In this article we discuss position paper KG:024:2023:1 of February 16, 2023. In this position paper the Knowledge Group on dividend withholding tax and other withholding taxes answers the question whether the purchase of shares in its parent company by a subsidiary against admission of guilt in the form of shares in the subsidiary qualifies as an indirect purchase for the Dutch dividend withholding tax (DDWT) Act.

Reason

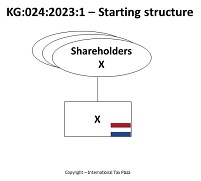

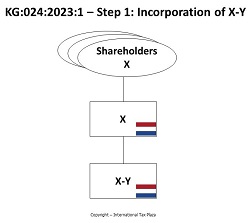

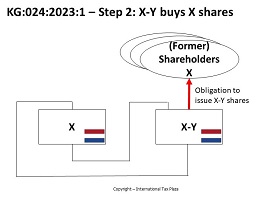

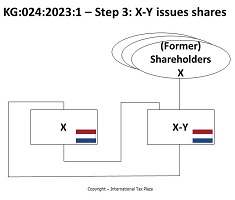

Companies X and Y intend to join forces. To this end, company X establishes a subsidiary (X-Y). The shareholders of X sell their X shares to the X-Y subsidiary. In return, the shareholders receive a claim against X-Y, which X-Y settles by issuing X-Y shares to the (former) shareholders of X. There will be no cash payment to the (former) shareholders of X.

Question

Does the purchase of the X-shares by the subsidiary X-Y against the admission of guilt to be settled in the form of X-Y-shares qualify as an intermediate share buyback for the purposes of the DDWT Act?

Answer

No, in this situation no transfer of assets from company X to its shareholders takes place, because the purchase of the shares in the parent company (X) by the subsidiary (X-Y) is accompanied by an obligation to at the same time issue shares in X-Y.

From the consideration of the tax authorities

As a result of the steps described above, X indirectly acquires shares in itself. This raises the question whether the acquisition of the X shares leads to an intermediate share buyback that is taxed under the DDWT Act.

Pursuant to Article 3, Paragraph 1, sub a of the DDWT Act a share buyback, other than for temporary portfolio investment purposes, is a taxable event for Dutch dividend withholding tax purposes. This is not only the case when a company buys back its own shares, but also when those shares are bought by a subsidiary. In that case an intermediate share buyback exists.

In DS March 14, 1979, ECLI:NL:PHR:1979:AX2762 the Dutch Supreme Court ruled as follows:

“That this means that, if such a subsidiary buys shares in its parent company, the value of the participation in the subsidiary and, consequently, the capital of the parent company is reduced with the amount that the subsidiary has to pay to the sellers to acquire the shares in the parent company, so that, if – like in the underlying case – the purchase price is covered by the profits that are present in the parent company, a shift capital as referred to above occurs.”

In such a situation, the withholding agent and the person that actually distributes the proceeds to the shareholders are therefore not the same legal entity. It is the parent company that is obliged to withhold (and that therefore is the withholding agent) since it is her capital that decreases as a result of the purchase/repurchase of its shares. Whereas it is the subsidiary that actually makes the proceeds available to the shareholders of its parent company.

Since the transfer of the shares in X takes place under the condition that X-Y issues shares to the (former) shareholders of X, in the underlying case, the acquisition by X-Y of the shares in its parent company X, against the issuance of shares X-Y, does not lead to a shift in capital whereby, on balance, any capital of X or X-Y flows to the (former) shareholders of X at the expense of equity of X-Y or a group company of X-Y.

The full Dutch text of the position paper can be found here.

Other position papers of the Knowledge Group on dividend withholding tax and (other) withholding taxes of which we already made an English summary can be found here.

Copyright – internationaltaxplaza.info

Follow International Tax Plaza on Twitter (@IntTaxPlaza)