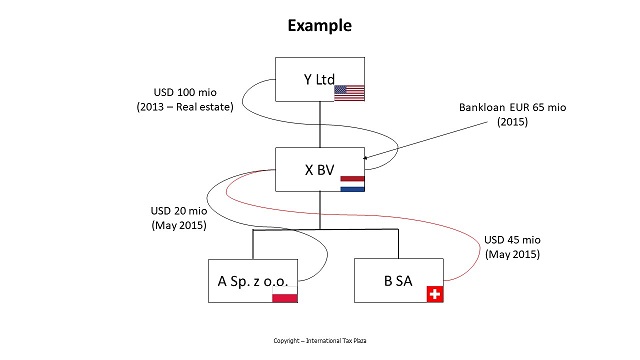

The Dutch entity X BV is a subsidiary of Y Ltd, which is a US entity. X BV has 2 subsidiaries: Polish A Sp. z o.o. and Swiss B SA. In 2013 X BV wants to obtain a new building to expand its activities. For being able to buy this building A BV obtains a loan from its shareholder X Ltd. This loan is denominated in US-dollars and amounts to US-dollar 100 mio. The maturity date of the loan is December 31, 2027.

In May 2015 both A Sp. z o.o. and B SA want to expand their business. To fund these expansions X BV obtains a Euro-loan from a bank. The loan amounts to EUR 65 mio. X BV use the funds it obtained via this loan to provide a US-dollar loan amounting to US-dollar 20 mio to A Sp. z o.o. and a loan amounting to US-dollar 45 mio to B SA. Both loans have a maturity date of May 31, 2030. At the time that X BV provided these loans 1 USD was exactly 1 EUR.

In this example X BV did not intend to (partially) hedge it the currency exchange risks it incurs with respect to its US-dollar loan payable to Y Ltd. with the US-dollar loans it provided to A Sp. z o.o. and B SA. Nor does an economic-business link exists between the US-dollar loan X BV obtained from Y Ltd. on one side and the US-dollar loans X BV provided to A Sp. z o.o. and B SA.

Separate valuation of all loans and liabilities

December 31, 2015

On December 31, 2015 USD/EUR exchange rate has changed to 1 USD i= 1,10 EUR. Therefore the commercial value of the loan payable to X Ltd. amounts to EUR 110 mio. The receivable from Sp. z o.o. amounts to USD 22 mio (+EUR 2 mio) and the receivable from B SA amounts to USD 49.5 mio (+EUR 4.5 mio). Since based on the principles of sound business practices X BV does not have to take into account unrealized currency exchange profits, but is allowed to take into account an unrealized currency exchange losses, for Dutch corporate income tax purposes X BV will report an unrealized currency exchange loss of EUR 10 mio (relating to the loan payable to Y Ltd.).

December 31, 2016

On December 31, 2016 USD/EUR exchange rate has changed to 1 USD = 1,05 EUR. Therefore the commercial value of the loan payable to Y Ltd. amounts to EUR 105 mio. Therefore for Dutch corporate income tax purposes X BV will have to recap EUR 5 mio of the EUR 10 mio unrealized exchange loss it took into account in 2015.

Since the EUR value of the loans provided still higher than the EUR 65 mio that had at the time they were provide to A SP. z o.o. (May 31,2015) X BV still does not have to into account an unrealized currency exchange profit with respect to these loans.

Consequently the total currency exchange loss X BV has taken into account as per the end of 2016 amount to EUR 5 mio (the EUR 10 mio loss taken into account in 2015 -/- the EUR 5 mio recap taken into account in 2016).

December 31, 2017

In 2017 the US-dollar really declines in value. As per December 31, 2017 1 USD = 0,9 EUR.

As per December 31, 2017 based on this exchange rate the loan payable to Y Ltd. amounts to EUR 90 mio. Consequently this is EUR 15 mio lower than the EUR 105 mio as per December 31, 2016. From this X BV has to recap another EUR 5 mio from the unrealized currency exchange loss it took into account in 2015. The remaining EUR 10 mio it does not have to take into account for Dutch corporate income tax purposes since these EUR 10 mio qualifies as an unrealized currency exchange gain.

However since the value of the US-dollar has gone below the value of 1 EUR it had when the loans to A. Sp. z o.o. and B SA were granted, X BVcan now take a currency exchange loss into account for Dutch corporate income tax purposes with respect to these loans. Since the commercial value of the loan to A Sp. z o.o amount to EUR 18 mio as per December 31, 2017 the unrealized currency exchange loss to be taken with respect to this loan amounts to EUR 2 mio. Since the commercial value of the loan to B SA amount to EUR 40.5 mio as per December 31, 2017 the unrealized currency exchange loss to be taken with respect to this loan amounts to EUR 4.5 mio.

As the example shows if the taxpayer is allowed to separately value its loans payable and its loans receivable X BV constantly has a tax advantage since it only has to take into account unrealized currency exchange losses.

|

2015 |

||

|

Unrealized FX result loan Y Ltd. |

-/- EUR 10 mio |

|

|

Unrealized FX result loan A Sp. z o.o. |

0 |

|

|

Unrealized FX result loan B SA |

0 |

|

|

Total FX result for the year 2015 |

-/- EUR 10 mio |

|

|

Total FX result for the year 2015 |

|

-/- EUR 10 mio |

|

|

|

|

|

2016 |

||

|

(Partial) Recap of 2015 FX result loan Y Ltd. |

+ EUR 5 mio |

|

|

Unrealized FX result loan A Sp. z o.o. |

|

|

|

Unrealized FX result loan B SA |

|

|

|

Total FX result for the year 2016 |

+ EUR 5 mio |

|

|

Total FX result for the period 2015 - 2016 |

|

-/- EUR 5 mio |

|

|

|

|

|

2017 |

|

|

|

(Partial) Recap of 2015 FX result loan Y Ltd |

+ EUR 5 mio |

|

|

Unrealized FX result loan A Sp. z o.o. |

-/- EUR 2 mio |

|

|

Unrealized FX result loan B SA |

-/- EUR 4.5 mio |

|

|

Total FX result for the year 2017 |

-/- EUR 1.5 mio |

|

|

Total FX result for the period 2015 - 2017 |

|

-/- EUR 6.5 mio |

Coherent valuation/hedge accounting

In the example it seems that for USD 65 mio the currency exchange risk incurred on the loan payable to Y Ltd is effectively hedged by the loans receivable from A Sp z o.o. and vice versa. If therefore the taxpayer is obliged to coherently value the loan payable and the loans receivable an unrealized currency exchange loss on the loan payable will be offset against the unrealized currency exchange gains on the loans receivable. An unrealized currency exchange loss on the loans receivable will be fully offset against the unrealized currency exchange gain on the loan payable. Consequently X BV would only be allowed to take an unrealized currency exchange loss into account for tax purposes with respect to the US-dollar amount with which the outstanding amount of the loan payable exceeds the total amount outstanding on the loans receivable (in our example USD 35 mio).

In figures this would mean the following:

|

2015 |

||

|

Unrealized FX result loan Y Ltd. |

-/- EUR 3.5 mio |

|

|

Total FX result for the year 2015 |

-/- EUR 3.5 mio |

|

|

Total FX result for the year 2015 |

|

-/- EUR 3.5 mio |

|

|

|

|

|

2016 |

||

|

(Partial) Recap of 2015 FX result loan Y Ltd. |

+ EUR 1.75 mio |

|

|

Total FX result for the year 2016 |

+ EUR 1.75 mio |

|

|

Total FX result for the period 2015 - 2016 |

|

-/- EUR 1.75 mio |

|

|

|

|

|

2017 |

|

|

|

(Partial) Recap of 2015 FX result loan Y Ltd |

+ EUR 1.75 mio |

|

|

Total FX result for the year 2017 |

+ EUR 1.5 mio |

|

|

Total FX result for the period 2015 - 2017 |

|

EUR 0 mio |

Conclusion

Considering the impact the approach of the Advocate General might have for taxpayers it will be very interesting to follow the case and to see whether or not the Dutch Supreme Court confirms the Advocate General’s opinion. However, the coherent valuation approach as we described above in our example doesn’t seem unreasonable to us. We feel that such a coherent valuation approach is much closer to the economic reality than an approach in which a separate valuation method is applied.

The reason herefor is that if in our example the taxpayer is allowed to value the loan payable and the loan receivable it will permanently be in an unrealized currency exchange loss position for as long as these loans are existing (unless at yearend the currency exchange rate is exactly the same as it was at the time that the loans were granted). If the US-dollar increase in value this unrealized currency exchange loss is incurred on the loan payable. And if the US-dollar decreases in value, an unrealized currency exchange loss is incurred on the loans receivable. However if the taxpayer is obliged to coherently value the loan payable and the loans receivable, the taxpayer will only be able to take into account an unrealized currency exchange result for Dutch corporate income tax purposes if the total of the unrealized currency exchange results incurred over the loan payable and the loans receivable result in a loss. Which in our example will only be the case if the US-dollar increases in value.

If the Dutch Supreme Court confirms the opinion of the Advocate General, in our opinion it would be helpfull if the Dutch Supreme Court would give more guidance on when to its opinion an highly effective hedge exists. Is it for example necessary that a certain minimum ratio exists between the outstanding amounts of the loans payable and loans receivable? Does it only exists if both the loan(s) payable and the loan(s) receivable are of the same nature (for example a long-term debt and a long-term receivable)? Or can for example a short-term receivable also be used to (temporarily) highly effectively hedge a currency exchange risk that is incurred over a long-term debt?

Copyright – internationaltaxplaza.info

Follow International Tax Plaza on Twitter (@IntTaxPlaza)