On May 31, 2023, the Dutch cabinet presented the proposal for the Minimum Tax Act 2024 (implementation of Pillar 2) to the Dutch House of Representatives. Together with the bill, an explanation of the estimated budgetary effect of the Minimum Tax Act 2024 (Pillar 2) has been sent to the House of Representatives. This estimate has been certified by the Centraal Planbureau (CPB) (Netherlands Bureau for Economic Policy Analysis) and provides a few interesting insights.

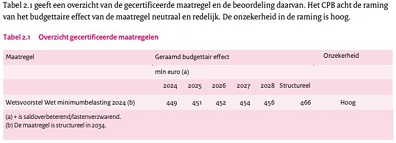

The certification issued by the CPB regarding the estimate budgetary effect of the Minimum Tax Act 2024 is as follows:

“The CPB assesses the estimate of the budgetary effect as reasonable and neutral. The estimate has a high degree of uncertainty due to uncertain behavioral responses and various assumptions required due to data limitations.”

Breakdown of expected additional tax revenues

The total estimated budgetary effect is split in:

- an amount for the QDTT;

- an amount for the IIR and UTPR; and

- an amount resulting from an ‘expected’ shifting of profits from low-taxing jurisdictions to the Netherlands.

The QDTT

The first amount is the amount of additional tax revenue that the QDTT is expected entail. For the years 2024 to 2027, the additional tax revenues are estimated to annually amount between EUR 38 and 43 million. On a structural basis, the additional tax revenues are estimated to amount to EUR 55 million annually.

The estimated amount(s) is based on data as included in Dutch corporate income tax returns. For this, companies have been selected that meet the turnover criteria of the Minimum Tax Act 2024 (EUR 750 million) and that are not part of the exempt sectors. To this the multinationals that have a CbCR obligation have been added. The expectation therefore seem to be reasonably substantiated.

However, more interesting are the reasons of why the QDTT will lead to additional tax revenues.

The Netherlands has various schemes for which no exception is provided for under the Minimum Tax Act 2024. These schemes may cause the effective tax rate of entities in the Netherlands to fall below the minimum 15%. Consequently, additional taxes will (have to) be levied. Examples of these schemes are the reinvestment reserve (HIR), the forestry exemption, the agricultural exemption, the energy investment deduction (EIA), the environmental investment deduction (MIA), the random depreciation of environmental investments (VAMIL), etc.

According to the Dutch Ministry of Finance however, the most important schemes in these are the innovation box and the liquidation loss scheme. Under certain conditions, the innovation box reduces the tax rate on profits arising from innovative activities from 25.8% to 9%. The liquidation loss scheme is a supplement to the participation exemption that allows companies to deduct losses incurred when liquidating a participation from its taxable profit. The use of these schemes reduces the effective tax rate as it applies for the Minimum Tax Act 2024. As a result companies benefitting from these schemes may not meet the 15% criterion.

The IIR and the UTPR

The expected total annual additional tax revenue that the IIR and UTPR is estimated to generate amounts to approximately EUR 9 million annually. So a minimal additional tax revenue. The reason for this is that the ministry expects that almost all low-tax states will introduce a QDTT, apply increased tax rates or reduce tax base reductions. If a low-taxing jurisdiction does not introduce a QDTT, other jurisdictions will levy additional tax on the basis of an IIR and undertaxed UTPR.

Income from shifting profits from low-taxing jurisdictions to the Netherlands

The Dutch Ministry of Finance expects that large bulk of the additional tax revenues (EUR 409 million) will result from the shifting of profits from low-taxing jurisdictions to the Netherlands.

This estimation is once again based on the expectation that almost all low-tax jurisdictions will introduce a QDTT, or start charging higher tax rates or will reduce existing tax base reductions. The Ministry assumes that an excess profit exists in these currently low-taxing jurisdictions, which is mainly caused by tax incentives. Because these tax incentives will be significantly reduced, the Ministry assumes that part of these profits will flow back to the regular market jurisdictions such as the Netherlands.

Both the Ministry and the CPB acknowledge that the estimate has a very large uncertainty because it is based on an assumption of behavioral effects and that it is therefore uncertain how much profit will ultimately be shifted from low-taxing jurisdictions to regular market jurisdictions such as the Netherlands.

Remarks by International Tax Plaza

In the Netherlands the story started with Dutch politicians feeding an anti-multinational sentiment by stating that multinationals and large domestic companies were avoiding huge amounts of Dutch corporate income tax, while at the same time hugely benefiting for all sort of governmental services (e.g. having access to highly-educated personnel, benefiting from the great Dutch infrastructure, etc.). From the estimation that was provided when the law proposal was sent to the Dutch House representatives it follows that actually it was only EUR 9 million per annum.

When the latest Dutch Government was formed about one and a half year ago, it estimated the structural annual additional tax revenues that the EU Pillar Directive would bring to amount to approximately EUR 1 billion per annum. At that moment the Dutch Government still needed to vote in favor of the EU Pillar 2 Directive. As per May 31, 2023 the estimated structural annual additional tax revenues is decreased to EUR 466 million.

And according to both the Dutch Ministry of Finance and the CPB of these total estimated structural annual additional tax revenues of EUR 466 million, an amount of approximately EUR 402 million per year is highly uncertain. A stated above the reason here for is that this amount of EUR 402 million is based on the assumption of certain behavioral effects occurring. In this respect we would like to add that nowhere the Dutch Ministry of Finance nor the CPB makes a referral that there might also be multinational groups that might shift activities/profits from the Netherlands to other regular market jurisdictions. So it is unclear whether such behavioral effects are even included in the estimation.

Then we also have the annual estimated structural additional tax revenues of EUR 52 million that QDTT is expected to entail. As is stated by the Ministry these are caused by tax incentive schemes. In order to remain attractive as a country and to encourage environmental friendly investments, these types of activities and investments will probably have to be stimulated/financed in a other manner. The question is therefore to what extent these additional tax revenues will be offset by other expenses and what the ultimately net budgetary effect will be?

So what finally remains is the EUR 9 million of additional tax revenues that the IIR and the UTPR are expected to result in. As stated above this EUR 9 million seems to be well substantiated by the Dutch Government.

So where the Dutch Government started with an estimate of EUR 1 billion of additional annual tax revenues about one and a half year ago, it ended up with:

- a pretty certain EUR 9 million;

- a pretty certain amount of EUR 55 million, of which it however is questionable whether it will have positive budgetary effect; and

- an amount of EUR 402 million of which the government itself and the CPB state that it is highly uncertain.

So the question that remains for us is whether the implementation of a minimum tax for large multinationals and large domestic groups is going to result in a substantially positive budgetary effect in the Netherlands? And that then raises the question why the Dutch Government has been so positive about the 2 Pillar solution?

On June 2, 2023 we already published a Dutch version of this article. Although it should be noted that this article contains some additional information in comparison to our June 2 article.

Copyright – internationaltaxplaza.info

Follow International Tax Plaza on Twitter (@IntTaxPlaza)