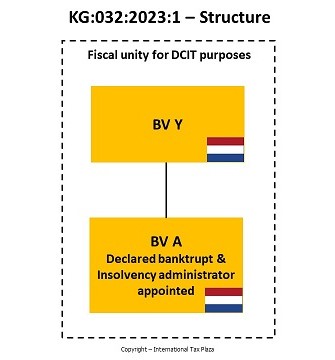

In this article we discuss position paper KG:032:2023:1. In this position paper the Knowledge Group restructuring facilities and fiscal unities of the Dutch tax authorities answers the question whether the possession requirement is still met when a subsidiary that is included as a subsidiary in a fiscal unity for Dutch corporate income tax purposes is declared bankrupt and an insolvency administrator is appointed.

The reason

Parent company BV Y and its subsidiary BV A form a fiscal unity for Dutch corporation income tax purposes. The court has declared BV A bankrupt and has appointed insolvency administrator. Dutch civil law applies to the bankruptcy. As a result of the being declared bankrupt, BV A loses the power to manage and dispose of its assets. These powers are transferred to the insolvency administrator.

Question

Do the bankruptcy of BV A and the appointment of an insolvency administrator at BV A mean that the possession requirement of Article 15, Paragraph 1 of the Dutch corporate income tax (DCIT) Act is no longer met?

Answer

No, the declaration of bankruptcy and the appointment of an insolvency administrator by the court do not mean that the possession requirement of Article 15, Paragraph 1 of the DCIT Act is no longer met.

Legal context

Article 15, Paragraph 1 of the DCIT Act reads as follows:

“In case a taxpayer (the parent company) has full legal and economic ownership of at least 95% of the shares in the nominal paid-up capital of another taxpayer (the subsidiary) and this ownership represents at least 95% of the statutory voting rights in the subsidiary and entitles the parent company in all cases to at least 95% of the profits and at least 95% of the assets of the subsidiary, at the request of both taxpayers, Dutch corporate income tax is levied from them as if there were one taxpayer, in the sense that the activities and assets of the subsidiary form part of the activities and assets of the parent company. The tax is levied from the parent company. In that case, the taxpayers together are regarded as a fiscal unity. More than one subsidiary can be part of a fiscal unity.”

From the considerations of the Dutch tax authorities

1. Pursuant to Article 15, Paragraph 10, under a of the DCIT Act a fiscal unity is broken-up if the requirements set by or pursuant to this Article are no longer met. In the underlying case, the question is whether, due to the declaration of bankruptcy and the appointment of the insolvency administrator, the possession requirement as laid down in Article 15, Paragraph 1 of the Dutch corporate income tax Act is still met.

2. Pursuant to Article 15aa, Paragraph 1, under c of the DCIT Act the deconsolidation moment is the moment at which the fiscal unity is broken-up with respect to a taxpayer, other than by dissolution and liquidation of a subsidiary. The dissolution of a subsidiary (that is a member of a fiscal unity) and the liquidation of the assets of that company therefore lead to the breaking-up of the fiscal unity with respect to that company. However in such case no deconsolidation moment exists.

3. In the underlying case, however, there is no question of dissolution and liquidation (yet), but only a declaration of bankruptcy and the appointment of an insolvency administrator. In as far as relevant here, however, after being declared bankrupt a legal entity is only dissolved, either by abrogation of the bankruptcy due to the condition of the estate or by insolvency (Article 2:19, Paragraph 1 of the Dutch Civil Code).

By operation of law Due to the bankruptcy order BV A loses management and the right to dispose of the assets belonging to the bankruptcy (Article 23 of the Dutch Bankruptcy Act). The insolvency administrator is charged with the management and liquidation of the bankrupt estate (Article 68 of the Dutch Bankruptcy Act).

4. In parliamentary history, the following has been stated regarding the situation in which a subsidiary within a fiscal unity goes bankrupt (Parliamentary Papers II 1999/00, 26854, no. 3, p. 23):

“In the event that a subsidiary that is included a fiscal unity goes bankrupt, the subsidiary remains part of the fiscal unity until the subsidiary is dissolved and liquidated. The fiscal unity is therefore not broken-up by the bankruptcy of a company that is part of the fiscal unity.”

5. With this statement, the legislator has shown that in the event of bankruptcy, despite the transfer of management and disposal powers to the insolvency administrator, the possession requirement will still be met (until a dissolution and a liquidation occur).

6. The aforementioned means that the fiscal unity between BV Y and BV A does not terminate by operation of law on the basis of Article 15, Paragraph 10 under a of the DCIT Act, at the moment the bankruptcy is declared by the court and an insolvency administrator is appointed.

The full Dutch text of the position paper (in the Dutch language) can be found here.

Copyright – internationaltaxplaza.info

Follow International Tax Plaza on Twitter (@IntTaxPlaza)