On September 12, 2023 the European Commission released a proposal for a Council Directive on Business in Europe: Framework for Income Taxation (BEFIT). This Directive lays down a common set of rules for computing the tax base of large groups of companies in the European Union and replaces the Commission's CCTB (common corporate tax base) and CCCTB (common consolidated corporate tax base) proposals, which are withdrawn. If the proposal for the Directive is adopted Member States should apply the new rules as laid down in this Directive as of July 1, 2028.

Furthermore the European Commission released a proposal for a Council Directive on transfer pricing, which integrates key transfer pricing principles into EU law with the aim of putting forward certain common approaches for Member States. If the Directive is adopted, Member Sates should apply the new transfer pricing rules as of January 1, 2026.

In this article you will find a few of our initial remarks with respect to these 2 Directives.

The proposal for a BEFIT-Directive

The BEFIT-Directive lays down rules:

(a) on delineating a group for the purposes of this Directive (‘BEFIT group’);

(b) for calculating an aggregated tax base for the companies and permanent establishments of the BEFIT group (‘BEFIT group member’ and ‘BEFIT tax base’);

(c) for allocating the BEFIT tax base to eligible BEFIT group members;

(d) simplifying transfer pricing risk assessments for transactions with associated enterprises outside the group;

(e) for the administration of the common legal framework.

The BEFIT-proposal builds on the OECD/G20 international tax agreement on a global minimum level of taxation, and the EU Pillar Two Directive that was adopted at the end of 2022.

Scope

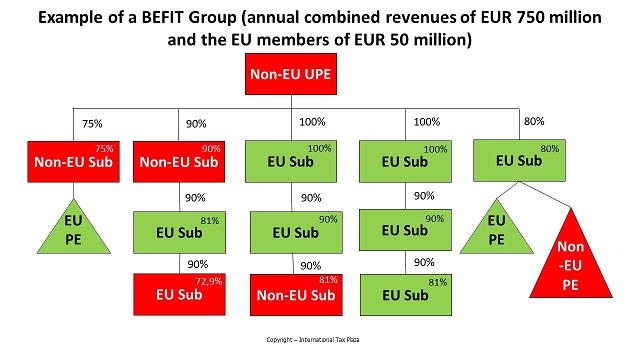

Article 2 of the Directive arranges that the new rules will be mandatory for domestic groups and multinational enterprise groups (MNE) which prepare consolidated financial statements and had annual combined revenues of EUR 750 million or more in at least two of the last four fiscal years.

For groups headquartered outside the EU, their EU group members would need to have raised at least EUR 50 million of annual combined revenues in at least two of the last four fiscal years or at least 5% of the total group revenues for the Directive to apply.

Groups, including Small and Medium Enterprise groups, that earn annual combined revenues of less than EUR 750 million can opt to apply the rules as long as they prepare consolidated financial statements and have a taxable presence in the EU.

Article 2, Paragraph 2 of the proposed Directive arranges that a company or a permanent establishment which is subject to this Directive shall cease to be subject to the national corporate tax law in all Member States where it is established in respect of all matters regulated by this Directive, unless otherwise stated in this Directive.

BEFIT-Group

Article 5, Paragraph 1 of the Directive arranges that A BEFIT group exists where two or more companies or permanent establishments which fall within the scope of this Directive meet the following conditions:

(a) the company is either the ultimate parent entity of the group or any other company of the group in which the ultimate parent entity holds, directly or indirectly, at least 75% of the ownership rights or of the rights giving entitlement to profit;

(b) the head office of the permanent establishment is either the ultimate parent entity of the group or any other member (company or entity) of the group in which the ultimate parent entity holds, directly or indirectly, at least 75% of the ownership rights or of the rights giving entitlement to profit.

Calculating the preliminary tax result of a BEFIT group member

As for Pillar 2 the financial accounts form the basis for computing the preliminary tax result of a BEFIT group member. Articles 8 to 41 of the Directive set out the adjustments that are to be made to a group member’s financial accounting net income or loss for the fiscal year when computing that member’s preliminary tax result. These adjustments include amongst others:

- adjustments for dividends and gains or losses from the disposition of shares (participation exemption);

- adjustments for incomes or losses of permanent establishments;

- adjustments for the interest limitation rules as laid in down in Article 2 of Council Directive (EU) 2016/1164 of 12 July 2016;

- adjustments for shipping activities covered by a tonnage tax regime;

- adjustments for rollover relief for replacement assets; and

- adjustments for unrealised foreign currency exchange gain or loss in relation to fixed assets and liabilities;

Furthermore the Directive contains a set of provisions that contain regulations regarding depreciation costs.

The financial accounting net income or loss of a BEFIT group member shall be adjusted by the difference between the value of stocks and work-in-progress at the beginning and the end of the fiscal year. In this respect an exception is made for stocks and work-in-progress relating to long term contracts.

The Directive also contains regulations regarding the treatment of provisions, bad debts and hedging under the BEFIT regulations.

Furthermore the Directive contains regulations that apply when entering or leaving a BEFIT Group and in case of corporate restructurings.

Aggregation of the tax base at EU group level

The tax bases of all members of the group will be aggregated into one single tax base. This will entail cross-border loss relief, as losses will automatically be set off against profits across borders, as well as an increased tax certainty in transfer pricing compliance.

Allocation of the aggregated tax base

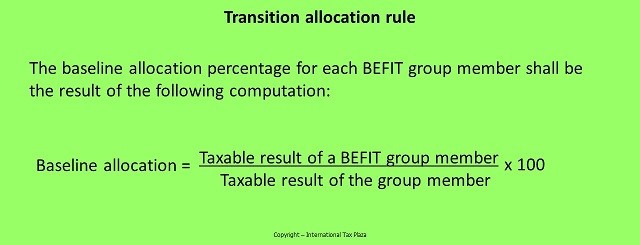

By using a transitional allocation rule, each member of the BEFIT group will have a percentage of the aggregated tax base calculated on the basis of the average of the taxable results in the previous three fiscal years.

Transitional allocation rule

In Article 45 the BEFIT-Directive also contain a transitional allocation rule. This transitional allocation rule will apply to each fiscal year between July 1, 2028 and June 30, 2035 at the latest (the ‘transition period’). The transitional allocation rule will pave the way for a permanent allocation method that can be based on a formulary apportionment using substantive factors. In designing a permanent allocation method, the transitional solution will make it possible to take into account more recent County-by-Country Reporting (CbCR) data and information gathered from the first years of the application of BEFIT. It will also allow for a more thorough assessment of the impact that the implementation of the OECD/G20 Inclusive Framework Two-Pillar Approach is expected to have on national and BEFIT tax bases. If appropriate, the Commission may propose a Directive whereby the aggregated tax base will be allocated based on a factor-based formula.

Special allocation rules apply to: Upstream/extractive activities, shipping not covered by a tonnage tax regime, inland waterways transport and air transport.

Simplified approach to transfer pricing compliance

The Articles 50 through 53 of the Directive contain provisions that arrange for a simplified approach to transfer pricing compliance for activities, where these are performed through transactions between a BEFIT group member and an associated enterprise outside the BEFIT group

Filing the BEFIT information return

Article 57 of the Directive contains regulations regarding the filing the BEFIT information return.

The BEFIT information return must be submitted by the filing entity to the filing authority (the taxauthority in its state of residency) no later than four months after the end of the fiscal year.

The ‘filing entity’ is one of the following:

(a) the ultimate parent entity, when located in a Member State; or

(b) if the ultimate parent entity is not located in a Member State, the entity located in a Member State, that has been appointed by the BEFIT group to fulfil the obligations in relation to the BEFIT group information return set out in Article 57 on behalf of the BEFIT group.

Article 57, Paragraph 3 arranges that the BEFIT information return shall comprise the following information:

(a) identification of the filing entity and other BEFIT group members, including their tax identification numbers, if any, and the Member State in which the BEFIT group members are resident for tax purposes or situated in the form of a permanent establishment;

(b) information on the overall corporate structure of the BEFIT group, including the ownership interest in the BEFIT group members held by other BEFIT group members.

(c) the fiscal year to which the BEFIT information return relates;

(d) information and computation of the following:

(i) the outcome of the preliminary tax result of each BEFIT group member;

(ii) the BEFIT tax base;

(iii) the allocated part of each BEFIT group member;

(iv) information about the ‘baseline allocation percentage’, as computed in accordance with Article 45 of the Directive.

Individual tax returns and assessments

Next to the BEFIT information return that has to be filed by the filing entity, each BEFIT group member shall have to file its individual tax return with the competent authority of the Member State in which that BEFIT group member is resident for tax purposes or situated in the form of a permanent establishment.

Notwithstanding the aforementioned, members of the same BEFIT group which are resident for tax purposes or situated in the form of a permanent establishment in the same Member State may choose to file one combined individual tax return in that Member State.

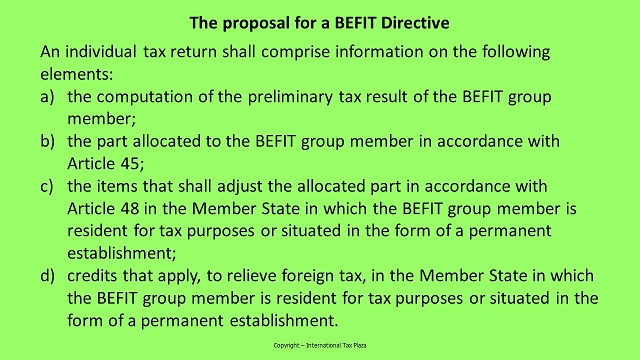

The individual tax return shall comprise information on the following elements:

(a) the computation of the preliminary tax result of the BEFIT group member;

(b) the part allocated to the BEFIT group member in accordance with Article 45;

(c) the items that shall adjust the allocated part in accordance with Article 48 in the Member State in which the BEFIT group member is resident for tax purposes or situated in the form of a permanent establishment;

(d) credits that apply, to relieve foreign tax, in the Member State in which the BEFIT group member is resident for tax purposes or situated in the form of a permanent establishment.

Obviously each Member State in which a BEFIT group member files an individual tax return shall issue a individual tax assessment to that BEFIT group member.

Appeals

Appeals and judicial appeals against the BEFIT information return have to be filed by the filing entities. Appeals have to be filed with an administrative body in the state of which it is a resident within two months after the return was issued or notified. Subsequently the filing enity has the right to appeal directly to the courts of the Member State where it is resident for tax purposes or situated in the form of a permanent establishment within two months of the receipt of the decision of the aforementioned administrative appeals body.

A BEFIT group member may appeal against the content of the individual tax assesment before the competent authority of the Member State where that BEFIT group member is resident for tax purposes or situated in the form of a permanent establishment within two months after the assessment was notified to it. Subsequently a BEFIT group member shall have the right to appeal to the courts of the Member State where it is resident for tax purposes or situated in the form of a permanent establishment within two months after the decision of the administrative appeals body was notified to it.

Article 77 of the Directive, which by mistake is numbered Article 7, arranges that five years after this Directive starts to apply, the Commission shall examine and evaluate its functioning and report to the European Parliament and the Council to that effect.

Article 78 of the Directive arranges that Member States shall adopt and publish the laws, regulations and administrative provisions necessary to comply with this Directive by 1 January 2028 and that they shall apply those provisions from 1 July 2028.

The full text of the as released by the European Commission on September 12, 2023 can be found here.

The proposal for a Council Directive on transfer pricing

Where the BEFIT-Directive that only is mandatory for groups that have annual combined revenues of EUR 750 million or more, if adopted the Council Directive on transfer pricing will apply to all taxpayers that are registered in, or subject to, tax in one or more Member States, including permanent establishments in one or more Member States.

Article 4 specifies that when the terms and conditions of cross-border intragroup transactions are not at arm’s length, they must be adjusted to reflect the terms and conditions that would have been established between independent parties and the profits taxed accordingly.

For the purpose of this Directive, a permanent establishment should be treated as an associated enterprise and thus the general rule contained in article 4 is also relevant for the attribution of profit to permanent establishment. As a consequence, the internal dealings between head office and permanent establishment should be determined in accordance with the arm’s length principle.

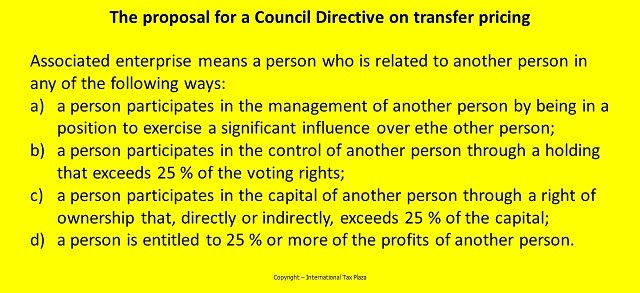

Article 5 of the Directive arranges that for the purpose of this Directive, ‘associated enterprise’ means a person who is related to another person in any of the following ways:

(a) a person participates in the management of another person by being in a position to exercise a significant influence over ethe other person;

(b) a person participates in the control of another person through a holding that exceeds 25 % of the voting rights;

(c) a person participates in the capital of another person through a right of ownership that, directly or indirectly, exceeds 25 % of the capital;

(d) a person is entitled to 25 % or more of the profits of another person.

The Directive contains provisions for corresponding (Article 6) and compensating (Article 7) adjustments.

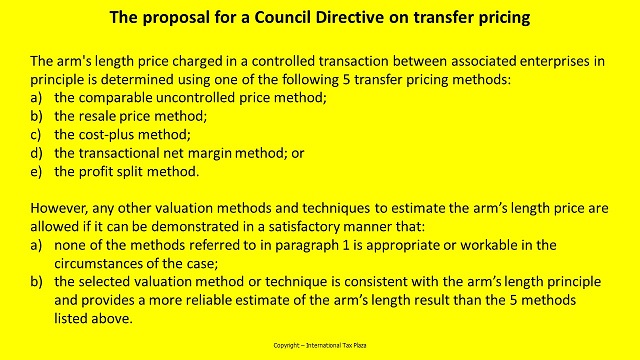

Article 9 Member States arranges that the arm's length price charged in a controlled transaction between associated enterprises in principle is determined using one of the following 5 transfer pricing methods:

(a) the comparable uncontrolled price method;

(b) the resale price method;

(c) the cost-plus method;

(d) the transactional net margin method; or

(e) the profit split method.

However, any other valuation methods and techniques to estimate the arm’s length price are allowed if it can be demonstrated in a satisfactory manner that:

(a) none of the methods referred to in paragraph 1 is appropriate or workable in the circumstances of the case;

(b) the selected valuation method or technique is consistent with the arm’s length principle and provides a more reliable estimate of the arm’s length result than the 5 methods listed above.

Article 10 of the Directive arranges that the arm's length price is determined by applying the most appropriate transfer pricing method to the circumstances of the case. Whereby the most appropriate transfer pricing method shall be selected from among the transfer pricing methods set out in Article 9, taking into consideration the following criteria:

(a) the respective strengths and weaknesses of the transfer pricing methods;

(b) the appropriateness of a transfer pricing method in view of the nature of the controlled transaction, determined in particular through an analysis of the functions undertaken by each enterprise in the controlled transaction, taking into account assets used and risks assumed;

(c) the degree of comparability between the controlled and uncontrolled transactions, including the reliability of comparability adjustments, if any, that may be required to eliminate differences between them;

(d) the availability of reliable information needed to apply the selected transfer pricing method.

Article 11 arranges that it must be ensured that the transactions under analysis are comparable. In order to determine whether two or more transactions are comparable, the following factors shall be considered, to the extent that they are economically relevant to the facts and circumstances of a transaction:

(a) the contractual terms of the transaction;

(b) the functions performed by each of the parties to the transaction, taking into account assets used and risks assumed, including how those functions relate to the wider generation of value by the MNE group to which the parties belong, the circumstances surrounding the transaction, and industry practices;

(c) the characteristics of the property transferred or of services provided;

(d) the economic circumstances of the parties and of the market in which the parties operate;

(e) the business strategies pursued by the parties.

Article 11, Paragraph 3 arranges that an uncontrolled transaction is comparable to a controlled transaction if either of the following conditions is met:

(a) none of the differences (if any) between the transactions being compared or between the enterprises undertaking those transactions could materially affect the price in the open market;

(b) reasonably accurate adjustments can be made to eliminate the material effects of such differences.

Article 12 of the Directive arranges that, when the application of the transfer pricing methods produces a range of values, the arm's length range is determined using the interquartile range of the results of the uncontrolled comparables. Whereby the interquartile range is the range from the 25th to the 75th percentile of the results derived from the uncontrolled comparables.

Article 115 of the Directive arranges the Commission shall examine and evaluate the application of this Directive every 5 years and submit a report on its evaluation to the European Parliament and to the Council. The first report shall be submitted by December 31, 2031.

Article 20 arranges that Member States shall adopt and publish, by 31 December 2025 at the latest, the laws, regulations and administrative provisions necessary to comply with this Directive and that they shall apply those provisions from 1 January 2026.

The full text of the proposal for a the Council Directive on transfer pricing as released by the European Commission on September 12, 2023 can be found here.

Copyright – internationaltaxplaza.info

Follow International Tax Plaza on Twitter (@IntTaxPlaza)