On December 6, 2022 the important Policy Decree hybrid entity provisions was published in the Dutch State Gazette. The Decree regards the Dutch dividend withholding tax Act, the Dutch withholding tax Act 2021 and the explanation of the hybrid entity provisions.

Legal context

Article 4, Paragraph 2 of the Dutch dividend withholding tax Act

2. Tax is not withheld from the proceeds of shares, profit-sharing certificates and loans as referred to in Article 10, Paragraph 1, sub d of the Dutch corporate income tax Act:

a. the beneficiary of the proceeds is a body that, according to the tax law of:

1. another member state of the European Union or another state party to the Agreement on the European Economic Area is a resident there, or

2. is a resident of a state with which the Netherlands has concluded a treaty for the prevention of double taxation or a public entity within the Kingdom for which the Netherlands has made arrangements for the prevention of double taxation that, respectively, provides for a dividends arrangement, not being a Member State of the European Union or a State party to the Agreement on the European Economic Area, and

b. at the time the proceeds are made available, the beneficiary of the proceeds has an interest in the withholding agent to which the participation exemption, referred to in Article 13 of the Dutch corporate i8ncome tax Act, or the participation settlement, as referred to in Article 13aa of that Act, applies if the beneficiary would be a resident of the Netherlands.

Article 4, Paragraph 9 of the Dutch dividend withholding tax Act

4. If, according to the tax legislation of the state under whose law that beneficiary was established, a beneficiary is not treated there as the party entitled to the proceeds of shares, profit-sharing certificates and loans as referred to in Article 10, Paragraph 1, sub d of the Dutch corporate income tax Act because the beneficiary of the proceeds is not a resident of that State either under the tax legislation of that State or the tax legislation of another State, for the purposes of this article, an underlying beneficiary to that proceeds shall be deemed to be the beneficiary of said proceeds, provided that each such beneficiary is treated there as the beneficiary of such proceeds under the tax laws of the State of which it is a resident. Underlying entitlement as referred to in the first sentence only exists insofar as the entitlement to the proceeds referred to in that sentence is directly related to a participation in the person who would be the beneficiary of the proceeds without the application of the first sentence. The second Paragraph shall not apply in the event that with respect to each underlying beneficiary, withholding tax under that Paragraph would not be omitted if the underlying beneficiary would have held its indirect interest in the withholding agent immediately.

Article 2.1 of the Dutch withholding tax Act 2021

Article 2.1 Paragraph 1, sub e

1. Taxpayer for the tax is a body that is entitled to benefits as referred to in Article 3.1 and that:

(…)

e. under the tax regulations of the state, not being a low-tax jurisdiction, under whose law the beneficiary was incorporated is not treated there as the beneficiary of those proceeds because that beneficiary is not established there under the tax regulations of that state, and that beneficiary is not established in the latter state according to the tax regulations of another state.

Article 2.1 Paragraph 4 preamble and sub a

4. The first paragraph, sub e, does not apply if:

a. it is made plausible that every underlying beneficiary which, whether or not together with one or more other entities with which it forms a cooperating group as referred to in Article 10a, Paragraph 6 of the Dutch corporate income tax Act, has a qualifying interest in the body referred to in the Paragraph 1, sub e, under the tax regulations of the state in which the underlying beneficiary is established is treated there as the beneficiary of the benefits referred to in the preamble to Paragraph 1, and is not a body to which the Paragraph 1, subs a, b, c or d, would apply without the interposing of the beneficiary.

Article 24, Paragraph 4 of the Dutch – US Tax Treaty

4. In the case of an item of income, profit or gain derived through a person that is fiscally transparent under the laws of either State, such item shall be considered to be derived by a resident of a State to the extent that the item is treated for the purposes of the taxation law of such State as the income, profit or gain of a resident.

The Decree of December 6, 2022

For a specific case the Decree clarifies the application of Article 4, Paragraph 9 of the Dutch corporate income tax Act, as well as Article 2.1, Paragraph 1, sub e read in conjunction with Paragraph 4, sub a of the Dutch withholding tax Act 2021 in line with the explanation of the hybrid entity provision in (Article 24, Paragraph 4 of the Convention between the Kingdom of the Netherlands and the United States of America for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income (or similar treaty provisions). As of the date of entry into force of the underlying Decree (December 7, 2022) the Decree of March 19, 1997, IFZ/204M, infobulletin 1997, 232 is withdrawn.

In practice there is a lack of clarity – particularly in structures in relation to the US – about the application of the aforementioned hybrid entity provisions regarding the specific case as described in the Decree. During the parliamentary discussion of the Act on the introduction of a conditional withholding tax on dividends, the Secretary of State noted that the government recognizes this problem and that it will be examined whether this gives cause to provide for this in appropriate cases. By means of this decree, the Secretary of State meets this requirement and provides clarity.

Case

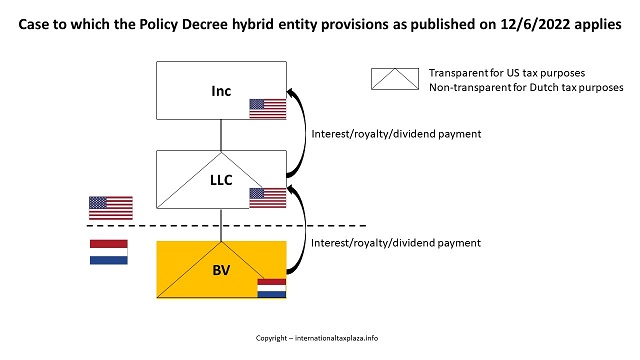

A company incorporated under the laws of the US (hereinafter: Inc.) and domiciled there and as such fully subject to US income tax, holds all shares in a US hybrid entity. The latter entity is an LLC incorporated under the laws of one of the US states. This LLC qualifies as tax transparent under US rules. However, for Dutch tax purposes the LLC qualifies as a non-transparent entity. The LLC in its turn holds all shares in a Dutch private company (hereinafter: BV). This Dutch BV is established in the Netherlands and is fully subject to taxation (corporate income tax) in the Netherlands. Based on American tax rules, the BV is regarded as a tax-transparent entity (a so-called 'disregarded entity') on the basis of the check-the-box-election. Schematically this looks like this:”

At a certain moment the Dutch BV pays a certain amount of dividend, interest royalties to the LLC in the United States. In principle, from a Dutch tax point of view, the proceeds accrue to the LLC. From a Dutch tax perspective both the BV and the LLC are considered to be non-transparent. Since according to US criterions both the BV and the LLC are transparent for US tax purposes the US only recognizes one body, namely the Inc. For US tax purposes the payment of the dividend, interest or royalties between de BV and the LLC and subsequently the LLC and the Inc. are therefore not visible. The income underlying this payment (the profit of the BV which is the ‘source’ of the payment, but without taking into account any deduction (if any) related to the payment of the dividends, interest or royalties) is, however, taken into account in the US at Inc. level as Inc.'s income.

Application of the hybrid entity provision

In the case as described above, the income of the BV that has been (re)paid from the BV as either dividends, interest or royalties to a hybrid entity (the LLC) has been taken into account by the US as income of a US resident (the Inc.). In this situation, in the interpretation of the Dutch Secretary of State for Finance – provided that the condition mentioned below is met – the non-transparent entity (the Inc.) can be regarded as 'the beneficiary of those proceeds', as referred to in Article 4, Paragraph 9 of the Dutch dividend withholding tax Act, and as 'the beneficiary of the proceeds', as meant in Article 2.1, Paragraph 4, sub a of the Dutch withholding tax Act 2021. This interpretation also applies if there is a stacking of hybrid entities. Furthermore in the case as described above – subject to the same condition as described below – the dividend, interest or royalties payments are regarded as income that is regarded to be income of a resident of a Contracting State for the application of Article 24, Paragraph 4, of the Dutch - US Tax Treaty or a treaty provision corresponding thereto (such as treaty provisions corresponding with Article 1, Paragraph 2, of the OECD Model Tax Convention).

The abovementioned is subject to the condition that the Dutch withholding agent demonstrates that the income from which the payment of the dividends, interest or royalties is made by him has been taken into account for tax purposes by the underlying participant(s) (ITP: in this case the Inc.).

This can, for example, be done on the basis of a tax return that was filed in the other state showing that the underlying income of the Dutch entity is allocated to the non-transparent entity in the US for tax purposes. If in the US, in order to avoid double taxation over the underlying income, a credit of (Dutch) corporate income tax is granted, this does not affect the fact that this income has been taken into account in the US, assuming that the credit granted does not exceed the (Dutch) corporate income tax that – from a US tax perspective – can be attributed to the underlying income.

For the sake of completeness, the Secretary of State notes that it is irrelevant whether the underlying income was taken into account as taxable income of the underlying participant(s) in the year of payment of the dividends, interest or royalties or in an earlier year. This occurs, for example, in the following situation:

The BV in the case realizes the profit in year 1. This profit is accounted for in Inc.’s US tax return in that same year (year 1). The BV decides to add the profit to its profit reserve and to distribute it in the form of a dividend in year 3. In such a case, the BV can use the interpretation of the hybrid entity provision described above since the profit has already been accounted for by Inc. in a previous year

Here you can find the text (in Dutch) of the Policy Decree hybrid entity provisions as published in the Dutch State Gazette on December 6, 2022.

Copyright – internationaltaxplaza.info

Follow International Tax Plaza on Twitter (@IntTaxPlaza)