On March 25, 2024 on the website of the Dutch tax authorities a position paper of the Knowledge Group reorganization facilities and fiscal unities answered the question whether the substitution of Article 14a of the Dutch Corporate Income Tax (DCIT) Act means that Article 13, Paragraph 16, of the DCIT Act applies to a 3% shareholding that was obtained through a legal demerger and that before the legal demerger was part of a 6% shareholding that the demerging legal entity held. (KG:032:2024:2).

Facts

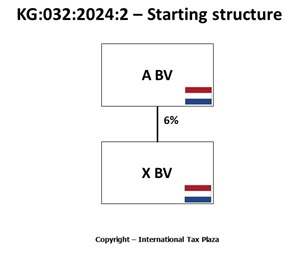

- A BV has held a 6% shareholding in X BV for more than a year;

- The participation exemption as meant in Article 13, Paragraph 1 of the DCIT Act has continuously applied to this shareholding during the entire period of ownership by A BV;

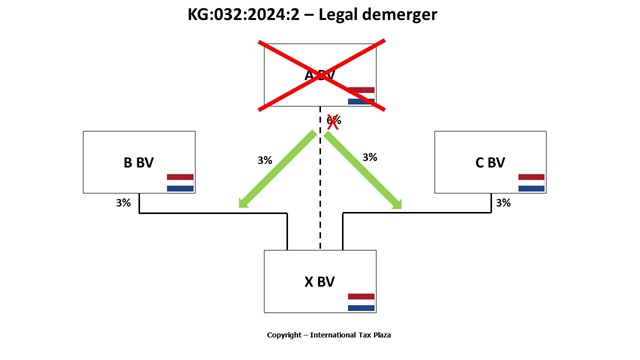

- A BV is legally demerged into B BV and C BV. As a result of the legal demerger A BV ceases to exist and B BV and C BV each acquire a 3% shareholding in X BV.

- The demerger takes place in a tax-free manner with the application of Article 14a DCIT Act.

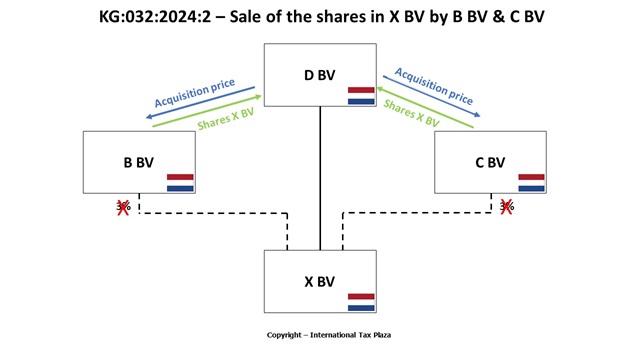

- A year after the demerger both B BV and C BV sell their shareholdings in X BV to D BV.

Question

Does the participation exemption apply to the profits that B BV and C BV realize through the sale of their shareholdings in X BV to D BV?

Legal context

Article 14a, Paragraph 2 of the DCIT Act

For as far as relevant Article 14a, Paragraph 2 of the DCIT Act, which contains regulations with respect to legal demergers, reads as follows:

“(…)

If the profit is disregarded, the acquiring legal entity shall take the place of the demerging legal entity with respect to all that has been acquired through the demerger.”

Article 13, Paragraph 16 of the DCIT Act

Article 13, Paragraph 16 of the DCIT Act reads as follows:

“If an interest that the taxpayer has already held for more than one year and for which it during that period was continuously eligible for the participation exemption is no longer considered to constitute a participation for the mere reason that the size of that interest no longer meets the condition of at least 5% as referred to in Paragraphs 2 or 3, the participation exemption shall continue to apply for a period of three years from the time that the said condition is no longer met with respect to benefits derived from that interest and costs incurred in relation to the acquisition or disposal of that interest. Paragraphs 6, 7 and 9 shall apply mutatis mutandis.”

Answer as given by the Knowledge group

Yes, the participation exemption applies to the profits that B BV and C BV realize through the sale of the shares in X BV to D BV. At the level of B BV and C BV, the shares in X BV constitute a so-called "expiring participation" as referred to in Article 13, Paragraph 16 of the DCIT Act. B BV and C BV replaced A BV for the circumstance that A BV already held the shares in X BV for more than a year and for which A BV continuously qualified for the participation exemption during that period. Although the interest in X BV no longer qualifies as a participation at the level of B BV and C BV, the participation exemption continues to apply for a three-year period.

The full text of the position paper (in Dutch) including the assessment of the tax Dutch authorities can be found here.

Copyright – internationaltaxplaza.info

Follow International Tax Plaza on Twitter (@IntTaxPlaza)