In this article we discuss position paper KG:024:2022:9 of August 4, 2022. In its position paper the Knowledge Group on dividend withholding tax and (other) withholding taxes answers the question whether an indirect share buy-back can be recognized in the situation in which a subsidiary acquires all shares in its parent company through an exchange of shares exchange.

Reason

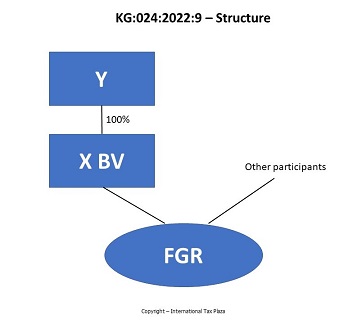

A private limited liability company (hereinafter: BV X) and other participants hold participations in an open mutual fund (hereinafter: FGR). All shares in BV X are held by [Y]. Thus, [Y] indirectly participates in the aforementioned FGR.

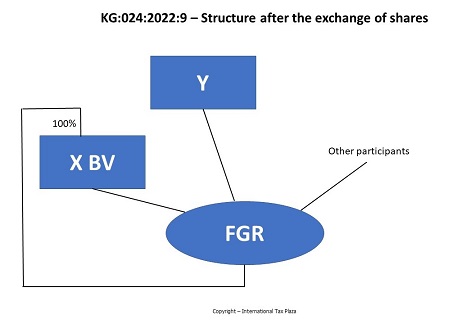

[Y] contributes its shares in BV X, into the FGR in return for an issuance of participations in the FGR (to [Y]). As a result of the exchange of shares, a reciprocal shareholding is created: BV X is now both shareholder/participant as well as a subsidiary of the FGR.

Question

Can an indirect share buy-back be recognized in an exchange of shares whereby the subsidiary acquires all shares in the parent company?

Answer

No, in the case of an exchange of shares, by which the subsidiary acquires all shares in the parent company, there is no question of an indirect share buy-back. The recognition of an indirect share buy-back requires that the acquisition of the shares in the parent company is accompanied by a payment of a purchase price by the subsidiary. Because in that case there would be a shift of assets from the parent company to its shareholder. However, this is not the case in the situation of an exchange of shares.

From the consideration of the tax authorities

An indirect share buy-back occurs when shares in the parent company are purchased by a subsidiary. In that case there is a shift of capital assets from the (parent) company to its shareholders since the parent company's interest in the subsidiary decreases in value (an impoverishment). This is because the purchase price paid by the subsidiary does not represent any real capital asset for the parent company. After all, the interest that the subsidiary has in the mother is for the mother (indirectly) an interest in herself.

In the case of an exchange of shares, the FGR (the subsidiary) does not acquire the shares in the parent company (BV X) against the payment of a purchase price, but against the issuance of participations to [Y]. In such case, the impoverishment referred to above does not occur. In case of an exchange of shares as described above, there is therefore no question of an indirect share buy-back.

The full Dutch text of the position paper can be found here.

Other position papers of the Knowledge Group on dividend withholding tax and (other) withholding taxes of which we already made an English summary can be found here.

Copyright – internationaltaxplaza.info

Follow International Tax Plaza on Twitter (@IntTaxPlaza)