Where the effective tax rate of a jurisdiction in which constituent entities are located is below the minimum tax rate for a fiscal year, the MNE group shall compute the top-up tax for each of its constituent entities that has qualifying income included in the computation of net qualifying income of that jurisdiction separately.

This top-up tax shall be computed on a jurisdictional basis.

Joint ventures

The computation of the top-up tax of the joint venture and its joint venture affiliates, shall be made in accordance with Chapters III to VII, as if they are constituent entities of a separate MNE group and the joint venture was the ultimate parent entity of that group.

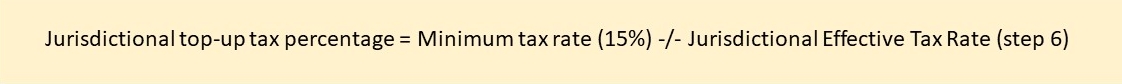

Step 7a – Jurisdictional top-up tax percentage for a fiscal year

The top-up tax percentage for a jurisdiction for a fiscal year shall be computed in accordance with the formula that is laid down in Article 26, Paragraph 2 of the proposed Directive.

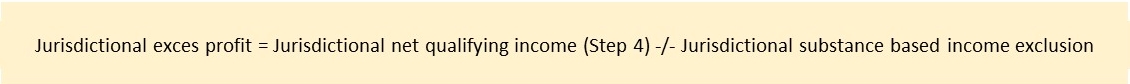

Step 7b – The jurisdictional top-up tax for a fiscal year

The jurisdictional top-up tax for a fiscal year shall be computed in accordance with the formula that is laid down in Article 26, Paragraph 3 of the proposed Directive:

1 Unless a filing entity of an MNE group elects not to apply the substance-based income exclusion, the excess profit for the jurisdiction for the fiscal year shall be computed in accordance with the following formula:

2 The additional top-up basically only can come into play in case adjustments that are made to covered taxes (Step 5) or qualifying incomes or losses (Step 4) result in the recalculation of the effective tax rate and top-up tax of a (MNE) group for a prior fiscal year. The additional top-up tax is to be determined in accordance with the provisions as laid down in Article 28 of the proposed Directive.

3 The domestic top-up tax is the qualified domestic top-up tax of Article 10 of the proposed EU Directive. Please note that this qualified domestic top-up tax only comes into play if a Member State where constituent entities of an MNE Group are located elects to apply such qualified domestic top-up tax.

Minority-owned subgroups & minority-owned constituent entities

The computation of the effective tax rate and the top-up tax for a jurisdiction in accordance with Chapters III to VII with respect to a minority-owned subgroup shall apply as if each minority-owned subgroup was a separate MNE group.

The effective tax rate and top-up tax of a minority-owned constituent entity (not being an investment entity) that is not a member of a minority-owned subgroup shall be computed on an entity basis in accordance with Chapters III to VII.

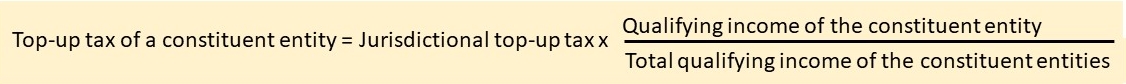

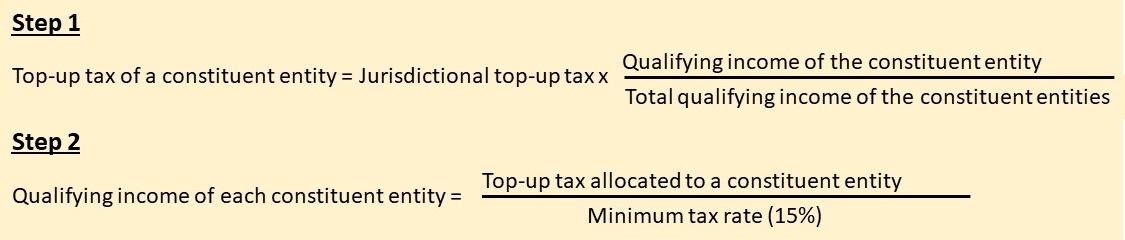

Step 7c – Computing the top-up tax of a constituent entity for a fiscal year

The top-up tax of a constituent entity for a fiscal year shall be computed as follows:

Adjustments made for a prior fiscal year

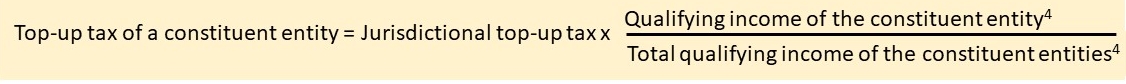

If the jurisdictional top-up tax results from a recalculation pursuant to Article 28, Paragraph 1 and there is a net qualifying loss in the jurisdiction for the fiscal year, the top-up tax shall be allocated to each constituent entity using the known formula:

4 based on the qualifying income of the constituent entities in the fiscal years for which the recalculations pursuant to Article 28, Paragraph 1 are performed.

Stateless constituent entities

The top-up tax of the stateless constituent entities located in a jurisdiction shall be computed, for each fiscal year, separately from the top-up tax of all other constituent entities located in the same jurisdiction.

Additional top-up tax

Where, pursuant to Articles 15, Paragraph 7 (“disposal of immovable property”), 21, Paragraph 7 (“non-payment of a deferred tax liability”), 24, Paragraph 1 (“adjustment to the covered taxes in the financial accounts”), 24, Paragraph 4 (“non-payment of the amount accrued by a constituent entity as tax expense and included in adjusted covered taxes for a fiscal year”) and 38, Paragraph 5 (“the deemed distribution tax recapture account”), an adjustment to covered taxes (Step 5) or qualifying income or loss results (Step 4) in the recalculation of the effective tax rate (Step 6) and top-up tax (Step 7) of the MNE group for a prior fiscal year, the effective tax rate and top-up tax shall be recomputed. The top-up tax shall be recomputed in accordance with the steps described above and the effective tax rate shall be recomputed in accordance with the rules as described in Step 6.

Any amount of incremental top-up tax arising from such recalculation shall be treated as excluded from the calculation of the effective tax rate (Step 6c) in and the calculation of the net qualifying income (Step 6a) for the fiscal year during which the recalculation is made.

If such a recalculation results in an additional top-up tax, and there is a net qualifying loss for the jurisdiction, the qualifying income of each constituent entity located in the jurisdiction shall be an amount equal to the top-up tax allocated to such constituent entities pursuant to the formula described above under “Adjustments made for a prior fiscal year” divided by the minimum tax rate (15%). So this is basically a 2 step calculation. First you calculate the additional top-up tax allocated to each constituent entity. Secondly you divide this top-up tax by 15%.

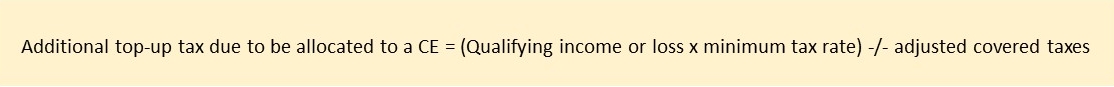

Where, pursuant to Article 20, Paragraph 5 (See Step 5), additional top-up tax is due, the qualifying income of each constituent entity located in the jurisdiction shall be an amount equal to the top-up tax allocated to such constituent entity divided by the minimum tax rate. The allocation shall be made pro-rata, to each constituent entity, based on the following formula:

The additional top-up tax shall only be allocated to constituent entities that record an amount of adjusted covered tax that is less than zero and less than the qualifying income or loss of such constituent entities multiplied by the minimum tax rate.

Where a constituent entity is allocated additional top-up tax in accordance with the above, it shall be treated as a low-taxed constituent entity for the purpose of Chapter II (“Income Inclusion Rule and Undertaxed Payments Rule”).

De minimis exclusion

Article 29 of the proposed EU Directive lays down the regulations regarding the so called de minimis exclusion. Basically the de minimis exclusion means that By way of derogation from Articles 25 to 28, at the election5 of the filing constituent entity, the top-up tax due for the constituent entities located in a jurisdiction shall be equal to zero for a fiscal year if, for such fiscal year:

(a) the average qualifying revenue of the constituent entities located in that jurisdiction for the fiscal year6 and the two previous fiscal years is less than EUR 10 million; and

(b) the average qualifying income or loss of the constituent entities located in that jurisdiction for the fiscal year and the two previous fiscal years7 is a loss or is less than EUR 1 million.

The de minimis exclusion is not applicable to stateless entities and investment entities. The revenue and qualifying income of such entities shall be excluded from the computation of the de minimis exclusion.

5 The aforementioned election will have to be made on an annual basis and separately for each jurisdiction.

6 The qualifying revenue of the constituent entities located in a jurisdiction for a fiscal year shall be the sum of the revenues of the constituent entities located in that jurisdiction, reduced or increased by any adjustment carried out in accordance with Chapter III (“Calculation of the Qualifying Income or Loss”) of the proposed Directive (See also Step 4).

7 The qualifying income or loss of a jurisdiction located in a jurisdiction for a fiscal year shall be the net qualifying income or loss of that jurisdiction as computed under step 6a.

All steps above are repeated for all jurisdictions in which the group is active.

Once you have computed the top-up tax for a fiscal year you continue with Step 8.

Copyright – internationaltaxplaza.info

Follow International Tax Plaza on Twitter