On December 8, 2022 on the website of the Court of Justice of the European Union (CJEU) the judgment of the CJEU in Cases C-247/21, Luxury Trust Automobil GmbH versus Finanzamt Österreich, ECLI:EU:C:2022:966 was published. The judgment shows the importance of using the correct and proper wording on invoices in order to avoid VAT-problems.

This request for a preliminary ruling concerns the interpretation of Article 42(a) of Council Directive 2006/112/EC of 28 November 2006 on the common system of value added tax (OJ 2006 L 347, p. 1), as amended by Council Directive 2010/45/EU of 13 July 2010 (JO 2010 L 189, p. 1) (‘the VAT Directive’), read in conjunction with Article 197(1)(c) of that directive and Article 219a of that directive.

The request has been made in proceedings between Luxury Trust Automobil GmbH and the Finanzamt Österreich (Tax Office, Austria; ‘the tax authority’) concerning the value added tax (VAT) claimed from that company in respect of the tax year 2014.

The dispute in the main proceedings and the questions referred for a preliminary ruling

15 Luxury Trust Automobil is a limited liability company established in Austria engaged in brokerage and selling luxury vehicles in several countries, both within the European Union and in third countries.

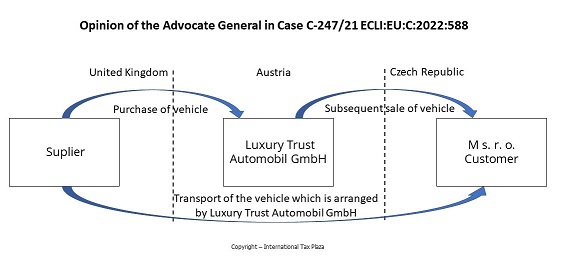

16 In 2014, Luxury Trust Automobil bought vehicles from a supplier established in the United Kingdom which it resold to the company M s. r. o. (‘M’), which is established in the Czech Republic. Those vehicles were transported directly from the United Kingdom to the Czech Republic.

17 The undertakings involved in those supplies each acted under the VAT identification number of their State of establishment. Three invoices issued by Luxury Trust Automobil, dated March 2014 (‘the invoices at issue’), therefore mentioned that company’s Austrian VAT identification number, M’s Czech VAT identification number and the VAT identification number of the supplier established in the United Kingdom. Each of the invoices also included the reference ‘Exempt intra-Community triangular transaction’.

18 In the recapitulative statement for March 2014, Luxury Trust Automobil indicated M’s Czech VAT identification number and reported the existence of intra-Community triangular transactions.

19 However, in a tax inspection, it was found that the triangular transaction scheme was not applicable because, contrary to the requirements of Paragraph 25(4) of the UStG 1994, the invoices at issue did not contain any statement as to transfer of the tax liability. The transaction was therefore deemed to be a failed triangular transaction that could not be remedied after the event. In view of the use of Luxury Trust Automobil’s Austrian VAT identification number, it must be accepted that there was an intra-Community acquisition in Austria, in accordance with Paragraph 3(8) of the UStG 1994. It was on the basis of those factors that, by a decision of 25 April 2016, the tax authority assessed the VAT payable by Luxury Trust Automobil in respect of 2014.

20 The referring court states that, after that tax inspection, Luxury Trust Automobil corrected the invoices at issue by amendments of 23 May 2016, adding to those invoices a reference to the transfer of the tax liability to M. However, there was no evidence that those amendments had actually been served on that company. Furthermore, the latter is described as a ‘missing trader’ by the Czech tax authorities. Although M was registered in the Czech Republic for VAT purposes during the period in which the supplies at issue were carried out, the Czech tax authorities had not managed to contact it and M neither declared nor paid VAT in the Czech Republic in respect of those supplies.

21 The tax authority’s decision of 25 April 2016 was the subject of an objection which was rejected by the Finanzamt Baden Mödling (Baden Mödling Tax Office, Austria). Luxury Trust Automobil then brought an action before the Bundesfinanzgericht (Federal Finance Court, Austria).

22 According to that court, the application of the provisions relating to triangular transactions is not mandatory in a situation such as that referred to in Paragraph 25(1) of the UStG 1994. The intermediary acquiring in the goods in a triangular transaction, such as, in the present case, Luxury Trust Automobil, is entitled to choose whether or not, with regard to a particular supply, it wishes to apply those provisions. That right must be exercised at the time when the transaction in question is carried out.

23 In that context, if that intermediary acquiring the goods wishes to obtain exemption of an intra-Community acquisition in the Member State of destination and the transfer of the tax liability relating to that acquisition to the final recipient of that acquisition, it must issue an invoice containing the information referred to in Paragraph 25(4) of the UStG 1994. The statement that the final customer is liable to pay the VAT, provided for in that provision, was not included in the invoices at issue.

24 Paragraph 25 of the UStG 1994 is therefore not applicable, so that the transaction at issue must be dealt with in the light of the general provisions of that law. Under those provisions, since Luxury Trust Automobil used its Austrian VAT identification number, it made an intra-Community acquisition in Austria. The acquisition must therefore be regarded as having taken place in Austria unless and until that company demonstrates that that acquisition was taxed in the Czech Republic. Since that condition has not been satisfied, that company is not entitled to deduct input VAT in respect of that acquisition.

25 Luxury Trust Automobil brought an appeal on a point of law against the judgment of the Bundesfinanzgericht (Federal Finance Court) before the Verwaltungsgerichtshof (Supreme Administrative Court, Austria), which is the referring court in the present case.

26 The dispute in the main proceedings concerns the tax due under the second sentence of Paragraph 3(8) of the UStG 1994, that is to say, the additional taxation of an intra-Community acquisition deemed to be such by virtue of the use of an Austrian VAT identification number.

27 In that context, the Verwaltungsgerichtshof (Supreme Administrative Court) points to three difficulties.

28 First, that court notes that it follows from the first paragraph of Article 41 of the VAT Directive that an intra-Community acquisition is deemed to take place within the territory of the Member State which issued the VAT identification number used for the purposes of that acquisition. However, in accordance with Article 42 of that directive, that is not the case where the recipient of a subsequent supply has been designated as liable for VAT under Article 197 of that directive.

29 In that regard, Article 197(1)(c) of the VAT Directive provides that the invoice relating to such a transaction must be drawn up in accordance with the provisions of Sections 3 to 5 of Chapter 3 of Title XI of that directive.

30 There is therefore ‘designation’ of the recipient of a supply as being liable for VAT, within the meaning of Article 42 of that directive, where the invoice contains a statement such as that mentioned in Article 226(11a) of that directive, that is to say the words ‘Reverse charge’.

31 However, the referring court considers that, although recital 7 of Directive 2010/45 supports strict compliance with the invoicing provisions, the purpose of the words ‘Reverse charge’ on invoices relating to triangular transactions is to ensure that the final customer in such a transaction can clearly and easily recognise that the tax liability is transferred to it. According to that court, that objective can also be achieved by the reference to ‘Exempt intra-Community triangular transaction’ appearing on the invoices at issue, particularly if account is taken of the fact that a VAT amount is not shown on the invoice, but the amount mentioned on those invoices is expressly referred to as the ‘net amount of the invoice’.

32 In those circumstances, it cannot be ruled out that the initial entry on the invoices at issue may satisfy the conditions laid down by EU law for the designation of the recipient of a supply as being liable for the VAT.

33 Secondly, if that were not to be the case, the referring court notes that, in paragraph 49 of its judgment of 19 April 2018, Firma Hans Bühler (C‑580/16, EU:C:2018:261), the Court held that Article 42(a) of the VAT Directive concerns the basic condition required in order for an acquisition such as that at issue in the case giving rise to that judgment to be deemed to be subject to VAT, in accordance with Article 40 of that directive. By contrast, Article 42(b) of that directive lays down the detailed rules relating to proof of taxation in the Member State of destination, which must be regarded as formal requirements.

34 One of the substantive conditions under Article 42(a) requires the person to whom the supply is made pursuant to Article 197 of the VAT Directive to have been designated as liable for payment of VAT on the invoice relating to that supply.

35 In those circumstances, the invoices must, as regards the deduction of input tax, be regarded as formal requirements which may, as a general rule, be corrected, the correction applying retroactively to the year in which the invoice was initially drawn up. Furthermore, even if VAT has been wrongly invoiced, an invoice may be corrected if the person who issued the invoice shows that he or she acted in good faith or completely eliminated, in sufficient time, the risk of loss of tax revenue.

36 The referring court is uncertain, however, whether such a possibility of correction also exists in respect of a substantive condition, especially since the application of the rules on triangular transactions is not mandatory, since taxable persons may decide not to make use of the simplification arrangement established by that legislation.

37 In that context, it is also necessary to determine whether it is sufficient for the person who issued an invoice to correct it and send it to the recipient of the supply in question or whether the correction must also have been received by that recipient. Any retroactive effect of such a correction would also have to be determined, in accordance with the judgment of 15 September 2016, Senatex (C‑518/14, EU:C:2016:691).

38 Thirdly, the referring court notes that Luxury Trust Automobil claims that Czech law is applicable. That law, unlike Austrian law, does not require the invoices to contain a reference to the transfer of the tax liability. The determination of the applicable law nevertheless requires the interpretation of Article 219a of the VAT Directive.

39 In those circumstances the Verwaltungsgerichtshof (Supreme Administrative Court) decided to stay the proceedings and to refer to the Court of Justice the following questions for a preliminary ruling:

‘(1) Is Article 42(a) of [the VAT Directive] in conjunction with Article 197(1)(c) of that Directive … to be interpreted as meaning that the person to whom the supply is made is to be designated as liable for payment of VAT if the invoice, which does not show the amount of value added tax, states: “Exempt intra-Community triangular transaction”?

(2) If the first question is answered in the negative:

(a) Can such a mention on the invoice be amended so as to apply retroactively (by stating: “Intra-Community triangular transaction in accordance with Paragraph 25 of [the UStG 1994]. Liability for payment of VAT is transferred to the customer”)?

(b) Is it necessary for the invoice recipient to receive the amended invoice in order for an amendment to be effective?

(c) Does the effect of the amendment apply retroactively to the original date of invoicing?

(3) Is Article 219a of [the VAT Directive] to be interpreted as meaning that the rules on invoicing to be applied are those of the Member State whose provisions would be applicable if a “customer” has not (yet) been designated on the invoice as the person liable for payment of VAT; or are the rules to be applied those of the Member State whose provisions would be applicable if the designation of the “customer” as the person liable for payment of VAT is accepted as valid?’

Judgment

The CJEU (Eighth Chamber) ruled as follows:

1. Article 42(a) of Council Directive 2006/112/EC of 28 November 2006 on the common system of value added tax, as amended by Council Directive 2010/45/EU of 13 July 2010, read in conjunction with Article 197(1)(c) of Directive 2006/112, as amended, must be interpreted as meaning that, in a triangular transaction, the final customer has not been validly designated as liable for the value added tax (VAT) where the invoice issued by the intermediary acquiring the goods does not contain the words ‘Reverse charge’, referred to in Article 226(11a) of Directive 2006/112, as amended.

2. Article 226(11a) of Directive 2006/112, as amended by Directive 2010/45 must be interpreted as meaning that the omission, on an invoice, of the words ‘Reverse charge’, required under that provision, may not subsequently be corrected by adding a statement that that invoice relates to an intra-Community triangular transaction and that the tax liability is transferred to the person to whom the supply is made.

Legal context

European Union law

The VAT Directive

3 Article 2(1)(b)(i) of the VAT Directive provides:

‘The following transactions shall be subject to VAT:

…

(b) the intra-Community acquisition of goods for consideration within the territory of a Member State by:

(i) a taxable person acting as such, or a non-taxable legal person, where the vendor is a taxable person acting as such who is not eligible for the exemption for small enterprises provided for in Articles 282 to 292 and who is not covered by Articles 33 or 36’.

4 Title V of that directive is entitled ‘Place of taxable transactions’. In Chapter 2 of that title, Articles 40 to 42 of that directive define the place of an intra-Community acquisition of goods.

5 Under Article 40 of that directive, ‘the place of an intra-Community acquisition of goods shall be deemed to be the place where dispatch or transport of the goods to the person acquiring them ends’.

6 Article 41 of the VAT Directive states:

‘Without prejudice to Article 40, the place of an intra-Community acquisition of goods as referred to in Article 2(1)(b)(i) shall be deemed to be within the territory of the Member State which issued the VAT identification number under which the person acquiring the goods made the acquisition, unless the person acquiring the goods establishes that VAT has been applied to that acquisition in accordance with Article 40.

If VAT is applied to the acquisition in accordance with the first paragraph and subsequently applied, pursuant to Article 40, to the acquisition in the Member State in which dispatch or transport of the goods ends, the taxable amount shall be reduced accordingly in the Member State which issued the VAT identification number under which the person acquiring the goods made the acquisition.’

7 Article 42 of that directive is worded as follows:

‘The first paragraph of Article 41 shall not apply and VAT shall be deemed to have been applied to the intra-Community acquisition of goods in accordance with Article 40 where the following conditions are met:

(a) the person acquiring the goods establishes that he has made the intra-Community acquisition for the purposes of a subsequent supply, within the territory of the Member State identified in accordance with Article 40, for which the person to whom the supply is made has been designated in accordance with Article 197 as liable for payment of VAT;

(b) the person acquiring the goods has satisfied the obligations laid down in Article 265 relating to submission of the recapitulative statement.’

8 Title IX of that directive is entitled ‘Exemptions’. Chapter 4 of that title deals with exemptions for intra-Community transactions. Section 2 of that chapter concerns exemptions for intra-Community acquisitions of goods. In that section, Article 141 of that directive provides:

‘Each Member State shall take specific measures to ensure that VAT is not charged on the intra-Community acquisition of goods within its territory, made in accordance with Article 40, where the following conditions are met:

(a) the acquisition of goods is made by a taxable person who is not established in the Member State concerned but is identified for VAT purposes in another Member State;

(b) the acquisition of goods is made for the purposes of the subsequent supply of those goods, in the Member State concerned, by the taxable person referred to in point (a);

(c) the goods thus acquired by the taxable person referred to in point (a) are directly dispatched or transported, from a Member State other than that in which he is identified for VAT purposes, to the person for whom he is to carry out the subsequent supply;

(d) the person to whom the subsequent supply is to be made is another taxable person, or a non-taxable legal person, who is identified for VAT purposes in the Member State concerned;

(e) the person referred to in point (d) has been designated in accordance with Article 197 as liable for payment of the VAT due on the supply carried out by the taxable person who is not established in the Member State in which the tax is due.’

9 In Title XI of the VAT Directive, entitled ‘Obligations of taxable persons and certain non-taxable persons’, Article 197(1) of that directive provides:

‘VAT shall be payable by the person to whom the goods are supplied when the following conditions are met:

(a) the taxable transaction is a supply of goods carried out in accordance with the conditions laid down in Article 141;

(b) the person to whom the goods are supplied is another taxable person, or a non-taxable legal person, identified for VAT purposes in the Member State in which the supply is carried out;

(c) the invoice issued by the taxable person not established in the Member State of the person to whom the goods are supplied is drawn up in accordance with Sections 3 to 5 of Chapter 3.’

10 Article 219a of that directive provides:

‘Without prejudice to Articles 244 to 248, the following shall apply:

(1) Invoicing shall be subject to the rules applying in the Member State in which the supply of goods or services is deemed to be made, in accordance with the provisions of Title V.

(2) By way of derogation from point (1), invoicing shall be subject to the rules applying in the Member State in which the supplier has established his business or has a fixed establishment from which the supply is made or, in the absence of such place of establishment or fixed establishment, the Member State where the supplier has his permanent address or usually resides, where:

(a) the supplier is not established in the Member State in which the supply of goods or services is deemed to be made, in accordance with the provisions of Title V, or his establishment in that Member State does not intervene in the supply within the meaning of Article 192a, and the person liable for the payment of the VAT is the person to whom the goods or services are supplied.

However where the customer issues the invoice (self-billing), point (1) shall apply.

(b) the supply of goods or services is deemed not to be made within the Community, in accordance with the provisions of Title V.’

11 The content of invoices is specified in Section 4 of Chapter 3 of Title XI of that directive. Among the provisions of that section, Article 226 of that directive provides:

‘Without prejudice to the particular provisions laid down in this Directive, only the following details are required for VAT purposes on invoices issued pursuant to Articles 220 and 221:

…

11(a) where the customer is liable for the payment of the VAT, the mention “Reverse charge”;

…’

Directive 2010/45

12 Recital 7 of Directive 2010/45 reads as follows:

‘Certain requirements concerning the information to be provided on invoices should be amended to allow better control of the tax, to create a more uniform treatment between cross-border and domestic supplies and to help promote electronic invoicing.’

Austrian law

13 Paragraph 3(8) of the Umsatzsteuergesetz 1994 (1994 Law on Turnover Tax), of 23 August 1994 (BGBl. 663/1994), in the version applicable in respect of 2014 (BGBl. I, 112/2012) (‘the UStG 1994’), entitled ‘Place of intra-Community acquisition’, is worded as follows:

‘The intra-Community acquisition is made within the territory of the Member State in which the goods are located when their dispatch or transport ends. If the acquirer uses, in its dealings with the supplier, a VAT identification number issued to it by another Member State, the acquisition shall be deemed to have been made in the territory of that Member State, unless and until the acquirer proves that the acquisition has been taxed by the Member State referred to in the first sentence. In the case of such proof, Paragraph 16 shall apply by analogy.’

14 Paragraph 25 of the UStG 1994, entitled ‘Triangular transaction’, provides:

‘Definition

Paragraph 25(1) A triangular transaction occurs where three traders effect taxable transactions concerning the same goods in three different Member States, those goods are sent directly by the first supplier to the final customer and the conditions set out in subparagraph 3 are met. That shall also apply where the final customer is a legal person which is not a trader or is not acquiring the goods for its undertaking.

Place of the intra-Community acquisition in the case of a triangular transaction

(2) The intra-Community acquisition within the meaning of the second sentence of Paragraph 3(8) shall be deemed to be taxed when the trader (acquirer) proves that a triangular transaction has occurred and that it has complied with its obligations concerning the duty to declare under subparagraph 6. If the trader does not comply with its duty to declare, the tax exemption shall be forfeited retroactively.

Tax exemption on the intra-Community acquisition of goods

(3) The intra-Community acquisition shall be exempt from VAT where the following conditions are met:

(a) the trader (acquirer) has no residence or establishment in the national territory but is identified for VAT purposes within the territory of the Community;

(b) the acquisition is made with a view to a subsequent supply by the trader (acquirer) in the national territory to a trader or a legal person identified for VAT purposes in the national territory;

(c) the goods acquired originate in a Member State other than that in which the trader (acquirer) is identified for VAT purposes;

(d) the right to dispose of the goods acquired is directly transferred by the first trader or first acquirer directly to the final customer (recipient);

(e) in accordance with subparagraph 5, the recipient is liable to pay the tax.

Issuing of invoice by the acquirer

(4) The issuing of the invoice shall be governed by the provisions of the Member State in which the acquirer operates its business. If the supply is made from the acquirer’s permanent establishment, the law of the Member State in which the establishment is situated shall be applicable. If the recipient of the supply to whom liability for the tax passes settles the supply by means of a credit note, the issuance of the invoice shall be governed by the provisions of the Member State in which the supply is delivered.

Where the provisions of this Federal Law are applicable to the issuance of the invoice, the invoice must additionally contain the following details:

– an express reference to the existence of an intra-Community triangular transaction and the fact that the final customer is liable for the tax;

– the VAT identification number under which the trader (acquirer) made the intra-Community acquisition and subsequent supply of the goods; and

– the VAT identification number of the recipient of the supply.

Person liable for payment of the tax

(5) In the case of a triangular transaction, the recipient of the taxable supply shall be liable to pay the tax where the invoice issued by the acquirer corresponds to subparagraph 4.

Obligations of the acquirer

(6) In order to comply with the obligations concerning the duty to declare under subparagraph 2, the trader shall be required to provide the following details in the recapitulative statement:

– the VAT identification number in the national territory under which it made the intra-Community acquisition and subsequent supply of goods;

– the VAT identification number of the recipient of the subsequent supply by the trader, issued to it in the Member State of destination of the goods dispatched or transported;

– for each one of those recipients, the total consideration paid in respect of the deliveries thus made by the trader in the Member State of destination of the goods dispatched or transported. These amounts are to be stated in respect of the calendar quarter in which the tax liability arose.

Obligations of the recipient

(7) In calculating the tax under Paragraph 20, the amount payable under subparagraph 5 is to be added to the amount ascertained.’

From the considerations of the Court

The first question

40 By its first question, the referring court asks, in essence, whether Article 42(a) of the VAT Directive, read in conjunction with Article 197(1)(c) of that directive, must be interpreted as meaning that, in a triangular transaction, the final customer has been validly designated as the person liable for payment of VAT where the invoice issued by the intermediary acquiring the goods does not contain the words ‘Reverse charge’.

41 As a preliminary point, it should be borne in mind that a triangular transaction is a transaction by which goods are supplied by a supplier, identified for VAT purposes in one Member State, to an intermediary acquiring the goods, identified for VAT purposes in a second Member State, who, in turn, supplies those goods to a final customer, identified for VAT purposes in a third Member State, those goods being transported directly from the first Member State to the third Member State.

42 That triangular transaction is eligible for a derogation from the rule laid down in Article 2(1)(b) of the VAT Directive, according to which the intra-Community acquisition of goods for consideration within the territory of a Member State is subject to VAT (see, to that effect, judgment of 19 April 2018, Firma Hans Bühler, C‑580/16, EU:C:2018:261, paragraph 27).

43 That derogation consists, first, in exempting the intra-Community acquisition carried out by the intermediary acquiring the goods, who is identified for VAT purposes in the second Member State and, second, in transferring liability for the taxation of that acquisition to the final customer, established and identified for VAT purposes in the third Member State, the intermediary acquiring the goods being exempt from the requirement to identify itself for VAT purposes in that latter Member State. That derogation results from the relationship between the rule laid down in Article 40 of that directive and the derogation flowing from Article 42 thereof.

44 Article 40 of the VAT Directive lays down the rule that the place of taxation of a intra-Community acquisition is the place where dispatch or transport of the goods to the person acquiring them ends. In order to ensure the correct application of that rule, Article 41 of that directive provides that, where the person acquiring the goods does not establish that VAT has been applied to that acquisition in accordance with Article 40 of that directive, the place of the intra-Community acquisition is to be deemed to be within the territory of the Member State which issued the VAT identification number under which the person acquiring the goods made the acquisition.

45 Article 42 of that directive derogates from the application of that rule in the context of triangular transactions as defined in Article 141 of the VAT Directive where, first, the person acquiring the goods establishes that he or she has made the intra-Community acquisition in question for the purposes of a subsequent supply, within the territory of the Member State identified in accordance with Article 40 of that directive and for which the person to whom the supply is made has been designated in accordance with Article 197 of that directive as liable for payment of VAT, and, secondly, the person acquiring the goods has satisfied the obligations relating laid down in Article 265 of that directive relating to submission of the recapitulative statement.

46 In accordance with Article 197(1)(c) of the VAT Directive, the invoice issued by the intermediary acquiring the goods must be drawn up in accordance with Sections 3 to 5 of Chapter 3 of Title XI of that directive. Among those provisions, Article 226(11a) of that directive requires the invoice to include the words ‘Reverse charge’ where the customer is liable for payment of the VAT.

47 In that context, in order to answer the first question, it is necessary to consider not only the wording of Article 42(a) of the VAT Directive, but also the context in which it occurs and the objectives pursued by the rules of which it is part (see, to that effect, judgment of 19 April 2018, Firma Hans Bühler, C‑580/16, EU:C:2018:261, paragraph 33).

48 First, as regards the wording of Article 42 of the VAT Directive, it follows from that provision, first, that it is a derogation from the first paragraph of Article 41 of that directive and, secondly, that the application of that derogation is subject to the two cumulative conditions laid down in Article 42(a) and (b) of that directive being met (see, to that effect, judgment of 19 April 2018, Firma Hans Bühler, C‑580/16, EU:C:2018:261, paragraph 45).

49 While Article 42(a) of the VAT Directive specifies the basic condition required for an acquisition made in a triangular transaction to be deemed to be subject to VAT in accordance with Article 40 of that directive, Article 42(b) of that directive specifies the formal conditions in accordance with which proof of taxation in the Member State of destination of the intra-Community transport or dispatch must be adduced (see, to that effect, judgment of 19 April 2018, Firma Hans Bühler, C‑580/16, EU:C:2018:261, paragraph 49).

50 Secondly, as regards the context of Article 42 of the VAT Directive, it is apparent from the case-law of the Court that that article details and supplements the conditions of application of the simplification measure provided for in Article 141 of that directive (see, to that effect, judgment of 19 April 2018, Firma Hans Bühler, C‑580/16, EU:C:2018:261, paragraph 37). Both Article 42(a) of the VAT Directive and Article 141(e) of that directive refer to Article 197 of that directive, which in turn requires compliance with the provisions of Chapter 3 of Title XI of that directive, of which Article 226 of that directive forms part.

51 It follows that, in the specific context of the derogation applicable to triangular transactions, the intermediary acquiring the goods in a triangular transaction cannot substitute another statement for the words ‘Reverse charge’ while Article 226(11a) of the VAT Directive expressly requires those words to be stated.

52 Thirdly, the objectives pursued by the derogation referred to in Articles 42 and 141 of the VAT Directive support that interpretation.

53 Although the purpose of Article 141 of that directive is to avoid a situation whereby the intermediary acquiring the goods has to satisfy identification and declaration obligations in the Member State of destination of the goods (judgment of 19 April 2018, Firma Hans Bühler, C‑580/16, EU:C:2018:261, paragraph 41), Articles 41 and 42 of that directive are intended to ensure that the intra-Community acquisition in question is subject to VAT payable by the final customer, while avoiding double taxation of that transaction (judgment of 19 April 2018, Firma Hans Bühler, C‑580/16, EU:C:2018:261, paragraph 50 and the case-law cited).

54 As the Advocate General observed in point 46 of her Opinion, one of the purposes served by an invoice, and its details required under Article 226 of the VAT Directive, is to inform the recipient of the invoice of the legal assessment of the transaction of the issuer of the invoice. That purpose becomes even more imperative where the issuer considers that, exceptionally, it is not he or she but the recipient of the supply who is liable for the VAT.

55 Since the derogation provided for in Articles 42 and 141 of the VAT Directive is optional, it is the formality required by Article 226(11a) of that directive which makes it possible to ensure that the final recipient of a supply is aware of his or her tax obligations. The feature of the reverse charge procedure is precisely that if no VAT payment takes place between the supplier and the taxable person that is the recipient of a supply, it is because the latter is liable for that tax in respect of that supply (see, to that effect, judgment of 2 July 2020, Terracult, C‑835/18, EU:C:2020:520, paragraph 22). There must therefore be no uncertainty in that regard.

56 In the light of the foregoing, the answer to the first question is that Article 42(a) of the VAT Directive, read in conjunction with Article 197(1)(c) of that directive, must be interpreted as meaning that, in a triangular transaction, the final customer has not been validly designated as liable for payment of VAT where the invoice issued by the intermediary acquiring the goods does not contain the words ‘Reverse charge’, referred to in Article 226(11a) of that directive.

The second question

57 By its second question, the referring court asks, in essence, whether Article 226(11a) of the VAT Directive must be interpreted as meaning that the omission, on an invoice, of the words ‘Reverse charge’ required under that provision may subsequently be corrected by adding a statement that that invoice relates to an intra-Community triangular transaction and that the tax liability is transferred to the person to whom the supply is made.

58 If the answer to the second question is in the affirmative, the referring court asks, first, whether the validity of such a correction is conditional on its being received by its recipient and, secondly, whether the invoice thus corrected has retroactive effect from the original date of invoicing.

59 In that regard, it should be borne in mind that, although the Court has recognised that the fundamental principle of VAT neutrality requires that the deduction or refund of input VAT be allowed even if the taxable person has failed to comply with some of the formal requirements, that is subject to the condition that the substantive requirements have otherwise been satisfied (see, to that effect, judgments of 27 September 2007, Collée, C‑146/05, EU:C:2007:549, paragraph 31; of 19 April 2018, Firma Hans Bühler, C‑580/16, EU:C:2018:261, paragraphs 50 and 51; and of 21 October 2021, Wilo Salmson France, C‑80/20, EU:C:2021:870, paragraph 76).

60 The transactions in question should be taxed taking into account their objective characteristics (see, to that effect, judgment of 27 September 2007, Collée, C‑146/05, EU:C:2007:549, paragraph 30 and the case-law cited).

61 There can therefore be no question of correcting the invoice where a condition for the application of the derogation applicable to triangular transactions, such as the entry required by Article 226(11a) of the VAT Directive, is not met. As the Advocate General noted in points 57 and 61 of her Opinion, the retrospective fulfilment of a mandatory condition for transfer of the VAT liability to the recipient of a supply does not constitute a correction. It is the issuance of the required invoice for the first time, which cannot have retroactive effect.

62 Having regard to the foregoing considerations, the answer to the second question is that Article 226(11a) of the VAT Directive must be interpreted as meaning that the omission, on an invoice, of the words ‘Reverse charge’ required under that provision may not subsequently be corrected by adding a statement that that invoice relates to an intra-Community triangular transaction and that the tax liability is transferred to the person to whom the supply is made.

The third question

63 By its third question, the referring court asks, in essence, whether Article 219a of the VAT Directive must be interpreted as requiring the provisions relating to invoicing of the Member State of the intermediary acquiring the goods to be applied, or those of the Member State of the final customer.

64 The referring court raises that issue because, in the main proceedings, Luxury Trust Automobil submits that Czech law should be applied. Czech law does not require the invoices to contain a reference to the transfer of the tax liability.

65 It is apparent, however, from the answers given to the first two questions that the answer to the third question cannot affect the outcome of the main proceedings.

66 Due to the absence of the words ‘Reverse charge’ on the invoices at issue, the designation of the final customer as the person liable for payment of VAT was not validly effected. The intermediary acquiring the goods must therefore be regarded as liable for that tax in the Member State which issued it with the identification number which it used for the purposes of the intra-Community acquisition in question, in accordance with the first paragraph of Article 41 of the VAT Directive.

67 In any event, the requirements set out in Article 42, Article 141(e) and Article 226(11a) of the VAT Directive cannot vary from one Member State to another. The referring court is under an obligation to interpret the law applicable to the dispute in the main proceedings, whether it be the law of the Member State of the intermediary acquiring the goods or that of the final customer, in accordance with EU law (see, by analogy, judgment of 18 November 2020, DelayFix, C‑519/19, EU:C:2020:933, paragraph 51).

68 In the light of the foregoing, there is therefore no need to answer the third question.

Costs

69 Since these proceedings are, for the parties to the main proceedings, a step in the action pending before the national court, the decision on costs is a matter for that court. Costs incurred in submitting observations to the Court, other than the costs of those parties, are not recoverable.

Copyright – internationaltaxplaza.info

Follow International Tax Plaza on Twitter (@IntTaxPlaza)