In this article we discuss position paper KG:024:2022:11 of September, 2022 regarding the Dutch dividend withholding tax consequences of an indirect share buy-back.

In its position paper the Knowledge Group on dividend withholding tax and (other) withholding taxes has answered the question whether in case of a purchase by a subsidiary of shares in its parent company, there is an indirect share buy-back of shares in the subsidiary in itself.

Reason

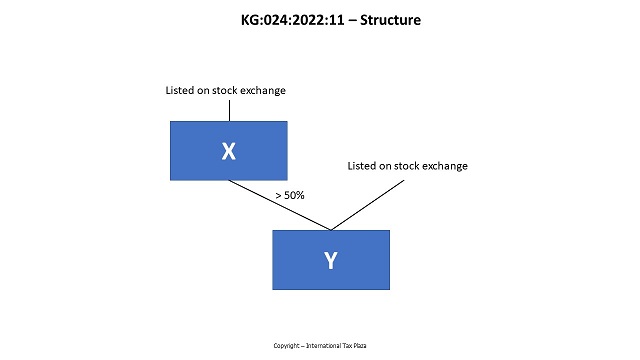

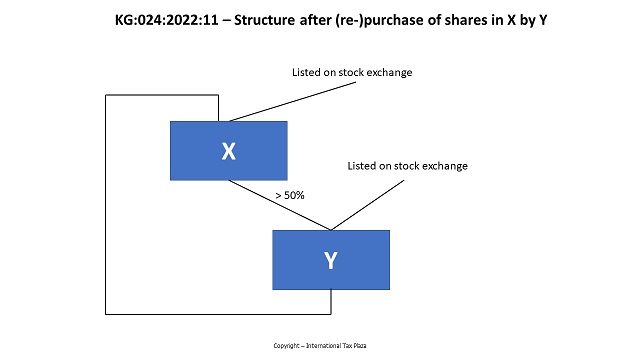

X is listed on the stock exchange and holds a majority interest in Y. The other shares of Y are also listed on the stock exchange. At some point in time, subsidiary Y purchases shares X on the stock exchange.

Y argues that with this purchase it in fact indirectly purchased its own shares, which should therefore be regarded as amortized for tax purposes.

Question

Does the purchase of shares by the subsidiary in its parent company (indirectly) constitute an indirect share buy-back of shares in the subsidiary?

Answer

No, the purchase of shares in the parent company by a subsidiary does not constitute an indirect share buy-back of shares in that subsidiary. It however constitutes an indirect share buy-back of shares in the parent company. It should furthermore be noted that insofar as there is impoverishment at the level of the subsidiary the purchase of the shares in the parent company might also constitute a disguised profit distribution at a subsidiary level.

From the consideration of the tax authorities

Pursuant to Article 3, Paragraph 1, sub a of the DDWT Act a purchase of shares, other than for temporary investment purposes, constitutes a taxable event for Dutch dividend withholding tax purposes. This is not only the case when a company buys back its own shares, but also if those shares are repurchased by a subsidiary. In that case there is an indirect share buy-back.

In the case of an indirect share buy-back, the withholding agent and the entity that actually distributes the proceeds to the shareholders are therefore not the same legal entity. In such case it’s the parent company that is obliged to withhold Dutch dividend withholding tax because it is the capital of the parent company that decreases as a result of the (re-)purchase of its shares. And it is the subsidiary that distributes the proceeds to the shareholders of its parent company.

In the case of an indirect share buy-back the subsidiary may also be impoverished, namely insofar as the shares in the parent company actually also represent an interest in the subsidiary. In that case, there is an impoverishment at the level of the subsidiary since the shares in its parent company do not constitute a real asset for the subsidiary (since the shares represent an interest in the subsidiary itself) and the subsidiary has paid the purchase price to the shareholders of the parent company.

However, the impoverishment of the subsidiary does not have the character of a share buy-back, as there is no change with regard to the (issued) shares of the subsidiary itself. Therefor the impoverishment has the character of a disguised profit distribution.

NB: insofar as the parent company owns assets other than the shares in the subsidiary, there is no impoverishment at the level of the subsidiary. To that extent, the shares that the subsidiary acquires in its parent company do indeed constitute a real asset.

The full Dutch text of the position paper can be found here.

Other position papers of the Knowledge Group on dividend withholding tax and (other) withholding taxes of which we already made an English summary can be found here.

Copyright – internationaltaxplaza.info

Follow International Tax Plaza on Twitter (@IntTaxPlaza)