In this article we discuss position paper KG:040:2022:5 of June 17, 2022. In this position paper the Knowledge Group on international taxation, corporate income tax & the taxation of profits answers the question whether in its view the Interest and Royalties Directive precludes the taxation of interest received by a company that was incorporated under Dutch law and that has relocated to Belgium and which legal form was converted into a BVBA (Belgian legal form) from an indirect subsidiary that is a resident of the Netherlands.

The underlying case

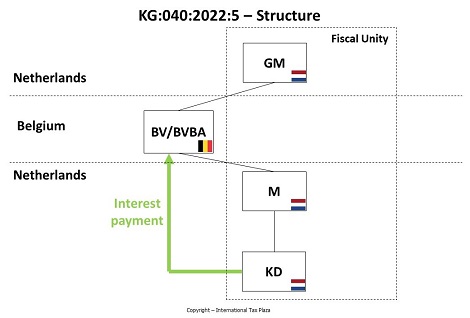

A company that was incorporated under Dutch law, relocated to Belgium in 2016 and subsequently was converted into a BVBA (hereafter: BV/BVBA) receives interest from an indirect subsidiary (hereafter: KD) that is a resident of the Netherlands. All shares in KD are held by a parent company residing in the Netherlands (hereafter: M). The shares in M are held by BV/BVBA. All shares in BV/BVBA are held by GM, a company residing in the Netherlands. With the exception of BV/BVBA, all companies are part of a (Papillon) fiscal unity for Dutch corporate income tax purposes.

For answering the question whether the Netherlands is allowed to levy taxes over the interest income the following should be taken into account. Based on the fictional place of business as laid down in Article 2, Paragraph 5, of the Dutch Corporate Income Tax (DCIT) Act, BV/BVBA remains fully subject to Dutch corporate income tax. Furthermore, pursuant to Article 11, Paragraph 2 of the Dutch-Belgian Tax Convention, the Netherlands may levy up to 10% of the gross amount of the interest received; the conditions of Article 11, Paragraph 3, of the Dutch-Belgian Tax Convention are not met.

Legal context

Article 2, Paragraph 5, of the Dutch Corporate Income Tax (DCIT) Act

If the incorporation of a body has taken place under Dutch law, then for the purposes of this Act, with the exception of Articles 13 to 13d, 13i to 13k, 14a, 14b, 15 and 15a, the body is always deemed to be in to be a resident of the Netherlands. (…)

Article 11, Paragraph 2 of the Dutch-Belgian Tax Convention

However, interest arising in a Contracting State may also be taxed in that State according to the laws of that State, but if the beneficial owner of the interest is a resident of the other Contracting State, the tax so charged shall not exceed 10 per cent of the gross amount of the interest.

Article 11, Paragraph 3, of the Dutch-Belgian Tax Convention

Notwithstanding paragraph 2, interest shall not be taxed in the Contracting State in which it arises,

a. if the beneficial owner of such interest is an enterprise of the other Contracting State and it does not concern interest on loans or money deposits represented by bearer securities;

b. if it concerns interest on loans or money deposits represented by bearer securities and the beneficial owner of the interest is an enterprise of the other Contracting State carrying on a banking or insurance business and owning the relevant securities for at least three months prior to the date of payment of the interest;

c. if it concerns interest on trade receivables - including receivables represented by commercial paper – caused by the payment of the purchase price of supplies of merchandise, goods or services by companies in installments;

d. if interest is paid in respect of a loan granted, guaranteed or insured, or a credit granted, guaranteed or insured, under a general scheme arranged by a Contracting State, one of its political subdivisions, local authorities thereof, the NV De Nederlandsche Bank or the National Bank of Belgium of which the purpose is to promote exports;

e. if the interest is paid to the other Contracting State, a political subdivision, a local authority thereof or to NV De Nederlandsche Bank or to the National Bank of Belgium.

Question

Does the Interest and Royalty Directive, Directive 2003/49/EC (hereafter: the Directive), preclude taxation by the Netherlands of the interest received by the transferred company (BV/BVBA) from its indirect subsidiary (KD) which is a resident of the Netherlands?

Answer

The Directive does not preclude taxation by the Netherlands of the interest received by the transferred company (BV/BVBA) from its indirect subsidiary (KD) which is a resident of the Netherlands.

From the consideration of the tax authorities

The Directive provides for a common tax regime for cross-border interest and royalty payments between associated companies within the European Union. Under certain conditions, interest and royalty payments within the European Union are exempt from taxation in the source country.

In the underlying case those conditions are not met.

First of all because in the underlying case the creditor (BV/BVBA) can be regarded as a Dutch company within the meaning of the Directive. In that case, the Directive does not prevent the Netherlands from taking the interest income into account at the level of BV/BVBA. The aforementioned follows from Article 1, Paragraph 9 and Article 3, part a of the Directive.

Secondly, the association criterion within the meaning of Article 3, part b of the Directive is not met. After all, the creditor (BV/BVBA) holds an indirect 100% interest in the debtor (KD), while the Directive requires that the participation is held directly.

The fact that the debtor (KD) is a member of GM’s fiscal unity for Dutch corporate income tax purposes does not alter this. For the purposes of the Directive, the fiscal unity regime does not mean that GM must be regarded as the debtor. For the application of the Directive, the company that pays or owes the interest must be considered (see in particular Article 1, Paragraphs 2, 7 and 15 of the Directive). In the underlying case that is KD, regardless of whether it is part of a fiscal unity. Nor does the (preamble to the) Directive contain any indication that national group schemes, such as the Dutch fiscal unity regime, may influence the association criterion.

It should also be noted that KD, even after its consolidation in the fiscal unity, continues to be regarded as a separate taxable entity. Moreover, the fiscal unity regime has no third-party effect, as follows from the Dutch Supreme Court October 20, 2006, ECLI:NL:HR:2006:AW3942 and Parliamentary Documents I 2001/02, 26 854, no. 45d, page 3. It is relevant here that the creditor (BV/BVBA) is not part of the fiscal unity. Also in view of this, the fiscal unity regime is of no importance for the application of Article 3, part b of the Directive.

The full Dutch text of the position paper can be found here.

Other position papers of the Knowledge Group on international taxation, corporate income tax & the taxation of profits of which we already made an English summary can be found here.

Copyright – internationaltaxplaza.info

Follow International Tax Plaza on Twitter (@IntTaxPlaza)