In this article we discuss position paper KG:024:2023:2 of January 10, 2023. In this position paper the Knowledge Group on dividend withholding tax and other withholding taxes answers the question whether withholding tax is due on a guarantee fee that is causally related to a loan from an affiliate that is a resident of a low-taxing jurisdiction.

The underlying case

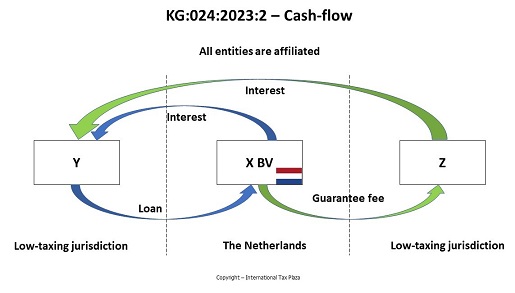

A Dutch company (X B.V.) has borrowed money from an affiliated company (Y). Y is a resident of a low-taxing jurisdiction (hereinafter: LTJ 1). Withholding tax is due over interest payments made to Y.

X B.V. provides loans to various group companies. X B.V. entered into a guarantee agreement with an also affiliated company (Z) for the event that the interest income that X B.V. realizes on those loan notes receivables is insufficient for X B.V. to meet its payment obligations on the loan notes payables it has outstanding. Z is also a resident of a low-taxing jurisdiction. X B.V. pays a guarantee fee to Z. The amount of the guarantee fee depends, among other things, on the results that X B.V. achieves on its financing activities.

The guarantee agreement explicitly mentions the loan for which the guarantee is provided, namely the loan from Y to X B.V. The annual accounts show that a causal relationship exists between the interest costs due over the loan Y has provided to X B.V. and the amount of the guarantee fee. This is also apparent from the calculation of the guarantee fee.

Question

Is under the Withholding Tax Act 2021 (hereinafter: WT Act 2021) withholding tax due over the guarantee fee paid to Z?

Answer

Yes, withholding tax is due over the guarantee fee paid to Z because the guarantee fee qualifies as interest for the WT Act 2021, the beneficiary of the guarantee fee (Z) is a resident of a low-taxing jurisdiction and is affiliated with the withholding agent (X B.V.). The WT Act 2021 does not require that the beneficiary is also the lender.

From the consideration of the tax authorities

Legal context

Article 3.1, under a, of the WT Act 2021 arranges that a withholding tax is levied over the benefits in the form of interest as referred to in Article 3.3 WT Act 2021. Article 3.3 WT Act 2021 arranges the following regarding the concept of interest:

Paragraph 1, opening words reads as follows: “The benefits in the form of interest are the payments of any kind – including costs – in respect of loans (…).”

Paragraph 2 reads as follows: “For the purposes of this article, a loan is understood to mean: a debt arising from a loan agreement or from an agreement comparable therewith.”

It must be assessed whether the guarantee fees paid constitute “compensations of any kind – including costs – in respect of loans” within the meaning of Article 3.3, Paragraph 1, WT Act 2021.

As long as the guarantee is not invoked, the guarantee agreement in itself does not qualify as a loan. After all, until that moment there is no case of a debt arising from that agreement. However, this does not mean that the guarantee fee does not qualify as interest within the meaning of Articles 3.1 and Article 3.3 of the WT Act 2021. Since the loan provided by Y for which the guarantee has been agreed does qualify as a loan as described in Article 3.3, Paragraph 2 of the WT Act 2021, it must therefore be assessed whether the payment of the guarantee fee can be regarded as a payment in respect of that loan.

From the Parliamentary history it emerges that the legislator envisages a broad economic approach to the concept of interest.

The guarantee fee paid by X B.V. is due under the guarantee agreement concluded with Z. From the agreement it follows that the compensation has been agreed regarding a loan provided by Y. The guarantee ensures that the interest and repayment obligations to Y are met. Also from the annual accounts and the calculation of the guarantee fee it follows that the interest costs owed to Y and the amount of the guarantee fee are directly related. Therefore it can be concluded that a (sufficient) direct relationship between the guarantee payment and the loan provided by Y exists. Therefore this guarantee payment qualifies as a payment under a loan as referred to in Article 3.3, Paragraph 1 of the WT Act 2021.

The fact that the guarantee fee is paid another party than the creditor, namely to Z, is irrelevant in this regard. Article 3.3, Paragraph 1, under a, of the WT Act 2021 only requires that the interest is due by a withholding agent that is affiliated with the beneficiary. Since in the underlying case X B.V. and Z are affiliated, condition is met.

Now that Z is a resident of a low-taxing jurisdiction, pursuant to Article 2.1, Paragraph 1, sub a, WT Act 2021, it is liable to the withholding tax regarding the guarantee fee. X B.V. must therefore withhold withholding tax over the guarantee fee.

The full Dutch text of the position paper can be found here.

Other position papers of the Knowledge Group on dividend withholding tax and (other) withholding taxes of which we already made an English summary can be found here.

Copyright – internationaltaxplaza.info

Follow International Tax Plaza on Twitter (@IntTaxPlaza)