In this article we discuss position paper KG:211:2022:5 of January 4, 2022. In this position paper the Knowledge Group on tax liability & qualification of legal forms answers the question whether a Vennootschap onder firma (VOF) (general partnership) which is established under Belgian law is to be considered a transparent partnership for Dutch individual income tax purposes, Dutch corporate income tax purposes, Dutch dividend withholding tax purposes and other Dutch withholding tax purposes.

It should be noted that the in the situation that is described under the reason for the opinion, the Belgian general partnership is held by 3 Dutch individuals (so the partnership is situated under the Dutch taxpayers), but the qualification method as described below also applies if a general partnership is situated above a Dutch taxpayer (eg as a shareholder of a Dutch limited liability entity).

The position paper is very interesting since in this position paper the Dutch tax authorities set out the criteria according to which a foreign legal form/partnership is to be qualified for Dutch tax purposes. These criteria can therefore also be used if one has to qualify a partnership that is established under the laws of another jurisdiction.

Reason

In 2002 the Belgian general partnership was qualified as a transparent partnership for tax purposes, but since in 2019 the new Belgian Companies and Associations Code entered into force in Belgium the Dutch tax authorities reclassified this legal form.

Three partners have set up a general partnership which has its registered office in Belgium. All three partners contributed the same amount of capital, for which they each receive the same number of shares (without nominal value) in the partnership.

Question

Does a general partnership which was established under Belgian law qualify as a transparent partnership, even after the amendment of the Belgian Companies and Associations Code, for the Dutch Corporate Income Tax Act, the Dutch Individual Income Tax Act, the Dutch Dividend Withholding Tax Act and the Dutch Withholding Tax Act 2021?

Answer

Yes. For the application of the Dutch Corporate Income Tax Act, the Dutch Individual Income Tax Act, the Dutch Dividend Withholding Tax Act and the Dutch Withholding Tax Act 2021 the Belgian general partnership is still to be regarded as a transparent partnership.

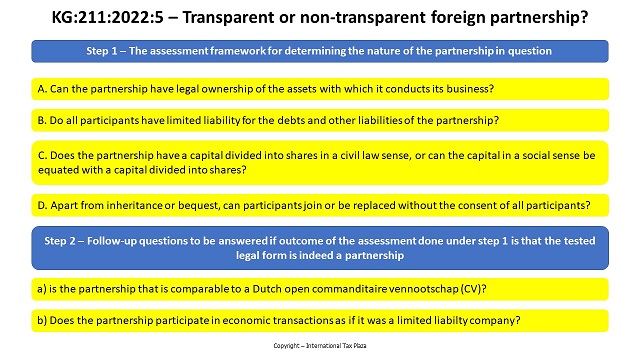

From the consideration of the tax authorities

For Dutch tax purposes foreign legal forms or partnerships must be classified in accordance with the Decree of December 11, 2009. From the Decree it follows that in order to assess whether essentially the legal form classifies as a limited liability company or as a partnership first an analysis must be made on the basis of the civil law and regulations of the country in question. According to the Decree, in particular four questions are important for this assessment: the so-called assessment framework. In addition to this assessment framework, certainly if a comparable Dutch legal form does not exist, other facts and circumstances may also play a role in determining the nature of the partnership in question.

The initial assessment of the legal form does not look at the specific interpretation given to the relevant partnership in the articles of association or agreement. The qualification is based on the civil law of the country in question. In the event that the relevant (foreign) legislation allows that matters relevant for the qualification are arranged for in statutory provisions, the statutes of the partnership may be important.

Step 1 – The assessment framework for determining the nature of the partnership in question

The assessment framework consists out of the following 4 questions:

Question A

Can the partnership have legal ownership of the assets with which it conducts its business?

This is the case if, under civil law, the partnership can acquire assets and can enter into rights and obligations in the name of the partnership. This also applies if the partnership acquires legal ownership of assets as a result of a registration in the trade register or in a register of a comparable institute, as a result of which the partnership has acquired legal personality.

Question B

Do all participants have limited liability for the debts and other liabilities of the partnership?

In this respect limited liability of a participant means that the liability does not extend beyond the invested capital or the obligation to fully pay-in. In the case of an unlimited liability, the liability is not limited to a fixed amount.

Question C

Does the partnership have a capital divided into shares in a civil law sense, or can the capital in a social sense be equated with a capital divided into shares?

If the company’s capital is divided into equal or proportionate parts (participations), entitling to a proportionate share of the profit and liquidations distribution and a proportionate control, the capital will be equated in a civil law sense with a capital divided into shares.

Question D

Apart from inheritance or bequest, can participants join or be replaced without the consent of all participants?

On the basis of the legal provisions, the transfer of the participations or the entry or replacement of the participants is generally regulated in the articles of association or by agreement. To answer this question, the articles of association or the agreement must be assessed and tested against the content of the decision of January 11, 2007, no. CPP2006/1869M.

Based on the above assessment framework, it is determined whether the partnership is a non-transparent (almost always a limited liability company) or a transparent body (partnership).

Limited liability companies

In principle, a body constitutes a limited liability company if, on the basis of foreign civil law, the ownership lies with the partnership, all participants have limited liability in the sense referred to above and the capital is divided into shares. In the case of limited liability companies, the agreement is usually drawn up in accordance with mandatory law, but the articles of association can also be completed on the basis of additional law. Limited liability companies are considered to be non-transparent entities.

In any case a limited liability company in the sense referred to above exists if:

– if three or four questions of the assessment framework have been answered in the affirmative; or

– in cases in which it has been established that the liability of all participants in a partnership is limited to their contribution or the obligation to fully pay-in, the business is owned by the partnership and the business is otherwise also not run for the account and risk of the participants (Dutch Supreme Court, June 2, 2006, no. 40,919).

Partnerships

Partnerships are aimed at the personal cooperation of the participants with a mandatory contribution, whereby the cooperation agreement can be completed according to the wishes of the participants. Under civil law, all participants, but at least one of them, have unlimited liability. From a civil law perspective, partnerships do not have capital divided into shares, but the content of the agreement can be designed in such a way that in fact a capital divided into shares exists.

Step 2 – Follow-up questions to be answered if outcome of the assessment done under step 1 is that the tested legal form is indeed a partnership

If, after testing the criteria included in the assessment framework, it is concluded that there is no limited liability company, then in principle it is a partnership. However, in that situation it still needs to be assessed whether

(a) there is a partnership that is comparable to a Dutch open commanditaire vennootschap (CV) (an (open) limited partnership); or whether

(b) the partnership in this case participates in economic transactions as if it was a limited liabilty company.

If both these questions are answered with 'no', then the partnership is considered transparent.

Ad a. A partnership is comparable to a Dutch CV if the partnership has the following characteristics.

– A business is run in the name of the partnership.

– There is at least one "general partner" and one "limited partner".

– The general partner is liable to third parties without limitation or for an equal part (as referred to under question B above).

– The limited partner is only internally liable up to a maximum of the capital invested by him.

– The limited partner does not perform any external acts of management and administration.

– The company has no capital divided into shares.

If the partnership is comparable to a Dutch CV, based on Article 2, Paragraph 3, sub c, of the AWR (the General State Taxes Act) it must be assessed (question D) whether it concerns an open or closed CV. If in this case question D is answered in the affirmative, then the partnership is considered a non-transparent partnership (open CV).

Ad b. Finally, if there is a partnership that is not comparable to a Dutch closed CV, then with the help of the answers to questions (C) and (D) and on the basis of the judgment of the Supreme Court of November 24, 1976, no. 17.998, it must be assessed whether this partnership in this case participates in social transactions as if it was a limited liabilty company. This will generally be the case if the capital invested by the participants can socially be considered divided into shares and the participations are freely transferable. In that case there is still a non-transparent partnership.

As stated above if both follow-up questions (a and b) are answered in the negative, the partnership is considered transparent.

Outcome of the underlying case

In the case of a Belgian vennootschap onder firma, the Dutch tax authorities come to the conclusion that only question A is to be answered in the affirmative. Therefore the Belgian VOF does not qualify as limited liability company, but as a partnership. Therefore the Dutch tax authorities took a look at the follow-up questions and came to the following conclusion:

“Now that only question A can be answered in the affirmative and the facts and circumstances of the underlying case furthermore show that the business within that VOF is run at the risk and expense of the partners, (in the underlying case) the Belgian general partnership must be regarded as a transparent general partnership for the purposes of Dutch tax law.”

The full Dutch text of the position paper can be found here.

Other position papers of the Knowledge Group on dividend withholding tax and (other) withholding taxes of which we already made an English summary can be found here.

Copyright – internationaltaxplaza.info

Follow International Tax Plaza on Twitter (@IntTaxPlaza)