On July 21, 2023 the Australian Government opened a public consultation regarding the modernization of individual tax residency. The closing date for submissions is September 22, 2023.

The Australian Government is consulting on a new, modernised individual tax residency framework. The proposed model adopts a two-step approach. When designing the new framework the Board of Taxation sought to ensure that the model’s design was consistent with the following four principles:

- Adhesive residency (It should be harder to cease being a tax resident than it is to become a tax resident);

- Certainty;

- Simplicity; and

- Integrity.

In accordance with these principles, the Board’s model has the following features:

- Physical presence is the primary measure of residency – moving Australia to closer alignment with international practice;

- The rules focus on Australian connections – such that, for the most part, two individuals with identical physical presence and other connections to Australia have the same residency outcomes; and

- The rules apply only objective criteria, removing any requirement to test intention or undertake broad, holistic examinations of all relevant facts and circumstances.

The Board’s proposed model adopts a two-step approach:

Step 1 – Primary tests

The 183-day Test

The Board proposed that the primary test would be a simple 'bright line' test – a person who is physically present in Australia for 183 days or more in any income year would be an Australian tax resident.

To address concerns that an individual would be able to manipulate the 183-day test by spending 183 days in Australia across two income years, the Board proposed secondary tests, based on 45 days of physical presence and other factors, that indicate the individual has a sufficient connection with Australia to be treated as a resident for tax purposes.

The Government Officials Test:

This test would replace the outdated Commonwealth superannuation test. It would ensure that government (including federal, state and territory) officials deployed overseas in the service of an Australian government are tax residents throughout their deployment. An individual who meets the Board’s proposed Government Officials Test would be a tax resident, despite not meeting the 183-day test or the secondary tests.

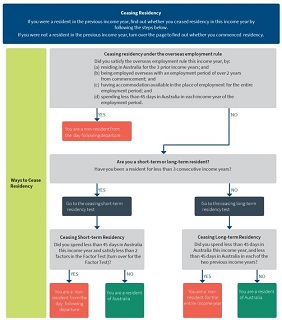

Step 2 – Secondary tests – Commencing/Ceasing Residency

An individual who is not a tax resident under Step 1, would need to consider Step 2. The applicable test under Step 2 would depend on whether the individual was a tax resident in the previous income year.

An individual who was not a tax resident in the previous income year would need to apply the Commencing Residency Test to determine whether they have become a tax resident in the current income year.

An individual who was a tax resident in the previous income year would need to apply one of three rules under the Ceasing Residency Test to determine whether they have ceased being a tax resident in the current income year.

(a) The Overseas Employment Rule would apply to long-term residents who take up an employment opportunity overseas for over two years.

(b) The Ceasing Short-Term Residency Rule would apply to individuals who have been tax residents for less than three income years, being the current year and the two immediate prior years.

(c) The Ceasing Long-Term Residency Rule would apply to individuals who have been tax residents for three or more income years (being the current year and the two immediate prior years).

The publication document as released on July 23, 2023 by the Australian can be found here.

Copyright – internationaltaxplaza.info

Follow International Tax Plaza on Twitter (@IntTaxPlaza)