1. The UTPR top-up tax amount allocated to a Member State shall be computed by multiplying the total UTPR top-up tax, as determined in accordance with paragraph 2, by the Member State’s UTPR percentage as determined in accordance with paragraph 5.

2. The total UTPR top-up tax for a fiscal year shall be the sum of the top-up tax of all the low-taxed constituent entities of the MNE group for that fiscal year, as determined in accordance with Article 26, subject to the adjustments set out in paragraphs 3 and 4.

3. The UTPR top-up tax of a low-taxed constituent entity shall be equal to zero where, for the fiscal year, such low-taxed constituent entity is wholly held directly by the ultimate parent entity, or indirectly through one or more parent entities, which are located either:

(a) in a Member State; or

(b) in a third country jurisdiction where it is required to apply a qualified income inclusion rule in respect of its low-taxed constituent entity for the fiscal year.

4. Where paragraph 3 does not apply, the UTPR top-up tax of a low-taxed constituent entity shall be reduced by the amount of top-up tax allocated to a parent entity located in a third country jurisdiction which is required to apply a qualified income inclusion rule in respect of the constituent entity.

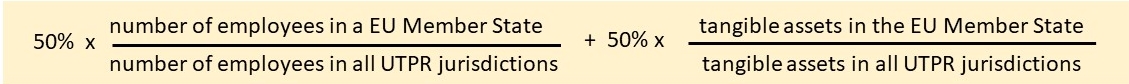

5. A Member State’s UTPR percentage shall be computed, for each fiscal year and for each MNE group, according to the following formula:

where:

(a) the number of employees in the Member State is the total number of employees of all the constituent entities of the MNE group located in that Member State;

(b) the number of employees in all jurisdictions with a qualified UTPR is the total number of employees of all the constituent entities of the MNE group located in a jurisdiction that has a qualified UTPR in force for the fiscal year;

(c) the total value of tangible assets in the Member State is the sum of the net book value of tangible assets of all the constituent entities of the MNE group located in that Member State;

(d) The total value of tangible assets in all jurisdictions with a qualified UTPR is the sum of the net book value of tangible assets of all the constituent entities of the MNE group located in a jurisdiction that has a qualified UTPR in force for the fiscal year.

6. The number of employees shall be the number of employees on a full-time equivalent basis of all constituent entities located in the relevant jurisdiction, including independent contractors provided that they participate in the ordinary operating activities of the constituent entity.

The tangible assets shall include the tangible assets of all constituent entities located in the relevant jurisdiction but shall not include cash or cash equivalent, intangible or financial assets.

7. A permanent establishment shall be allocated the employees whose payroll costs are included, and tangible assets that are included, in its separate financial accounts pursuant to Article 17(1) adjusted in accordance with Article 17(2).

The number of employees and the net book value of tangible assets held by an investment entity shall be excluded from the elements of the formula.

The number of employees and the net book value of tangible assets of a flow-through entity shall be excluded from the elements of the formula, unless they are allocated to a permanent establishment or, in the absence of a permanent establishment, to the constituent entities that are located in the jurisdiction where the flow-through entity was created.

8. By way of derogation from paragraph 5, a Member State’s UTPR percentage for an MNE group shall be deemed to be zero for a fiscal year where that Member State has not collected from the relevant constituent entities the UTPR top-up tax amount which it was allocated in a prior fiscal year.

The number of employees and the net book value of tangible assets of the constituent entities of an MNE group which is located in a Member State with a UTPR percentage of zero for a fiscal year shall be excluded from the elements of the formula for allocating the total UTPR top-up tax to the MNE group for that fiscal year.

Copyright – internationaltaxplaza.info