On December 22, 2022 on the website of the Court of Justice of the European Union (CJEU) the judgment of the CJEU in Case C-656/21, IM Gestão de Ativos (IMGA) – Sociedade Gestora de Organismos de Investimento Coletivo SA & others versus Autoridade Tributária e Aduaneira, ECLI:EU:C:2022:1024, was published.

This request for a preliminary ruling concerns the interpretation of Article 5, Paragraph 2 of Council Directive 2008/7/EC of 12 February 2008 concerning indirect taxes on the raising of capital (OJ 2008 L 46, p. 11).

The request has been made in proceedings between IM Gestão de Ativos (IMGA) – Sociedade Gestora de Organismos de Investimento Coletivo SA and 31 common funds managed by it, namely IMGA Rendimento Semestral, IMGA Ações Portugal Cat A, IMGA Ações América Cat A, IMGA Mercados Emergentes, IMGA Eurofinanceiras, IMGA Eurocarteira, IMGA Rendimento Mais, IMGA Investimento PPR, IMGA Alocação Moderada Cat A, IMGA Alocação Dinâmica Cat A, IMGA Global Equities Selection Cat A, IMGA Liquidez Cat A, IMGA Money Market Cat A, IMGA Euro Taxa Variável Cat A, IMGA Dívida Pública Europeia, IMGA Retorno Global Cat A, IMGA Poupança PPR, IMGA Alocação Conservadora Cat A, IMGA Iberia Equities ESG Cat A, IMGA Iberia fixed income ESG Cat A, IMGA Alternativo, CA Curto Prazo, IMGA Ações Europa, IMGA Flexível Cat A, CA Monetário, CA Rendimento, Eurobic PPR/OICVM Ciclo Vida 35-44, Eurobic PPR/OICVM Ciclo Vida 45-54, Eurobic PPR/OICVM Ciclo Vida + 55, Eurobic Seleção Top and IMGA European Equities Cat A, on the one hand, and, on the other, the Autoridade Tributária e Aduaneira (Tax and Customs Authority, Portugal) concerning the imposition of stamp duty on the marketing of those common funds.

The dispute in the main proceedings and the questions referred for a preliminary ruling

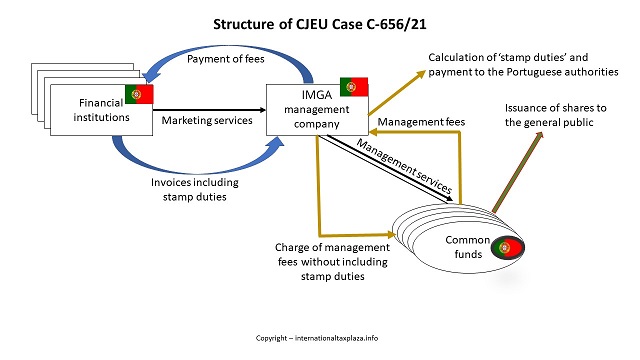

11 IMGA is a management company of undertakings for collective investment in transferable securities (‘common funds’). It manages and represents the 31 common funds referred to in paragraph 2 of this judgment.

12 In order to publicise the shares in the common funds in question and to market those shares, IMGA relies on financial institutions, mainly commercial banks with a network of branches covering the territory of Portugal and which have experience in financial intermediation and placing securities with the public.

13 During the period from January to December 2019, four banks marketed shares issued by the common funds at issue in the main proceedings to the general public. Those banks received fees for providing marketing services which allowed the new capital contributions to be raised, which they charged to IMGA as manager of the common funds. The banks also included stamp duty, collected from IMGA, on the invoices issued, in accordance with Item 17.3.4 of the TGIS.

14 In 2019, IMGA charged management fees to the common funds, part of which, namely EUR 8 752 232.43, consisted of the amount of the fees, charged by the banks referred to in the preceding paragraph, for marketing the shares subscribed, although that amount did not include stamp duty calculated by the banks in respect of the fees in question. IMGA also calculated and paid to the State a sum of EUR 350 089.30 in stamp duty, at the rate of 4% laid down in Item 17.3.4 of the TGIS, corresponding to the same marketing fees, which amount it passed on to the common funds.

15 The applicants in the main proceedings lodged an administrative appeal against that imposition of stamp duty with the Divisão de Serviço Central da Unidade dos Grandes Contribuintes (Division of the Central Office of the Large Taxpayers Unit, Portugal).

16 That appeal having been dismissed, the applicants in the main proceedings brought an action before the Tribunal Arbitral Tributário (Centro de Arbitragem Administrativa – CAAD) (Tax Arbitration Tribunal (Centre for Administrative Arbitration – CAAD), Portugal), the referring court, seeking, inter alia, a declaration that the notices of assessment and self-assessment of the stamp duty at issue in the main proceedings are unlawful.

17 In support of their application, the applicants in the main proceedings put forward two pleas in law. According to the first plea, the levying of stamp duty on that part of the fee charged by IMGA to the common funds, which reflects the marketing fees and the corresponding stamp duty which have already been invoiced by the banks, on which the banks have already levied stamp duty, constitutes double taxation of a single supply of services.

18 According to the second plea, pursuant to Article 5(2)(a) of Directive 2008/7, the marketing of new subscriptions for shares in common funds should be exempt from any indirect tax. That obligation to exempt concerns both the invoicing of marketing services by the banks to IMGA and the re-invoicing of the cost of the same service by IMGA to common funds.

19 After rejecting the first plea, the referring court states, in the context of the examination of the second plea, that it has doubts as to whether EU law precludes the levying of stamp duty on the remuneration received by banks for services relating to the marketing of shares in common funds, either when invoicing the management company of those funds for those services or when passing on the amounts paid for those services by the management company on those funds.

20 In those circumstances, the Tribunal Arbitral Tributário (Centro de Arbitragem Administrativa – CAAD) (Tax Arbitration Tribunal (Centre for Administrative Arbitration – CAAD)) decided to stay the proceedings and to refer the following questions to the Court for a preliminary ruling:

‘(1) Does Article 5(2) of Directive [2008/7] preclude national legislation, such as Item 17.3.4 of the [TGIS], under which stamp duty is levied on fees which banks charge open-ended securities investment fund management companies for gaining new subscriptions for shares, that is, for obtaining new inflows of capital for the investment funds in the form of new subscriptions for units issued by the funds?

(2) Does Article 5(2) of Directive [2008/7] preclude national legislation under which stamp duty is levied on the management fees charged to open-ended securities investment funds by management companies, in so far as those management fees include the fees which the banks charge the fund management companies for the aforementioned activity?’

Judgment

The CJEU (Fifth Chamber) ruled as follows:

Article 5(2)(a) of Council Directive 2008/7/EC of 12 February 2008 concerning indirect taxes on the raising of capital must be interpreted as precluding national legislation which provides for the imposition of stamp duty on, first, the remuneration received by a financial institution from a common fund management company for the supply of marketing services for the purposes of new capital contributions aimed at the subscription of newly issued shares in funds and, second, the amounts which that management company receives from common funds in so far as those amounts include the remuneration which that management company has paid to financial institutions in respect of those marketing services.

Legal context

European Union law

3 Recitals 1 to 3 and 9 of Directive 2008/7 are worded as follows:

‘(1) Council Directive 69/335/EEC of 17 July 1969 concerning indirect taxes on the raising of capital [(OJ 1969 L 249, p. 25),] has been substantially amended several times … Since further amendments are to be made, it should be recast in the interests of clarity.

(2) The indirect taxes on the raising of capital, namely the capital duty (the duty chargeable on contributions of capital to companies and firms), the stamp duty on securities, and duty on restructuring operations, regardless of whether those operations involve an increase in capital, give rise to discrimination, double taxation and disparities which interfere with the free movement of capital. The same applies as regards other indirect taxes with the same characteristics as capital duty and the stamp duty on securities.

(3) Consequently, it is in the interests of the internal market to harmonise the legislation on indirect taxes on the raising of capital in order to eliminate, as far as possible, factors which may distort conditions of competition or hinder the free movement of capital.

…

(9) Apart from capital duty, no indirect taxes on the raising of capital should be levied. In particular, no stamp duty should be levied on securities, regardless of the origin of such securities, and regardless of whether they represent a company’s own capital or its loan capital.’

4 Article 1 of Directive 2008/7 provides:

‘This Directive regulates the levying of indirect taxes in respect of the following:

(a) contributions of capital to capital companies;

(b) restructuring operations involving capital companies;

(c) the issue of certain securities and debentures.’

5 Article 2 of that directive, entitled ‘Capital company’, states:

‘1. For the purposes of this Directive “capital company” means:

(a) any company which takes one of the forms listed in Annex I;

(b) any company, firm, association or legal person the shares in whose capital or assets can be dealt in on a stock exchange;

(c) any company, firm, association or legal person operating for profit, whose members have the right to dispose of their shares to third parties without prior authorisation and are only responsible for the debts of the company, firm, association or legal person to the extent of their shares.

2. For the purposes of this Directive, any other company, firm, association or legal person operating for profit shall be deemed to be a capital company.’

6 Article 5 of that directive, entitled ‘Transactions not subject to indirect tax’, states, in paragraph 2 thereof:

‘Member States shall not subject the following to any form of indirect tax whatsoever:

(a) the creation, issue, admission to quotation on a stock exchange, making available on the market or dealing in stocks, shares or other securities of the same type, or of the certificates representing such securities, by whomsoever issued;

(b) loans, including government bonds, raised by the issue of debentures or other negotiable securities, by whomsoever issued, or any formalities relating thereto, or the creation, issue, admission to quotation on a stock exchange, making available on the market or dealing in such debentures or other negotiable securities.’

7 According to Article 1(1) to (3) of Directive 2009/65/EC of the European Parliament and of the Council of 13 July 2009 on the coordination of laws, regulations and administrative provisions relating to undertakings for collective investment in transferable securities (UCITS) (OJ 2009 L 302, p. 32), undertakings for collective investment in transferable securities (UCITS) to which that directive applies may be constituted in accordance with contract law (common funds managed by management companies), trust law (as unit trusts) or statute (as investment companies).

8 Under the first sentence of Article 87 of that directive:

‘A UCITS unit shall not be issued unless the equivalent of the net issue price is paid into the assets of the UCITS within the usual time limits.’

Portuguese law

9 Article 1(1) of the Código do Imposto do Selo (Stamp Duty Code) provides:

‘Stamp duty shall be charged on all transactions, contracts, documents, securities, papers and other legal matters or situations provided for in the Tabela Geral do Imposto do Selo [(Schedule of Stamp Duties)], including transfers of goods free of charge.’

10 The Schedule of Stamp Duties (‘TGIS’) includes an Item 17, concerning financial transactions, which is worded as follows:

‘Financial transactions,

…

17.3. Transactions performed or brokered by credit institutions, financial corporations or other entities deemed by law to be such institutions or corporations, and any other financial institution – on the amount charged:

…

17.3.4. Other fees and payments for financial services, including fees for card-based payment transactions – [stamp duty rate:] 4%.’

Consideration of the questions referred

21 By its two questions, which it is appropriate to examine together, the referring court asks, in essence, whether Article 5(2)(a) of Directive 2008/7 must be interpreted as precluding national legislation which provides for the imposition of stamp duty on, first, the remuneration received by a financial institution from a common fund management company for the supply of marketing services for the purposes of new capital contributions, aimed at the subscription of newly issued shares in funds and, second, the amounts which that management company receives from common funds in so far as those amounts include the remuneration which that management company has paid to financial institutions in respect of those marketing services.

22 As a preliminary point, it should be recalled that Directive 2008/7, according to Article 1(a) thereof, regulates the levying of indirect taxes in respect of contributions of capital to capital companies. Those indirect taxes include stamp duty on securities and other indirect taxes with the same characteristics as the stamp duty on securities, as is apparent from recital 2 of that directive.

23 Article 2(2) of that directive provides, moreover, that any company, firm, association or legal person operating for profit which does not fall within the categories of capital companies mentioned in Article 2(1) is deemed to be a capital company.

24 In the present case, it is apparent from the order for reference that the tax at issue in the main proceedings constitutes a stamp duty levied on the remuneration paid to banks for services relating to the marketing of new subscriptions for shares in common funds. It is also apparent that, under Portuguese law, the concept of ‘investment funds’ refers to a body of assets, without legal personality, belonging to the participants under the general regime of community of property.

25 The Court has already held that a grouping of persons which does not have legal personality and whose members provide capital for a separate fund with a view to making profits must be regarded as being an ‘association operating for profit’ within the meaning of Article 2(2) of Directive 2008/7, so that, pursuant to Article 2(2), it is deemed to be a capital company for the purposes of that directive (see, to that effect, judgment of 12 November 1987, Amro Aandelen Fonds, 112/86, EU:C:1987:488, paragraph 13).

26 It follows from those considerations that common funds, such as those at issue in the main proceedings, must be deemed to be capital companies and, consequently, fall within the scope of Directive 2008/7.

27 Having made those preliminary observations, it should be recalled that Article 5(2)(a) of Directive 2008/7 prohibits Member States from subjecting to any form of indirect taxation whatsoever, the creation, issue, admission to quotation on a stock exchange, making available on the market or dealing in stocks, shares or other securities of the same type, or of certificates representing such securities, by whomsoever issued.

28 However, in view of the objective pursued by that directive, Article 5 thereof must be interpreted broadly, so as to ensure that the prohibitions it lays down are not denied practical effect. Thus the prohibition of a taxation of transactions for the raising of capital also applies to transactions which are not expressly covered by that prohibition, where such taxation is tantamount to taxing a transaction forming an integral part of an overall transaction with regard to the raising of capital (see, to that effect, judgment of 19 October 2017, Air Berlin, C‑573/16, EU:C:2017:772, paragraphs 31 and 32 and the case-law cited).

29 Thus, the Court has held that, where an issue of securities has no point until those securities find investors, a tax on the initial acquisition of a newly issued security is in reality levied on the very issue of that security as it forms an integral part of an overall transaction with regard to the raising of capital. The aim of maintaining the practical effect of Article 5(2)(a) of Directive 2008/7 implies, therefore, that ‘issue’, for the purposes of that provision, includes the first acquisition of securities immediately consequent upon their issue (see, by analogy, judgment of 15 July 2004, Commission v Belgium, C‑415/02, EU:C:2004:450, paragraphs 32 and 33).

30 Similarly, the Court has held that the transfer of beneficial ownership of shares, for the sole purpose of a transaction admitting those shares to listing on a stock exchange and with no impact on their beneficial ownership, must be regarded as merely an incidental transaction, integral to that transaction admitting those shares, which, in accordance with Article 5(2)(a) of Directive 2008/7, cannot be subject to any form of taxation whatsoever (see, to that effect, judgment of 19 October 2017, Air Berlin, C‑573/16, EU:C:2017:772, paragraphs 35 and 36).

31 Since services relating to the marketing of shares in common funds, such as those at issue in the main proceedings, are closely linked to the operations relating to the issuing and making available on the market of shares, within the meaning of Article 5(2)(a) of Directive 2008/7, they must be regarded as forming an integral part of an overall transaction with regard to the raising of capital.

32 Subject to verification by the referring court, those funds fall within the scope of Directive 2009/65, pursuant to Article 1(1) to (3) thereof. In that regard, the payment of the price corresponding to the shares purchased – which is the sole objective of a marketing operation – relates to the substance of the raising of capital and is, as is apparent from Article 87 of Directive 2009/65, a condition which must be satisfied in order for the shares in the funds in question to be issued.

33 It follows that publicising the existence of investment instruments in such a way as to promote the subscription of shares in common funds is a necessary business approach and which, on that basis, must be regarded as an incidental transaction, integral to the issue of shares in those funds and their being made available on the market.

34 Furthermore, since the application of Article 5(2)(a) of Directive 2008/7 depends on the close link between marketing services and operations relating to the issue of shares in those funds and their being made available on the market, the decision to entrust those commercial transactions to third parties rather than performing those operations directly is irrelevant for the purposes of such application.

35 In that regard, it should be borne in mind, first, that that provision does not make the obligation of the Member States to exempt transactions for the raising of capital subject to any condition relating to the status of the body responsible for performing those transactions. Second, whether or not there is a legal obligation to engage the services of a third party is not a relevant condition when it falls to be determined whether a transaction must be regarded as forming an integral part of the overall transaction with regard to the raising of capital (see, to that effect, judgment of 19 October 2017, Air Berlin, C‑573/16, EU:C:2017:772, paragraph 37).

36 It follows that marketing services such as those at issue in the main proceedings are an integral part of a transaction to raise capital, so that charging a stamp duty on them falls within the scope of the prohibition laid down in Article 5(2)(a) of Directive 2008/7.

37 Furthermore, it should be noted that the practical effect of that provision would be compromised if, although it precludes the imposition of stamp duty on the remuneration received by banks in respect of services relating to the marketing of new shares in common funds from the management company of those funds, it were permissible for that stamp duty to be charged on the same remuneration when they were re-invoiced by that management company to the funds in question.

38 In the light of the foregoing considerations, the answer to the questions referred is that Article 5(2)(a) of Directive 2008/7 must be interpreted as precluding national legislation which provides for the imposition of stamp duty on, first, the remuneration received by a financial institution from a common fund management company for the supply of marketing services for the purposes of new capital contributions aimed at the subscription of newly issued shares in funds and, second, the amounts which that management company receives from common funds in so far as those amounts include the remuneration which that management company has paid to financial institutions in respect of those marketing services.

Costs

39 Since these proceedings are, for the parties to the main proceedings, a step in the action pending before the national court, the decision on costs is a matter for that court. Costs incurred in submitting observations to the Court, other than the costs of those parties, are not recoverable.

Copyright – internationaltaxplaza.info

Follow International Tax Plaza on Twitter (@IntTaxPlaza)