In this article we discuss position paper KG:024:2022:16 of May 24, 2022. In this position paper the Knowledge Group on dividend withholding tax and other withholding taxes answers the question whether a Total Return on Equity Swap (TRES) qualifies as a share buy-back (of own shares) as meant in Article 3, Paragraph 1, under a of the Dutch dividend withholding tax (DDWT) Act.

The underlying case

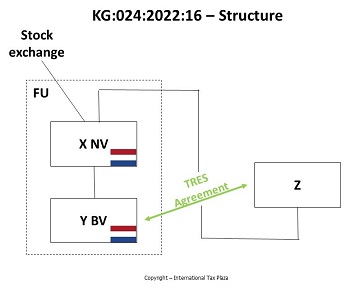

- X NV is a company that is listed on a stock exchange that is a resident of the Netherlands;

- Y BV is a subsidiary of X NV. For Dutch corporate income tax purposes Y BV included in the fiscal unity of X NV. Y BV that enters into a TRES on the shares of X NV with a financial services provider, Z;

- The TRES is a derivative whereby the parties agree that during the term of the contract, the value development of specific listed shares (in this case the shares in X NV) and the net dividends paid on those shares will be paid to the fiscal unity of X NV against the payment of a periodic fee to Z by the fiscal unity of X NV;

- The periodic payment due by the fiscal unity of X NV to Z consists of interest over the amount equal to the purchase price Z paid for the underlying shares in X NV;

- The holder of the TRES (in this case the fiscal unity of X NV) is entitled to compensation that is equal to the increase in value of the shares X NV. However, if the shares X NV decrease in value the holder of the TRES must pay an amount equal to that decrease in value to Z. It is virtually impossible that the full value of the share will be paid during the term of the TRES;

- In principle, the TRES has a fixed term and includes the possibility of an early termination. An extension, whereby the parties again agree again on the conditions, is also possible;

- Z obtains the contractually agreed numbers of shares in X NV in the market and must sell the underlying shares back to the market upon termination of the TRES. The strict obligation to hold shares in X NV is limited to the period from the ex-dividend date to the dividend determination date (‘record date’);

- The TRES is settled at a price consisting of more defined elements such as the weighted average of the share price less defined costs;

- The TRES is settled in cash and does not create an obligation for fiscal unity of X NV to pay the initial value of the shares to the bank. Z will never transfer the shares in X NV to Y BV or X NV.

Question

Does a TRES, concluded between a Dutch resident company and an unaffiliated financial services provider, qualify as a share buy-back as meant in Article 3, Paragraph 1, under a of the DDWT Act?

Answer

No, a TRES as designed in the underlying does not qualify as a share buy-back as meant in Article 3, Paragraph 1, under a of the DDWT Act. The reason therefor is that no shift in assets takes place from the company to shareholders (via the financial services provider).

From the consideration of the tax authorities

Article 3 of the DDWT Act determines which proceeds are in any case subject to the levying of Dutch dividend withholding tax. In its judgment of February 18, 1959 (ECLI:NL:HR:1959:AY0777) the Dutch Supreme Court characterized a proceed as follows:

“that the characteristic of a distribution that qualifies as proceeds from a share is in general that it is based on a shift of assets from the company to the shareholder as a result of which any amount of money or other value, covered by the profits available in the company is withdrawn from the company’s equity in favor of the shareholder.”

From this judgment it emerges that in order to establish a proceed, a shift of assets from the company to the shareholder must take place. This also emerges from the judgment of the Dutch Supreme Court from November 14, 1956, ECLI:NL:HR:1956:AY1512, regarding the purchase of shares:

"that it must therefore generally be assumed that by such a transaction the equity of the public limited company decreases by an amount equal to the purchase price paid for the shares, while this amount benefits the shareholder."

In the underlying case, Z buys the shares in the market. At that moment, X NV doesn’t impoverish. Also during the term and when the TRES is settled no shift in capital from X NV to its shareholders takes place. After all, the TRES is settled in cash and doesn’t create an obligation for X NV to pay the initial value of the shares to Z, nor will it have the obligation to pay the value of those shares at a later date. In addition, it is virtually impossible that during the term of the TRES the full value of the share will be paid. Furthermore Z will never transfer the X NV shares to Y BV.

Also, the periodic fee that the fiscal unity of X NV owes to Z cannot be equated with a shift of assets from X NV, via Z, to the shareholders in X NV, because only an interest element is due over the purchase price of the underlying X NV shares and not the purchase price itself (also not when the TRES is settled). The TRES can therefore not be seen as an indirect repurchase of shares from shareholders on the stock exchange, as referred to in paragraph 7.1. of the Decree of the State Secretary of Finance of November 29, 2022 (Stcrt. 2022, 32364).

Considering the fact that in the underlying case the TRES does not lead to a shift of assets from X NV to the shareholders of X NV, the TRES does not qualify as a share buy-back as meant in Article 3, Paragraph 1, under a of the DDWT Act.

The full Dutch text of the position paper can be found here.

Other position papers of the Knowledge Group on dividend withholding tax and (other) withholding taxes of which we already made an English summary can be found here.

Copyright – internationaltaxplaza.info

Follow International Tax Plaza on Twitter (@IntTaxPlaza)