On June 22, 2023 on the website of the Court of Justice of the European Union (CJEU) the judgment of the CJEU in the Joined Cases C-258/22, H Lebensversicherung, ECLI:EU:C:2023:506, was published.

Introduction

This request for a preliminary ruling concerns the interpretation of Article 63 TFEU.

The request has been made in proceedings between H Lebensversicherung and Finanzamt Hannover-Nord (Hanover-Nord Tax Office, Germany) (‘the tax authorities’) concerning the calculation of the basis of assessment for business tax due for 2001.

The dispute in the main proceedings and the question referred for a preliminary ruling

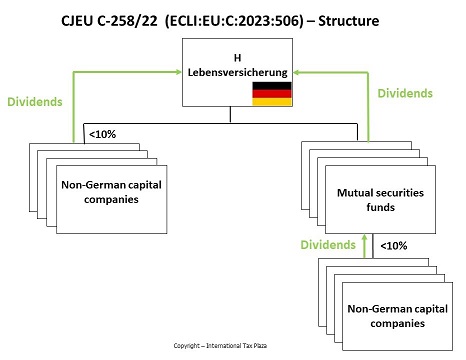

13 H Lebensversicherung is an establishment governed by public law and subject to corporation tax and business tax, which operates a life insurance undertaking. During the 2001 tax period, that establishment received dividends from a number of non-resident capital companies in which it held direct shareholdings of less than 10% of the capital, and dividends from its shareholdings in mutual securities funds. The distributions carried out by those funds were derived from dividends from non-resident capital companies in which those funds held shareholdings of less than 10% of the capital.

14 By a request made in April 2004, H Lebensversicherung exercised the right of option which life insurance and health insurance undertakings have under point 2 of the eighth sentence of Paragraph 34(7) of the new version of the KStG.

15 In calculating the basis of assessment for H Lebensversicherung’s business tax, the tax authorities, on the basis of the first sentence of Paragraph 7 of the Law on business tax, took as the operating profit the profit to be determined in accordance with the provisions of the Law on corporation tax. Due to the exercise of the right of option provided for in point 2 of the eighth sentence of Paragraph 34(7) of the new version of the KStG, as from the 2001 tax period, in accordance with Paragraph 8b(1) of the KStG, 20% of the dividends received by virtue of holdings of less than 10% in the capital of non-resident capital companies were not to be taken into account for the purposes of determining the taxable profit in respect of H Lebensversicherung’s corporation tax. However, that 20% of dividends, which was not taken into account when determining that taxable profit, was added back to the latter by the tax authorities pursuant to the first sentence of point 5 of Paragraph 8 of the Law on business tax. On that basis, those authorities determined separately the loss that could be carried forward by H Lebensversicherung to 31 December 2001.

16 By an action brought before the Niedersächsische Finanzgericht (Finance Court, Lower Saxony, Germany), H Lebensversicherung contested the application of the first sentence of point 5 of Paragraph 8 of the Law on business tax and the resulting add-back of 20% of the dividends, alleging a difference in treatment as compared with dividends from resident companies. In 2001, Paragraph 8b(1) of the KStG was not yet applicable to distributions of dividends carried out by resident capital companies, which, as regards those latter dividends, precluded such an add-back under point 5 of Paragraph 8 of the Law on business tax. H Lebensversicherung submits that the difference in the temporal applicability of that provision according to the registered office of the company distributing dividends gave rise to discrimination in situations involving a foreign component and constitutes an infringement of the free movement of capital.

17 Since that court upheld H Lebensversicherung’s action by a judgment of 25 January 2018, the tax authorities brought an appeal on a point of law (Revision) before the Bundesfinanzhof (Federal Finance Court, Germany), the referring court.

18 The Bundesfinanzhof (Federal Finance Court) states, in the first place, that the appeal on a point of law (Revision) should be allowed under national law and that the dividends received by H Lebensversicherung during the 2001 tax period by virtue of holdings of less than 10% in the capital of non-resident companies should be subject in full to business tax, like distributions from mutual securities funds, in so far as such distributions were themselves based on distributions from holdings of less than 10%.

19 The referring court explains that, in accordance with Paragraph 6 of the Law on business tax, the basis of assessment for business tax is to consist of the operating profit for the purposes of business tax and that, under Paragraph 7 of that law, that profit is established according to a two-stage calculation.

20 At the first stage of that calculation, the profit resulting from an industrial or commercial activity is determined in accordance with the provisions of the Law on income tax or of the Law on corporation tax. At the second stage, add-backs and reductions are carried out, respectively, under Paragraphs 8 and 9 of the Law on business tax.

21 Thus, since H Lebensversicherung exercised the right of option provided for in point 2 of the eighth sentence of Paragraph 34(7) of the new version of the KStG, Paragraph 8b(1) of the KStG must be applied to the dividends which H Lebensversicherung received, during the 2001 tax period, directly or indirectly from non-resident capital companies by means of holdings in investment funds, in such a way that, at the first stage of the calculation, only 80% of those dividends are taken into account in the profit resulting from the industrial or commercial activity.

22 At the second stage of the calculation, the 20% of the dividends from non-resident capital companies which was not taken into account at the first stage must be added back. Under point 5 of Paragraph 8 of the Law on business tax, which was applicable for the first time to the 2001 tax period, dividends which were not taken into account under Paragraph 8b(1) of the KStG are to be added back to the operating profit resulting from the industrial or commercial activity, in so far as they were deducted when determining that profit. The consequence of such an add-back is that all the dividends from holdings in those companies are subject to business tax.

23 In the second place, the referring court states that, during the 2001 tax period, the provisions according to which, at the first stage of the calculation of the basis of assessment for business tax, 20% of the dividends paid to H Lebensversicherung were not taken into account, were applicable only to dividends from holdings in non-resident companies. As regards dividends paid by resident capital companies, Paragraph 8b(1) of the KStG was applicable for the first time during the 2002 tax period. Therefore, dividends from holdings in resident companies paid during the 2001 tax period had to be taken into account in their entirety as from that first stage. Accordingly, at the second stage of that calculation, there was no need to carry out an add-back under point 5 of Paragraph 8 of the Law on business tax. Indeed, that latter provision applied only if and to the extent that the dividends in question were not taken into account under Paragraph 8b(1) of the KStG. Dividends from holdings in resident companies that were paid during the 2001 tax period were therefore, ultimately, subject in full to business tax.

24 In the third place, the Bundesfinanzhof (Federal Finance Court) states that, by a judgment of 6 March 2013, it held, in a similar case, that the fact that, unlike for dividends derived from holdings in resident companies, the add-back rule laid down in point 5 of Paragraph 8 of the Law on business tax applied for the first time to the 2001 tax period as regards dividends derived from holdings in non-resident companies, was contrary to the free movement of capital guaranteed under EU law.

25 That said, in the dispute in the main proceedings, the referring court has doubts as to whether the add-back of dividends from holdings in non-resident companies, required in respect of the 2001 tax period by point 5 of Paragraph 8 of the Law on business tax, constitutes a restriction on the free movement of capital. In its view, the application of that provision to dividends from holdings of less than 10% in the capital of non-resident companies did not have the effect of affording those dividends less favourable tax treatment than dividends from comparable holdings in resident companies. It states that, in both cases, dividends derived from holdings of less than 10% were entirely included in the basis of assessment for business tax. According to the referring court, the add-back of dividends from holdings in non-resident companies merely results in equal tax treatment between domestic and cross-border investments, since, without that add-back, dividends received during the 2001 tax period by virtue of holdings of less than 10% in non-resident companies would have benefited from more favourable business tax treatment than dividends received by virtue of comparable holdings in resident companies. Consequently, in its view, it appears unlikely that such differences during the two stages of the calculation of the basis of assessment for business tax, which have no bearing on the amount of the tax, could be such as to discourage investors that are subject to that tax from investing in non-resident companies.

26 Furthermore, the referring court states that it no longer maintains the position adopted in its judgment of 6 March 2013, referred to in paragraph 24 above, according to which a factual situation such as that at issue in the main proceedings is similar to the factual situation that was at issue in the case which gave rise to the judgment of 22 January 2009, STEKO Industriemontage (C‑377/07, EU:C:2009:29). It is true that the latter situation also concerned the application, in respect of the 2001 tax period, of Paragraph 8b of the KStG to income from holdings in non-resident capital companies. It observes, however, that, unlike in the situation at issue in the main proceedings, in the case which gave rise to the latter judgment, holdings in non-resident companies were subject, during the 2001 tax period, to higher corporation tax than corresponding holdings in resident companies. According to the referring court, in the present case, the add-back carried out under point 5 of Paragraph 8 of the Law on business tax for the purposes of business tax does not, ultimately, result in less favourable tax treatment for situations involving a foreign component.

27 In those circumstances, the Bundesfinanzhof (Federal Finance Court) decided to stay the proceedings and to refer the following question to the Court of Justice for a preliminary ruling:

‘Is Article 56(1) [EC] (now Article 63(1) [TFEU]) to be interpreted as precluding a provision of a Member State under which, when calculating the basis of assessment for a company’s business tax, dividends derived from holdings in foreign capital companies of less than 10% (“free-float holdings”) are to be added back to the basis of assessment for the tax if and to the extent that those dividends were deducted from the basis of assessment at a previous stage of the calculation, whereas, with regard to such dividends derived from free-float holdings in capital companies with their registered office in the Member State concerned, no deduction and, consequently, no add-back of the dividends is to take place when calculating the basis of assessment for business tax?’

Judgment

The CJEU (Sixth Chamber) ruled as follows:

Article 63 TFEU must be interpreted as not precluding legislation of a Member State under which, when calculating the basis of assessment for a company’s business tax, dividends from holdings of less than 10% in non-resident capital companies are to be added back to that basis of assessment, if and to the extent that those dividends were deducted from that basis of assessment at a previous stage of that calculation, whereas dividends from comparable holdings in resident capital companies are included from the outset in the abovementioned basis of assessment, without being deducted from or, consequently, added back to that basis of assessment.

Legal context

German Law on income tax

3 Under point 1 of Paragraph 20(1) of the Einkommensteuergesetz (Law on income tax), as amended by the Gesetz zur Fortentwicklung des Unternehmenssteuerrechts (Law on the further development of tax law in relation to undertakings) of 20 December 2001 (BGBl. 2001 I, p. 3858):

‘(1) Income from capital shall include:

1. shares of profits (dividends), yields and other proceeds from shares, rights of enjoyment to which the right to share in the profits and in the proceeds of the liquidation of a capital company is related, and from shares in limited liability companies, in trading and business cooperatives and in associations for the exploitation of mineral deposits which have the rights of a legal person.’

German Law on corporation tax

4 Paragraph 8b(1) and (3) of the Körperschaftsteuergesetz (Law on corporation tax), as amended by the Law on the further development of tax law in relation to undertakings (‘the KStG’), provides:

‘(1) Earnings within the meaning of points 1, 2, 9 and 10(a) of Paragraph 20(1) of the Law on income tax shall not be taken into account for the purposes of determining the income. …

…

(3) Reductions in profits related to the holding referred to in subparagraph 2 shall not be taken into account for the purposes of determining the profits.’

5 Point 1 of Paragraph 34(4) of the KStG is worded as follows:

‘(4) Paragraph 8b shall apply for the first time to:

1. earnings within the meaning of points 1 and 2 of Paragraph 20(1) of the Law on income tax, to which Part Four of the Law on corporation tax, as amended by Article 4 of the Law of 14 July 2000 (BGBl. 2000 I, p. 1034), shall no longer apply in respect of the distributing company’.

6 Paragraph 34(7) of the KStG, as amended by the Gesetz zur Umsetzung der Protokollerklärung der Bundesregierung zur Vermittlungsempfehlung zum Steuervergünstigungsabbaugesetz (Law on implementing the declaration of the Federal Government in the minutes concerning the recommendation on mediation made relating to the Law on reduction of tax benefits) of 22 December 2003 (BGBl. 2003 I, p. 2840) (‘the new version of the KStG’), provides:

‘(7) Paragraph 8b shall apply for the first time to:

…

[eighth sentence] Paragraph 8b(8) and the first sentence of point 1 of Paragraph 21(1) shall apply:

…

2. upon a single and irrevocable application to be submitted by 30 June 2004, as from the 2001 to 2003 tax periods, and, in the case of a fiscal year differing from the calendar year, as from the 2002 to 2004 tax periods (period of retroactivity). Paragraph 8b(8) shall apply in that regard in the following version:

“(8) Subparagraphs 1 to 7 shall apply to holdings which, in life insurance and health insurance undertakings, correspond to investments, subject to the proviso that earnings, profits and reductions in profits shall be taken into account to the extent of 80% in the calculation of the income. …”’

German Law on business tax

7 The Gewerbesteuergesetz (Law on business tax), as amended by the Law on the further development of tax law in relation to undertakings (‘the Law on business tax’), provides, in Paragraph 6 thereof, that the basis of assessment for business tax is to consist of the operating profit for the purposes of business tax.

8 Paragraph 7 of the Law on business tax provides that the operating profit for the purposes of business tax is to be the profit resulting from an industrial or commercial activity, established in accordance with the provisions of the Law on income tax or of the Law on corporation tax, which must be taken into account when determining the income relating to the tax period for the purposes of corporation tax which corresponds to the tax period for the purposes of business tax, increased and reduced by the amounts referred to in Paragraphs 8 and 9 of the Law on business tax.

9 Under Paragraph 8 of the Law on business tax:

‘The following amounts shall be added back to the profit resulting from an industrial or commercial activity (Paragraph 7) in so far as they were deducted when calculating the profit:

…

5. the surplus of shares of profits (dividends) which has not been taken into account under point 40 of Paragraph 3 of the Law on income tax or under Paragraph 8b(1) of the Law on corporation tax, and income treated as such and earnings from holdings in a company, in an association of persons or in corporate funds within the meaning of the Law on corporation tax, in so far as they do not meet the requirements set out in points 2a or 7 of Paragraph 9, after deduction of operating expenses which are economically linked to those revenues, to the extent that they are not taken into account under Paragraph 3c of the Law on income tax and under Paragraph 8b(5) of the Law on corporation tax. …’

10 Paragraph 9 of the Law on business tax is worded as follows:

‘The sum of the profit and of the add-backs shall be reduced:

…

7. by the profits from shares in a capital company whose registered office and central management and control are situated outside the territorial area to which this law applies, and at least 10% (subsidiary) of whose share capital the undertaking has held, without interruption, since the beginning of the tax period …’

11 Paragraph 36(4) of the Law on business tax provides:

‘Point 5 of Paragraph 8 shall apply for the first time to the 2001 tax period.’

German Law on investment companies

12 Paragraph 40(2) of the Gesetz über Kapitalanlagegesellschaften (Law on investment companies), as amended by the Law on the further development of tax law in relation to undertakings, provides:

‘Point 40 of Paragraph 3 of the Law on income tax and Paragraph 8b(1) and Paragraph 37(3) of the Law on corporation tax shall apply to domestic and foreign income from a mutual securities fund which is distributed and to income which is not used for the purposes of distribution or coverage of costs.’

From the considerations of the Court

28 By its question, the referring court asks, in essence, whether Article 63 TFEU must be interpreted as precluding legislation of a Member State under which, when calculating the basis of assessment for a company’s business tax, dividends from holdings of less than 10% in non-resident capital companies are to be added back to that basis of assessment, if and to the extent that those dividends were deducted from that basis of assessment at a previous stage of that calculation, whereas dividends from comparable holdings in resident capital companies are included from the outset in the abovementioned basis of assessment, without being deducted from or, consequently, added back to that basis of assessment.

29 Article 63(1) TFEU lays down a general prohibition on restrictions on the movement of capital between Member States and between Member States and third countries.

30 In accordance with settled case-law, measures, inter alia, which are such as to discourage non-residents from making investments in a Member State or to discourage that Member State’s residents from doing so in other States constitute restrictions on the free movement of capital (judgment of 16 June 2022, ACC Silicones, C‑572/20, EU:C:2022:469, paragraph 31 and the case-law cited).

31 National measures which may be classified as ‘restrictions’ within the meaning of Article 63(1) TFEU include, in particular, measures establishing a difference in treatment which, where it leads to less favourable treatment of the income of a resident of a Member State originating in another State in comparison with the treatment of income originating in the first Member State, is liable to discourage such a resident from investing his or her capital in another State (see, to that effect, judgment of 29 April 2021, Veronsaajien oikeudenvalvontayksikkö (Income paid by UCITS), C‑480/19, EU:C:2021:334, paragraph 27 and the case-law cited).

32 In the present case, it is apparent from the request for a preliminary ruling that, during the 2001 tax period, different tax rules were applicable, when calculating the basis of assessment for business tax, to dividends received from resident companies and to dividends received from non-resident companies.

33 As the referring court states, during the 2001 tax period, the provisions according to which, at the first stage of that calculation, 20% of the dividends received were not included in that basis of assessment, were applicable only to dividends from holdings in non-resident companies. Therefore, at the second stage of the abovementioned calculation, only those latter dividends were covered by point 5 of Paragraph 8 of the Law on business tax, which provides that dividends which had not been taken into account under Paragraph 8b(1) of the KStG were to be added back to the operating profit resulting from the industrial or commercial activity in question, in so far as they had been deducted when determining that profit. That had the consequence that the 20% of dividends which had previously been deducted from the abovementioned basis of assessment was added back to the latter.

34 As regards dividends paid by resident capital companies, Paragraph 8b(1) of the KStG was applicable for the first time during the 2002 tax period. That meant that, when calculating the basis of assessment for a company’s business tax, the entirety of those dividends, paid during the 2001 tax period, had to be taken into account as from the first stage of that calculation. Since Paragraph 8b(1) of the KStG was not applicable, no part of those dividends was excluded. Therefore, at the second stage of that calculation, there was no longer any need to carry out an add-back under point 5 of Paragraph 8 of the Law on business tax, since that provision was applicable only if and to the extent that dividends had not been taken into account under Paragraph 8b(1) of the KStG.

35 As is clear from the explanations provided by the referring court, the result of such a difference in treatment during the two stages of the calculation of the basis of assessment for business tax was that both dividends paid by resident companies and those paid by non-resident companies were included in their entirety in that basis of assessment and were subject to the same tax burden. Although the dividends paid by resident companies were included in that basis of assessment from the outset, 80% of the dividends paid by non-resident companies were included in that basis of assessment during the first stage of that calculation, while the remaining 20% was added back to it during the second stage of that calculation, with the result that they were 100% subject to business tax in respect of the 2001 tax period.

36 Therefore, that difference in treatment, during the two stages of the calculation of the basis of assessment for business tax, between dividends distributed by resident companies and those paid by non-resident companies does not lead to unfavourable treatment of the latter in comparison with the former, since, in both cases, all the dividends are included in that basis of assessment.

37 On the contrary, that difference in treatment and, in particular, the add-back of 20% of the dividends to the basis of assessment for business tax, as contested by H Lebensversicherung, are intended to ensure that the dividends distributed by non-resident companies are subject to the same tax burden as those paid by resident companies by being included in their entirety in that basis of assessment.

38 In that regard, the situation at issue in the main proceedings differs from the one that was at issue in the case which gave rise to the judgment of 22 January 2009, STEKO Industriemontage (C‑377/07, EU:C:2009:29), in which the consequence of the application, to dividends distributed by resident companies and by non-resident companies, of two different taxation systems in respect of corporation tax for the 2001 tax period, was that only companies holding shares in resident companies could benefit from a tax advantage.

39 By that judgment, the Court held that, due to the application, to dividends distributed by resident companies and by non-resident companies, of two different taxation systems in respect of corporation tax for the 2001 tax period, resident companies holding depreciated shares in non-resident companies were, during that tax period, in a less favourable situation than those holding such shares in resident companies, since a resident company could deduct from its taxable income reductions in profits resulting from the partial write-down of holdings in resident companies, but could not deduct from its taxable income such reductions in profits where they related to holdings in non-resident companies (see, to that effect, judgment of 22 January 2009, STEKO Industriemontage, C‑377/07, EU:C:2009:29, paragraphs 25 and 26).

40 By contrast, in the situation at issue in the main proceedings, as has been noted in paragraphs 35 and 37 above, both dividends received from resident companies and those received from non-resident companies are included in their entirety in the basis of assessment for business tax and are subject to the same tax burden.

41 The argument of H Lebensversicherung that a restriction on the free movement of capital stems from the complexity of the national legislation at issue in the main proceedings and from the unpredictable nature of that legislation, on account of the reform and the fact that there was uncertainty regarding investment results solely with respect to investments in non-resident companies, cannot be upheld. First, it is apparent from the request for a preliminary ruling, as has been noted in paragraph 14 above, that the application of that legislation stems from the exercise of a right by H Lebensversicherung. Second, the arguments put forward by H Lebensversicherung relating to the complexity of that legislation are not capable of demonstrating that the rules laid down by that legislation were impossible or excessively difficult to comply with when investing in non-resident companies.

42 Lastly, it is true that national measures which can be regarded as ‘restrictions’ within the meaning of Article 63(1) TFEU include not only measures liable to prevent or limit the acquisition of shares in companies established in other States, but also measures liable to discourage the maintenance of such holdings in companies established in other States (judgment of 22 January 2009, STEKO Industriemontage, C‑377/07, EU:C:2009:29, paragraph 24 and the case-law cited).

43 In that regard, the arguments put forward by H Lebensversicherung seek to demonstrate that the national legislation at issue in the main proceedings made the resale of holdings in a non-resident company more attractive than their maintenance, since, in the event of the resale of those holdings, the resulting capital gains would not have been subject to business tax. However, such arguments are not capable of demonstrating that dividends distributed by a non-resident company were subject to a disadvantage in comparison with those distributed by a resident company due to the maintenance of such holdings.

44 Consequently, since the difference in treatment arising from the legislation of a Member State, during the stages of calculating the basis of assessment for business tax, between dividends distributed by resident companies and those paid by non-resident companies does not lead to unfavourable treatment of the latter in comparison with the former, given that, in both cases, all the dividends are included in that basis of assessment and are subject to the same tax burden, such a difference in treatment is not liable to discourage that Member State’s residents from investing their capital in another State and, accordingly, does not constitute a restriction on the free movement of capital.

45 Therefore, the answer to the question referred is that Article 63 TFEU must be interpreted as not precluding legislation of a Member State under which, when calculating the basis of assessment for a company’s business tax, dividends from holdings of less than 10% in non-resident capital companies are to be added back to that basis of assessment, if and to the extent that those dividends were deducted from that basis of assessment at a previous stage of that calculation, whereas dividends from comparable holdings in resident capital companies are included from the outset in the abovementioned basis of assessment, without being deducted from or, consequently, added back to that basis of assessment.

Costs

46 Since these proceedings are, for the parties to the main proceedings, a step in the action pending before the referring court, the decision on costs is a matter for that court. Costs incurred in submitting observations to the Court, other than the costs of those parties, are not recoverable.

Copyright – internationaltaxplaza.info

Follow International Tax Plaza on Twitter (@IntTaxPlaza)