In Step 6 we are going to calculate the effective tax rates for the fiscal year for each of the jurisdictions in which a (MNE) Group is active.

The computation of the effective tax rate and the top-up tax for a jurisdiction in accordance with Chapters III to VII with respect to a minority-owned subgroup shall apply as if each minority-owned subgroup was a separate MNE group.

The effective tax rate and top-up tax of a minority-owned constituent entity (not being an investment entity) that is not a member of a minority-owned subgroup shall be computed on an entity basis in accordance with Chapters III to VII.

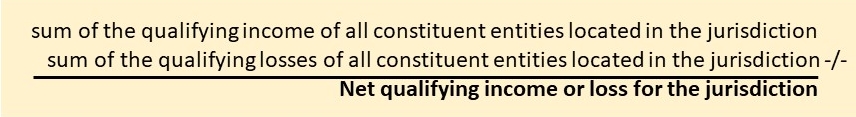

Step 6a - Computing the net qualifying income of the constituent entities in the jurisdiction

We start by computing the total net qualifying income of the constituent entities in the jurisdiction. The total net qualifying income is calculated as follows:

Qualifying income or loss of constituent entities that are investment entities are excluded from the calculation of the net qualifying income.

Members of a minority-owned subgroup

The adjusted covered taxes (Step 5) and qualifying income or loss (Step 4) of members of a minority-owned subgroup shall be excluded from the net qualifying income computed in accordance with the abovementioned formula.

Furthermore the adjusted covered taxes and qualifying income or loss of a minority-owned constituent entity (not being an investment entity) shall be excluded from the net qualifying income computed in accordance with the abovementioned formula

Step 6b - Computing the adjusted covered taxes of the constituent entities in the jurisdiction

The adjusted covered taxes of the constituent entities is the sum of the adjusted covered taxes of all the constituent entities located in the jurisdiction determined in accordance with Chapter IV (See Step 5).

Adjusted covered taxes of constituent entities that are investment entities are excluded from the calculation

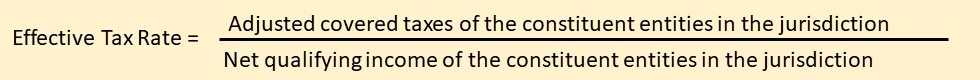

Step 6c - Computing of the Effective Tax Rate for a jurisdiction

The effective tax rate of the stateless constituent entities located in a jurisdiction shall be computed, for each fiscal year, separately from the effective tax rate of the constituent entities located in the same jurisdiction.

Adjusted covered taxes and qualifying income or loss of constituent entities that are investment entities are excluded from the calculation of the effective tax rate. NB Note the remarks made below regarding investment entities.

Members of a minority-owned subgroups & minority-owned constituent entities

The adjusted covered taxes and qualifying income or loss of members of a minority-owned subgroup shall be excluded from the determination of the residual amount of the effective tax rate of the MNE group computed in accordance with the abovementioned formula.

The adjusted covered taxes and qualifying income or loss of a minority-owned constituent entity (not being an investment entity) shall be excluded from the determination of the residual amount of the effective tax rate of the MNE group computed in accordance with the abovementioned formula.

If the Effective Tax Rate for a jurisdiction for a fiscal year is 15% or higher, you do not have to continue with Step 7. If the Effective Tax Rate for a jurisdictions is below 15% you continue with Step 7 - Computation of the jurisdictional top-up tax for a fiscal year.

Determination of the effective tax rate and top-up tax of an investment entity

The proposed EU-Directive contains an Article (Article 39) that arranges how the effective tax rate and top-up tax of an investment entity is to be determined. Article 39 of the Directive reads as follows:

1. Where a constituent entity of an MNE group is an investment entity that is not a tax transparent entity and that has not made an election in accordance with Articles 40 (Election to treat an investment entity as a tax transparent entity) and 41( Election to apply a taxable distribution method), the effective tax rate of such investment entity shall be computed separately from the effective tax rate of the jurisdiction in which it is located.

2. The effective tax rate of the investment entity as referred to in paragraph 1 shall be equal to its adjusted covered taxes divided by an amount equal to the allocable share of the MNE group in the qualifying income or loss of the investment entity.

Where more than one investment entity are located in a jurisdiction, their effective tax rate shall be computed by combining their adjusted covered taxes as well as the allocable share of the MNE group in their qualifying income or loss.

3. The adjusted covered taxes of an investment entity as referred to in paragraph 1 shall be the adjusted covered taxes that are attributable to the allocable share of the MNE group in the qualifying income of the investment entity and the covered taxes allocated to the investment entity in accordance with Article 23.

4. The top-up tax of an investment entity as referred to in paragraph 1 shall be an amount equal to the top-up tax percentage of the investment entity multiplied by amount equal to the difference between the allocable share of the MNE Group in the qualifying income of the investment entity’s and the substance-based income exclusion computed for the investment entity.

Where more than one investment entity are located in a jurisdiction, their top-up tax shall be computed by combining their substance-based income exclusion amounts as well as the allocable share of the MNE group in their qualifying income or loss allocable share of the MNE group in the qualifying income or loss.

The top-up tax percentage of an investment entity shall be an amount equal to the difference between the minimum tax rate and the effective tax rate of such investment entity.

5. The substance-based income exclusion of an investment entity shall be determined in accordance with Article 27 Paragraphs 1 to 7. The eligible tangible assets and eligible payroll costs of eligible employees taken into account for such entity shall be reduced in proportion to the allocable share of the MNE group in the qualifying income of the investment entity divided by the total qualifying income of such investment entity.

6. For the purpose of this Article, the allocable share of the MNE group in the qualifying income or loss of an investment entity shall be determined in accordance with Article 8.

Copyright – internationaltaxplaza.info

Follow International Tax Plaza on Twitter