On May 4, 2023 on the website of the Court of Justice of the European Union (CJEU) the opinion of Advocate General Kokott in the joined Cases C‑454/21 P (Engie Global LNG Holding Sàrl, Engie Invest International SA and Engie SA versus the European Commission) and C‑451/21 P (Grand Duchy of Luxembourg versus the European Commission), ECLI:EU:C:2023:383, was published.

I. Introduction

1. These appeals give the Court another opportunity to review a tax ruling in the light of the rules on State aid. While such tax rulings, on the one hand, contribute to legal certainty, there is at times a latent suspicion, on the other hand, that they lead to agreements between tax authorities and taxpayers in some Member States which are potentially harmful to competition.

2. However, unlike in the other State aid procedures which the Commission has initiated in relation to tax rulings, the issue here is not transfer pricing that deviates from the arm’s length principle. Instead, in the underlying dispute, the Luxembourg tax authorities had communicated with the Engie group in two sets of tax rulings regarding the fiscal treatment of the restructuring of the group of companies in Luxembourg. In the end, the Commission certified that a convertible loan between different Luxembourg companies of the Engie group should be classified as external capital at the level of the ‘borrower’ and as equity capital at the level of the ‘lender’. The remuneration paid in connection with the financing operation was therefore not included in the basis of assessment for taxation at the level of the subsidiary but was treated as participation income at the parent company. The latter is usually not taxed within a group of companies, and Luxembourg is no exception. At the level of the subsidiary, on the other hand, tax was applied only to a special basis of assessment (‘margin’) agreed with the tax authorities.

3. In the decision at issue, the Commission considered that the Luxembourg tax authorities should not have treated the participation income at the level of the parent company as tax-exempt. It averred that the Grand Duchy, by taking a different view in the tax rulings, had granted aid to the respective parent companies and the Engie group. The fiscal authorities ought instead to have applied the general anti-abuse rule in Luxembourg law. The General Court fully endorsed the Commission’s view on this.

4. In the present appeal proceedings, the question arising in the first place is therefore whether the tax advantages gained by using convertible loans should be classified as a selective tax advantage within the meaning of Article 107(1) TFEU. It will also be necessary to answer the question whether State aid law demands correspondent taxation (that is, no tax exemption for participation income if the profits distributed have not already been fully taxed at the level of the subsidiary) in the domestic context.

5. In the second place, the question arises whether the Commission and the Court can review the national tax authorities and their tax assessments for ‘correctness’ by means of State aid law. An answer is thus required, in respect of both aspects, to the question to what extent the Commission can substitute its own interpretation (of national law) for an interpretation of national law by the national tax authorities (in this case a general anti-abuse rule) in order to demonstrate a selective advantage.

II. Legal framework

A. European Union law

6. The legal framework within EU legislation is Article 107 et seq. TFEU. The procedure regarding unlawful aid is regulated in Chapter III of Regulation (EU) 2015/1589 laying down detailed rules for the application of Article 108 TFEU (‘Regulation 2015/1589’).

B. Luxembourg law

7. Article 22(5) of the amended loi concernant l’impôt sur le revenu (Law on income tax, ‘the LIR’) of 4 December 1967 stipulates in effect that the conversion of assets is, in principle, treated as an exchange and thus as sale of the assets yielded and acquisition of the assets received. This can result in a taxable capital gain.

8. Point 1 of Article 22bis(2) of the LIR, in force, according to the judgment under appeal, when the tax rulings at issue were adopted, provides as follows:

‘(2) By way of derogation from Article 22(5), the exchange transactions referred to in points 1 to 4 below shall not result in the realisation of the capital gains related to the assets exchanged unless, in the cases referred to in points 1, 3 and 4, either the creditor or the shareholder waives the application of this provision:

1. upon conversion of a loan: the allocation to the creditor of securities representing the debtor’s share capital. In the event of conversion of a convertible capital loan, the capitalised interest in respect of the business year preceding the conversion shall be taxable at the time of the exchange;’

9. Article 164 of the LIR reads as follows:

‘(1) In determining the taxable income, it is irrelevant whether or not the income has been distributed to the parties entitled to that income.

(2) Distributions of any kind, made to holders of shares, participation certificates, founders’ shares, “jouissance” shares or any other securities, including variable-yield bonds conferring entitlement to a participation in the annual profits or in the proceeds of liquidation, shall be regarded as distributions for the purposes of the preceding paragraph.

(3) The taxable income shall include hidden profit distributions. A hidden profit distribution arises in particular where a shareholder, member of a company or interested party directly or indirectly receives benefits from a company or an association which he or she would not normally have received if he or she had not been a shareholder, member of a company or interested party.’

10. The first paragraph of Article 166 of the LIR provides:

‘Income from a participation held by:

1. a resident collective undertaking that its fully liable to tax and takes one of the forms listed in the Annex to paragraph 10;

2. a resident capital company that is fully liable to tax and is not listed in the Annex to paragraph 10;

3. a domestic permanent establishment of a collective undertaking referred to in Article 2 of Directive [2011/96];

4. a domestic permanent establishment of a capital company residing in a State with which the Grand Duchy of Luxembourg has concluded a convention for the avoidance of double taxation;

5. a domestic permanent establishment of a capital company or cooperative society residing in a State party to the Agreement on the European Economic Area (EEA) other than a Member State of the European Union, | shall be exempt where, on the date on which the income is made available, the recipient holds or undertakes to hold that participation for an uninterrupted period of at least 12 months and, throughout that period, the level of the participation does not fall below 10% or the acquisition price below EUR 1 200 000.’

11. Article 6 of the Luxembourg Steueranpassungsgesetz (Law on tax adjustment, ‘the StAnpG’) provides as follows:

‘Tax obligations cannot be circumvented or restricted by abuse of the forms and structural possibilities afforded by civil law. In the event of abuse, taxes shall be levied in the same way as they would be within a legal structure appropriate to the economic transactions, facts and circumstances concerned.’

III. Background to the dispute

12. The dispute arose from two sets of tax rulings issued by the Grand Duchy of Luxembourg to the Engie group. Each of these concerns two comparable intra-group financing structures.

13. In the interest of better understanding, I shall first set out the structure of the Engie group relevant to the dispute (Section A) before discussing the transactions on which the tax rulings were based, including the financing structure chosen by Engie (Section B). I shall then present the tax rulings issued by the Luxembourg tax authorities (Section C), the Commission decision (Section D) and the proceedings before the General Court as well as the judgment under appeal (Section E).

A. Structure of the Engie group

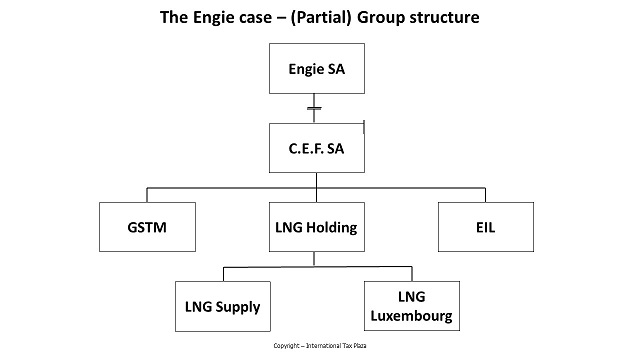

14. The Engie group consists of Engie SA, a company established in France, and all companies directly or indirectly controlled by Engie SA (paragraph 4 et seq. of the judgment under appeal). Those companies include several companies established in Luxembourg.

15. In Luxembourg, Engie SA controls, among others, Compagnie européenne de financement C.E.F. SA (‘CEF’), which was renamed Engie Invest International SA in 2015. The purpose of the company is the acquisition of participating interests in Luxembourg and foreign entities and the management, exploitation and control of such interests.

16. CEF holds all the shares in GDF Suez Treasury Management Sàrl (‘GSTM’), Electrabel Invest Luxembourg SA (‘EIL’) and GDF Suez LNG Holding Sàrl (‘LNG Holding’), which was founded in Luxembourg in 2009 and renamed Engie Global LNG Holding Sàrl in 2015.

17. The purpose of LNG Holding is also the acquisition of participating interests in Luxembourg and foreign entities and the management of such interests. For its part, the company holds all the shares in GDF Suez LNG Supply SA (‘LNG Supply’) and GDF Suez LNG Luxembourg Sàrl (‘LNG Luxembourg’). LNG Supply is active in the purchase, sale and trading of liquefied natural gas, gas and gas derivative products.

B. Transactions and financing structure

18. Between 2009 and 2015, a number of restructurings took place within the Luxembourg part of the Engie group which were implemented, inter alia, by means of complex intra-group financing structures, described in paragraph 12 et seq. and paragraph 36 et seq. of the judgment under appeal as follows:

1. Transfer of business activities to LNG Supply

19. The first restructuring involved LNG Holding (parent company) and its subsidiaries LNG Luxembourg (also ‘the intermediate company’) and LNG Supply (subsidiary).

20. On 30 October 2009, LNG Holding transferred its business activities in the liquefied natural gas and gas derivatives sector to LNG Supply. The acquisition price was 657 million United States dollars (USD) (approximately EUR 553.26 million).

21. To finance the intra-group transfer, LNG Luxembourg granted LNG Supply a mandatorily convertible loan (‘ZORA’) for a nominal amount of USD 646 million and a term of 15 years. No periodic interest was charged on the ZORA. Instead, LNG Supply was to grant LNG Luxembourg, the lender, its own shares when the ZORA was converted into equity at a later date.

22. The value of the shares to be granted is calculated on the basis of the nominal amount of the ZORA at the time of conversion plus or minus a variable component. The variable component is itself equivalent to the profits made by LNG Supply during the term of the ZORA, minus a taxable margin. The actual margin to be taxed and the basis of assessment for that margin were agreed with the fiscal authorities in a tax ruling (see Section C below). However, the variable component can also – in loss-making years – be negative. The amount of the variable component is also referred to as ‘the ZORA accretions’.

23. LNG Luxembourg, for its part, financed the ZORA by means of a forward contract with LNG Holding (which was still LNG Trading at that time). Under that contract, LNG Holding is to pay to LNG Luxembourg an amount equal to the nominal amount of the ZORA – namely USD 646 million – in exchange for the acquisition of the rights to the shares that LNG Supply will issue upon conversion of the ZORA.

24. In 2014, the ZORA was partially converted. As a so-called hybrid financing element, the ZORA is treated as a kind of debt at the level of the subsidiary, while being considered as equity at the level of the parent company at the moment of conversion. To that end, LNG Supply performed a capital increase of USD 699.9 million (approximately EUR 589.6 million), of which USD 193.8 million (approximately EUR 163.3 million) repaid part of the nominal amount of the ZORA in question and the remainder paid part of the ZORA accretions.

25. At the level of LNG Luxembourg (intermediate company), the partial conversion has led to a reduction of EUR 193.8 million in the ZORA recorded as an asset and to a corresponding reduction in the liability reported in respect of the forward contract. Consequently, the transaction was tax neutral at the level of LNG Luxembourg. The participation income subsequently received at the level of LNG Holding (parent company) in the form of the shares issued by LNG Supply (subsidiary) upon the conversion of the ZORA was treated as tax-exempt by application of group relief under Article 166 of the LIR (that is, tax exemption of profit distributions within a group). These tax-related consequences were provided for in the tax rulings (see Section C below).

2. Transfer of business activities to GSTM

26. The second restructuring involved CEF (parent company) and its subsidiaries EIL (also ‘the intermediate company’) and GSTM (subsidiary). With effect from 2010, CEF transferred its financing and ‘treasury management business’ to GSTM. The acquisition price for this amounted to approximately EUR 1.036 billion.

27. This intra-group transfer was also financed by a ZORA, with a term ending in 2026, which EIL granted to GSTM. The nominal value of the ZORA corresponds to the acquisition price. The financing structure corresponded in other respects to that for the transfer of business to LNG Supply; in particular, EIL concluded an identical forward contract with CEF, which means that reference may be made to the above remarks.

28. However, the ZORA has not yet been converted, so CEF has not yet received any resultant participation income.

C. Tax rulings issued by the Luxembourg tax authorities

29. In connection with those transactions and their respective financing, the Luxembourg tax authorities issued two sets of tax rulings to the Engie group (paragraph 17 et seq. of the judgment under appeal).

1. The tax rulings concerning the transfer of business activities to LNG Supply

30. The first tax ruling was issued on 9 September 2008. It gives an account of the establishment of LNG Supply and LNG Luxembourg and the plan to transfer the business of LNG Holding to LNG Supply.

31. For tax purposes, it is apparent from the tax ruling that LNG Supply is to be taxed in a particular manner only on a margin agreed with the Luxembourg tax authorities. According to the Commission decision of 20 June 2018, the basis of assessment is not LNG Supply’s profit (in terms of the difference between the business assets at the beginning and end of the financial year) but an amount ‘corresponding to “an overall net spread of ■% of the value of the gross amount of assets as shown in [LNG Supply’s] balance sheet”’. That net spread must not, however, be ‘lower than ■% of the annual gross turnover derived from the Enterprise’. That amount (margin) is then subject to the normal income tax rate (‘margin taxation’).

32. The result of this is that income is taxed on the basis of balance sheet values, or at least on the basis of turnover. That means that LNG Supply is liable for income tax even in the event of a loss. Because of that balance-sheet or turnover-based taxation, LNG Supply’s actual income (revenue minus expenditure) was no longer relevant to the basis of assessment for taxation. Why and on what legal basis the Luxembourg tax authorities agreed (or were allowed to agree) to that divergent taxation and are taxing such a net margin is not clear from the file. In any event, the economic result left to LNG Supply after the deduction of that margin did equate to the value of the ZORA accretions, as agreed.

33. According to the Commission decision, the Luxembourg tax authorities give LNG Luxembourg, the lender, the option to maintain the value of the ZORA in its accounts at book value during the life of the ZORA, which LNG Luxembourg did. The tax ruling further provides that the subsequent conversion of the ZORA into shares does not give rise to a taxable capital gain if LNG Luxembourg opts to apply Article 22bis of the LIR. The ZORA accretions included in the value of the shares issued is therefore not taxed. In that respect, they are treated as equity.

34. Lastly, the tax ruling of 9 September 2008 stipulates that LNG Holding record the payments made to LNG Luxembourg in connection with the forward contract as financial fixed assets, with the result that LNG Holding will not record in its accounts any income or any deductible expense in relation to that ZORA. In addition, the Luxembourg tax authorities confirm that the tax exemption for participation income under Article 166 of the LIR is applicable to the participating interest in LNG Supply purchased under the forward contract.

35. The second tax ruling was issued on 30 September 2008 and concerns the transfer of the effective management of LNG Trading to the Netherlands. The third tax ruling was issued on 3 March 2009 and confirms the amendments made to the financing structure laid down in the tax ruling of 9 September 2008, in particular the replacement of LNG Trading by LNG Holding and the implementation of the ZORA taken out by LNG Supply with LNG Luxembourg and LNG Holding. The fourth tax ruling was issued on 9 March 2012 and clarifies a number of accounting terms used to calculate the margin on which LNG Supply is taxed.

36. The last tax ruling was issued on 13 March 2014 and confirmed the view set out in the request of 20 September 2013. It concerns the tax treatment of the partial conversion of the ZORA taken out by LNG Supply. It follows from it, according to paragraph 27 of the judgment under appeal, that, upon conversion of that loan, LNG Supply will reduce its capital by an amount equal to the amount of that conversion.

37. From a tax perspective, the Luxembourg tax authorities confirm that the partial conversion in question will have no effect on LNG Luxembourg. LNG Holding will record in its accounts a profit equal to the difference between the nominal amount of the converted shares and the amount of that conversion (that is, the value of the ZORA accretions). Furthermore, it is established that that profit will be covered by the participation exemption under Article 166 of the LIR.

2. The tax rulings concerning the transfer of business activities to GSTM

38. The first tax ruling, issued on 9 February 2010, endorses a structure similar to the one established by LNG Holding to finance the transfer of its business activities in the liquefied natural gas sector to LNG Supply. The structure in question is based on a ZORA taken out by GSTM with EIL and used to finance the acquisition of CEF’s financing and ‘treasury management business’. Like LNG Supply, GSTM is taxed during the implementation of the ZORA on a margin agreed with the Luxembourg tax authorities.

39. The second tax ruling, issued on 15 June 2012, endorses the tax treatment of the financing transaction and is based on an analysis identical to that set out in the tax ruling of 9 September 2008 concerning the transfer of LNG Trading’s business to LNG Supply. However, it differs from the tax ruling of 9 September 2008 as regards the possible increase in the amount of the ZORA taken out by GSTM.

3. Summary

40. The net result of the tax rulings is that the operational companies LNG Supply and GSTM are taxed at the normal corporate tax rate only on a basis of assessment agreed with the tax authorities (margin). That basis of assessment for corporate tax was not determined within the framework of the normal determination of profits (usually a comparison of business assets) but on the basis of balance sheet values or at least on the basis of turnover. Consequently, the operational subsidiary is taxed even in the event of a loss.

41. The capital gains in excess of the basis of assessment thus determined (that is, the remaining effective profits) were not taxed at the level of the operational companies (LNG Supply and GSTM), because of the agreed margin taxation, and were attributed solely to the financing element (ZORA).

42. As a result of the forward contract, there is no profit at the level of the intermediate company when the ZORA is converted into shares. The profits derived from the conversion of the ZORA are then treated as equity at the level of the parent company and, by virtue of the group relief granted in Luxembourg (Article 166 of the LIR), are not taxed. Consequently, all that remains is the margin taxation of business activities described above.

D. Commission decision

43. On 23 March 2015, the European Commission sent the Grand Duchy of Luxembourg a request for information regarding the tax rulings issued to the Engie group. After informing the Grand Duchy of Luxembourg by letter of 1 April 2016 that it had doubts as to the compatibility of those tax rulings with State aid law, the Commission opened a formal investigation procedure under Article 108(2) TFEU on 19 September 2016. On 20 June 2018, the Commission adopted the decision at issue.

44. In the decision at issue, the Commission finds, in essence, that the Grand Duchy of Luxembourg granted the Engie group a selective advantage in breach of Articles 107(1) and 108(3) TFEU. The Commission objects to the practical effects of that structure on the group’s total tax liability, the fact being that, in essence, almost all of the profits made by the subsidiaries in Luxembourg are not actually taxed.

45. The Commission’s reasoning for considering that a selective advantage had been conferred is that, under the tax rulings, the ZORA accretions corresponding to the profits made by LNG Supply and GSTM were not taxed, apart from the margin agreed with the Luxembourg tax authorities, at the level of any of the companies involved in the transactions. According to the Commission, the advantage under State aid law lies specifically in the application of the tax exemption under Article 166 of the LIR to the participation income received by each of the parent companies upon conversion of the ZORA although no effective taxation was ensured at the level of the subsidiaries (or the intermediate companies).

46. Regarding the existence of a selective advantage, the Commission relies on a total of four different lines of argument.

47. First, the Commission considers that there has been selectivity at the level of the parent companies – LNG Holding and CEF – because the tax rulings at that level endorse the non-taxation of participation income corresponding, from an economic perspective, to the ZORA accretions. That treatment, it finds, derogates from a reference framework encompassing the Luxembourg corporate income tax system, under which entities liable for corporate income tax established in Luxembourg are taxed on the profits recorded in their annual accounts.

48. Second, the Commission considers that there has been selectivity at the level of the parent companies because the tax rulings endorse the application of the tax exemption for participation income under Article 166 of the LIR to the income received by the parent companies. In the Commission’s view, that treatment derogates from a reference framework limited to the rules on tax exemptions for participation income because, according to those rules, a tax exemption is only to be granted if the distributed profits have previously been taxed at the level of the subsidiaries (what is known as the Korrespondenzprinzip, or ‘principle of correspondence’).

49. Third, the Commission considers that the tax rulings have resulted in a selective advantage for the Engie group because the tax deductibility of the ZORA accretions at the level of the subsidiaries combined with their non-taxation at the level of the intermediate and parent companies has resulted in an overall reduction in the group’s total basis of assessment for taxation in Luxembourg. In the Commission’s view, that derogates from a reference framework encompassing the Luxembourg corporate income tax system, which does not allow such a reduction in the basis of assessment (group approach).

50. Fourth, as an alternative line of argument, the Commission posits that the tax rulings derogate from the Luxembourg anti-abuse rule in tax legislation – specifically, that the tax authorities have unlawfully failed to apply the anti-abuse rule in Article 6 of the StAnpG. In the Commission’s view, the financing structure created by the Engie group was abusive and the Luxembourg tax authorities consequently should not, on the basis of Luxembourg case-law, have issued those tax rulings (failure to combat abuse).

51. The Commission considers that the other conditions of State aid under Article 107(1) TFEU were also fulfilled and therefore decides that Luxembourg should recover the aid from LNG Holding. Any sums not repaid by LNG Holding should be recovered from Engie SA. Since the ZORAs under the second set of tax rulings have not yet been converted into GSTM shares, the Commission orders no recovery in connection with them. In respect of future conversions, it prohibits the continued treatment of resultant participation income as exempt from tax.

E. The procedure before the General Court and the judgment under appeal

52. By application lodged at the Registry of the General Court on 30 August 2018, the Grand Duchy of Luxembourg brought the action in Case T‑516/18, seeking annulment of the decision at issue.

53. By application lodged at the Registry of the General Court on 4 September 2018, Engie Global LNG Holding Sàrl, Engie Invest International SA and Engie SA (‘Engie’) brought the action in Case T‑525/18, also seeking annulment of the decision at issue.

54. By order of 15 February 2019, the President of the Seventh Chamber, Extended Composition, of the General Court granted the application of Ireland to intervene in Case T‑516/18.

55. By order of the President of the Second Chamber, Extended Composition, of the General Court of 12 June 2020, the parties having been heard, Cases T‑516/18 and T‑525/18 were joined for the purposes of the oral part of the procedure, in accordance with Article 68(1) of the Rules of Procedure of the General Court.

56. In support of their actions, Engie and the Grand Duchy of Luxembourg advanced six series of pleas, which allege, in essence:

– in the first series, infringement of Articles 4 and 5 TEU as well as Articles 3 to 5 and 113 to 117 TFEU, in so far as the Commission’s analysis would lead to tax harmonisation in disguise (third plea in Case T‑516/18 and fifth plea in Case T‑525/18);

– in the second series, infringement of Article 107 TFEU, in so far as the Commission considers that the tax rulings conferred an advantage on the grounds that they are incompatible with Luxembourg tax law (second plea in Case T‑516/18 and second plea in Case T‑525/18);

– in the third series, infringement of Article 107 TFEU, infringement of the obligation to state reasons in accordance with Article 296 TFEU and infringement of the principle of observance of the rights of the defence, in so far as Commission finds that advantage to be selective (first, fourth and sixth pleas in Case T‑516/18 and third, sixth and eighth pleas in Case T‑525/18);

– in the fourth series, infringement of Article 107 TFEU, in so far as the Commission considers that the tax rulings are imputable to the Luxembourg State and involve the commitment of State resources (first plea in Case T‑525/18);

– in the fifth series, infringement of Article 107 TFEU, in so far as the Commission wrongly classifies the tax rulings as individual aid (fourth plea in Case T‑525/18);

– in the sixth series, infringement of the general principles of EU law, in so far as the Commission orders the recovery of the aid (fifth plea in Case T‑516/20 and seventh plea in Case T‑525/18).

57. By the judgment under appeal, the General Court rejected all of those pleas and, consequently, dismissed the actions in Cases T‑516/18 and T‑525/18 in their entirety.

58. In respect of the first series of pleas, the General Court (paragraph 134 et seq., especially paragraph 150) held, in essence, that the Commission, in reviewing the tax rulings, had not engaged in any tax harmonisation but simply exercised the power conferred on it by Article 107(1) TFEU.

59. As regards the second and third series of pleas, the General Court set out in paragraph 230 of its judgment that, where some of the grounds underlying a decision can provide a sufficient legal basis for the decision by themselves, any errors in the other grounds have no effect on its operative part. The General Court first examined the limited reference framework, posited as consisting of Articles 164 and 166 of the LIR, and already finds an unjustifiable derogation from that reference framework alone. In agreement with the Commission, it expressed the view that the Commission was not required to extend the reference framework to include the provisions of the parent-subsidiary directive, particularly since the situation in question was purely internal (paragraph 263 et seq.). It held that the Commission had therefore been right to consider that the tax rulings had derogated from the reference framework consisting of Articles 164 and 166 of the LIR, meaning that the tax rulings represented an endorsement of an error in the application of the law (paragraph 288 et seq.).

60. As regards the alleged absence of a selective advantage in the light of the anti-abuse rule, the General Court stated that the Commission had sufficiently demonstrated that all the criteria necessary under Luxembourg law to establish an abuse of law were met: the use of forms or institutions governed by private law, the reduction in the tax burden, the use of inappropriate legal means and the absence of non-tax related reasons (paragraph 384 et seq., especially paragraph 410 et seq.).

61. Regarding the fourth series of pleas, the General Court held (paragraph 212 et seq.) that the tax rulings had been issued by the Luxembourg tax authorities and resulted in a reduction in the tax burden generally included in the budget of an undertaking, so that neither imputability to the Grand Duchy of Luxembourg nor the commitment of State resources was lacking.

62. With regard to the fifth series of pleas, the General Court stated (paragraph 479 et seq.) that the Commission was able to consider a measure applying a general scheme as individual aid without first being required to demonstrate that the provisions on which that scheme was based constituted an aid scheme, even if that was the case.

63. Lastly, in respect of the sixth series of pleas (paragraph 489 et seq.), the General Court held that the Commission had not infringed the general principles of legal certainty and the protection of legitimate expectations by ordering the Grand Duchy of Luxembourg to recover the aid. In particular, it held that undertakings to which aid had been granted may not, in principle, entertain a legitimate expectation that the aid was lawful unless it had been granted in compliance with the procedure provided for in Article 108 TFEU.

IV. The procedure before the Court

64. On 22 July 2021, Engie lodged the present appeal (Case C‑454/21 P) against the judgment of the General Court. Engie claims that the Court should:

– declare the present appeal admissible and well founded;

– set aside the judgment of the General Court of the European Union of 12 May 2021 in Joined Cases T‑516/18 and T‑525/18, Luxembourg and Engie Global LNG Holding and Others v Commission;

– give a final ruling on the substance in accordance with Article 61 of the Statute of the Court of Justice and, principally, grant the form of order sought by Engie at first instance or, in the alternative, annul Article 2 of Commission Decision (EU) 2019/421 of 20 June 2018 on State aid SA.44888 (2016/C) (ex 2016/NN) implemented by Luxembourg in favour of ENGIE (OJ 2019 L 78, p. 1), in so far as it orders the recovery of the aid;

– in the further alternative, refer the case back to the General Court;

– order the Commission to pay all the costs.

65. On 21 July 2021, the Grand Duchy of Luxembourg lodged the present appeal (Case C‑451/21 P) against the judgment of the General Court. Luxembourg claims that the Court should:

– set aside the judgment of the General Court of the European Union of 12 May 2021 in Joined Cases T‑516/18 and T‑525/18, Luxembourg and Engie Global LNG Holding and Others v Commission;

– principally, give final judgment in the matter, in accordance with Article 61 of the Statute of the Court of Justice, and uphold the forms of order sought by Luxembourg at first instance by annulling Commission Decision (EU) 2019/421 of 20 June 2018 on State aid SA.44888 (2016/C) (ex 2016/NN) implemented by Luxembourg;

– in the alternative, refer the case back to the General Court;

– order the Commission to pay the costs incurred by the Grand Duchy of Luxembourg.

66. The Commission contends, in both cases, that the Court should dismiss the appeals and order the appellants to pay the costs.

67. All the parties submitted written observations on the appeal before the Court and presented oral arguments together on 30 January 2023.

V. Legal assessment

68. In support of the appeal, Engie relies on three grounds of appeal and Luxembourg on four, which overlap in substance. In examining the grounds of appeal, I shall begin with those relied on by Engie (Sections A, B and C) and end with those relied on in addition by Luxembourg (Section D). I shall confine myself by way of example to the set of tax rulings concerning LNG Holding, since the ZORA relating to them has at least been partially converted. The remarks are also applicable to the second set of tax rulings concerning GSTM.

A. The first ground of appeal: incorrect interpretation of Article 107(1) TFEU in the context of the limited reference framework

69. By its first ground of appeal, Engie alleges (as does Luxembourg) that the General Court erred in law in interpreting Article 107(1) TFEU, particularly in its definition of the reference framework. The General Court had held that the tax rulings in favour of Engie derogated from the reference framework limited to Articles 164 and 166 of the LIR.

70. According to the settled case-law of the Court, classification as ‘State aid’ within the meaning of Article 107(1) TFEU requires that, first, there be intervention by the State or through State resources. Second, the intervention must be liable to affect trade between Member States. Third, it must confer a selective advantage on the beneficiary. Fourth, it must distort, or threaten to distort, competition.

71. In this instance, it is necessary only to review the General Court’s observations on the criterion of selective advantage. According to the Court’s settled case-law, for tax measures, selectivity has to be determined in several stages. The first step is to identify the ordinary or ‘normal’ tax system applicable in the Member State concerned (the ‘reference framework’). The second step is to judge, on the basis of that ordinary or ‘normal’ tax system, whether the tax measure at issue is a derogation from that ordinary system, in so far as it differentiates between operators which, in the light of the objective pursued by the ordinary system, are in a comparable factual and legal situation. If a derogation from ‘normal taxation’ has been established, the last step is to assess whether the derogation is justified.

72. In that process, the basis for determining the reference framework can only ever be the national legislature’s decision as to what it deems to be ‘normal’ taxation. Fundamental taxation decisions, particularly the decisions about taxation techniques but also the objectives and principles of taxation, are therefore for the Member State to make. It follows that neither the Commission nor the Court can judge national tax law by some ideal or fictitious tax system.

73. Since the determination of the reference system constitutes the starting point for the comparative examination to be carried out in the context of the assessment of selectivity, an error made in that determination necessarily vitiates the whole of the analysis of the condition relating to selectivity.

1. Findings of the General Court

74. The General Court found in paragraph 292 et seq. that Article 166 of the LIR did not make the grant of the participation exemption at the level of the parent company formally dependent on the taxation of distributed profits at the level of the subsidiary. It specified that, however, the link between Article 166 and Article 164 of the LIR meant that the participation exemption under Article 166 of the LIR was applicable solely to income which had not been deducted from the taxable income of the subsidiary (paragraph 297).

75. Additionally, the General Court found, although the ZORA accretions were not, formally speaking, profit distributions within the meaning of Article 164 of the LIR, the participation income exempted at the level of the parent companies nonetheless corresponded, in essence, to the amount of the accretions, so that those accretions corresponded in practical terms, in the specific circumstances of the present case, to profit distributions (paragraph 300).

76. The General Court found in paragraph 327 that, by confirming the exemption of participation income at the level of the parent companies in the tax rulings, income corresponding, from an economic perspective, to the amount of the ZORA accretions, deducted as expenses at the level of the subsidiaries, the Luxembourg tax authorities had derogated from the reference framework comprising Articles 164 and 166 of the LIR.

2. Assessment

77. Hence, Engie and Luxembourg allege that General Court erred in law and distorted the facts in these findings. They submit that the General Court was wrong to assume a link between Article 164 and Article 166 of the LIR when, in agreement with the Commission, it deemed that the Luxembourg tax rulings constituted State aid. It therefore needs to be clarified whether the General Court erred in law when it confirmed the reference system which the Commission had used in the decision at issue.

78. Correct determination of the applicable reference framework requires an interpretation of the Luxembourg tax law (LIR). The Commission objected to the admissibility of that limb of the plea on the ground that it concerned questions of fact. It is true that the assessment of facts – including, in principle, the General Court’s findings on national law – and evidence does not constitute a question of law which the Court can review in the context of an appeal. The Court has jurisdiction only to determine whether that law was distorted. However, the Court can assess the legal classification which has been given to national law by the General Court in the light of a provision of EU law. That is pivotal within the scope of Article 107(1) TFEU, since the selective advantage necessary to identify State aid arises only from a derogation from the ‘normal’ national tax system, the reference system.

79. Accordingly, State aid law recognises that the question whether the General Court adequately identified and defined the reference system arising from national law is a question of law. As such, it can be subject to review by the Court on appeal. An argument seeking to challenge the choice of appropriate reference system made in the first step of assessing the existence of a selective advantage is therefore admissible in the context of appeal proceedings.

80. As the arguments put forward by Engie and Luxembourg seek to challenge the existence assumed by the General Court of a principle of correspondence under Article 164 of the LIR, read in conjunction with Article 166 thereof, as the reference system for identifying State aid, the first limb of the second ground of appeal is admissible. The Court thus does have jurisdiction to examine in appeal proceedings the question in law as to whether the General Court correctly identified and applied the principle of correspondence in Luxembourg law as part of the reference system.

81. This being the case, I shall first elucidate the pivotal selective advantage (point (a)). Next, the standard of review for assessing tax rulings needs to be determined (point (b)). The reasoning of the General Court in determining the pivotal reference framework will be examined on that basis (points (c) and (d)). Since the Commission, at the hearing, questioned the consistency of Luxembourg tax law as such, I shall then consider whether a possible absence of a substantive correspondence clause in national law may constitute State aid (point (e)).

(a) The pivotal selective advantage

82. In the decision at issue, the Commission considers that there is a selective advantage because, in its view, there is a compelling link between Article 164 and Article 166 of the LIR. The Commission and, subsequently, the General Court have demonstrated that the financial structure chosen by the Engie group in derogation from normal corporate taxation largely results in the non-taxation of the profits made at the level of the subsidiaries if those subsidiaries make a profit. Both, however, overlook the fact that – also in derogation from normal corporate taxation – tax is levied even when the subsidiary makes a loss, as was evidently the case for LNG Supply in 2015 and 2016.

83. This is because what is taxed is always the margin agreed with the fiscal authorities, which is calculated at least on the basis of turnover, irrespective of any profits. By contrast, the Commission and, subsequently, the General Court emphasise that, at the level of the parent companies, where the profits ultimately accrued when the ZORA was converted, the participation exemption provided for in Article 166 of the LIR could be used even though those profits had not been ‘taxed’ at the level of the subsidiary in accordance with Article 164 of the LIR.

84. The Commission has therefore neither examined nor disputed the agreement of a margin intended, according to the tax rulings, to be the sole basis of assessment at the level of the subsidiaries. The question whether that method, which diverges from normal corporate taxation (balance-sheet or turnover-based taxation rather than comparison of book values), constitutes a selective advantage was not examined. Nor did the Commission either raise or examine the question whether that particular method under Luxembourg tax law was available to all comparable taxpayers. The same applies to the percentages set in that context. It remains unclear how these are calculated and what reasoning might justify their level.

85. This margin taxation, which particularly influences the value of the ZORA accretions, was thus not included in the subject matter of either the decision at issue or the judgment under appeal and cannot therefore be examined by the Court. However, the Commission remains free to remedy that situation in a new State aid decision, provided that the limitation period has not expired.

(b) Tax rulings as subject to review for compliance with State aid law and the applicable standard of review

86. Rather than pursue the above point, the Commission explicitly states in its decision that the State aid is derived from the tax rulings issued to the Engie group. It is not the group relief under Article 166 of the LIR (that is, the tax exemption of profit distributions within a group) as such but its application that is supposed to be problematic in terms of State aid law in this particular case. The Commission relies in that respect, albeit not explicitly, on an error in the application of the law by the Luxembourg authorities. That is drawn from the remarks on the narrow reference framework, which the Commission sees as consisting of Articles 164 and 166 of the LIR.

87. The General Court concurs with that view in assuming that the State aid identified by the Commission consists of the misapplication of Article 164 of the LIR, read in conjunction with Article 166 thereof, because a principle of correspondence can be inferred from Luxembourg corporate tax law. What is meant by this is that tax exemption at the level of the receiving parent company depends on the sums distributed having previously been taxed at the level of the subsidiary.

88. As a preliminary point, it must be pointed out that tax rulings do not, in themselves, constitute illegal State aid within the meaning of Article 107(1) TFEU. They are an important instrument for creating legal certainty, as the Commission itself acknowledges. The principle of legal certainty is a general principle of EU law. Tax rulings are therefore unproblematic in terms of State aid law as long as they are open to all taxpayers (usually upon request) and – like any other tax assessment – are in line with the relevant tax law. In that respect, they simply pre-empt the outcome of a later tax assessment.

89. However, if the tax ruling is reviewed for compliance with State aid law, the question arises as to whether any derogation from the tax law favourable to the taxpayer (meaning any erroneous tax ruling which benefits the taxpayer) may constitute State aid within the meaning of the Treaties. Strictly speaking, such an interpretation would be covered by the wording of Article 107(1) TFEU.

90. However, it contradicts the standard of review developed by the Court for State aid schemes in the form of general tax laws. The Court has emphasised that, given the current state of harmonisation of EU tax law, the Member States are free to establish the system of taxation which they deem most appropriate, and that this explicitly applies to the area of State aid. That discretion enjoyed by the Member States extends to determining the constitutive characteristics of each tax. This includes, in particular, the choice of tax rate, which may be proportional or progressive, and also the determination of the basis of assessment and the taxable event. The decision as to which foreign taxes can be set off against domestic tax liability and under which conditions this should be possible is another such decision of a general nature, which falls within the discretion of the Member State to determine the constitutive characteristics of its taxes. The same applies to the implementation and configuration of the arm’s length principle for transactions between affiliated companies.

91. However, that discretion enjoyed by the Member States would exceed its limits if they abused their tax law in order to grant advantages to individual undertakings in circumvention of the rules on State aid. Such an abuse of fiscal autonomy can be assumed when tax law is configured in an obviously inconsistent manner – as happened in the case of Gibraltar, for example. In its more recent case-law, therefore, the Court subjects general taxation decisions to scrutiny for compliance with State aid law only if they have been designed in a manifestly discriminatory manner, with the aim of circumventing the requirements of EU law on State aid.

92. There is no apparent reason not to transpose that case-law to situations where the law is misapplied in favour of the taxpayer. It follows, then, that not any incorrect tax ruling but only those which are manifestly erroneous in favour of the taxpayer constitute a selective advantage. Derogations from the applicable national reference framework are manifestly erroneous if they cannot be plausibly explained to a third party, such as the Commission or the Courts of the European Union, and are therefore equally evident to the taxpayer concerned. In such cases, State aid law can be considered to have been circumvented by means of a manifestly discriminatory manner of applying the law. The questions raised in the hearing as to whether elements of the Luxembourg legal literature or a Luxembourg court of first instance really interpret Luxembourg tax law differently from the fiscal authorities and other elements of the Luxembourg legal literature can then be left unanswered.

93. Nor should there be any fear that the Commission and the Courts of the European Union might become overburdened with correctly interpreting 27 different tax regimes in detail.

94. That overburdening is already evident in the present proceedings. The Commission’s reasoning, which the General Court found to be correct, is based on a different interpretation of Articles 164 and 164 of the LIR than that set out by Engie and, above all, Luxembourg. The General Court’s statements on the combined reading of Articles 164 and 166 of the LIR reveal that it had difficulties with the role of ‘second tax court of Luxembourg’. In paragraph 294 of the judgment under appeal, for example, the General Court mentions that Article 164 of the LIR provides for the taxation of income generated by a company, ‘irrespective of whether that income is distributed. Pursuant to the third paragraph of Article 164 of the LIR, that income also includes hidden profit distributions.’

95. According to its wording, however, Article 164 of the LIR concerns not the taxation of income but the definition of the basis of assessment at the level of the subsidiary. It says nothing about whether any income is taxed. The taxation of income is likely instead to follow from the particular taxable event and the applicability or non-applicability of tax exemption provisions which are set down elsewhere.

96. In addition, a broad interpretation of Article 107 TFEU – so that all erroneous tax rulings that benefit the taxpayer are considered selective advantages – would give rise to the following further problem: errors can occur when issuing tax rulings, just as they can when issuing any tax assessment. However, it is for the national fiscal authorities and the national courts to assess whether or not such a tax assessment is correct. If every simple error in the setting of tax suffices to be considered an infringement of State aid law, the Commission would consequently become a de facto supreme inspector of taxes and the Courts of the European Union, by dint of reviewing the Commission’s decisions, would become de facto supreme tax courts.

97. That, in turn, would impinge on the Member States’ fiscal autonomy, as indeed indicated by the first series of pleas in the main proceedings. Those speak of disguised tax harmonisation. Luxembourg’s third ground of appeal also sees the review for compliance with State aid law of tax assessments and tax laws concerning non-harmonised taxes as an encroachment on its fiscal autonomy.

98. The Court has already addressed these considerations elsewhere. For instance, Advocate General Pikamäe has explained that what governs the setting of ‘normal’ taxation are the rules of positive law. In order to avoid any encroachment on the exclusive competence of the Member States in the area of direct taxation, the existence of an advantage within the meaning of Article 107 TFEU can be verified only by reference to the normative framework outlined by the national legislature in the actual exercise of that competence. In applying that normative framework, he writes, the national tax authorities need to be allowed a margin of appreciation in, for example, transfer pricing.

99. The Court emphasises on that point that parameters and rules external to the national tax system at issue cannot be taken into account in the examination of the existence of a selective tax advantage within the meaning of Article 107(1) TFEU and for the purposes of establishing the tax burden that should normally be borne by an undertaking, unless that national tax system makes explicit reference to them. This is an expression of the principle of fiscal legality, which forms part of the EU legal order as a general principle of law. It demands that any obligation to pay a tax and all the essential elements defining the substantive features thereof must be provided for by law. The taxable person must be in a position to foresee and calculate the amount of tax due and determine the point at which it becomes payable. The Court moreover emphasises that any fixing of the methods and criteria for determining an ‘arm’s length’ outcome falls within the discretion of the Member States.

100. Such limited reviewing of national law is thus required not least in the light of taxpayers’ interest in legal certainty. As set out above (point 88 et seq.), tax rulings are, even more than other tax assessments, important instruments for creating legal certainty. Both the principle of legal certainty and the associated institution of the finality of administrative acts would be devalued if every erroneous tax assessment (advance tax rulings as well as normal tax assessments) might be considered an infringement of State aid law.

101. In the light of the case-law cited above (point 90 et seq.), I therefore take the view that individual tax assessments (whether normal tax assessments or advance tax rulings) should be reviewed only on the basis of a restricted standard of review that is limited to a plausibility check. That will mean that not every error in the application of national tax law is evidence of a selective advantage. Thus, only the manifest derogation in favour of the taxpayer of a tax ruling (or tax assessment) from the reference framework encompassing the national tax law can constitute a selective advantage. In the absence of such a manifest derogation, the tax assessment may be unlawful, but a possible derogation from the reference framework does not by itself mean that it constitutes State aid within the meaning of Article 107 TFEU.

(c) The existence of a correctly determined reference framework (Article 164 of the LIR, read in conjunction with Article 166 thereof)

102. It follows that the Court is not required to examine whether the legal consequence granted in the tax rulings and contested by the Commission actually follows from Luxembourg tax law. The only decisive factor is whether that legal consequence manifestly does not follow from Luxembourg tax law.

103.This would be the case if a principle of correspondence manifestly followed from Article 164 of the LIR, read in conjunction with Article 166 thereof, as the Commission and the General Court held to be the applicable reference framework.

(1) Non-inclusion of the parent-subsidiary directive in the reference framework (first limb of Engie’s first ground of appeal)

104. It is not objectionable, contrary to the view of Engie and Luxembourg, that the parent-subsidiary-directive was not included in the reference framework. It is true that, until its amendment in 2014, the parent-subsidiary directive did not require prior taxation of profits at the level of the subsidiary as a condition for exempting capital income at the level of the parent company from tax.

105. However, the reference framework must be determined on the basis of applied national law. An EU directive cannot, in principle, be applied directly to the taxpayer (in this case Engie), since it is addressed to the Member State. Moreover, since no cross-border situation was involved (all the companies concerned being established in Luxembourg), the matter did not fall within the material scope of the directive. Consequently, the appropriate reference framework is Luxembourg law alone (in this case, Articles 164 and 166 of the LIR).

106. This does not mean, however, that the parent-subsidiary directive is without relevance. As was reiterated at the hearing, Article 166 of the LIR transposes the parent-subsidiary directive into Luxembourg law and governs both cross-border and internal situations. That must certainly be taken into account when interpreting the reference framework.

(2) Link between Article 164 and Article 166 of the LIR in Luxembourg law (the ‘principle of correspondence’)

107. Engie’s and Luxembourg’s appeal is furthermore directed against the Commission’s finding of a compelling link between Article 164 and Article 166 of the LIR. If such a link did exist, the use of tax exemptions for participation income would depend under Luxembourg law on taxation at the level of the subsidiary. The application of group relief (tax exemption of profit distributions within a group) could then constitute an error in the application of the law, since the ZORA accretions were not included in the basis of assessment for taxation at the level of the subsidiary.

108. The question therefore arises whether the tax law of the Grand Duchy of Luxembourg actually requires such corresponding taxation. Only then would the General Court not have erred in law in holding that to be the correct reference framework (for in-depth discussion of this, see point 78 et seq. above). When the reduced standard of review suggested above is applied, the question can quite clearly be answered in the negative, since the existence of such a link is certainly not manifest.

109. The wording in national law (Articles 164 and 166 of the LIR) contains no link between the two provisions. On the contrary, they each relate to different types of taxpayer. They do not make it clear that hidden profit distribution under Article 164(3) of the LIR, such as, for example, increased interest payments for shareholder loans (which are added back into the calculation of the basis for assessment at the level of the subsidiary), should be treated at tax-exempt participation income under Article 166 of the LIR. Nor, conversely, do they state that tax-exempt income under Article 166 of the LIR should be treated as profit appropriation within the meaning of Article 164 of the LIR.

110. That interpretation of Articles 164 and 166 of the LIR ‘proposed’ by the Commission, which the General Court adopted, may well be possible, but it does not follow from the wording of the national law. The opposite (that there is no principle of correspondence, as argued by Luxembourg and Engie) is also possible and, indeed, is more closely in line with the wording. Given that Article 166 of the LIR constitutes a transposition of the parent-subsidiary directive and the latter did not provide for a correspondence clause when the tax rulings were issued, an interpretation in line with the directive also argues against the General Court’s interpretation of Article 166 of the LIR.

111. That conclusion is even confirmed by the Commission’s decision and the judgment of the General Court. Each of them also reasoned, in the alternative, that non-application of the anti-abuse rule (Article 6 of the StAnpG) would create a selective advantage and affirmed that that had happened. Logically, however, that reasoning and that conclusion are possible only if the legal conditions for ‘double non-taxation’ were met at the level of the subsidiary and the parent company. It therefore seems that both the Commission and the General Court had doubts as to whether their own interpretation of Articles 164 and 166 of the LIR was necessarily (and therefore manifestly) correct.

112. Moreover, misapplication of Articles 164 and 166 of the LIR on the part of the fiscal authority can never be an abusive arrangement on the part of the taxpayer under Article 6 of the StAnpG.

113. The interpretation that Luxembourg relies on in the tax rulings is thus by no means a manifestly erroneous interpretation of national law. The Commission and the General Court therefore proceeded on the basis of an incorrect reference framework, since the reference framework they relied on is not manifestly apparent from Luxembourg law.

114. According to settled case-law, an error in determining the reference system necessarily vitiates the entire analysis of the condition relating to selectivity. Consequently, the appeals lodged by Engie and Luxembourg are already well founded for that reason.

(d) In the alternative: is there a principle of correspondence based on an interpretation of Article 164 of the LIR, read in conjunction with Article 166 thereof?

115. If, on the other hand, the standard of review were not reduced to manifest errors in the tax rulings, the Court would have to decide in detail how Articles 164 and 166 of the LIR were to be correctly interpreted in order to assess whether the General Court had relied on the correct reference framework. That would require an in-depth knowledge of Luxembourg tax law which I do not claim to possess. Nonetheless, I doubt that a principle of correspondence could actually be inferred – as the Commission and the General Court did in paragraph 292 et seq. – from a combined reading of Articles 164 and 166 of the LIR. I substantiate these doubts below with my interpretation, in the alternative, of Luxembourg tax law.

116. As already set out above (point 109), the wording argues against a principle of correspondence. Article 166(1) of the LIR made no direct reference to Article 164 of the LIR. It can be assumed that Article 166(1) of the LIR exhaustively governs the conditions under which participation exemptions are granted. It refers only to a minimum holding period and a minimum amount for the participation, however, and not to any requirement for the distributed profits to have been previously taxed. Moreover, it cannot be inferred from Article 164 of the LIR that the distributed income must be taxed at the level of the subsidiary. Notably, Article 164 of the LIR concerns only the basis of assessment (see point 95 above) of the subsidiary. The basis of assessment and tax liability are two different matters in tax law.

117. Furthermore, the spirit and purpose of the two provisions do not necessarily require such correspondence either. That is already clear from the parent-subsidiary directive, which likewise did not contain that condition until it was amended in 2014. The parent-subsidiary directive may not have been perfect without such a correspondence rule, but its provisions nonetheless made sense and were not inconsistent. Since Article 166 of the LIR transposes the parent-subsidiary directive in Luxembourg, without differentiating between cross-border and internal distributions, that assertion from the parent-subsidiary directive (no principle of correspondence when the tax rulings were issued) can be applied to the interpretation of Article 166 of the LIR.

118. Unfortunately, Luxembourg had only limited success in precisely explaining the purpose of Article 166 of the LIR at the hearing. However, the Commission’s assertion that Article 166 of the LIR is inconsistent and has no purpose of its own is not convincing either. Group relief (as provided for in Article 166 of the LIR) usually has two purposes. For one thing, it prevents the economic double taxation of already taxed income. For another, it ensures that a (taxpayer- or object-based) tax exemption at the level of the subsidiary remains in place if the subsidiary distributes its (then tax-exempt) profit to the shareholder (parent company). That makes it possible to achieve some equality of treatment between simple and multi-layered corporate structures and thus a certain level of neutrality as far as legal and organisational forms are concerned. That also seems to me to be the purpose of the rules laid down in Article 166 of the LIR within Luxembourg law. It thus also argues against the existence of a far-reaching and unwritten principle of correspondence.

119. The same applies in consideration of the principle of individual taxation (Subjektsteuerprinzip), on which income taxes are usually based. The taxation of one taxpayer does not normally depend on the actual taxation of another. The legislature can certainly introduce such correspondence within certain limits. Then, however, the requirement of legal enactment in tax law (a classic field in which the executive has a right to intervene) demands that that correspondence be reflected in the wording of the law.

120. Contrary to the remarks made by the Commission – and subsequently by the General Court – an unwritten principle of correspondence does not necessarily follow from the Grand Duchy of Luxembourg’s reply of 31 January 2018 either, which was set out in recital 202 of the Commission’s decision. According to that reply, all the participations the income of which can benefit from the exemption under Article 166 of the LIR are also covered by Article 164 of the LIR. This, however, says nothing about prior taxation at the level of the subsidiaries but only confirms that the distribution itself must not lead to a reduction in the basis of assessment for taxation.

121. Lastly, a compelling link cannot be derived from the – presumably non-binding – Opinion of the Conseil d’État (Luxembourg Council of State) of 2 April 1965 on the legislative draft of Article 166 of the LIR. It may be that the purpose of group relief in Luxembourg law is to avoid multiple taxation. However, contrary to the remarks made by the General Court, that does not mean that Luxembourg law would not accept double non-taxation in a specific individual case. The parent-subsidiary directive, for example, sought to avoid double taxation and, as a result of its lack of a correspondence clause, accepted the possibility of double non-taxation until it was amended in 2014.

122. All of that shows that the unwritten principle of correspondence relied on by the Commission and the General Court cannot be inferred from Luxembourg law as the reference system. To do so might indeed make it possible to close gaps in taxation occurring, for example, as a result of hybrid means of financing. However, as the Court has already held on several occasions, EU institutions such as the Commission or the General Court cannot use State aid law to shape some ideal tax law. In non-harmonised tax law, that is ultimately the task of the national legislature.

123. Ultimately, in determining and applying the reference framework, the Commission and, subsequently, the General Court overlooked the fact that the supposed double non-taxation did not occur as a result of application of Articles 164 and 166 of the LIR. For one thing, the subsidiaries are taxed, though very little. For another, even if the ZORA accretions were to be regarded as (open or hidden) profit distributions at the level of the subsidiary, Article 164 of the LIR would not be relevant. It would be only if the ZORA accretions had reduced the basis of assessment for taxation. They may have done so within the framework of normal corporate taxation. In this case, however, the certainly strange result (very low taxation of the operating subsidiaries) was caused solely by the margin taxation which was agreed with the Luxembourg fiscal authorities.

124. Consequently, the Commission and the General Court relied on the wrong reference framework (Articles 164 and 166 of the LIR instead of the legal basis for margin taxation) and then even interpreted it incorrectly (by assuming an unwritten principle of correspondence). The entire analysis of the condition relating to selectivity is thus vitiated. In that respect too, the appeals lodged by Engie and Luxembourg are well founded.

(e) Is Luxembourg tax law inconsistent because of the absence of a substantive correspondence clause?

125. Lastly, the Commission further suggested that, in the absence of such a correspondence clause, Luxembourg tax law was inconsistent and therefore constituted State aid in itself.

126. This, however, has no bearing on the conclusion drawn above (point 124), for two reasons. First, the Commission decision at issue and the judgment of the General Court under appeal are concerned not with the Luxembourg law as an aid scheme but only with the tax rulings as individual aid (see also point 86 above). Consequently, the absence of a statutory correspondence clause is not part of the subject matter of the dispute.

127. Second, a national tax law which can lead to non-taxation if hybrid means of financing are used is not necessarily inconsistent.

128. The General Court did correctly point out in paragraph 293 of the judgment under appeal that, on the understanding explained above, double non-taxation of profits can occur under Luxembourg tax law. The tax exemption at the level of the company receiving the distribution under point 2 of Article 166(1) of the LIR does indeed seem to be independent of what happens, in terms of taxation, to the distributed profits at the level of the distributing company. However, that does not cross the line into inconsistency.

129. For one thing, group relief of that kind (that is, tax exemption of profit distributions within a group) is widespread and common internationally. That is apparent, in the cross-border context, from the existence of the parent-subsidiary directive, which is based on a similar idea and also lacked a substantive correspondence clause until 2014. For another thing, the Member States are, in principle, free to decide the precise form of such group relief as they see fit. In that respect, the case-law of the Court on national set-off rules in the cross-border context, the precise form of which is also a matter for the Member States, can be transposed to this situation.

130. It is true that, from the perspective of legal policy and against the background of global efforts to work towards a fair tax system, ‘stateless’ or untaxed income should be prevented wherever possible. Neutralising such – especially cross-border – incongruities in taxation is a concern pursued by both the OECD and the EU.

131. In the present case, however, it is in the first place doubtful whether one can speak of ‘untaxed’ income at all, as the subsidiary’s profits do not go entirely untaxed. Rather, they are taxed in a different manner (special margin taxation) according to the tax rulings. In the second place, the OECD and EU measures are directed exclusively at hybrid mismatch arrangements resulting from the (non-concerted) interaction of different Member States’ or third countries’ corporate income tax systems. They do not cover the kind of incongruities that have their origin in purely domestic tax systems. In that respect, it may well be desirable in terms of legal policy, and has now become widespread internationally, to prevent the occurrence of untaxed income by means of specific substantive correspondence clauses.

132. Indeed, such a clause has evidently been introduced in Luxembourg for the future, to transpose the parent-subsidiary directive amended in 2014. However, that changes only the reference framework for the future.

133. Consequently, the decision remains a matter for the national legislature. It – and not the Commission or the Courts of the European Union – must decide whether and in what situations a substantive correspondence clause should be introduced.

3. Summary regarding the first ground of appeal

134. In conclusion, therefore, only the Luxembourg legislature could, by passing a law to that effect, have ensured that corresponding taxation between the distributing and receiving corporations formed the reference framework for normal taxation in Luxembourg. Since that was not done, or was not done until later, the Commission relied on a possibly preferable but ultimately fictitious tax system instead of the applicable national tax law. As already set out above (point 72 et seq.), that is not permitted by State aid law.

135. Consequently, the first ground of appeal is well founded. The General Court erred in law in assuming a compelling link between Article 164 and Article 166 of the LIR, and therefore a principle of correspondence, when determining the reference framework. That link is neither manifest (point 107 et seq.) nor, upon closer examination, can it be inferred from the wording of the national provisions, their spirit and purpose, or the settled case-law of the Luxembourg courts (point 115 et seq.).

B. The second ground of appeal: incorrect interpretation of Article 107 TFEU by using Article 6 of the StAnpG as a reference framework

136. In an alternative line of argument, the General Court rejected another plea partly because it held that the Luxembourg tax authorities had not applied the general anti-abuse rule contained in Article 6 of the StAnpG despite the conditions for it being satisfied.

137. In their second ground of appeal, therefore, Engie and Luxembourg therefore allege that the General Court erred in law in rejecting their plea at first instance, claiming that there had been no infringement of Article 107 TFEU. The non-application of Article 6 of the StAnpG in the present case, they argue, does not constitute a derogation from the reference framework comprising Luxembourg law.

138. Under the Luxembourg general anti-abuse rule contained in Article 6 of the StAnpG, tax obligations cannot be circumvented or restricted by abuse of the forms and structural possibilities afforded by civil law. In the event of abuse, taxes are to be levied in the same way as they would be within a legal structure appropriate to the economic transactions, facts and circumstances concerned.

139. In the case under consideration, the Court must for the first time address the question whether the misapplication or non-application of a general national anti-abuse rule in tax law (Article 6 of the StAnpG in this case) constitutes State aid within the meaning of Article 107 TFEU.

1. Findings of the General Court

140. In paragraph 384 et seq., the General Court proceeds on the assumption that the Commission has demonstrated that the four conditions developed in Luxembourg case-law for identifying abuse under Article 6 of the StAnpG are fulfilled. Moreover, it considers, there was no need to take Luxembourg administrative practice into account, since the provision on abuse of law raised no difficulties of interpretation (paragraph 409 of the judgment under appeal).

141. Specifically, the Commission and, subsequently, the General Court (paragraph 388) assume that other financial instruments (direct equity or debt instruments) were available which would not have led to non-taxation of the profits made at the level of the subsidiaries. The ZORA could, for example, have been issued directly by the relevant parent company to its own subsidiary. Using a convertible loan without the involvement of an intermediate company would also have resulted in appropriate taxation.

142. On that basis, the tax rulings should not have been issued in their current form. The Luxembourg tax authorities should instead, the General Court holds, have applied the general anti-abuse rule contained in Article 6 of the StAnpG. In the view of the General Court, the Grand Duchy of Luxembourg granted Engie a selective tax advantage by failing to apply that provision.

2. Assessment

143. Engie and Luxembourg contend that the General Court, in determining the reference framework, was wrong to assume that it had not been necessary for the Commission to take Luxembourg administrative practice into account. In addition, they argue, the Commission and the General Court made several manifest errors of interpretation and application in interpreting the four cumulative conditions for identifying abuse and in characterising the specific facts of the case as meeting those conditions.

144. Since the Commission and, subsequently, the General Court allege an infringement of the prohibition on State aid by reason of the non-application of a general anti-abuse rule, it is first necessary to discuss that approach and the applicable standard of review (point (a)) so that the correct reference framework can be determined. I shall go on to investigate whether the General Court relied on the correct reference framework in the present case (point (b)).

(a) Review for compliance with State aid law of the application of general anti-abuse rules in tax law

145. Only if the Luxembourg tax authorities would have had to apply the general anti-abuse rule laid down in Article 6 of the StAnpG when issuing the tax rulings would it be worth considering whether they derogated from that reference framework (Article 6 of the StAnpG). In that respect too, however, the Commission and the General Court ultimately allege only a simple error in the application of Luxembourg law. This, however, is not enough to establish a selective advantage (see point 89 et seq. above).

146. Moreover, there is necessarily some leeway in the application of general anti-abuse rules (GAARs), similar to that which the tax authorities can use when determining the ‘correct’ transfer price.

147. Not only is the concept of abuse particularly subject to the assessments of each Member State’s legal system. A finding of abuse is moreover, by its very nature, highly dependent on the individual case.

148. In that respect, the assertion of the General Court in paragraph 409 of the judgment under appeal, according to which ‘the provision on abuse of law raised no difficulties of interpretation in the present case’, appears doubtful. There is probably no general anti-abuse rule in tax law that does not present difficulties of interpretation. That is all the more apparent given that interpreting the norms in Luxembourg tax law that had allegedly been misused was enough to present the General Court itself with difficulties (see point 94 et seq. above.).

149. It is probable that the application of an anti-abuse rule is mandatory in very few cases. These can only be situations that are obvious because they have already been clarified in the financial case-law of the Member States (not the Commission or the General Court). That is all the more relevant in view of the fact that, according to the case-law of the Court, taxpayers are even free to choose, within the bounds of the law, the fiscal arrangements that are most favourable to them.

150. In view of the peculiarities of general anti-abuse rules, the standard of review for assessing the application of such rules for compliance with State aid law must certainly be reduced to a pure plausibility check. Such cases must therefore involve a manifest misapplication of the anti-abuse rule. That can be assumed where it is not possible to explain plausibly why the case in question should not be considered a matter of abuse.

(b) Application of these principles to the present case

151. Appropriately as a starting point, the Commission and, subsequently, the General Court (paragraph 398 et seq.) assumed a reference framework comprising Article 6 of the StAnpG. Under Article 6 of the StAnpG, abuse has occurred if four cumulative criteria are met, namely the use of forms or institutions governed by private law, the reduction in the tax burden, the use of inappropriate legal means and the absence of non-tax related reasons.