On August 1, 2022 on the website of the Court of Justice of the European Union (CJEU) the judgment of the CJEU in Case C-267/21, Uniqa Asigurări SA versus Agenţia Naţională de Administrare Fiscală – Direcţia Generală de Soluţionare a Contestaţiilor and Direcţia Generală de Administrare a Marilor Contribuabili, ECLI:EU:C:2022:614, was published. The dispute in the underlying case is whether or not Article 59 of Directive [2006/112, as amended by Directive 2008/8] is to be interpreted as meaning that claims settlement services supplied by [partner] companies to an insurance company, in the name and on behalf of that company, can be classified in the category of services supplied by consultants, engineers, consultancy firms, lawyers, accountants and other similar services, as well as data processing and the provision of information?

Introduction

This request for a preliminary ruling concerns the interpretation of Article 59 of Council Directive 2006/112/EC of 28 November 2006 on the common system of value added tax (OJ 2006 L 347, p. 1), as amended by Council Directive 2008/8/EC of 12 February 2008 (OJ 2008 L 44, p. 11).

The request has been made in proceedings between Uniqa Asigurări SA (‘Uniqa’), whose headquarters are established in Romania, on the one hand, and, on the other, the Agenția Națională de Administrare Fiscală – Direcția Generală de Soluționare a Contestațiilor (National Agency for Tax Administration – Directorate-General for the settlement of complaints, Romania) and the Direcția Generală de Administrare a Marilor Contribuabili (Directorate-General for large-scale taxpayers, Romania) (together ‘the tax authority’), concerning the determination, for the purposes of collecting value added tax (VAT), of the place where a supply of services is deemed to be carried out.

The dispute in the main proceedings and the question referred for a preliminary ruling

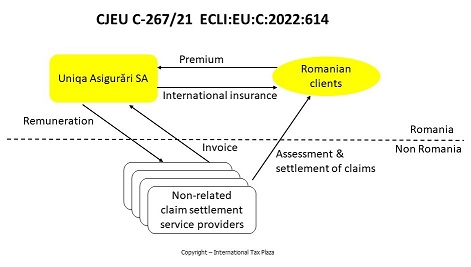

9 Uniqa offers, in Romania, insurance policies covering the risks relating to motor accidents and medical expenses occurring outside the territory of that Member State.

10 As regards insurance against civil liability in respect of the use of motor vehicles, Uniqa entered into partnerships with 26 companies having their registered office outside Romania (‘the partner companies’). Those partner companies settle claims of Uniqa’s customers in the country in which the accident occurred. They handle the claims for compensation by proceeding with, inter alia, the opening of complaints files, the verification of the validity of the insurance policy, the examination of the causes and circumstances of the accident, the finding of damage, the assessment of damage, the proposal of replacement or repair solutions, the estimation of compensation, the verification of quotes, as well as the compensation for repairs and the examination of recoveries. In respect of material damage of an amount up to or equivalent to EUR 15 000 caused by an accident, those partner companies are free to approve or reject claims for compensation, while remaining liable, in respect of both the insured parties and Uniqa, for the reasoning and the amount of the payments made by way of settlement of claims. In respect of material damage exceeding EUR 15 000, they are required to collaborate with Uniqa for the purposes of settling a claim for compensation.

11 As regards medical insurance policies, Coris International handles, in the name and on behalf of Uniqa, claims for compensation made by insurance policy holders. In particular, Coris International undertakes to ensure that insured persons have assistance 24 hours a day and to provide them with technical, organisational and legal assistance. In addition, that company fixes the amount of compensation and ensures payment thereof, and informs Uniqa of the events which have occurred.

12 Uniqa did not declare the VAT due under the reverse charge regime on the services that had been invoiced to it by the partner companies and Coris International between 1 January 2007 and 31 December 2009 in respect of their handling and complaint resolution fees, on the ground that, under Article 133(1) of the Tax Code, the place of those services was the place of establishment of the supplier of the services.

13 Following an inspection covering the period from 1 January 2007 to 31 December 2011, the tax authority ordered Uniqa to pay additional VAT in a total amount of 3 439 412 Romanian lei (RON) (approximately EUR 698 596) and incidental charges in a total amount of RON 3 706 077 (approximately EUR 752 760) relating to the services referred to in paragraph 12 above.

14 The tax authority took the view that it was appropriate to apply, not the general rule laid down in Article 133(1) of the Tax Code, but the exception set out in Article 133(2)(g), point 5, of that code. It therefore found that the place of supply of the services provided by the partner companies and Coris International was in the Member State where the customer in receipt of those services is established, namely Romania.

15 By decision of 15 September 2016, the tax complaint lodged by Uniqa against the notice of assessment and the tax inspection report making Uniqa liable for payment of the sums referred to in paragraph 13 of the present judgment was rejected. Uniqa then brought, on 23 December 2016, an application for annulment of that decision, and of that notice of assessment and that report, before the Curtea de Apel București (Court of Appeal, Bucharest, Romania).

16 By judgment of 19 June 2018, that court confirmed that the place of supply of claims settlement services is the place where the customer has established its business, in the present case, Romania, taking the view that those services were similar to those of engineers, referred to in the third indent of Article 9(2)(e) of the Sixth Directive, as interpreted by the judgment of 7 October 2010, Kronospan Mielec (C‑222/09, EU:C:2010:593). The Curtea de Apel București (Court of Appeal, Bucharest) partially annulled the acts of the tax authority referred to in paragraph 15 of the present judgment, on account of the unjustified duration of the tax inspection, and dismissed the action as to the remainder.

17 Uniqa and the tax authority each brought an appeal against that judgment before the referring court.

18 The referring court notes that the Court has already interpreted the exceptions relating to the determination of the place of supply of services. In particular, it held in its judgment of 16 September 1997, von Hoffmann (C‑145/96, EU:C:1997:406), that the expression ‘other similar services’ refers not to professions, such as those of lawyers, consultants, accountants or engineers, but only to services. Furthermore, that expression refers not to some common feature of the disparate activities mentioned in the Sixth Directive but to services that are similar to those of each of those activities, viewed separately.

19 However, that case-law does not make it possible to resolve, in the dispute in the main proceedings, the issue of classification of supplies of complex services involving multiple activities, which must be analysed as a whole, such as those relating to the handling and settlement of claims carried out by the partner companies and Coris International.

20 In those circumstances, the Înalta Curte de Casaţie și Justiţie (Supreme Court of Cassation and Justice, Romania) decided to stay the proceedings and to refer the following question to the Court of Justice for a preliminary ruling:

‘Is Article 59 of Directive [2006/112, as amended by Directive 2008/8] to be interpreted as meaning that claims settlement services supplied by [partner] companies to an insurance company, in the name and on behalf of that company, can be classified in the category of services supplied by consultants, engineers, consultancy firms, lawyers, accountants and other similar services, as well as data processing and the provision of information?’

Judgment

Article 56(1)(c) of Council Directive 2006/112/EC of 28 November 2006 on the common system of value added tax must be interpreted as meaning that claims settlement services provided by third-party companies, in the name and on behalf of an insurance company, do not come within the scope of the ‘services of consultants, engineers, consultancy bureaux, lawyers, accountants and other similar services, as well as data processing and the provision of information’ referred to in that provision.

Legal context

European Union law

The Sixth Directive

3 Article 9, under the heading ‘Supply of services’, of Sixth Council Directive 77/388/EEC of 17 May 1977 on the harmonisation of the laws of the Member States relating to turnover taxes – Common system of value added tax: uniform basis of assessment (OJ 1977 L 145, p. 1) (‘the Sixth Directive’) provided:

‘1. The place where a service is supplied shall be deemed to be the place where the supplier has established his business or has a fixed establishment from which the service is supplied or, in the absence of such a place of business or fixed establishment, the place where he has his permanent address or usually resides.

2. However:

…

(c) the place of the supply of services relating to:

…

– valuations of movable tangible property,

…

shall be the place where those services are physically carried out;

(e) the place where the following services are supplied when performed for customers established outside the Community or for taxable persons established in the Community but not in the same country as the supplier, shall be the place where the customer has established his business or has a fixed establishment to which the service is supplied or, in the absence of such a place, the place where he has his permanent address or usually resides:

…

– services of consultants, engineers, consultancy bureaux, lawyers, accountants and other similar services, as well as data processing and the supplying of information,

…’

4 The Sixth Directive was repealed and replaced by Directive 2006/112, which entered into force on 1 January 2007.

Directive 2006/112

5 Title V of Directive 2006/112, under the heading ‘Place of taxable transactions’, included, in particular, a Chapter 3, itself entitled ‘Place of supply of services’, which set out Articles 43 to 59 of that directive.

6 Article 56(1)(c) of that directive provided:

‘The place of supply of the following services to customers established outside the [European Union], or to taxable persons established in the [European Union] but not in the same country as the supplier, shall be the place where the customer has established his business or has a fixed establishment for which the service is supplied, or, in the absence of such a place, the place where he has his permanent address or usually resides:

…

(c) the services of consultants, engineers, consultancy bureaux, lawyers, accountants and other similar services, as well as data processing and the provision of information;

…’

7 Article 59(c) of Directive 2006/112, as amended by Directive 2008/8, provides, as of 1 January 2010:

‘The place of supply of the following services to a non-taxable person who is established or has his permanent address or usually resides outside the [European Union], shall be the place where that person is established, has his permanent address or usually resides:

…

(c) the services of consultants, engineers, consultancy firms, lawyers, accountants and other similar services, as well as data processing and the provision of information;

…’

Romanian law

8 Article 133 of the Legea nr. 571/2003 privind Codul fiscal (Law No 571/2003 establishing the Tax Code), in its version applicable to the dispute in the main proceedings (‘the Tax Code’), provides:

‘(1) The place of supply of services shall be deemed to be the place where the supplier is established or has a fixed establishment from which the services are supplied.

(2) By way of derogation from paragraph (1), with regard to the following services, the place of supply of the services shall be deemed to be:

…

(g) the place where the customer to whom the services are supplied is established or has a fixed establishment, provided that the customer concerned is established or has a fixed establishment outside the [European Union] or is a taxable person acting as such, established or having a fixed establishment within the [European Union], but not in the same State as the supplier, in the case of the following services:

…

5. services supplied by consultants, engineers, lawyers, accountants and accounting experts, consultancy bureaux and other similar services;

…’

From the considerations of the Court

21 It should be noted that, according to settled case-law, in the procedure laid down by Article 267 TFEU providing for cooperation between national courts and the Court of Justice, it is for the latter to provide the national court with an answer which will be of use to it and enable it to decide the case before it. To that end, the Court should, where necessary, reformulate the question referred to it. The Court may also find it necessary to consider provisions of EU law which the national court has not referred to in its question (judgment of 15 July 2021, Ministrstvo za obrambo, C‑742/19, EU:C:2021:597, paragraph 31 and the case-law cited).

22 In that regard, it should be noted that Article 59 of Directive 2006/112, as amended by Directive 2008/8, has been applicable from 1 January 2010. It is, however, apparent from the information provided by the referring court that the dispute in the main proceedings relates to Uniqa’s failure to declare VAT on the services supplied by the partner companies and Coris International during the period between 1 January 2007 and 31 December 2009. In those circumstances, that provision is inapplicable, from a temporal point of view, to the dispute in the main proceedings.

23 However, in the light of the facts at issue in the main proceedings and the wording of the question referred, it must be held that it is the interpretation of Article 56(1)(c) of Directive 2006/112 that is relevant for the resolution of that dispute.

24 In those circumstances, in order to provide the referring court with an answer which will be of use to it and enable it to determine the dispute before it, it is necessary to reformulate the question referred and to consider that, by that question, that court asks, in essence, whether Article 56(1)(c) of Directive 2006/112 must be interpreted as meaning that claims settlement services provided by third-party companies, in the name and on behalf of an insurance company, come within the scope of the ‘services of consultants, engineers, consultancy bureaux, lawyers, accountants and other similar services, as well as data processing and the provision of information’ referred to in that provision.

25 In order to answer that question, it must, first of all, be borne in mind that Article 56(1)(c) of Directive 2006/112 does not refer to professions, such as those of lawyers, consultants, accountants or engineers, but to supplies of services. The EU legislature has used the professions mentioned in that provision as a means of defining the categories of supplies of services to which it refers (see, by analogy, judgment of 7 October 2010, Kronospan Mielec, C‑222/09, EU:C:2010:593, paragraph 19 and the case-law cited).

26 Therefore, it is important to determine whether the claims settlement services provided in the name and on behalf of an insurance company come within the scope of supplies of services principally and habitually carried out as part of the professions listed in Article 56(1)(c) of Directive 2006/112 (see, by analogy, judgment of 16 September 1997, von Hoffmann, C‑145/96, EU:C:1997:406, paragraph 16 and the case-law cited).

27 In that regard, it should be stated, as a preliminary point, that, in view of the two circumstances that, first, every supply of services must normally be regarded as distinct and independent and, secondly, a transaction which comprises a single supply of services from an economic point of view should not be artificially split, so as not to distort the functioning of the VAT system, the characteristic elements of the transaction concerned must be examined in order to determine whether the supplies of services provided constitute several distinct principal supplies or one single supply. In particular, in the context of the cooperation established by virtue of Article 267 TFEU, it is for the national courts to determine whether the taxable person makes a single supply in a particular case and to make all definitive findings of fact in that regard (see, to that effect, judgment of 27 September 2012, Field Fisher Waterhouse, C‑392/11, EU:C:2012:597, paragraphs 18 and 20 and the case-law cited).

28 According to the referring court, the claims settlement services at issue in the main proceedings constitute supplies of complex services involving multiple activities, which must be analysed as a whole. In particular, as stated in paragraphs 10 and 11 of the present judgment, the services provided by the partner companies cover all activities relating to the settlement of claims involving Uniqa’s customers in the countries in which those claims arise. Those services also include the exercise of decision-making powers, in so far as they require, in respect of material damage in an amount up to or equivalent to EUR 15 000 caused by an accident, approval or rejection of claims for compensation. Similarly, as regards medical insurance, Coris International handles, in the name and on behalf of Uniqa, claims for compensation made by insurance policy holders, by providing all of the organisational, technical and legal services required.

29 That preliminary point having been made, it should, in the first place, be borne in mind that the exercise of the profession of engineer covers services which are characterised by the fact that they involve not only the application of existing knowledge and procedures to specific problems, but also the acquisition of new knowledge and the development of new procedures designed to resolve those problems or new problems (judgment of 7 October 2010, Kronospan Mielec, C‑222/09, EU:C:2010:593, paragraph 21).

30 Claims settlement services provided in the name and on behalf of an insurance company, such as those referred to in paragraphs 10 and 11 of the present judgment, do not come within the scope of services that meet those characteristics. In particular, while it does not appear to be excluded that the assessment of damage resulting from a road traffic accident may be carried out by an engineer, such an activity clearly does not come within the scope of the services principally and habitually carried out as part of that profession, such as those identified in paragraph 29 of the present judgment. Nor can such a possibility, moreover, be envisaged as regards the assessment of patients in the context of medical insurance for trips abroad.

31 Accordingly, it must be held that claims settlement services provided in the name and on behalf of an insurance company are not covered by the concept of services of engineers within the meaning of Article 56(1)(c) of Directive 2006/112.

32 In the second place, as regards services carried out as part of a lawyer’s profession, the Court has already stated that such services principally and habitually concern the representation or defence of the interests of a person, as a general rule in the context of a dispute in which there are conflicting interests (see, to that effect, judgments of 16 September 1997, von Hoffmann, C‑145/96, EU:C:1997:406, paragraph 17, and of 6 December 2007, Commission v Germany, C‑401/06, EU:C:2007:759, paragraphs 36 and 37).

33 Furthermore, the Court has specified that the services carried out by a lawyer seek primarily to ensure that a claim of a legal nature succeeds (see, to that effect, judgment of 6 December 2007, Commission v Germany, C‑401/06, EU:C:2007:759, paragraph 39).

34 Supplies of services such as those provided by the partner companies and Coris International by way of the settlement of claims do not come within the scope of services principally and habitually performed as part of a lawyer’s profession. Those latter supplies of services are characterised by their contribution to the administration of justice, whereas claims settlement services in the name and on behalf of an insurance company fall more broadly within an economic activity.

35 In particular, such claims settlement services are primarily concerned with the finding and assessment of damage or medical expenses incurred, and the assessment of the compensation payable to the insured person and, where appropriate, the actual payment of that compensation and, on that basis, do not necessarily come within the scope of the field of litigation. Thus, those services do not require beforehand the representation and defence of the interests of the insurance company in the context of a dispute where there are conflicting interests although, as the case may be, recourse to the services of a lawyer may prove necessary at a later stage.

36 It follows that claims settlement services provided in the name and on behalf of an insurance company are not covered by the concept of services of lawyers within the meaning of Article 56(1)(c) of Directive 2006/112.

37 In the third place, it must be stated that claims settlement services such as those provided by the partner companies and Coris International do not correspond to the services principally and habitually provided by a consultant, a consultancy bureau or an accountant. In particular, unlike consultancy services, claims settlement services in the name and on behalf of an insurance company involve the exercise of decision-making power as regards the award of compensation or refusal to grant that compensation, which amount to more than merely consultancy services.

38 In the fourth place, it is necessary to determine whether claims settlement services provided in the name and on behalf of an insurance company come within the scope of ‘other similar services’ referred to in Article 56(1)(c) of Directive 2006/112.

39 The words ‘other similar services’ refer not to some common feature of the disparate activities referred to in that provision but to services similar to those of each of those activities, viewed separately. A service must thus be regarded as being similar to that of one of the activities mentioned in that article when they both serve the same purpose (see, to that effect, judgment of 6 December 2007, Commission v Germany, C‑401/06, EU:C:2007:759, paragraph 31 and the case-law cited).

40 In that regard, it is sufficient to note that the purpose of such services is the handling and processing of claims for compensation submitted by persons insured by the insurance company in the name and on behalf of which they are provided.

41 Thus, it is apparent from the information provided by the referring court that the claims settlement services provided by the partner companies include complex handling and complaint settlement services, involving multiple activities, which must be analysed as a whole, the purpose of which is to remedy damage suffered by a person injured outside his or her Member State of residence in accordance with procedures with which that person is familiar. Furthermore, with regard to the services provided by Coris International, the referring court has stated that these are activities which are carried out for the purpose of settling complaints lodged by holders of medical insurance policies for trips abroad concluded by Uniqa for its clients, covering in particular the guarantee of assistance 24 hours a day to insured persons and the provision to insured persons of technical, organisational and legal assistance.

42 However, none of the services of engineers, lawyers, accountants, consultancy bureaux or consultants listed in Article 56(1)(c) of Directive 2006/112 pursues the objective identified in paragraph 40 of the present judgment.

43 It follows that claims settlement services provided in the name and on behalf of an insurance company cannot be regarded as ‘other similar services’ within the meaning of Article 56(1)(c) of Directive 2006/112.

44 In the fifth and final place, it must also be stated that such claims settlement services cannot be likened to data processing services or be treated as equivalent to the provision of information.

45 In the light of all of the foregoing considerations, the answer to the question referred is that Article 56(1)(c) of Directive 2006/112 must be interpreted as meaning that claims settlement services provided by third-party companies, in the name and on behalf of an insurance company, do not come within the scope of the ‘services of consultants, engineers, consultancy bureaux, lawyers, accountants and other similar services, as well as data processing and the provision of information’ referred to in that provision.

Costs

46 Since these proceedings are, for the parties to the main proceedings, a step in the action pending before the referring court, the decision on costs is a matter for that court. Costs incurred in submitting observations to the Court, other than the costs of those parties, are not recoverable.

On those grounds, the Court (Tenth Chamber) hereby rules:

Article 56(1)(c) of Council Directive 2006/112/EC of 28 November 2006 on the common system of value added tax must be interpreted as meaning that claims settlement services provided by third-party companies, in the name and on behalf of an insurance company, do not come within the scope of the ‘services of consultants, engineers, consultancy bureaux, lawyers, accountants and other similar services, as well as data processing and the provision of information’ referred to in that provision.

Copyright – internationaltaxplaza.info

Follow International Tax Plaza on Twitter (@IntTaxPlaza)