On October 6, 2022 on the website of the Court of Justice of the European Union (CJEU) the judgment of the Court of Justice of the European Union (the CJEU) in the joined cases C-433/21 and C434/21, Agenzia delle Entrate versus Contship Italia SpA, ECLI:EU:C:2022:760, was published.

Introduction

These requests for a preliminary ruling concern the interpretation of Article 18 TFEU, in conjunction with the principle of the freedom of establishment enshrined in Article 49 TFEU.

The requests have been made in two sets of proceedings – the facts of which are identical save in respect of the relevant tax years, namely the 2005 tax year in Case C‑433/21 and the 2004 tax year in Case C‑434/21 – between Contship Italia SpA (‘Contship’), on the one hand, as the acquiring company of, and successor in law to, Borgo Supermercati Srl, and the Agenzia delle Entrate (Revenue Agency, Italy), on the other, regarding the application of measures to prevent tax avoidance by shell companies.

The disputes in the main proceedings and the questions referred for a preliminary ruling

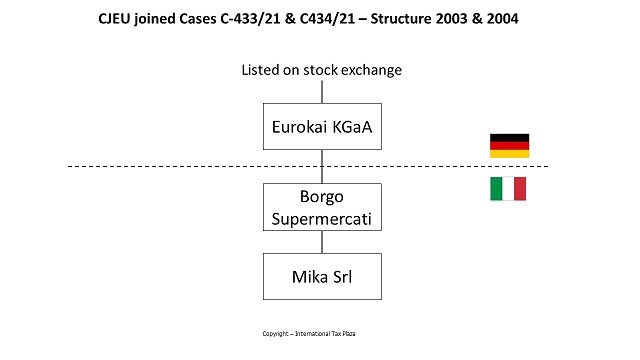

5 Borgo Supermercati was a limited liability company governed by Italian law and wholly owned by Eurokai KGaA, a company listed on the stock exchange in Germany. During the 2004 and 2005 tax years, Borgo Supermercati was a ‘pure holding’ company, as its activity consisted exclusively in managing its shareholding in Mika Srl, of which it was the sole shareholder.

6 By two notices of assessment relating to the 2004 and 2005 tax years, the tax authorities considered, pursuant to Article 30 of Law No 724/1994, that Borgo Supermercati met the criteria of a shell company and, in accordance with that article, determined that company’s taxable income for corporate income tax (imposta sui redditi delle società; IRES) purposes, reconstructing it from the value of that company’s sole asset, namely its 100% shareholding in Mika.

7 Borgo Supermercati brought two actions against those two notices of assessment before the Commissione tributaria provinciale di Genova (Provincial Tax Court, Genoa, Italy), which dismissed both actions in their entirety.

8 Borgo Supermercati brought two appeals against those dismissal decisions handed down by the Commissione tributaria provinciale di Genova (Provincial Tax Court, Genoa) before the Commissione tributaria regionale della Liguria (Regional Tax Court, Liguria, Italy), which upheld both appeals in part.

9 The Commissione tributaria regionale della Liguria (Regional Tax Court, Liguria) held that the fact that Borgo Supermercati was owned by a company listed on the stock exchange in Germany during the relevant tax year made it possible to extend to that company the ground for exclusion from the scope of the measures to prevent tax avoidance by shell companies provided for in Article 30(1)(5) of Law No 724/1994, the scope of which was limited at the time of the events in the main proceedings to companies listed directly on the Italian regulated market. That broad interpretation was held to be necessary pursuant to the principle that it is reasonable and appropriate to interpret the ground for exclusion relating to listing on the stock exchange in accordance with the principle of non-discrimination, even though the legislature made no provision for such broadening of the scope of Article 30(1)(5) of Law No 724/1994 until after the reform introduced by Law No 296/2006.

10 The tax authorities and Contship, which had acquired Borgo Supermercati in the meantime, appealed against the decisions of the Commissione tributaria regionale della Liguria (Regional Tax Court, Liguria) before the Corte suprema di cassazione (Supreme Court of Cassation, Italy), the referring court.

11 In support of its cross-appeals, Contship argues, in essence, that the company governed by German law which holds all the shares in Borgo Supermercati should, on the basis of a consistent interpretation of the legislation, have been treated as one of the ‘companies and entities whose securities are traded on Italian regulated markets’ referred to in Article 30(1)(5) of Law No 724/1994, in the version applicable ratione temporis to the events in the main proceedings, and, as a result, the measures to prevent tax avoidance by shell companies should not have been applied ex lege to the subsidiary of that company governed by German law. According to Contship, an interpretation of Article 30(1)(5) of Law No 724/1994 in the version prior to Law No 296/2006 which does not follow the approach described above would result in discrimination based on the nationality of the controlling entity and would be detrimental to freedom of establishment and to economic and commercial freedom within the European Union.

12 According to Contship, its interpretation is confirmed by the amendment made to Article 30(1)(5) of Law No 724/1994 by Law No 296/2006, which, to a certain extent, brought the relevant national legislation into line with the principles intrinsic to the EU legal order.

13 As a preliminary point, the referring court points out that the measures to prevent tax avoidance by shell companies laid down in Article 30 of Law No 724/1994 are intended to discourage the use of a specific legal form for purposes other than those which drive the normal system of collective commercial entities. That court specifies that those measures apply exclusively to for-profit commercial companies, including permanent establishments of foreign companies and ‘extraterritorial’ companies.

14 The referring court notes that the companies subject to those measures are to be identified by applying an ‘operational [nature]’ test, which is based on an assessment of the productivity of those companies’ assets in relation to minimum income parameters determined in advance by law. Accordingly, when a company declares, for the relevant tax year, income below the amount resulting from the application of those minimum income parameters, that company is presumed not to be of an operational nature, which leads to its taxable income being determined on the basis of the minimum income presumed by law.

15 The referring court adds that Article 30 of Law No 724/1994 also provides for grounds for exclusion from the scope of those measures. Those grounds for exclusion include that provided for in Article 30(1)(5) of Law No 724/1994 which, in the version applicable ratione temporis to the events in the main proceedings, provided that the measures to prevent tax avoidance by shell companies did not apply to ‘companies and entities whose securities are traded on Italian regulated markets’.

16 That court emphasises that the scope of Article 30(1)(5) of Law No 724/1994 was extended by Law No 296/2006, as from the tax year which was in progress on 4 July 2006, to ‘companies and entities that control companies and entities whose securities are traded on Italian and foreign regulated markets, as well as those listed companies and entities and the companies they control, even indirectly’. The Corte suprema di cassazione (Supreme Court of Cassation) nonetheless considers that that amendment is not applicable ratione temporis to the events in the main proceedings and that the wording of Article 30(1)(5) of Law No 724/1994 prior to that amendment did not allow for an interpretation according to which the broadening of the scope of the ground for exclusion corresponding to the subsidiaries of listed companies, whether in Italy or abroad, could already have been applicable at the time of those events.

17 In that context, the referring court is uncertain as to the compatibility of Article 30(1)(5) of Law No 724/1994, in the version applicable to the events in the main proceedings, with the principle of non-discrimination, in conjunction with the principle of freedom of establishment, enshrined in Article 18 TFEU and Article 49 TFEU respectively.

18 According to that court, Article 30(1)(5) of Law No 724/1994 may give rise to discrimination sensu stricto between companies issuing securities that are traded on Italian regulated markets and companies listed on foreign markets. Further, the fact that the ground for exclusion concerned – which could lead to a tax benefit – is not extended to parent companies listed on Italian and foreign regulated markets may give rise to a restriction on freedom of establishment, with the resulting deterrent effect on companies which, although they are non-resident and do not have a permanent establishment, nevertheless intend to exercise freedom of secondary establishment in Italy by controlling resident companies in that country.

19 In those circumstances, the Corte suprema di cassazione (Supreme Court of Cassation) decided to stay the proceedings and to refer the following question for a preliminary ruling in both Case C‑433/21 and Case C‑434/21:

‘Do Articles 18 (ex Article 12 TEC) and 49 (ex Article 43 TEC) TFEU preclude national legislation which, like Article 30(1)(5) of [Law No 724/1994], in the version applicable ratione temporis, prior to the amendments introduced by [Law No 296/2006], excludes from the measures to prevent tax avoidance by non-operational companies – based on minimum revenue and income thresholds relative to the value of specific corporate assets, which, if not met, is a sign that the company is non-operational and means that the taxable income must be determined by way of presumption – only companies and entities whose securities are traded on Italian regulated markets and not companies and entities whose securities are traded on foreign regulated markets, as well as the companies that control or are controlled by, even indirectly, those listed companies and entities?’

20 By decision of the President of the Court of Justice of 3 September 2021, the present cases were joined for the purposes of the oral and written parts of the procedure and of the decision of the Court.

Judgment

the Court (Eighth Chamber) ruled as follows:

Article 49 TFEU must be interpreted as not precluding national legislation which restricts the ground for exclusion from the scope of the measures to prevent tax avoidance by shell companies to companies whose securities are traded on national regulated markets, excluding from the scope of that ground for exclusion other companies, whether national or foreign, whose securities are not traded on national regulated markets but which are controlled by companies and entities listed on foreign regulated markets.

Legal context

3 Article 30(1) of legge n. 724 – Misure di razionalizzazione della finanza pubblica (Law No 724 on measures to rationalise public finances) of 23 December 1994 (Ordinary Supplement to GURI No 304 of 30 December 1994), in the version applicable to the disputes in the main proceedings (‘Law No 724/1994’), provided:

‘Unless there is evidence to the contrary, public limited companies, partnerships limited by shares, limited liability companies, general partnerships and limited partnerships, as well as non-resident companies and entities of any kind, with a permanent establishment in State territory shall be deemed non-operational if the total amount of revenues, increase in inventories and income, excluding extraordinary income as evidenced by the income statement, where required, is below the sum of the amounts obtained by applying: (a) 1% to the value of the goods set out in Article 53(1)(c) of [decreto del Presidente della Repubblica n. 917 – Approvazione del testo unico delle imposte sui redditi (Presidential Decree No 917 approving the codified law on income tax) of 22 December 1986 (Ordinary Supplement to GURI No 302 of 31 December 1986)], even where they are financial fixed assets, plus the value of the credits; (b) 4% to the value of the fixed assets made up of property and of goods set out in Article 8-bis(1)(a) of [decreto del Presidente della Repubblica n. 633 – Istituzione e disciplina dell’imposta sul valore aggiunto (Presidential Decree No 633 establishing and regulating value added tax) of 26 October 1972 (Ordinary Supplement to GURI No 292 of 11 November 1972, p. 2)], as amended, including leasing contracts; (c) 15% to the value of the other fixed assets, including leasing contracts.

…

The provisions set out above do not apply to: …

(5) companies and entities whose securities are traded on Italian regulated markets …’

4 Article 1(109) of legge n. 296 – Disposizioni per la formazione del bilancio annuale e pluriennale dello Stato (legge finanziaria 2007) (Law No 296 laying down rules for the preparation of the annual and multiannual State budget (2007 Finance Law)) of 27 December 2006 (Ordinary Supplement to GURI No 299 of 27 December 2006), in the version applicable to the disputes in the main proceedings (‘Law No 296/2006’), extended, as from the tax year which was in progress on 4 July 2006, the scope of the exclusion provided for in Article 30(1)(5) of Law No 724/1994 to ‘companies and entities that control companies and entities whose securities are traded on Italian and foreign regulated markets, as well as those listed companies and entities and the companies they control, even indirectly’.

Admissibility of the requests for a preliminary ruling

21 The Italian Government raises a plea of inadmissibility as regards the requests for a preliminary ruling on the ground that the question asked in each of the joined cases is hypothetical.

22 That government argues that the ground for exclusion from the scope of the measures to prevent tax avoidance by shell companies provided for in Article 30(1)(5) of Law No 724/1994 applied, at the time of the events in the main proceedings, only to companies and entities whose securities were traded on Italian regulated markets and that, as a result, given that Contship has never issued securities, either on the Italian market or on a foreign market, it cannot claim that the national legislation at issue in the main proceedings discriminated against it.

23 It must be recalled in that regard that it is solely for the national court before which the dispute has been brought, and which must assume responsibility for the subsequent judicial decision, to determine in the light of the particular circumstances of the case both the need for a preliminary ruling in order to enable it to deliver judgment and the relevance of the questions which it submits to the Court. Consequently, where the questions submitted concern the interpretation of EU law, the Court is, in principle, bound to give a ruling (judgments of 18 October 1990, Dzodzi, C‑297/88 and C‑197/89, EU:C:1990:360, paragraphs 34 and 35; of 13 November 2018, Levola Hengelo, C‑310/17, EU:C:2018:899, paragraph 27 and the case-law cited; and of 28 April 2022, Caruter, C‑642/20, EU:C:2022:308, paragraph 28).

24 Indeed, it is settled case-law that questions on the interpretation of EU law referred by a national court in the factual and legislative context which that court is responsible for defining, and the accuracy of which is not a matter for the Court to determine, enjoy a presumption of relevance. The Court may refuse to rule on a question referred by a national court only where it is quite obvious that the interpretation of EU law that is sought bears no relation to the actual facts of the main action or its purpose, where the problem is hypothetical, or where the Court does not have before it the factual or legal material necessary to give a useful answer to the questions submitted to it (judgments of 5 December 2006, Cipolla and Others, C‑94/04 and C‑202/04, EU:C:2006:758, paragraph 25; of 13 November 2018, Levola Hengelo, C‑310/17, EU:C:2018:899, paragraph 28 and the case-law cited; and of 28 April 2022, Caruter, C‑642/20, EU:C:2022:308, paragraph 29 and the case-law cited).

25 In this instance, it is apparent from the orders for reference that, although Contship has never issued securities, either on the Italian market or on a foreign market, the discriminatory nature of the ground for exclusion provided for in Article 30(1)(5) of Law No 724/1994 could flow from a difference in treatment between the subsidiaries of companies whose securities are traded on Italian regulated markets and the subsidiaries of companies whose securities are traded on foreign regulated markets.

26 The referring court seeks, in addition, to ascertain whether the national legislation at issue in the main proceedings would have a deterrent effect on companies listed on foreign regulated markets which, although they are non-resident and do not have a permanent establishment, nevertheless intend to exercise their freedom of secondary establishment in Italy by controlling resident companies in that country.

27 Thus, it is not quite obvious that the interpretation of EU law that is sought bears no relation to the actual facts of the main actions or their purpose.

28 Having regard to the foregoing, it must be held that the requests for a preliminary ruling are admissible.

Consideration of the questions referred

Preliminary observations

29 As a preliminary point, it should be borne in mind that, according to settled case-law, Article 18 TFEU applies independently only to situations governed by EU law in respect of which the FEU Treaty lays down no specific prohibition of discrimination. In the field of freedom of establishment, the principle of non-discrimination is given specific expression in Article 49 TFEU (judgments of 29 February 1996, Skanavi and Chryssanthakopoulos, C‑193/94, EU:C:1996:70, paragraphs 20 and 21, and of 5 February 2014, Hervis Sport- és Divatkereskedelmi, C‑385/12, EU:C:2014:47, paragraph 25, and order of 22 October 2021, O and Others, C‑691/20, not published, EU:C:2021:895, paragraphs 20 and 21).

30 Accordingly, given that the facts in the main proceedings concern an Italian company controlled by a company established in another Member State, Article 49 TFEU is the relevant provision for assessing whether the national legislation concerned is compatible with EU law (see, by analogy, judgments of 13 November 2012, Test Claimants in the FII Group Litigation, C‑35/11, EU:C:2012:707, paragraph 91, and of 3 March 2020, Tesco-Global Áruházak, C‑323/18, EU:C:2020:140, paragraph 52).

31 As a result, Article 49 TFEU alone must be interpreted, without there being any need to interpret Article 18 TFEU.

Freedom of establishment

32 By its questions, the referring court asks, in essence, whether the freedom of establishment enshrined in Article 49 TFEU precludes legislation, such as Article 30(1)(5) of Law No 724/1994, in the version applicable to the events in the main proceedings, which restricts the ability to take advantage of the ground for exclusion from the scope of the measures to prevent tax avoidance by shell companies only to companies whose securities are traded on national regulated markets, excluding from the scope of that ground for exclusion other companies, whether national or foreign, whose securities are not traded on national regulated markets but which are controlled by companies and entities listed on foreign regulated markets.

33 In the first place, it should be borne in mind that Article 49 TFEU requires the elimination of restrictions on freedom of establishment of nationals of a Member State in the territory of another Member State. That freedom includes, pursuant to Article 54 TFEU, for companies established in accordance with the legislation of a Member State and having their registered office, central administration or principal place of business within the European Union, the right to pursue their activities in other Member States through a subsidiary, branch or agency (see, to that effect, judgments of 21 September 1999, Saint-Gobain ZN, C‑307/97, EU:C:1999:438, paragraph 35, and of 20 January 2021, Lexel, C‑484/19, EU:C:2021:34, paragraph 33 and the case-law cited).

34 Freedom of establishment aims to ensure that nationals of other Member States and the companies referred to in Article 54 TFEU receive the same treatment as nationals of the host Member State, by prohibiting any discrimination based on the place in which companies have their seat (judgments of 12 December 2006, Test Claimants in Class IV of the ACT Group Litigation, C‑374/04, EU:C:2006:773, paragraph 43, and of 3 March 2020, Tesco-Global Áruházak, C‑323/18, EU:C:2020:140, paragraph 59 and the case-law cited).

35 Not only overt discrimination based on the location of the registered offices of companies, but also all covert forms of discrimination which, by the application of other criteria of differentiation, lead in fact to the same result are, in that regard, prohibited (judgments of 5 February 2014, Hervis Sport- és Divatkereskedelmi, C‑385/12, EU:C:2014:47, paragraph 30; of 3 March 2020, Tesco-Global Áruházak, C‑323/18, EU:C:2020:140, paragraph 62; and of 25 February 2021, Novo Banco, C‑712/19, EU:C:2021:137, paragraph 31).

36 National legislation which makes a distinction, for the purpose of determining taxable income, according to the place in which the relevant securities are traded may be so prohibited.

37 However, in this instance, in accordance with Article 30(1)(5) of Law No 724/1994, in the version applicable ratione temporis to the events in the main proceedings, only ‘companies and entities whose securities are traded on Italian regulated markets’ can take advantage of the ground for exclusion from the scope of the measures to prevent tax avoidance by shell companies.

38 Accordingly, having regard to the scope of that provision, it is clear that the national legislation at issue in the main proceedings does not give rise to any difference in treatment between a company held by a parent company listed in Germany, such as Contship, and a company held by a parent company listed in Italy. Given that that legislation allows only companies which are themselves listed on the Italian regulated market to take advantage of the ground for exclusion from the scope of the measures to prevent tax avoidance by shell companies provided for in Article 30(1)(5) of Law No 724/1994, it is irrelevant whether a company is the subsidiary of a parent company listed in Italy or abroad.

39 By contrast, it is apparent from the information available to the Court that Contship had never issued securities on the Italian regulated market and, for that reason, like any other Italian unlisted company, could not take advantage of the ground for exclusion from the scope of the measures to prevent tax avoidance by shell companies provided for in Article 30(1)(5) of Law No 724/1994. As a result, if Contship had been controlled by a company listed in Italy instead of a company listed in Germany, it could not have relied on the ground for exclusion provided for in that provision either.

40 In those circumstances, the application of Article 30(1)(5) of Law No 724/1994 cannot result in any difference in treatment between a company held by a parent company listed on a foreign market and a company held by a parent company listed on the Italian market.

41 In the second place, it is settled case-law that Article 49 TFEU precludes any national measure which, even if applicable without discrimination on grounds of nationality, is liable to hinder or render less attractive the exercise by EU citizens of the freedom of establishment guaranteed by the FEU Treaty, and that such restrictive effects may arise, inter alia, where, on account of national legislation, a company may be deterred from setting up subsidiary bodies, such as permanent establishments, in other Member States and from carrying on its activities through such bodies (judgment of 3 September 2020, Vivendi, C‑719/18, EU:C:2020:627, paragraph 51, and order of 22 October 2021, O and Others, C‑691/20, not published, EU:C:2021:895, paragraph 23).

42 In that connection, it should be emphasised that, under the principle of the fiscal autonomy of Member States, in the absence of harmonisation measures at EU level, it is for the Member States to determine the tax measures applicable to presumed shell companies. However, such a power must be exercised in accordance with EU law, in particular the provisions of the FEU Treaty on freedom of establishment (see, by analogy, judgments of 30 June 2011, Meilicke and Others, C‑262/09, EU:C:2011:438, paragraphs 37 and 38, and of 19 December 2019, Brussels Securities, C‑389/18, EU:C:2019:1132, paragraph 48 and the case-law cited).

43 In this instance, however, it is apparent from the legislation at issue in the main proceedings that where a parent company is listed on the Italian regulated market, its subsidiary cannot take advantage of the ground for exclusion from the scope of the measures to prevent tax avoidance by shell companies provided for in Article 30(1)(5) of Law No 724/1994 if that subsidiary is not itself listed.

44 It follows that no tax treatment which confers an advantage on subsidiaries is subject to the condition that parent companies be listed on the national stock exchange.

45 Accordingly, as the legislation at issue in the main proceedings does not confer an advantage on companies held by parent companies listed on the national regulated market which wish to take advantage of the ground for exclusion from the scope of the measures to prevent tax avoidance by shell companies, that legislation cannot have any deterrent effect on parent companies listed on foreign markets.

46 Moreover, it must be noted, as the European Commission does, that the ground for exclusion provided for in Article 30(1)(5) of Law No 724/1994 applied only to presumed shell companies whose securities were traded on Italian regulated markets and thus excluded shell companies listed on foreign markets, including those of Member States other than the Italian Republic. However, that is not the case in the main proceedings and, therefore, an answer from the Court as to whether such a distinction should be regarded as discrimination as far as concerns freedom of establishment would go beyond the questions referred and would not be helpful to the referring court for a ruling on the disputes in the main proceedings.

47 Consequently, a restriction of the personal scope of the ground for exclusion from the scope of the measures to prevent tax avoidance by shell companies provided for in Article 30(1)(5) of Law No 724/1994, such as that at issue in the main proceedings, is not such as to hinder or render less attractive the establishment in Italy of a parent company listed on a foreign regulated market.

48 Having regard to all the foregoing considerations, the answer to the questions referred is that Article 49 TFEU must be interpreted as not precluding national legislation which restricts the ground for exclusion from the scope of the measures to prevent tax avoidance by shell companies to companies whose securities are traded on national regulated markets, excluding from the scope of that ground for exclusion other companies, whether national or foreign, whose securities are not traded on national regulated markets but which are controlled by companies and entities listed on foreign regulated markets.

Costs

49 Since these proceedings are, for the parties to the main proceedings, a step in the action pending before the national court, the decision on costs is a matter for that court. Costs incurred in submitting observations to the Court, other than the costs of those parties, are not recoverable.

Copyright – internationaltaxplaza.info

Follow International Tax Plaza on Twitter (@IntTaxPlaza)