Introductory remarks

The provisions for computing the adjusted covered taxes of the constituent entities in the jurisdiction are laid down in Chapter IV (Computation of Adjusted Covered Taxes). Chapter IV defines covered taxes and outlines the rules for the calculation of ‘adjusted covered taxes’ of a constituent entity for a fiscal year. The prime principle in allocating covered taxes is to assign them to the jurisdiction where underlying profits subject to these taxes were earned.

To ensure this principle, the Directive also provides special rules in respect of cross-border taxes or income streams in the case of a PE, transparent entity, controlled foreign company, a hybrid entity, or taxes on dividends.

Again some of the provisions in Chapters VI (Special Rules for Mergers and Acquisitions) and VII (Tax Neutrality and Distribution Regimes) of the proposed EU Directive might have to be taken into account when computing the adjusted covered taxes

The computation

Special situations

Before we start the actual computation it should be noted that there are a few special situations to which special arrangements apply when computing the adjusted covered taxes.

Tax attributes upon transition

When determining the effective tax rate for a jurisdiction in a transition year, and for each subsequent fiscal year, the MNE group shall take into account the deferred tax assets and deferred tax liabilities reflected or disclosed in the financial accounts of the constituent entities in a jurisdiction for the transition year.

Deferred tax assets and deferred tax liabilities shall be taken into account at the lower of the minimum tax rate and the applicable domestic tax rate. However, a deferred tax asset that has been accrued at a tax rate lower than the minimum tax rate may be taken into account at the minimum tax rate if the taxpayer can demonstrate that the deferred tax asset is attributable to a qualifying loss.

The impact of any valuation adjustment or accounting recognition adjustment with respect to a deferred tax asset shall be disregarded.

Deferred tax assets arising from items excluded from the computation of qualifying income or loss in accordance with Chapter III (See Step 4) shall be excluded from the calculation of the effective tax rate when such deferred tax assets are generated in a transaction that takes place after December 15, 2021.

In the case of a transfer of assets between constituent entities after December 15, 2021 and before the start of a transition year, the value of the acquired assets shall be based upon the transferring entity’s carrying value of the transferred assets at the time of the transfer.

For the moment I assume that the first fiscal year that the proposed Directive becomes effective (which is expected to be the first fiscal year of a group starting on or after January 1, 2023) and therefore for the first time applies to a group will automatically be considered a transition year for all groups to which the Directive starts to apply.

Constituent entities joining and leaving a MNE group

Article 32, Paragraph 3 of the EU Directive arranges that in the acquisition year, and in each succeeding fiscal year, the qualifying income or loss and adjusted covered taxes of the target shall be based on the historical carrying value of its assets and liabilities.

Specific allocation of covered taxes incurred by certain types of constituent entities

Although Article 23 is not the first article of Chapter IV of the proposed EU Directive it might be handy to start Step 5 of the process by reviewing article 23 and by identifying whether there are any situations within your group to which Article 23 of the proposed Directive applies.

Article 23 amongst others arranges:

- the allocation of covered taxes between the main entity its permanent establishments;

- the allocation of covered taxes included in the financial accounts of a tax transparent entity;

- how to allocate covered taxes in case a CFC-regime applies; and

- the allocation of covered taxes when a hybrid entity is involved.

You can find the full text of Article 23 here.

Ultimate parent entity that is a flow-through entity

The covered taxes of a flow-through entity that is an ultimate parent entity shall be reduced proportionally to the amount of qualifying income reduced in accordance with Article 36, Paragraph 1 of the proposed Directive (See Step 4).

The aforementioned shall also apply to a permanent establishment through which a flow-through entity that is an ultimate parent entity wholly or partly carries out its business or through which the business of a tax transparent entity is wholly or partly carried out provided that the ultimate parent entity’s ownership interest in that tax transparent entity is held directly or through one or more tax transparent entities.

Ultimate parent entity subject to a deductible dividend regime

The fourth paragraph of Article 37 arranges that the covered taxes of an ultimate parent entity that is subject to a deductible dividend regime, other than the taxes for which the dividend deduction was allowed, shall be reduced proportionally to the amount of qualifying income reduced in accordance with Article 37, Paragraph 2 of the proposed Directive (See Step 4).

Article 37, Paragraph 6 subsequently arranges that for the purpose of paragraph 4, a dividend distributed by a supply cooperative distribute patronage shall be treated as subject to tax in the hands of the recipient insofar as such dividend reduces a deductible expense or cost in the computation of the recipient’s taxable income or loss.

Computing the covered taxes

Step one in computing the adjusted covered taxes of the constituent entities in the jurisdiction is to compute the covered taxes. The computation of the covered taxes is done in accordance with the provisions laid down in Article 19 of the proposed EU Directive. Based on these provisions the covered taxes of a constituent entity shall include:

(a) taxes accrued in the financial accounts of a constituent entity with respect to its income or profits, or its share of the income or profits of a constituent entity in which it owns an ownership interest;

(b) taxes on distributed profits, deemed profit distributions, and non-business expenses imposed under an eligible distribution tax system;

(c) taxes imposed in lieu of a generally applicable corporate income tax; and

(d) taxes levied by reference to retained earnings and corporate equity, including taxes on multiple components based on income and equity.

the covered taxes of a constituent entity shall not include:

(a) the top-up tax accrued by a parent entity under a qualified income inclusion rule;

(b) the top-up tax accrued by a constituent entity under a qualified domestic top-up tax;

(c) taxes attributable to an adjustment made by a constituent entity as a result of the application of a qualified UTPR;

(d) disqualified refundable imputation tax; and

(e) taxes paid by an insurance company in respect of returns to policyholders.

Covered taxes in respect of any net gain or loss arising from the disposal of immovable property as referred to in the first subparagraph of Article 15, Paragraph 7 of the proposed Directive shall be excluded from the computation of the adjusted covered taxes in the fiscal year in which the constituent entity made the election as meant in Article 15, Paragraph 7.

Adjusted covered taxes

Once we have determined the amount of covered taxes we can start the computation of the adjusted covered taxes. The covered taxes as computed above are the starting point for this computation. Then the adjustments as arranged by the Articles 20-24 of the proposed EU Directive are made to the amount of covered taxes.

The additions to the covered taxes of a constituent entity for the fiscal year shall include:

(a) the amount of covered taxes accrued as an expense in the profit before taxation in the financial accounts;

(b) the amount of qualifying loss deferred tax asset that has been used pursuant to Article 22, Paragraph 31;

(c) the amount of covered taxes relating to an uncertain tax position previously excluded under point (h) that are paid for the fiscal year;

(d) the amount of credit or refund in respect of a qualified refundable tax credit that was accrued as a reduction to the tax expense.

Remark:

1 This point refers to the situations in which the constituent entity included a deferred tax asset in its financial statements for a loss that it incurred (and that it expected that it could use to set off against profits of other fiscal years) and that is set off against the taxable income of the underlying fiscal year.

The reductions to the covered taxes of a constituent entity for the fiscal year shall include:

(e) the amount of tax expense with respect to income excluded from the computation of qualifying income or loss under Chapter III (See Step 4) shall be deducted2;

(f) the amount of credit or refund in respect of a refundable tax credit that is not a qualified refundable tax credit that was not accrued as a reduction to the tax expense shall be deducted;

(g) the amount of covered taxes refunded or credited to a constituent entity that was not treated as an adjustment to tax expense, unless it relates to a qualified refundable tax credit shall be deducted;

(h) the amount of tax expense, which relates to an uncertain tax position shall be deducted;

(i) the amount of tax expense that is not expected to be paid within three years after the end of the fiscal year shall be deducted;

(j) any increase or decrease in covered taxes accrued in equity or other comprehensive income relating to amounts included in the computation of qualifying income or loss that will be subject to tax shall be added or deducted; and

(k) the total deferred tax adjustment amount as set out in Article 21 of the proposed Directive shall be added or deducted.

Remark

2 The text of this point raises the question how taxes are to be treated that relate to adjustments that are made to the qualifying income based on Chapters VI (Special Rules for Mergers and Acquisitions) and VII (Tax Neutrality and Distribution Regimes) of the proposed EU Directive.

NB It should be noted that for the purpose of computing adjusted covered taxes, where an amount of covered tax is described in more than one of the points (a through k) above, it shall only be taken into account once.

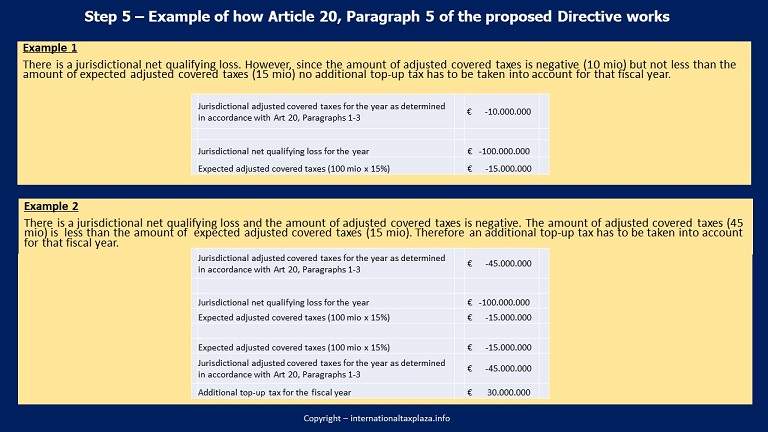

Based on Article 20, Paragraph 5 of the proposed Directive, where, for a fiscal year:

· there is a net qualifying loss in a jurisdiction; and

· the amount of adjusted covered taxes for that jurisdiction is negative and less than an amount equal to the net qualifying loss multiplied by the minimum tax rate (the “expected adjusted covered taxes”),

the amount equal to the difference between the amount of adjusted covered taxes and the amount of expected adjusted covered taxes shall be treated as an additional top-up tax for that fiscal year. This amount of additional top-up tax shall be allocated to each constituent entity in the jurisdiction in accordance with Article 28, Paragraph 3.

Constituent entities joining and leaving a MNE group

With the exception of the qualifying loss deferred tax asset, the deferred tax assets and deferred tax liabilities of a target that are transferred between MNE groups shall be taken into account by the acquiring MNE group in the same manner and to the same extent as if the acquiring MNE group controlled the constituent entity when such assets and liabilities arose.

Remark AJT: Does this mean the ‘purchaser’ should follow the treatment as the ‘seller’ did? Or does this mean that the ‘purchaser’ should take the amount into account that the asset would have if the treatment had been followed that the purchasing group normally follows.

Deferred tax liabilities of the target that have previously been included in the total deferred tax adjustment amount shall be treated pursuant to Article 21, Paragraph 7 of the proposed Directive as deducted by the disposing MNE group and as added by the acquiring MNE group in the acquisition year, except that any subsequent reduction of covered taxes shall have effect in the year in which the amount is recaptured.

Eligible distribution tax systems

Article 38, Paragraph 1 of the proposed Directive arranges that a filing constituent entity may make an election with respect to a constituent entity that is subject to an eligible distribution tax system to include the amount determined as a deemed distribution tax in accordance with the second paragraph 2 Article 38 in the adjusted covered taxes of the constituent entity for the fiscal year. The election shall be made annually in accordance with Article 43, Paragraph 2 and shall apply to all the constituent entities that are located in a jurisdiction.

According to Article 38, Paragraph 2 the amount of deemed distribution tax shall be the lesser of:

(a) the amount of adjusted covered taxes necessary to increase the effective tax rate as computed in accordance with of Article 26(2) for the jurisdiction for the fiscal year to the minimum tax rate; or

(b) the amount of tax that would have been paid if the constituent entities had distributed their total income under the eligible distribution tax system during the fiscal year.

The third paragraph arranges that where an election is made under Paragraph 1 (see above), a deemed distribution tax recapture account shall be established for each fiscal year in which such election applies. The amount of deemed distribution tax paid in the jurisdiction shall be added to the deemed distribution tax recapture account for the fiscal year in which it was established.

At the end of each succeeding fiscal year, the amount in the deemed distribution tax recapture accounts established for prior fiscal years shall be reduced, up to zero, by the taxes paid by the constituent entities during the fiscal year in relation to actual or deemed distributions.

Any residual amount in the deemed distribution tax recapture accounts remaining after the application of the first subparagraph shall be reduced, up to zero, by an amount equal to the net qualifying loss for a jurisdiction multiplied by the minimum tax rate.

Any residual amount of net qualifying loss remaining after the application of the last subparagraph of Paragraph 3 shall be carried forward to the following fiscal years and reduce any residual amount in the deemed distribution tax recapture accounts remaining after the application of Paragraph 3.

The outstanding balance, if any, of the deemed distribution tax recapture account at the end of the fourth fiscal year after such account was established, shall be treated as a reduction to the adjusted covered taxes in accordance with Article 28, Paragraph 1 for the fiscal year in which such account was established.

Taxes that are paid during the fiscal year in relation to actual or deemed distributions shall not be included in adjusted covered taxes to the extent they reduce a deemed distribution tax recapture account in accordance with Paragraph 3.

Article 38, Paragraph 7 arranges that where a constituent entity that is subject to an election under the first paragraph leaves the MNE group or substantially all of its assets are transferred to a person that is not a constituent entity of the same MNE group located in the same jurisdiction, any outstanding balance of the deemed distribution tax recapture accounts in previous fiscal years in which such account was established shall be treated as a reduction to the adjusted covered taxes for each of those fiscal years in accordance with Article 28, Paragraph 1.

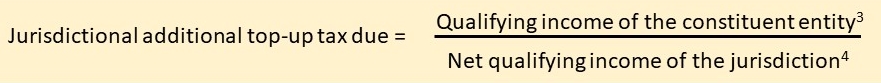

Any additional top-up tax amount due shall be multiplied by the following ratio to determine the additional top-up tax due for the jurisdiction:

where:

3 the qualifying income of the constituent entity shall be determined in accordance with Chapter III for each fiscal year in which there is an outstanding balance of the deemed distribution tax recapture accounts for the jurisdiction; and

4 the net qualifying income for the jurisdiction shall be determined in accordance with Article 25, Paragraph 2 for each fiscal year in which there is an outstanding balance of the deemed distribution tax recapture accounts for the jurisdiction.

Qualifying loss election

Article 22 of the proposed EU Directive contains regulations regarding the so-called qualifying loss election that the filing constituent entity may make. When making such election a deferred tax assets for a loss carry-forward is to be taken into account. In this respect one should note a.o. the following:

· The election can only be made if the total of all the net qualifying incomes or losses of the constituent entities located in a jurisdiction result in a net qualifying loss;

· The election is made for the jurisdiction;

· The deferred tax asset to be taken into account in this respect amounts to the total net qualifying loss in the jurisdiction x 15% (15% being the minimum tax rate);

· A qualifying loss election cannot be made for a jurisdiction with an eligible distribution tax system as defined in Article 38;

· The deferred tax asset will be decreased in future fiscal years in which the total of all the net qualifying incomes or losses of the constituent entities located in a jurisdiction result in a net qualifying income; and

· Where a qualifying loss election is revoked, any remaining qualifying loss deferred tax asset shall be reduced to zero as of the first day of the first fiscal year in which the qualifying loss election is no longer applicable.

Post-filing adjustments and tax rate changes

The last article that has to be taken into account in this Step is Article 24 of the proposed EU Directive. Article 24 lays down regulations that apply in situations in which post-filing adjustments are made for a previous fiscal year and in situations that tax rate changes take place after the filing of a top-up tax return for a fiscal year.

All steps above are repeated for each of the constituent entities of the group.

After finishing Step 5 you forward to Step 6.

Copyright – internationaltaxplaza.info

Follow International Tax Plaza on Twitter